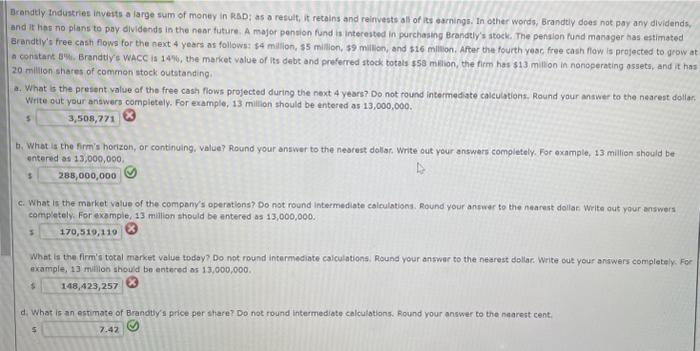

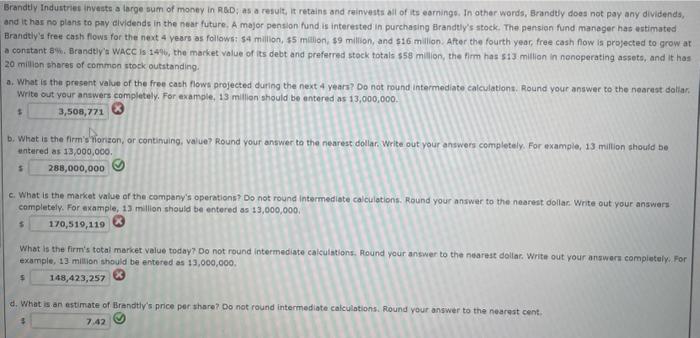

Brandty Industries inverts a large sum of money in RSD; as a result, it retains and reinvests alf of tes earnings. In other words, brandtly does not pay any dividends, and it hes no plans to pay dividends in the near future. A major pension fund is interested in purchasing Brandty's atosk, The penslon fund manager has estimated Erandtiy's free cash flows for the next 4 years as followss 14 million, 35 milkon, 39 million, and 316 milition. After the fourth yesc, free cash flow is projected to grow at A constant B4. Brandty's WeACC is 14%, the market value of its debt and preferred stock totals $53 miliion, the firm has $13 millon in nonoperating assets, and it has 20 milion shares of common stock outstanding a. What is the present value of the free cash flows projected during the next 4 years? Do not round intermediate calculations. Round your answer to the nearest dollan Wirite out your answers completely. For example, 13 million should be entered as 13,000,000. 5 (3) b. What is the firm's herizon, or continuing, value? Round your answer to the nestest dolist. Write out your answers completely. For example, 13 million should be entered as 13,009,000 3 c. What is the market value of the compeny's operations? Do not round intermediate calculations. Round your answer to the nearest dollar Weite out your answers complately. For example, 13 mililon should be antered as 13,000,000. 3 (3) What is the firm's total market value today? Do not round intermediate calculations. Round your answar to the nearest dollar. Write out your answers completely. For example, 13 mitilon should be entered os 13,000,000. d. What is an estimate of Brandify's price per share? Do not round intermediate calculations. Round your answer to the naarett cent, 5 Brandty Industree invests a targe sum of money in R\&D; as a result, it retains and reinvests all of its earnings. In other words, Brandely does not pay any dividends, and it has no plans to pny elvidends in the near future. A mojor pension fund is interested in purchasing Brandtly's stock. The pension fund maneger hat estimated Brandily's free cash flows for the next 4 years as follows: 54 milion, 45 malion, $9 million, and $16 m ilion. After the fourth year, free cash flow is projected to grow at a conatant B\%. Brandtly't Wace is 1496 , the market value of its debt and preferred stock fotals 559 million, the firm has 513 million in nenoperating assets, and it has 20 milion shares of common stock outstanding: a. What is the present value of the free cath flows projected during the next 4 years? Do not round intermediate calculationt. Round your answer to the nearest daliar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 3 b. Whet is the firm's Tionzon, or continuing, value? Round your answer ta the nearest dollar. Write out your answers completely. For example, 13 miltion shouid be entered as 13,000,000. 5 c. What is the market value of the compeny's operations? Do not round intermediate calculations. Round your answer to the nearest dollar Write out your answers. completely. For axamale, 13 million should be entered 3513,000,000, (3) What is the firm's total market velue today? Do not round intermediate calculations. Round your answer to the nearest doliar. Write out your answern completely. For example, 13. million should be entered as 13,000,000, d. What is an estimate of Brandtly's price per share? Do not round intermediate calculations. flound your answer to the nearest cent