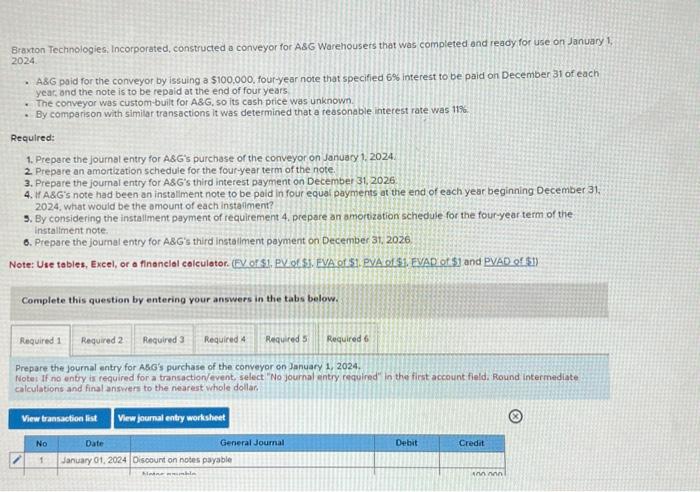

Braxton Technologies. Incorporated, constructed a conveyor for As 6 Warehousers that was completed and ready for use on January 1 , 2024. - A8G paid for the conveyor by issuing a $100.000, four-year note that specified 6% interest to be paid an December 31 of each year, ond the note is to be repaid at the end of four years - The conveyor was custombuilt for A\&G, so its cash price was unknown. - By comparison with similar transactions it was determined that a reasonable interest rate was 119. Required: 1. Prepare the journal entry for A\&G's purchase of the conveyor on Januacy 1, 2024. 2. Prepare an amortization schedule for the four-year term of the note. 3. Prepare the joumal entry for A\&G's third interest payment on December 31,2026 4. If A\&G's note had been an instaliment note to be poid in four equar payments at tie end of each year beginning December 31 . 2024 , what would be the amount of each instailment? 5. By considering the instaliment payment of requirement 4, prepare an amorvzation schedule for the fouryear term of the installment note. 6. Prepare the joumal entry for A\&G's third installment payment on December 31, 2026 . Note: Use tabies, Excel, or a financlal colculator. (EV of \$1, PV. of \$1. EVA of 51. PVA of 51. EVAD of \$1 and PVAD of \$1) Complete this question by entering your answers in the tabs below. Prepare the journal entry for AsG's purchase of the conveyor on January 1, 2024. Notet If no entry is required for a transaction/event, select "No journal entry cequined" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar. Braxton Technologies. Incorporated, constructed a conveyor for As 6 Warehousers that was completed and ready for use on January 1 , 2024. - A8G paid for the conveyor by issuing a $100.000, four-year note that specified 6% interest to be paid an December 31 of each year, ond the note is to be repaid at the end of four years - The conveyor was custombuilt for A\&G, so its cash price was unknown. - By comparison with similar transactions it was determined that a reasonable interest rate was 119. Required: 1. Prepare the journal entry for A\&G's purchase of the conveyor on Januacy 1, 2024. 2. Prepare an amortization schedule for the four-year term of the note. 3. Prepare the joumal entry for A\&G's third interest payment on December 31,2026 4. If A\&G's note had been an instaliment note to be poid in four equar payments at tie end of each year beginning December 31 . 2024 , what would be the amount of each instailment? 5. By considering the instaliment payment of requirement 4, prepare an amorvzation schedule for the fouryear term of the installment note. 6. Prepare the joumal entry for A\&G's third installment payment on December 31, 2026 . Note: Use tabies, Excel, or a financlal colculator. (EV of \$1, PV. of \$1. EVA of 51. PVA of 51. EVAD of \$1 and PVAD of \$1) Complete this question by entering your answers in the tabs below. Prepare the journal entry for AsG's purchase of the conveyor on January 1, 2024. Notet If no entry is required for a transaction/event, select "No journal entry cequined" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar