Answered step by step

Verified Expert Solution

Question

1 Approved Answer

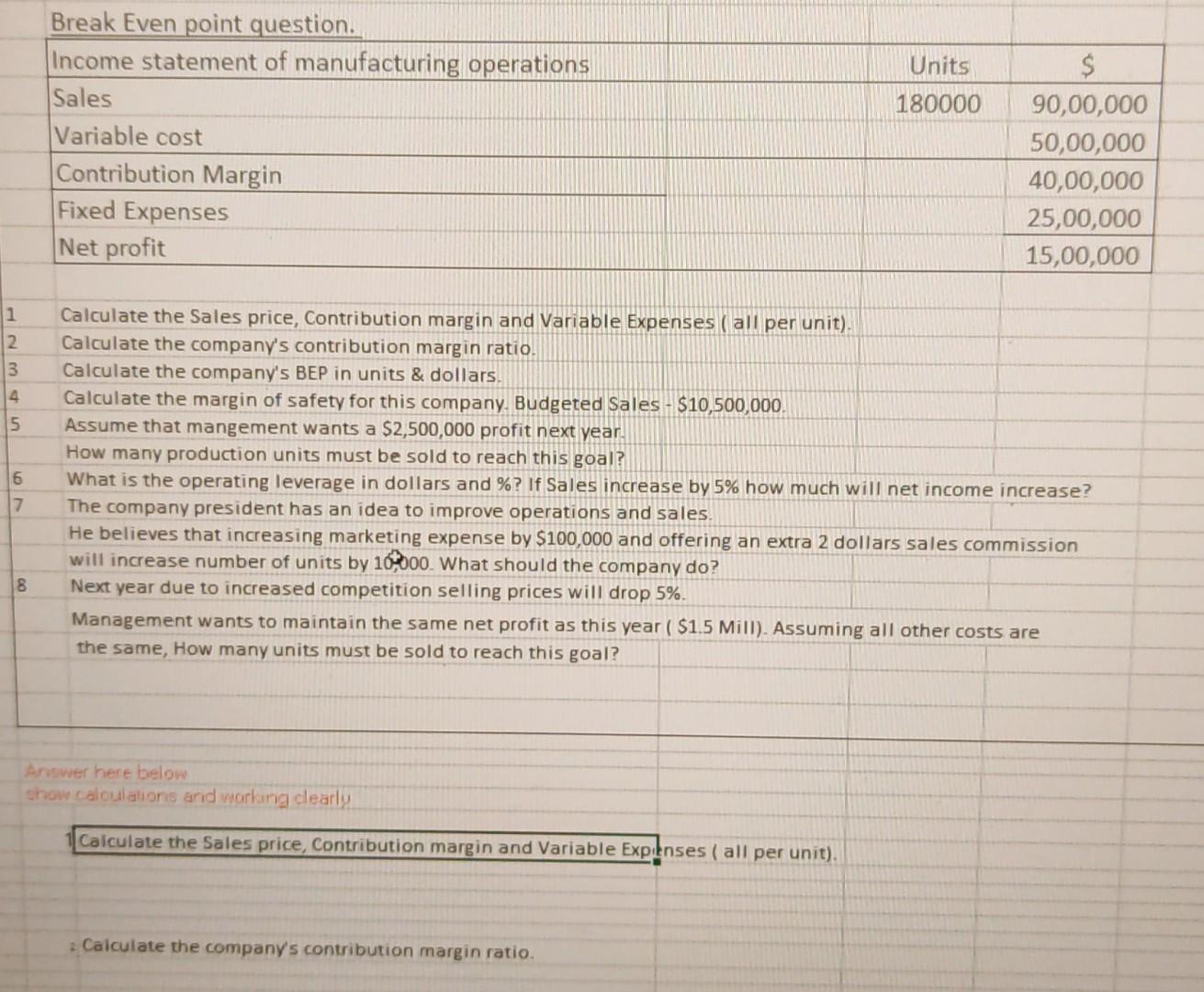

Break Even point question. Income statement of manufacturing operations Sales Variable cost Contribution Margin Fixed Expenses Net profit Units 180000 90,00,000 50,00,000 40,00,000 25,00,000

Break Even point question. Income statement of manufacturing operations Sales Variable cost Contribution Margin Fixed Expenses Net profit Units 180000 90,00,000 50,00,000 40,00,000 25,00,000 15,00,000 1 Calculate the Sales price, Contribution margin and Variable Expenses ( all per unit). Calculate the company's contribution margin ratio. Calculate the company's BEP in units & dollars. Calculate the margin of safety for this company. Budgeted Sales - $10,500,000. Assume that mangement wants a $2,500,000 profit next year. How many production units must be sold to reach this goal? What is the operating leverage in dollars and %? If Sales increase by 5% how much will net income increase? 4 6. The company president has an idea to improve operations and sales. He believes that increasing marketing expense by $100,000 and offering an extra 2 dollars sales commission will increase number of units by 10000. What should the company do? Next year due to increased competition selling prices will drop 5%. Management wants to maintain the same net profit as this year ( $1.5 Mill). Assuming all other costs are the same, How many units must be sold to reach this goal? Answer here below show calculations and working clearly Calculate the Sales price, Contribution margin and Variable Expenses ( all per unit). Calculate the company's contribution margin ratio.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculation of sales price contribution margin and variable costs per unit Sales Revenue pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started