Answered step by step

Verified Expert Solution

Question

1 Approved Answer

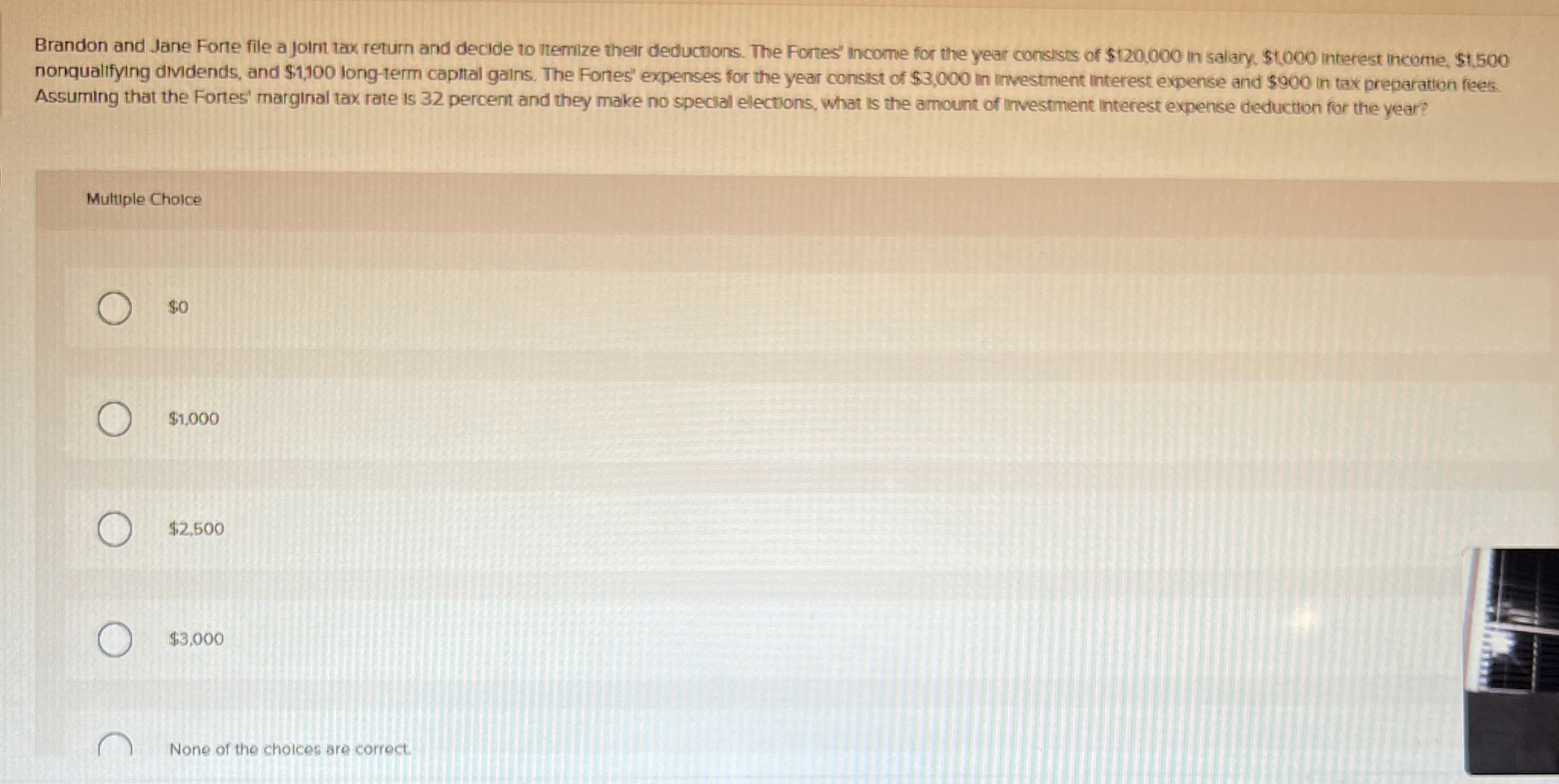

Brandon and Jane Forte file a joint tax retum and decide to itemize their deductions. The Fortes' income for the year consists of $ 1

Brandon and Jane Forte file a joint tax retum and decide to itemize their deductions. The Fortes' income for the year consists of $ in saliary, $ interest income, $

nonqualifying dividends, and $ longterm capttal gains. The Fortes" expenses for the year conslst of $ in investment interest expense and $ in tax preparation fiees.

Assuming that the Fonts" marginal tax rate is percent and they make no special elections, what is the amount of investment interest expense deduction for the year?

Multiple Cholce

$

$

$

$

None of the cholces are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started