Question

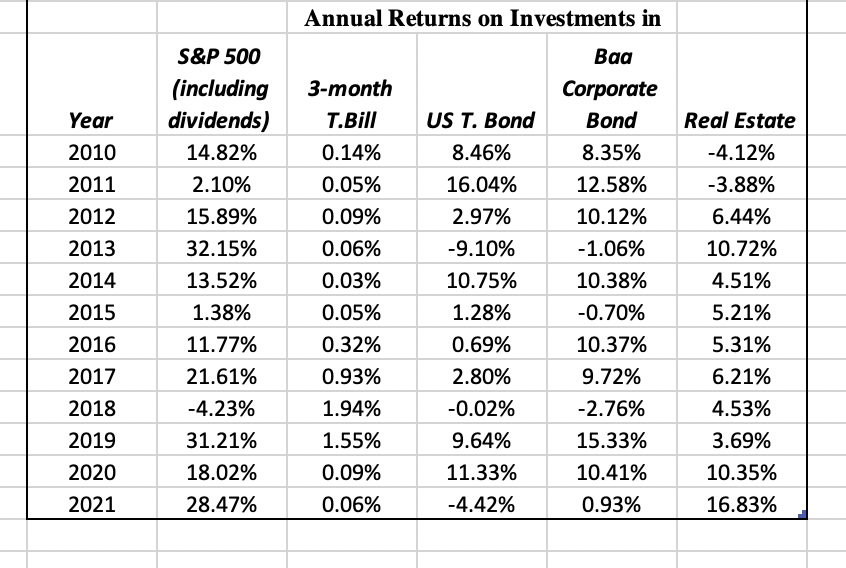

Brant Advisors is one of the largest assets managers in the world. They have a main goal of maximizing their investors return on investment. Using

Brant Advisors is one of the largest assets managers in the world. They have a main goal of maximizing their investors return on investment. Using linear programing and solver build a model that maximizes return on investment using a ten year average for the given asset types. There is 1,000,000 total to investand they cannot be more than 50% invested in one asset class. They must keep 5 percent liquidity as a minimum at all time. There are 6 decision variables: cash, stock, US T Bond, corporate bond, and real estate market. Additionally, Brant Advisors has three types of clients that require different portfolio allocations. Create a model that optimizes return on investment while accepting for each clients assigned risk level. Client A is young and willing to take risks, Client B is approaching retirement and is moderately risk averse, and Client C is fully retired and is risk adverse.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started