Answered step by step

Verified Expert Solution

Question

1 Approved Answer

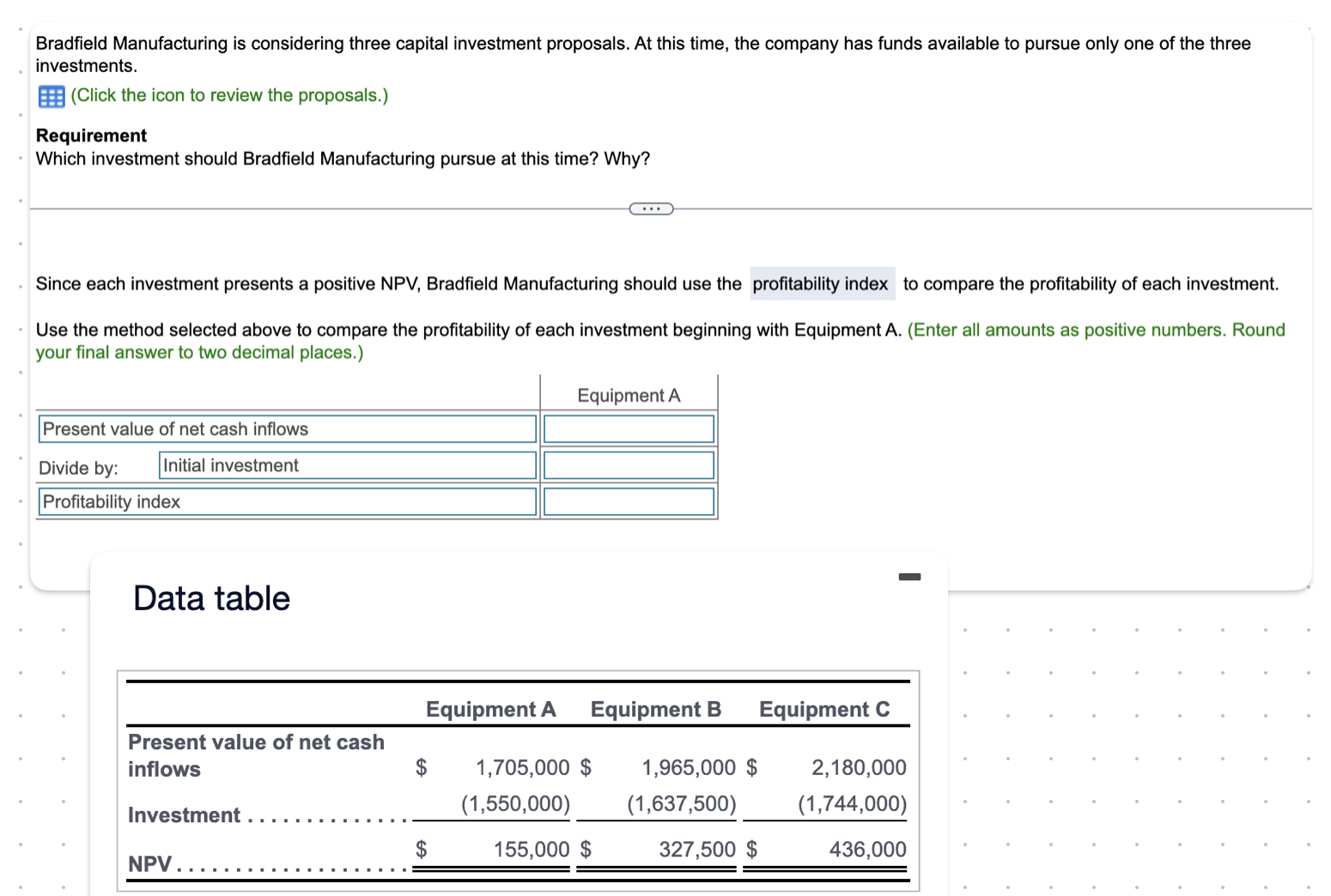

Bradfield Manufacturing is considering three capital investment proposals. At this time, the company has funds available to pursue only one of the three investments.

Bradfield Manufacturing is considering three capital investment proposals. At this time, the company has funds available to pursue only one of the three investments. (Click the icon to review the proposals.) Requirement Which investment should Bradfield Manufacturing pursue at this time? Why? Since each investment presents a positive NPV, Bradfield Manufacturing should use the profitability index to compare the profitability of each investment. Use the method selected above to compare the profitability of each investment beginning with Equipment A. (Enter all amounts as positive numbers. Round your final answer to two decimal places.) Equipment A Present value of net cash inflows Divide by: Initial investment Profitability index Data table Equipment A Equipment B Equipment C Present value of net cash inflows $ Investment 1,705,000 $ (1,550,000) 1,965,000 $ (1,637,500) 2,180,000 (1,744,000) $ 155,000 $ 327,500 $ 436,000 NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started