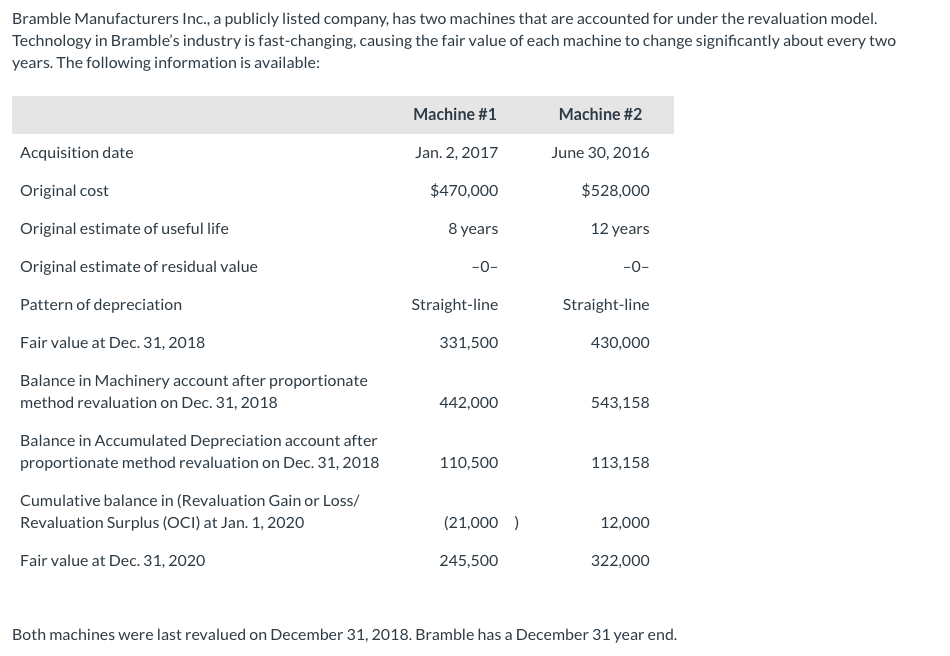

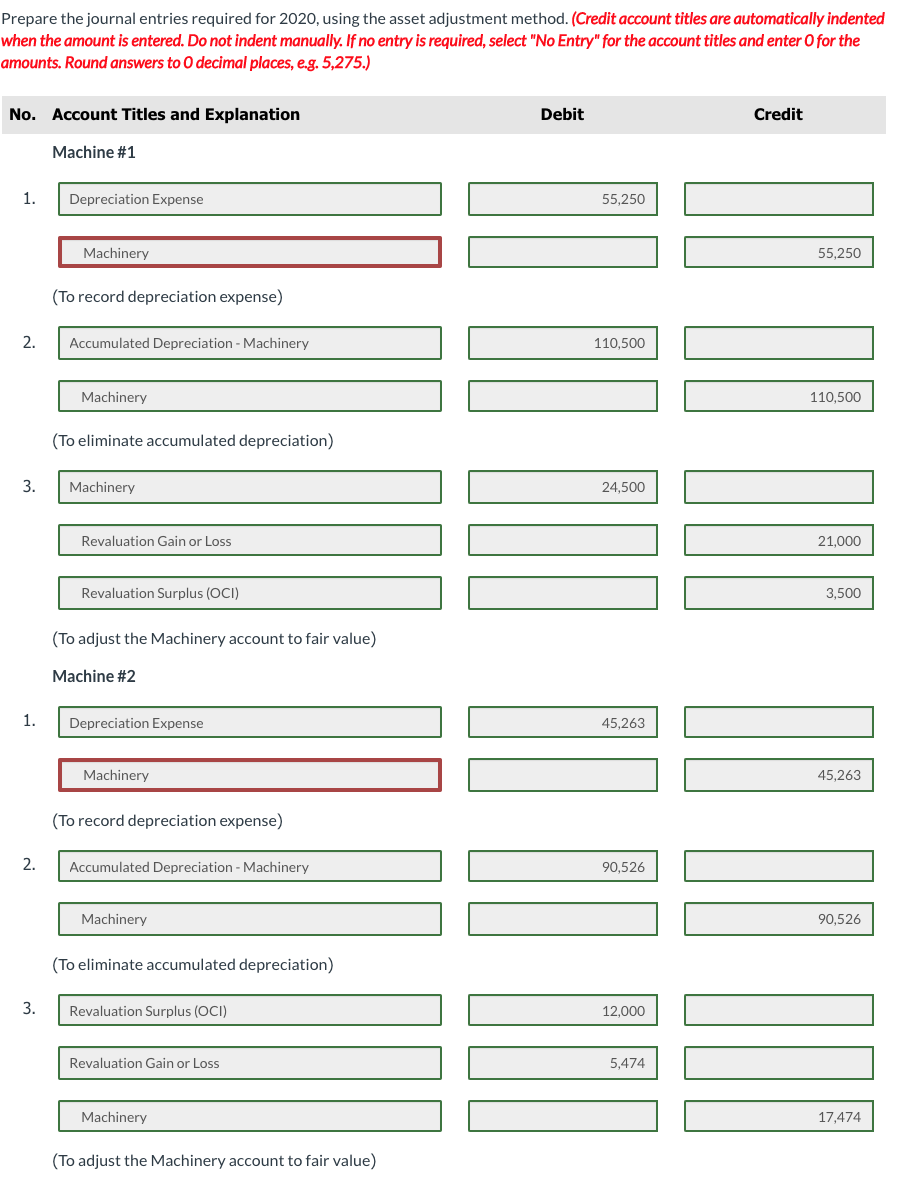

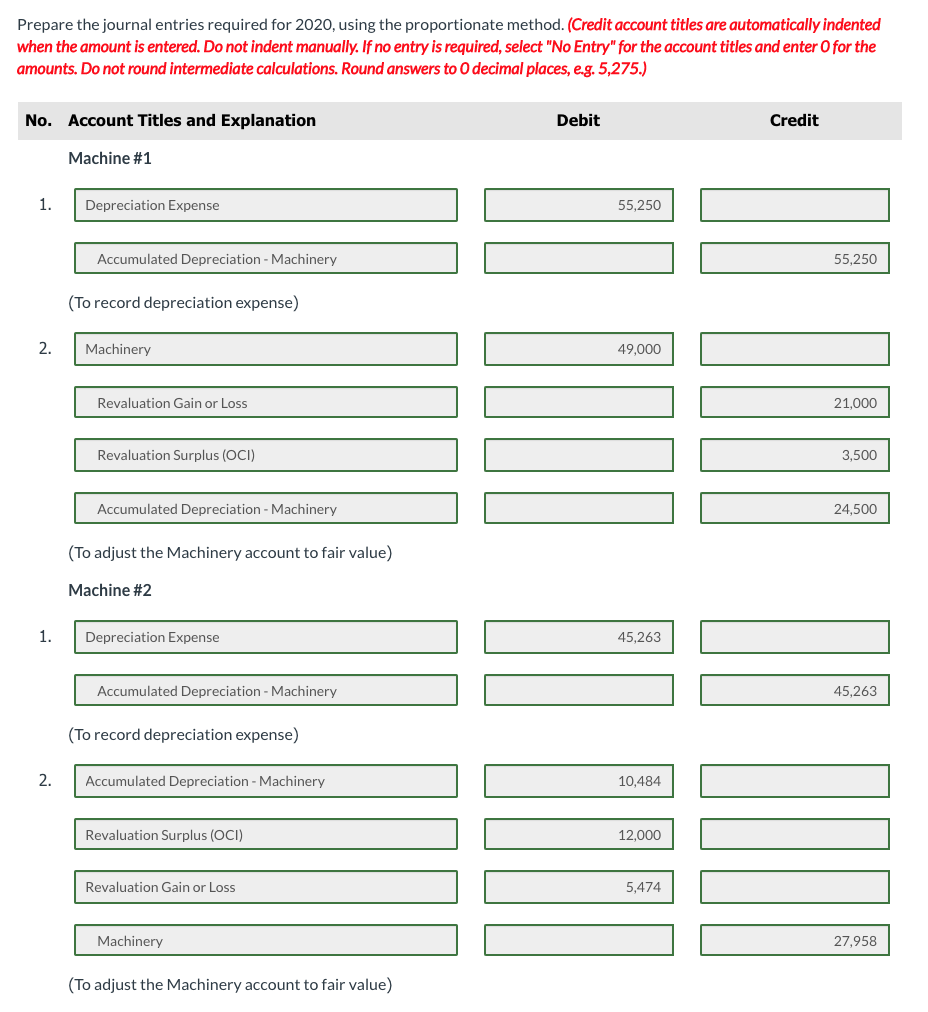

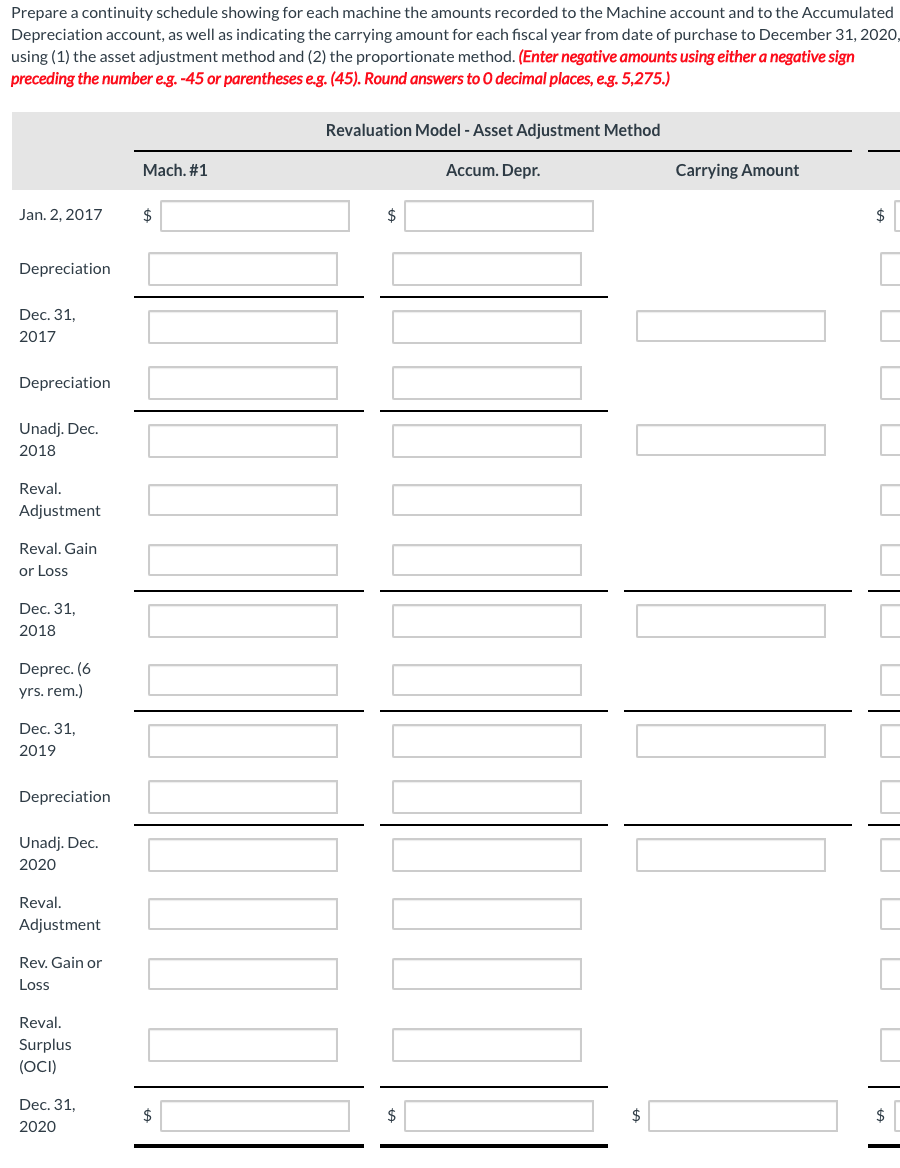

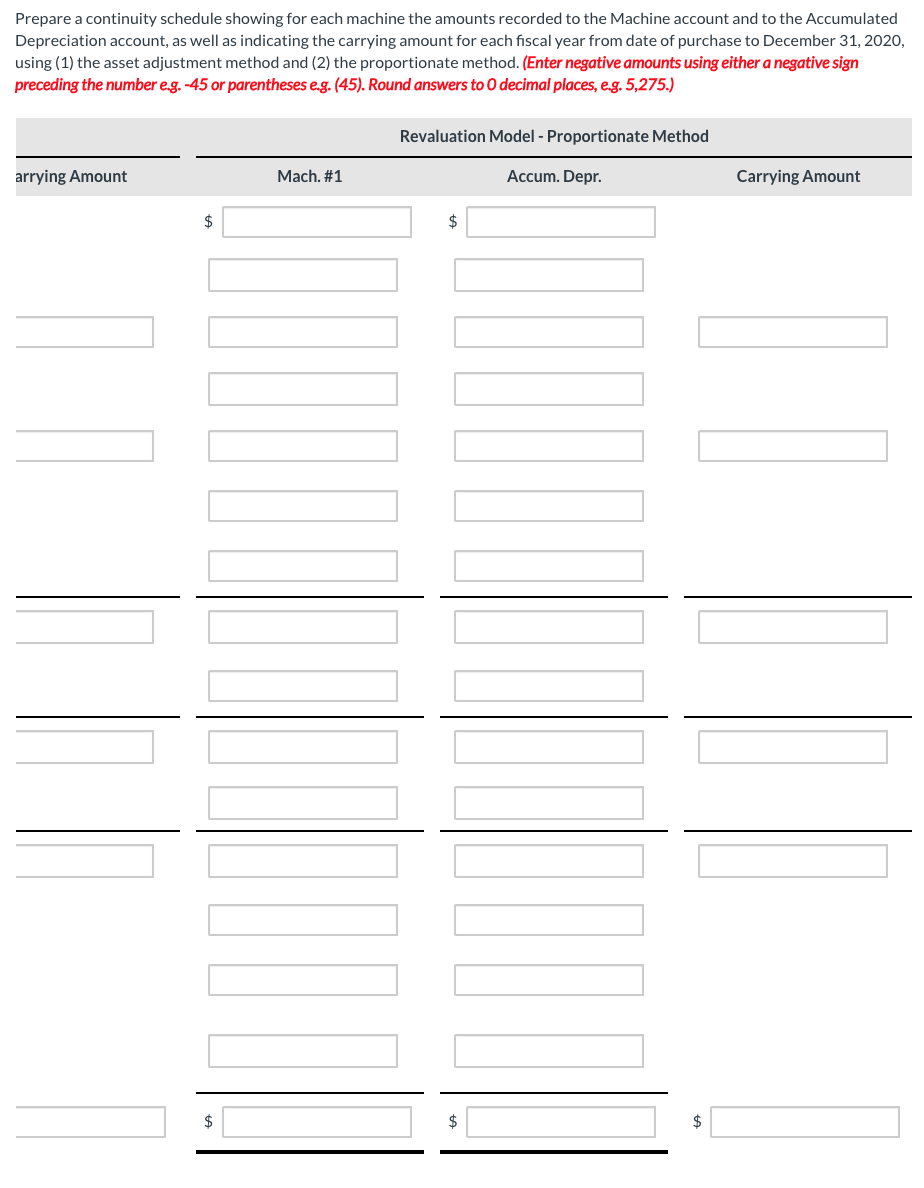

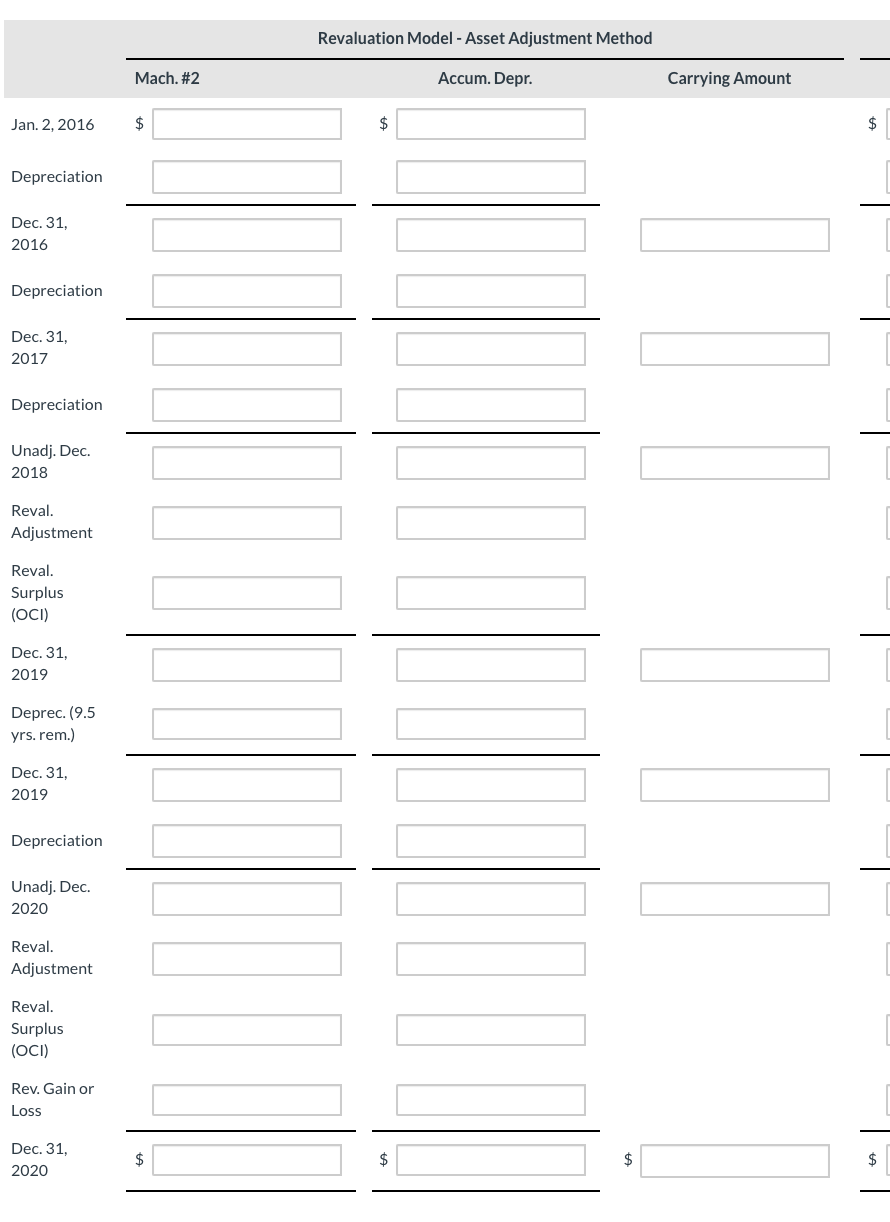

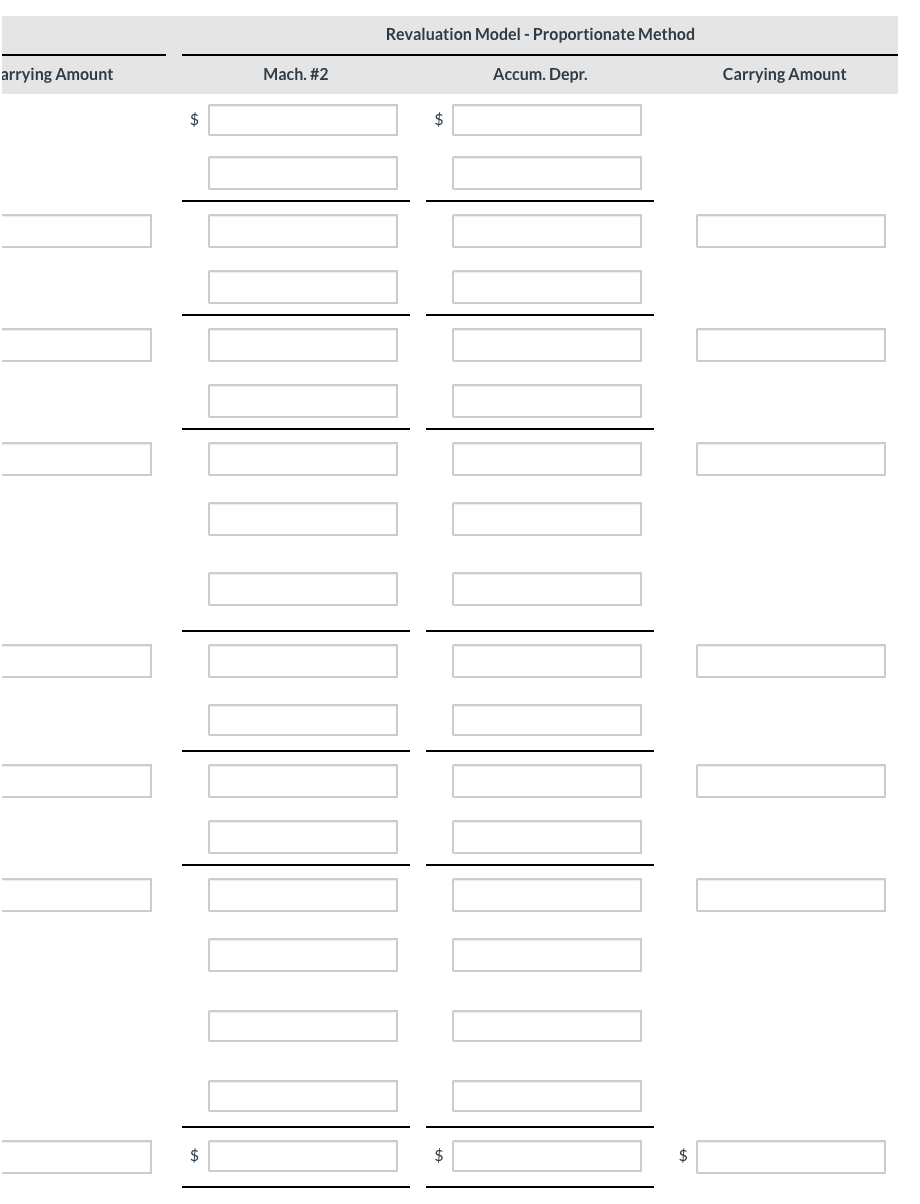

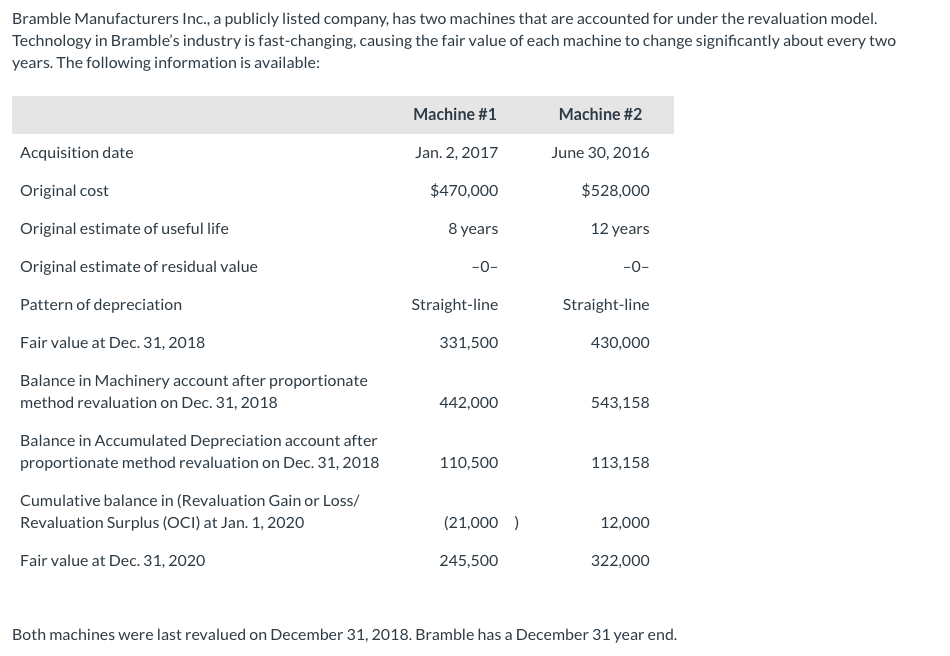

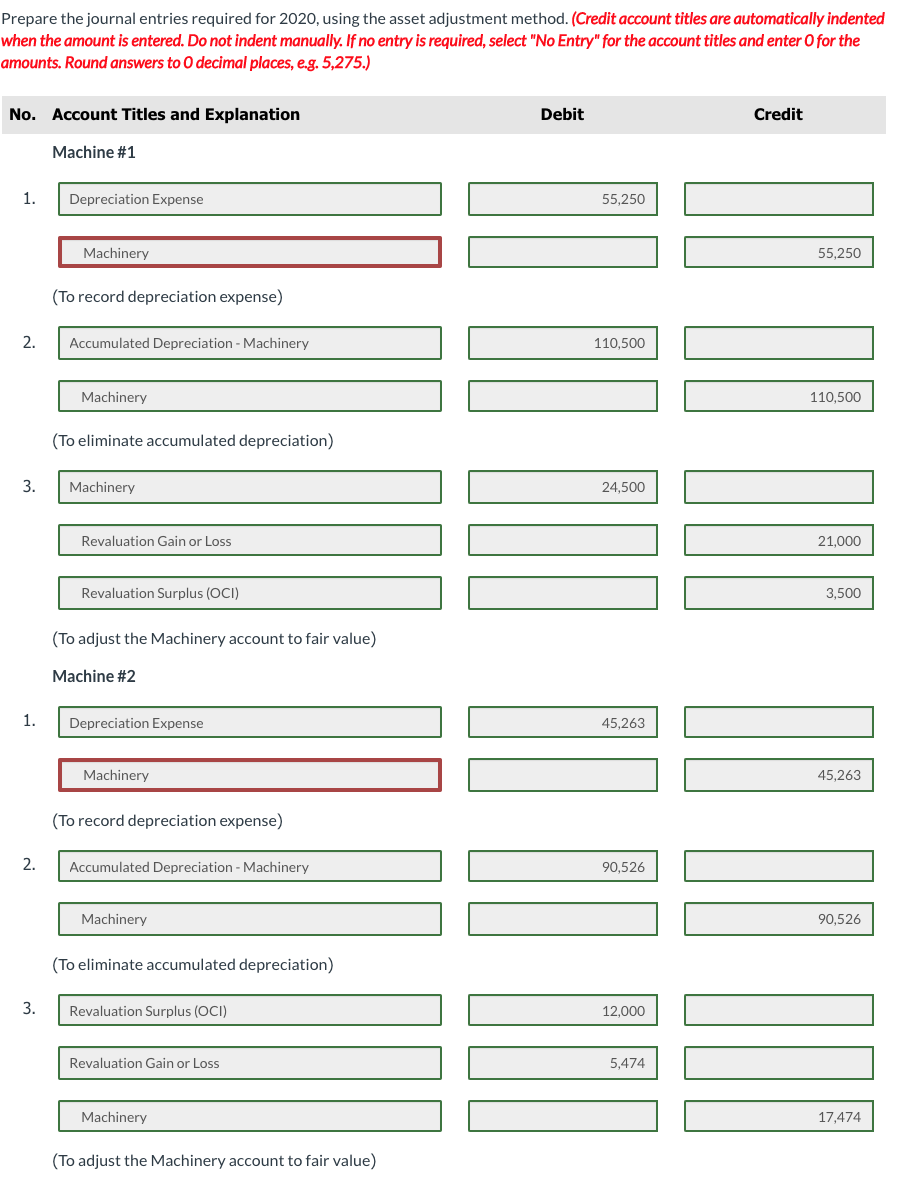

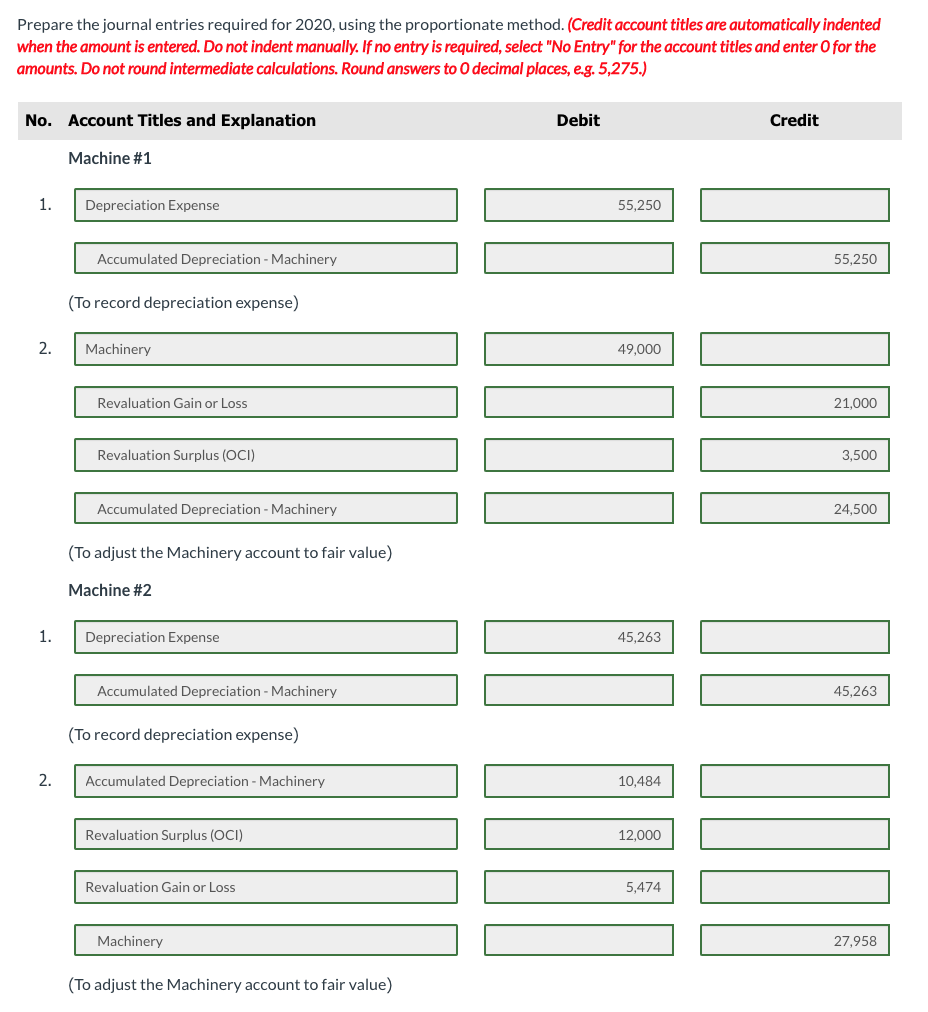

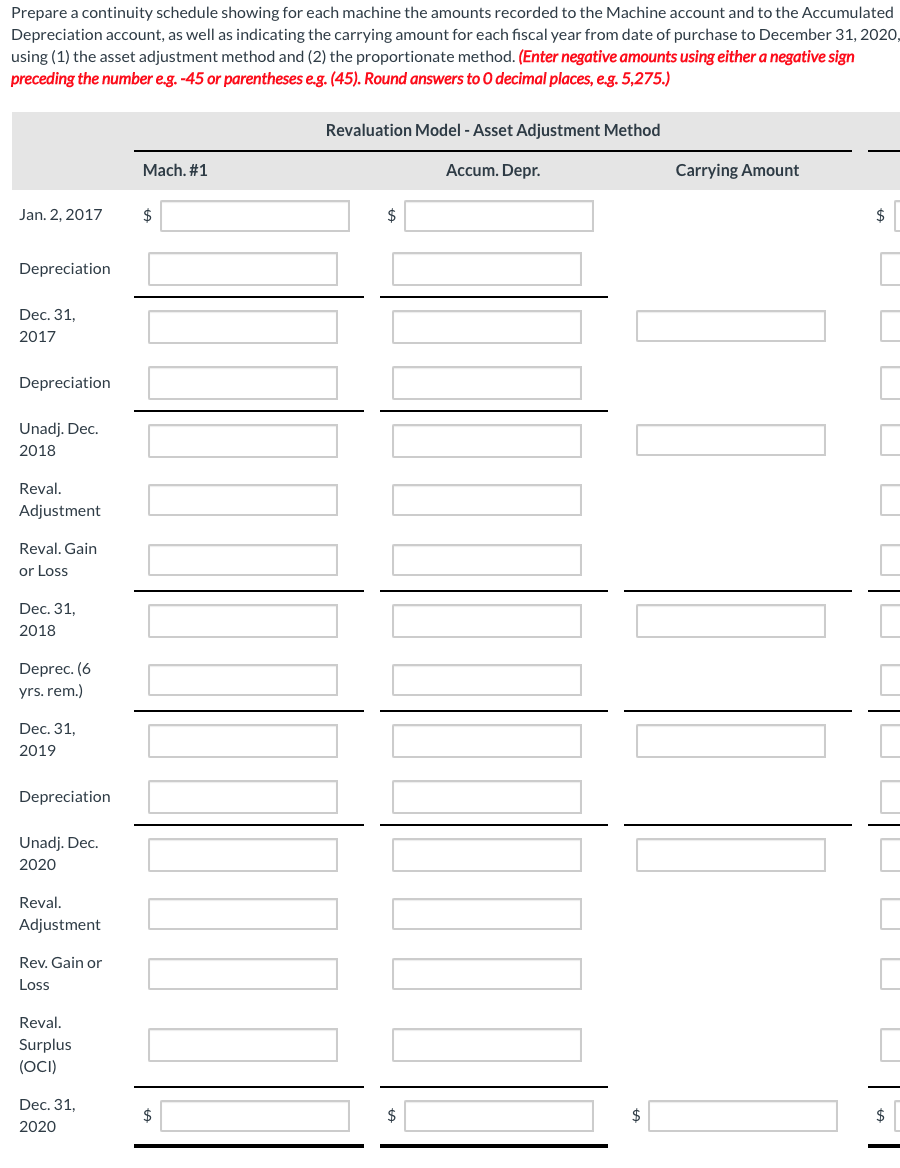

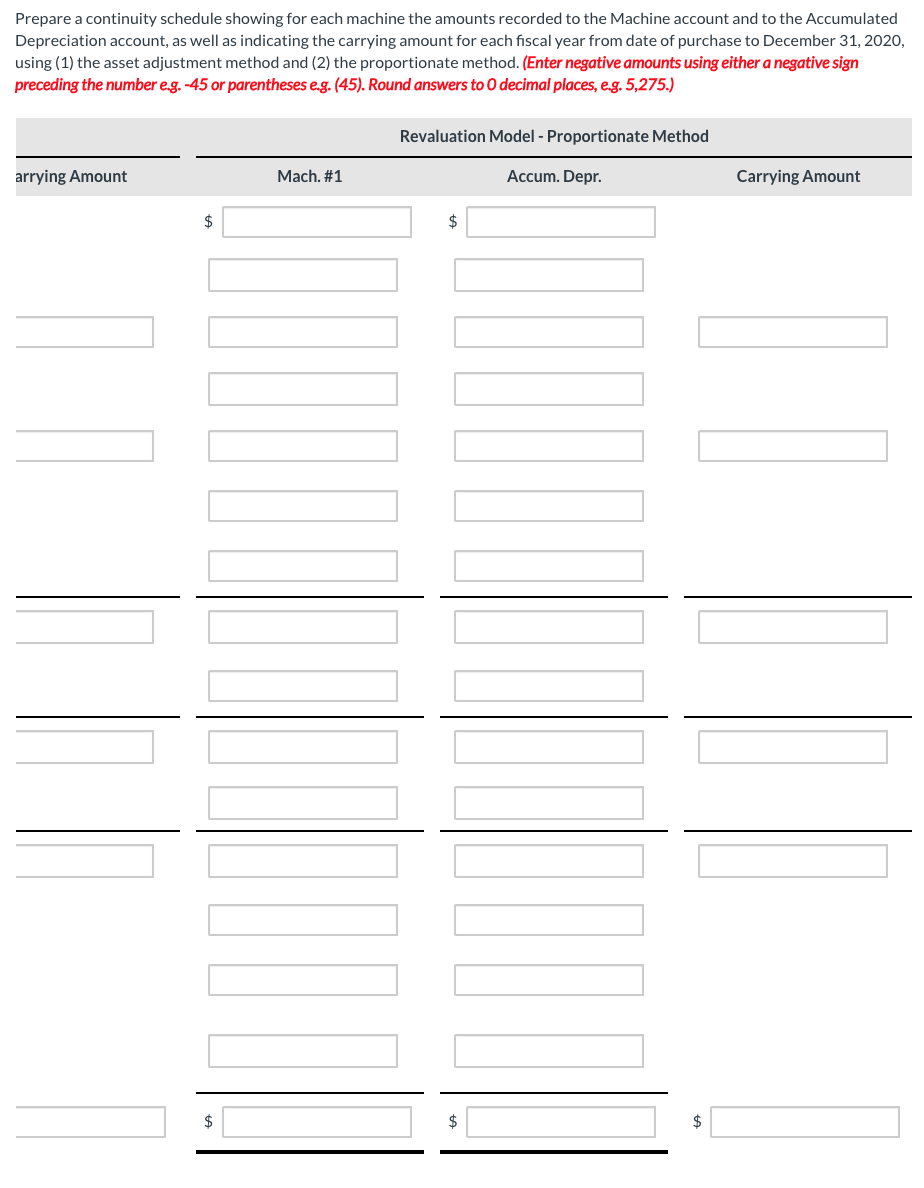

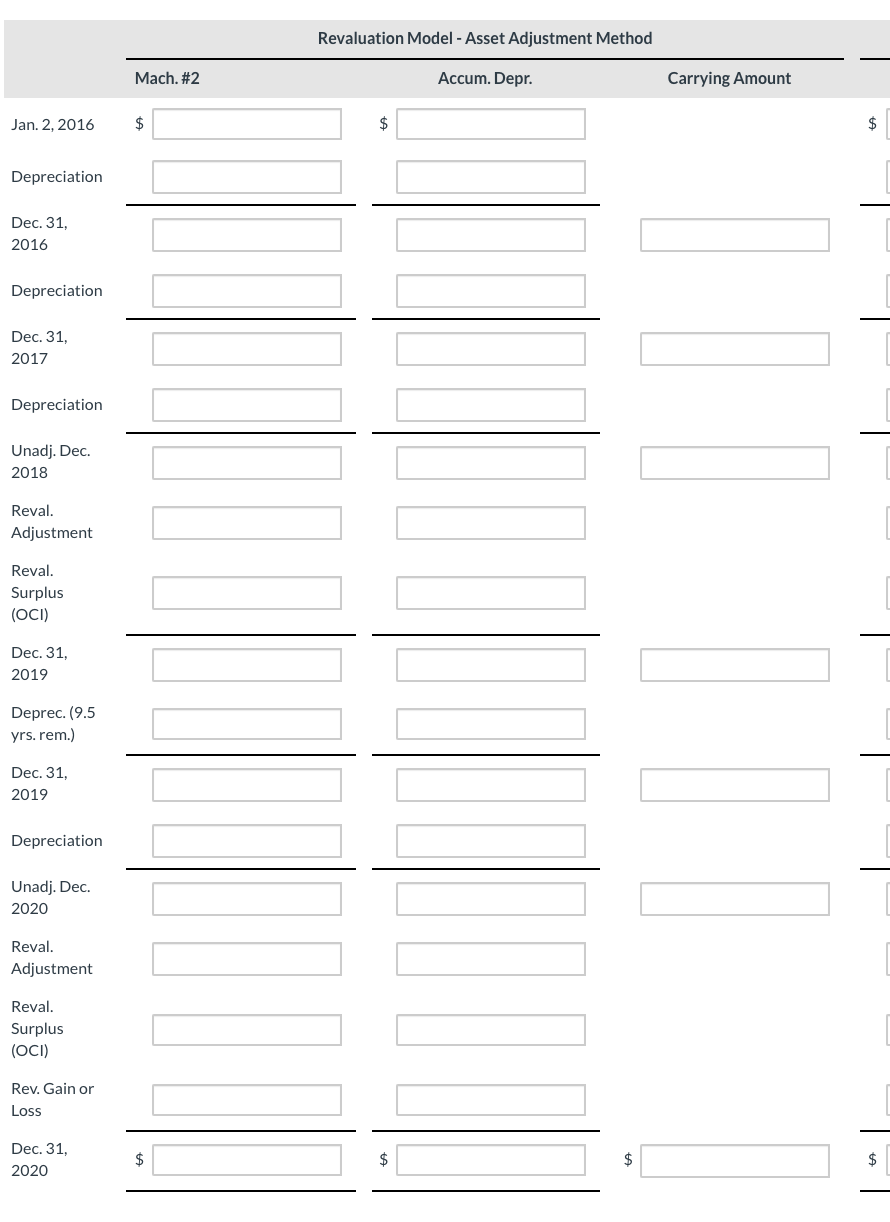

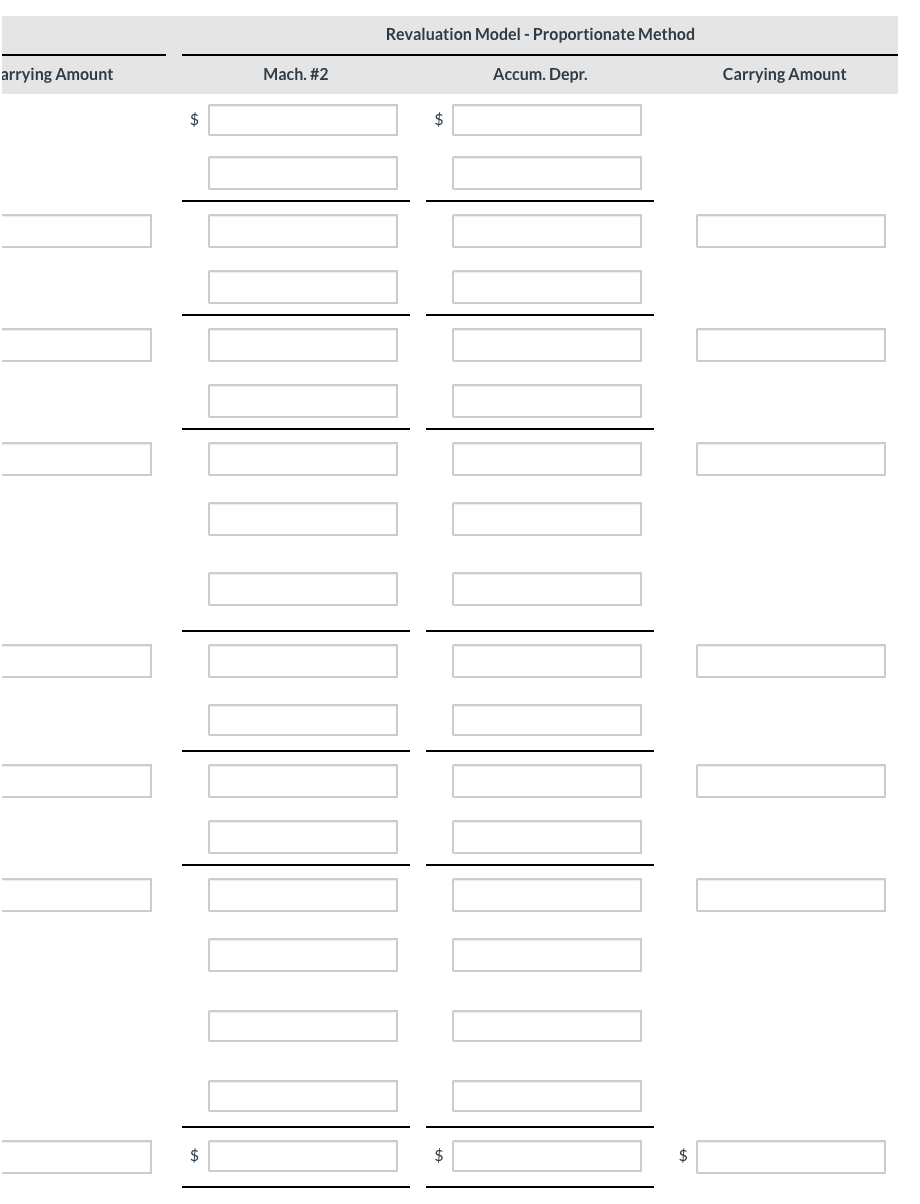

Bramble Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Bramble's industry is fast-changing, causing the fair value of each machine to change significantly about every two years. The following information is available: Machine #1 Machine #2 Acquisition date Jan. 2, 2017 June 30, 2016 Original cost $470,000 $528,000 Original estimate of useful life 8 years 12 years Original estimate of residual value -0- -0- Pattern of depreciation Straight-line Straight-line 331,500 430,000 Fair value at Dec. 31, 2018 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2018 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec. 31, 2018 442,000 543,158 110,500 113,158 Cumulative balance in (Revaluation Gain or Loss/ Revaluation Surplus (OCI) at Jan. 1, 2020 (21,000) 12,000 Fair value at Dec. 31, 2020 245,500 322,000 Both machines were last revalued on December 31, 2018. Bramble has a December 31 year end. Prepare the journal entries required for 2020, using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to 0 decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit Machine #1 1. Depreciation Expense 55,250 Machinery 55,250 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 110,500 Machinery 110,500 (To eliminate accumulated depreciation) 3. Machinery 24,500 Revaluation Gain or Loss 21,000 Revaluation Surplus (OCI) (To adjust the Machinery account to fair value) Machine #2 DER DA I. NIIN OTI DIDI DI DI 1. Depreciation Expense 45,263 Machinery 45,263 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 90,526 Machinery 90,526 (To eliminate accumulated depreciation) 3. Revaluation Surplus (OCI) 12,000 Revaluation Gain or Loss 5,474 Machinery 17,474 (To adjust the Machinery account to fair value) Prepare the journal entries required for 2020, using the proportionate method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Do not round intermediate calculations. Round answers to 0 decimal places, eg. 5,275.) No. Account Titles and Explanation Debit Credit Machine #1 1. Depreciation Expense 55,250 Accumulated Depreciation - Machinery 55,250 (To record depreciation expense) 2. Machinery 49,000 Revaluation Gain or Loss 21,000 Revaluation Surplus (OCI) 3,500 Accumulated Depreciation - Machinery 24,500 (To adjust the Machinery account to fair value) DAJTE MAJA I MOTO Machine #2 1. Depreciation Expense 45,263 Accumulated Depreciation - Machinery 45,263 