Question: Brad will graduate next year. When he begins work- ing, he plans to deposit $6000 at the end of each year into a retirement account

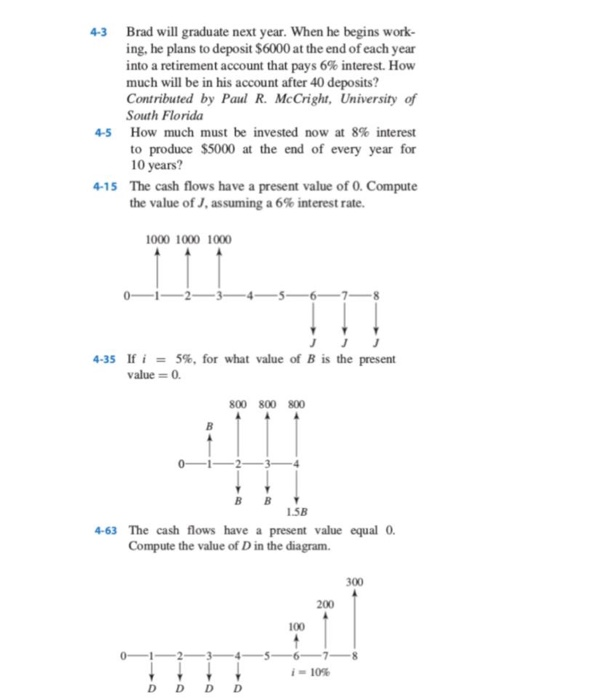

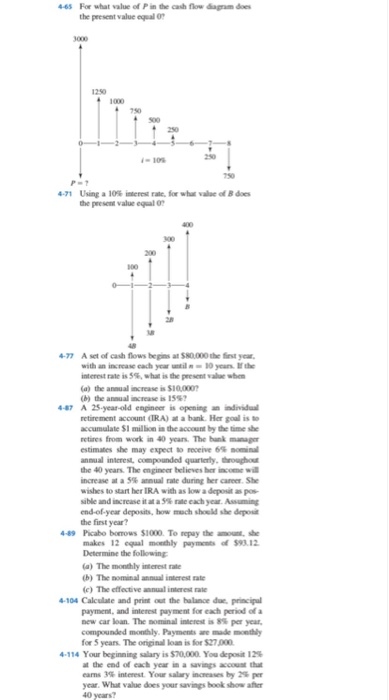

Brad will graduate next year. When he begins work- ing, he plans to deposit $6000 at the end of each year into a retirement account that pays 6% interest. How much will be in his account after 40 deposits? Contributed by Paut R. McCright, University of 4-3 South Florida 4-5 How much must be invested now at 8 % interest to produce $5000 at the end of every year for 10 years? The cash flows have a present value of 0. Compute the value of J, assuming a 6% interest rate. 4-15 1000 1000 1000 4-35 If i5%, for what value of B is the present value 0. 800 800 800 15B 4-63 The cash flows have a present value equal 0 Compute the value of D in the diagram. 300 200 100 i=10% D D D D For what value of P in the cash flow dagam does the peesent value equal 0 4-65 3000 1250 41000 750 s00 -105 Using a 10% interest rate, for what valae of B does the present value equal 0 4-71 200 100 4-77 A set of cash flows begins at $80,000 the first year, with an increase each year until n10 years. If the interest rate is 5%, what is the peesent value when (a) the annual increase is $10,000? (b the annual increase is 15%? 4-87 A 25-year-old engineer is opening an individual retirement account (IRA) at a bank. Her goal is to accumulate S1 million in the account by the time she retires from work in 40 years. The bunk manager estimates she may expect to receive 6% nominal annual interest, compounded quarterly, throughout the 40 years. The engineer believes her income will increase at a 5% annual rate during her career. She wishes to start her IRA with as low a deposit as pos sible and increase it at a 5% nae each ycar. Assuming end-of-year deposits, how much should she deposit the first year? 4-89 Picabo borows $1000. To repay the amoun, she makes 12 equal monthly payments of $93.12 Determine the following (a) The monthly interest rate (b) The nominal annual interest rate (c) The effective annual interest rate 4-104 Calculate and print out the balance due, principal payment, and interest payment for each period of a new car loan. The nominal interest is 8% per year, compounded monthly. Payments are made monthly for 5 years. The original loan is for $27,000 4-114 Your beginning salary is $70,000. You deposit 129 at the end of each year in a savings accoust that earns 3% interest. Your salary increases by 2% per year. What value does your savings book show after 40 years? 4123 A series of monthly cash flows is deposited into an account that earns 12% nominal interest com- pounded monthly. Each monthly deposit is equal to $2100. The first monthly deposit occurred on June 1, 2012 and the last monthly deposit will be on January 1, 2019. The account (the series of monthly deposits, 12% nominal interest, and monthly compounding) also has equivalent quarterly withdrawals from it. The first quarterly withdrawal is equal to $5000 and occurred on October 1, 2012. The last $5000 with- drawal will occur on January 1, 2019. How much remains in the account after the last withdrawal? 4-125 Assume that you plan to retire 40 years from now and that you expect to need $2M to support the lifestyle that you want. (a) If the interest rate is 10 % , is the following state- ment approximately true? "Waiting 5 years to start saving doubles what you must deposit each year." (b) If the interest rate is 12%, is the required multi- plier higher or lower than for the 10% rate in (a)? (c) At what interest rate is the following statement exactly true? "Waiting 5 years to start saving doubles what you must deposit each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts