Question

Brady Company has 30,000 shares of $10 par value common stock authorized and 20,000 shares issued and outstanding. On August 15, Year 6, Brady purchased

Brady Company has 30,000 shares of $10 par value common stock authorized and 20,000 shares issued and outstanding. On August 15, Year 6, Brady purchased 1,000 shares of treasury stock for $12 per share. These shares had originally been sold to investors for $11.50 per share. Brady uses the cost method to account for treasury stock. On September 14, Year 6, Brady sold 500 shares of the treasury stock for $14 per share.

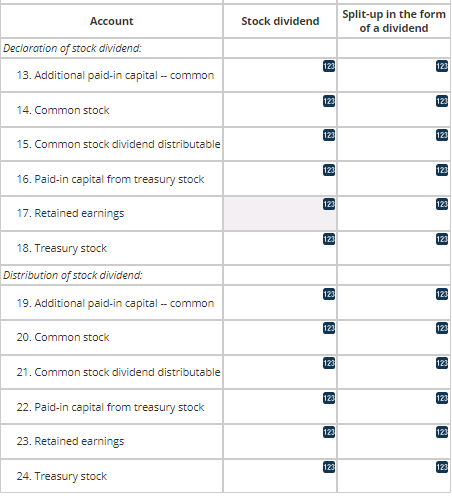

In October Year 6, Brady declared and distributed 2,000 shares as a stock dividend from unissued shares when the fair value of the common stock was $16 per share.

On December 20, Year 6, Brady declared a $1 per share cash dividend, payable on January 10, Year 7, to shareholders of record on December 31, Year 6.

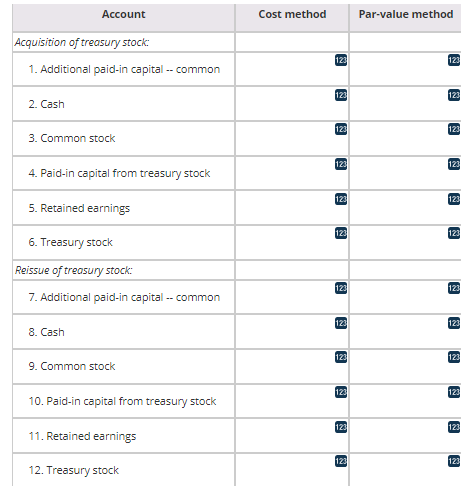

Determine the amounts to be recorded for the treasury stock transactions under the cost and par-value methods. Also determine amounts to be recorded for the declaration and distribution of a stock dividend and a split-up in the form of a dividend.

Calculate Brady's equity transactions using the information above. Enter the appropriate amounts in the designated cells below. Enter positive amounts for the accounts that should be debited, and negative amounts for the accounts that should be credited. Indicate negative amounts by using a leading minus (-) sign. If no entry is necessary, enter a zero (0) or leave the cell blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started