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 10,484 Revaluation Surplus (OCI) 12.000 Revaluation Gain or Loss 5,474 Machinery 27,958 (To adjust the Machinery account to fair value) Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Revaluation Model - Asset Adjustment Method Mach. #1 Accum. Depr. Carrying Amount Jan. 2, 2017 $ $ $ Depreciation Dec. 31, 2017 [ Depreciation Unadj. Dec. 2018 Reval. Adjustment Reval. Gain or Loss Dec. 31. 2018 Deprec. (6 yrs.rem.) Dec. 31. 2019 Depreciation Unadj. Dec. 2020 Reval. Adjustment [ Rev. Gain or Loss Reval. Surplus (OCI) Dec. 31, 2020 $ $ a Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45). Round answers to 0 decimal places, eg. 5,275.) Revaluation Model - Proportionate Method arrying Amount Mach. #1 Accum. Depr. Carrying Amount $ $ $ $ Revaluation Model - Asset Adjustment Method Mach. #2 Accum. Depr. Carrying Amount Jan. 2, 2016 $ $ $ Depreciation Dec. 31, 2016 Depreciation Dec. 31, 2017 Depreciation Unadj. Dec. 2018 Reval. Adjustment Reval. Surplus (OCI) Dec. 31, 2019 Deprec. (9.5 yrs. rem.) Dec. 31, 2019 Depreciation Unadj. Dec. 2020 Reval. Adjustment Reval. Surplus (OCI) Rev. Gain or Loss Dec. 31, 2020 $ $ Revaluation Model - Proportionate Method arrying Amount Mach. #2 Accum. Depr. Carrying Amount $ $ $ ta $ $ Bramble Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Bramble's industry is fast-changing, causing the fair value of each machine to change significantly about every two years. The following information is available: Machine #1 Machine #2 Acquisition date Jan. 2, 2017 June 30, 2016 Original cost $470,000 $528,000 Original estimate of useful life 8 years 12 years Original estimate of residual value -0- -0- Pattern of depreciation Straight-line Straight-line 331,500 430,000 Fair value at Dec. 31, 2018 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2018 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec. 31, 2018 442,000 543,158 110,500 113,158 Cumulative balance in (Revaluation Gain or