Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BREAK-EVEN ANALYSIS An advantage of the contribution margin approach is that we can quickly and easily estimate breakeven sales. Breakeven is simply the amount

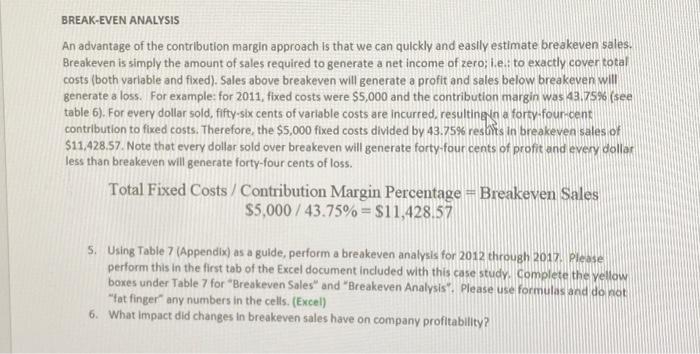

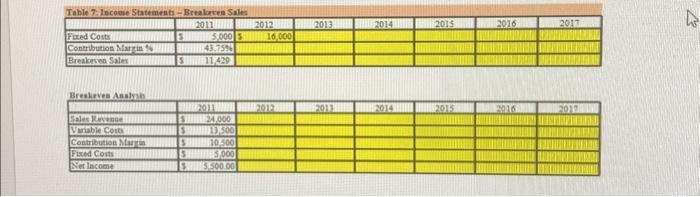

BREAK-EVEN ANALYSIS An advantage of the contribution margin approach is that we can quickly and easily estimate breakeven sales. Breakeven is simply the amount of sales required to generate a net income of zero; i.e.: to exactly cover total costs (both variable and fixed). Sales above breakeven will generate a profit and sales below breakeven will generate a loss. For example: for 2011, fixed costs were $5,000 and the contribution margin was 43.75% (see table 6). For every dollar sold, fifty-six cents of variable costs are incurred, resulting in a forty-four-cent contribution to fixed costs. Therefore, the $5,000 fixed costs divided by 43.75% results in breakeven sales of $11,428.57. Note that every dollar sold over breakeven will generate forty-four cents of profit and every dollar less than breakeven will generate forty-four cents of loss. Total Fixed Costs / Contribution Margin Percentage = Breakeven Sales $5,000/43.75%= $11,428.57 5. Using Table 7 (Appendix) as a guide, perform a breakeven analysis for 2012 through 2017. Please perform this in the first tab of the Excel document included with this case study. Complete the yellow boxes under Table 7 for "Breakeven Sales" and "Breakeven Analysis". Please use formulas and do not "fat finger" any numbers in the cells. (Excel) 6. What impact did changes in breakeven sales have on company profitability? Table 7. Income Statements-Breakeven Sales Fixed Costs Contribution Margin Breakeven Sales Breskeves Analysis Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Income 2011 $5,000 $ 43.75% $ 11,429 2011 24,000 $ 13,500 $ 10,500 $5,000 $ 5,500.00 2012 16,000 2012 2013 2013 2014 2014 2015 2015 2016 2017 2016 CHIVAMAKS Z MURENING 2017 4

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To perform the breakeven analysis for 2012 through 2017 well need to calculate the breakeven sales f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started