Answered step by step

Verified Expert Solution

Question

1 Approved Answer

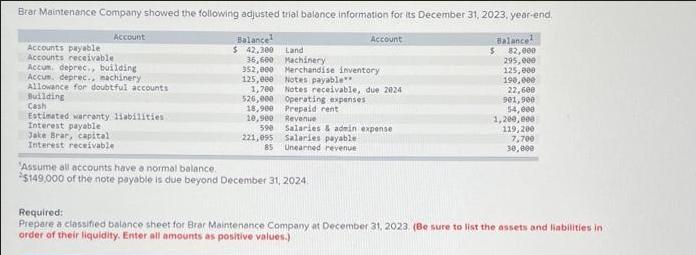

Brar Maintenance Company showed the following adjusted trial balance information for its December 31, 2023, year-end. Balance $ 42,300 Land Account Accounts payable Accounts

Brar Maintenance Company showed the following adjusted trial balance information for its December 31, 2023, year-end. Balance $ 42,300 Land Account Accounts payable Accounts receivable Accum deprec., building Accus. deprec., machinery. Allowance for doubtful accounts Building Cash Estimated warranty liabilities Interest payable Jake Brar, capital Interest receivable 36,600 Machinery 352,000 Merchandise inventory 125,000 Notes payable" 1,700 Notes receivable, due 2024 526,000 Operating expenses 18,900 10,900 590 221,095 85 Prepaid rent Revenue Account Salaries & admin expense Salaries payable Unearned revenue 'Assume all accounts have a normal balance. $149,000 of the note payable is due beyond December 31, 2024 Balance $ 82,000 295,000 125,000 190,000 22,600 901,900 54,000 1,200,000 119,200 7,700 30,000 Required: Prepare a classified balance sheet for Brar Maintenance Company at December 31, 2023. (Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values.)

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Brar Maintenance Company Balance Sheet December 31 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started