Loss/ Revaluation Surplus (OCI) at Jan. 1, 2020 (21,000) 12,000 Fair value at Dec. 31, 2020 245,500 322,000 Both machines were last revalued on December 31, 2018. Bramble has a December 31 year end. Prepare the journal entries required for 2020, using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to 0 decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit Machine #1 1. Depreciation Expense 55,250 Machinery 55,250 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 110,500 Machinery 110,500 (To eliminate accumulated depreciation) 3. Machinery 24,500 Revaluation Gain or Loss 21,000 Revaluation Surplus (OCI) (To adjust the Machinery account to fair value) Machine #2 DER DA I. NIIN OTI DIDI DI DI 1. Depreciation Expense 45,263 Machinery 45,263 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 90,526 Machinery 90,526 (To eliminate accumulated depreciation) 3. Revaluation Surplus (OCI) 12,000 Revaluation Gain or Loss 5,474 Machinery 17,474 (To adjust the Machinery account to fair value) Prepare the journal entries required for 2020, using the proportionate method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Do not round intermediate calculations. Round answers to 0 decimal places, eg. 5,275.) No. Account Titles and Explanation Debit Credit Machine #1 1. Depreciation Expense 55,250 Accumulated Depreciation - Machinery 55,250 (To record depreciation expense) 2. Machinery 49,000 Revaluation Gain or Loss 21,000 Revaluation Surplus (OCI) 3,500 Accumulated Depreciation - Machinery 24,500 (To adjust the Machinery account to fair value) DAJTE MAJA I MOTO Machine #2 1. Depreciation Expense 45,263 Accumulated Depreciation - Machinery 45,263 (To record depreciation expense) 2. Accumulated Depreciation - Machinery 10,484 Revaluation Surplus (OCI) 12.000 Revaluation Gain or Loss 5,474 Machinery 27,958 (To adjust the Machinery account to fair value) Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Revaluation Model - Asset Adjustment Method Mach. #1 Accum. Depr. Carrying Amount Jan. 2, 2017 $ $ $ Depreciation Dec. 31, 2017 [ Depreciation Unadj. Dec. 2018 Reval. Adjustment Reval. Gain or Loss Dec. 31. 2018 Deprec. (6 yrs.rem.) Dec. 31. 2019 Depreciation Unadj. Dec. 2020 Reval. Adjustment [ Rev. Gain or Loss Reval. Surplus (OCI) Dec. 31, 2020 $ $ a Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45). Round answers to 0 decimal places, eg. 5,275.) Revaluation Model - Proportionate Method arrying Amount Mach. #1 Accum. Depr. Carrying Amount $ $ $ $ Revaluation Model - Asset Adjustment Method Mach. #2 Accum. Depr. Carrying Amount Jan. 2, 2016 $ $ $ Depreciation Dec. 31, 2016 Depreciation Dec. 31, 2017 Depreciation Unadj. Dec. 2018 Reval. Adjustment Reval. Surplus (OCI) Dec. 31, 2019 Deprec. (9.5 yrs. rem.) Dec. 31, 2019 Depreciation Unadj. Dec. 2020 Reval. Adjustment Reval. Surplus (OCI) Rev. Gain or Loss Dec. 31, 2020 $ $ Revaluation Model - Proportionate Method arrying Amount Mach. #2 Accum. Depr. Carrying Amount $ $ $ ta $ $