Question

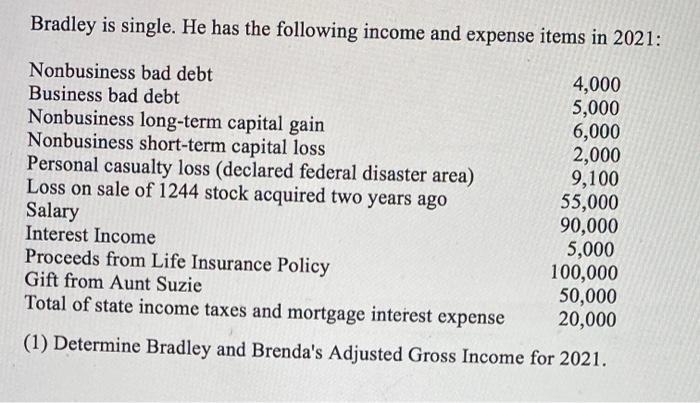

Bradley is single. He has the following income and expense items in 2021: 4,000 Nonbusiness bad debt Business bad debt 5,000 Nonbusiness long-term capital

Bradley is single. He has the following income and expense items in 2021: 4,000 Nonbusiness bad debt Business bad debt 5,000 Nonbusiness long-term capital gain Nonbusiness short-term capital loss 6,000 2,000 Personal casualty loss (declared federal disaster area) Loss on sale of 1244 stock acquired two years ago 9,100 55,000 Salary 90,000 Interest Income 5,000 Proceeds from Life Insurance Policy 100,000 Gift from Aunt Suzie 50,000 Total of state income taxes and mortgage interest expense 20,000 (1) Determine Bradley and Brenda's Adjusted Gross Income for 2021.

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Adjusted Cross Income is simply to add all form...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Comprehensive

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

40th Edition

1305874161, 978-1305874169

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App