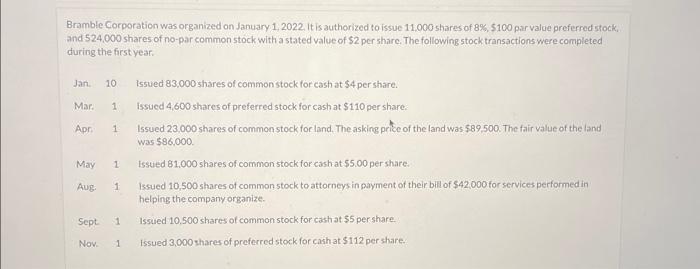

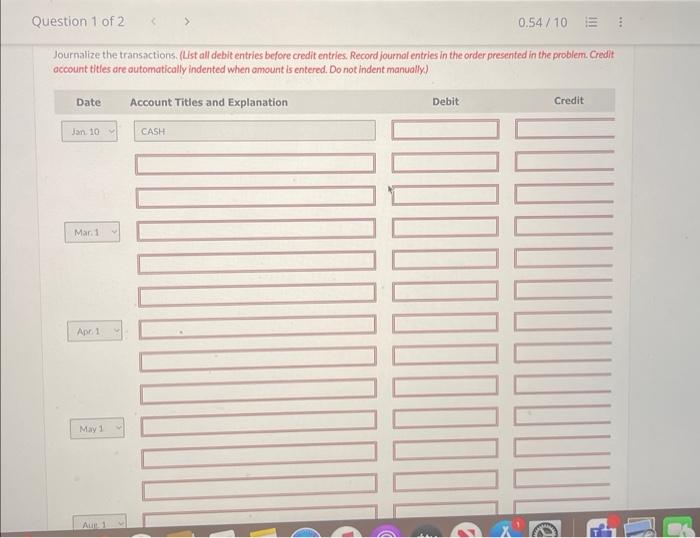

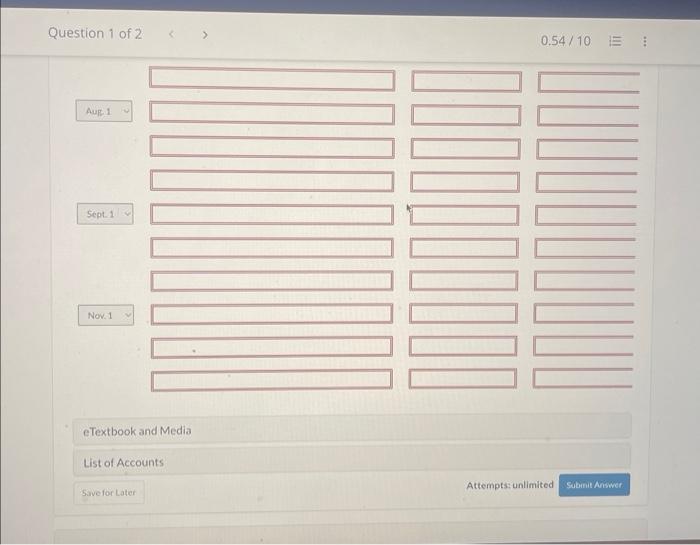

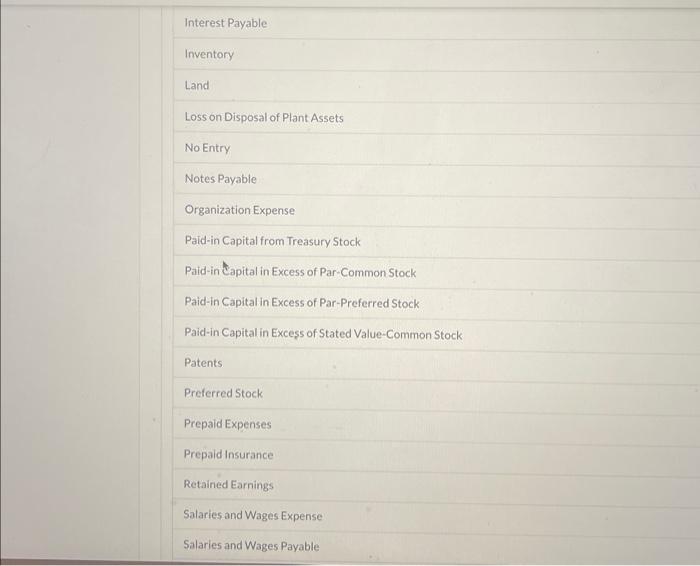

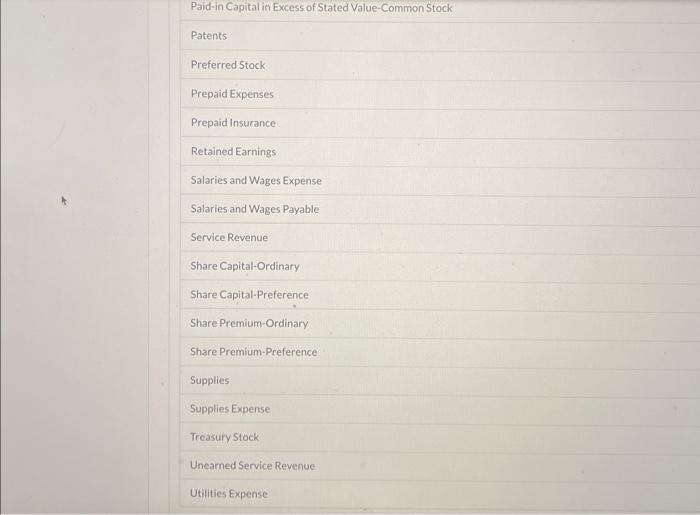

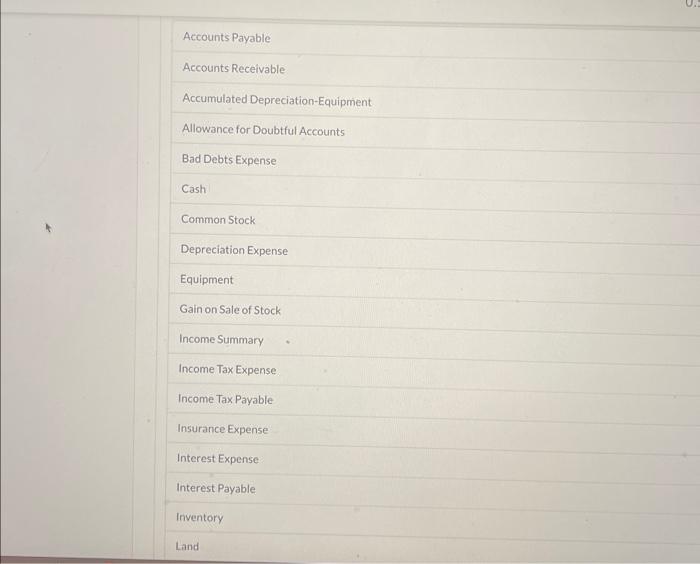

Bramble Corporation was organized on January 1, 2022. It is authorized to issue 11,000 shares of 8%,$100 par value preferred stock, and 524,000 shares of no-par common stock with a stated value of 52 per share. The following stock transactions were completed during the firstyear. Jan. 10 issued 83,000 shares of common stock for cash at $4 per share. Mar. 1 Issued 4,600 shares of preferred stock for cash at $110 per share. Apr: 1 Issued 23,000 shares of commonstock for land. The asking price of the land was $89,500. The fair value of the land was 586.000 May 1 issued 81,000 shares of common stock for cashat $5.00 per share. Aug. 1 issued 10,500 shares of common stock to attorneys in payment of their bil of $42,000 for services performed in helping the company organize. Sept. 1 Issued 10,500 shares of common stock for cashat $5 per share. Nov. 1 issued 3,000 shares of preferred stock for cash at $112 per share. Journalize the transactions. (List all debit entries before credit entries. Record joumal entries in the order presented in the problem. Credit occount titles are outomatically indented when amount is entered. Do not indent manually. Question 1 of 2 0.54/10 Aur: 1 . Sept 1 Now. 1 eTextbook and Media List of Accounts Sive for Later Attempts: unlimited Subinit Ariser. Interest Payable Inventory Land Loss on Disposal of Plant Assets No Entry Notes Payable Organization Expense Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Patents Preferred Stock Prepaid Expenses Prepaid Insurance Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Paid-in Capital in Excess of Stated Value-Common Stock Patents Preferred Stock Prepaid Expenses Prepaid Insurance: Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Service Revenue Share Capital-Ordinary Share Capital-Preference Share Premium-Ordinary Share Premium-Preference Supplies Supplies Expense Treasury Stock Unearned Service Revenue Utilities Expense Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debts Expense Cash Common Stock Depreciation Expense Equipment Gain on Sale of Stock Income Summary Income Tax Expense Income Tax Payable Insurance Expense Interest Expense Interest Payable Inventory Land