Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020.

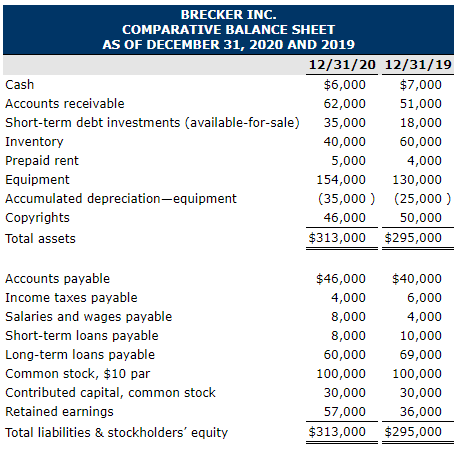

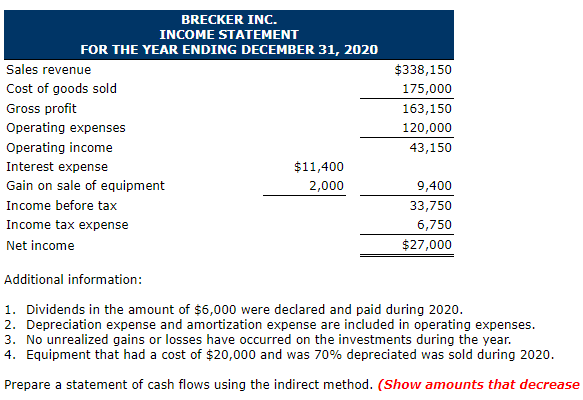

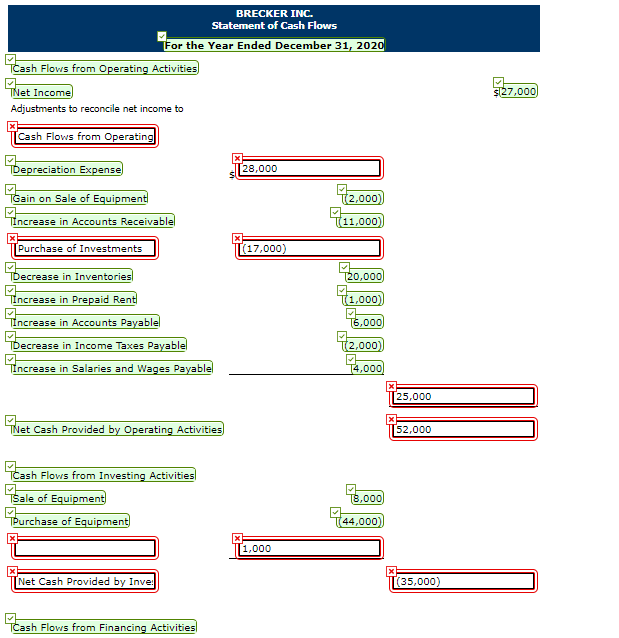

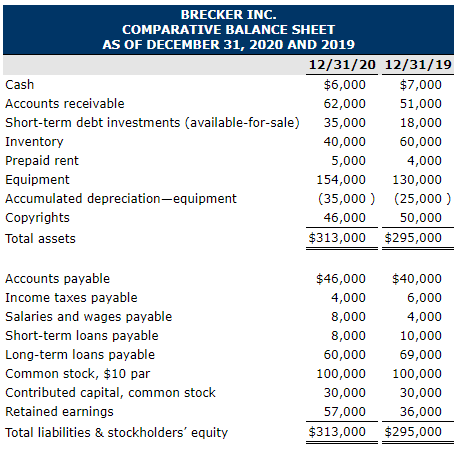

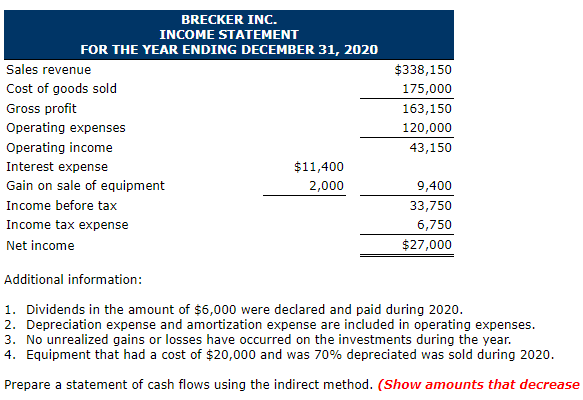

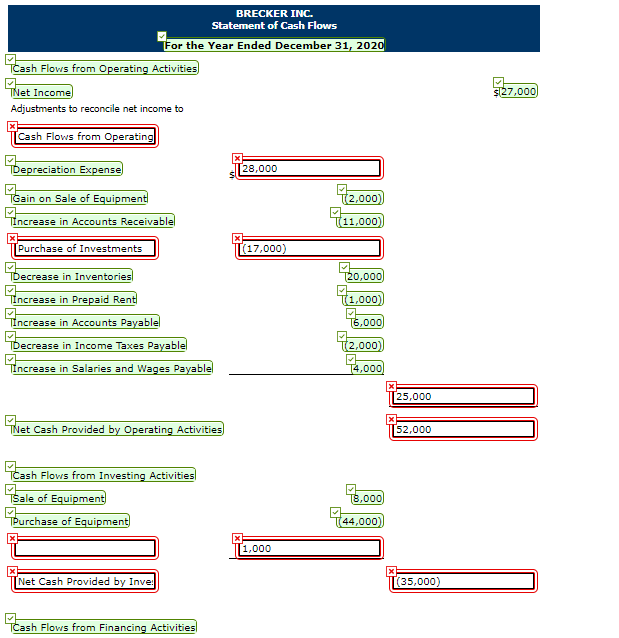

BRECKER INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,000 $7,000 Accounts receivable 62,000 51,000 Short-term debt investments (available-for-sale) 35,000 18,000 Inventory 40,000 60,000 Prepaid rent 5,000 4,000 Equipment 154,000 130,000 Accumulated depreciation equipment (35,000 ) (25,000) Copyrights 46,000 50,000 Total assets $313,000 $295,000 Accounts payable Income taxes payable Salaries and wages payable Short-term loans payable Long-term loans payable Common stock, $10 par Contributed capital, common stock Retained earnings Total liabilities & stockholders' equity $46,000 $40,000 4,000 6,000 8,000 4,000 8,000 10,000 60,000 69,000 100,000 100,000 30,000 30,000 57,000 36,000 $313,000 $295,000 BRECKER INC. INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2020 Sales revenue $338,150 Cost of goods sold 175,000 Gross profit 163,150 Operating expenses 120,000 Operating income 43,150 Interest expense $11,400 Gain on sale of equipment 2,000 9,400 Income before tax 33,750 Income tax expense 6,750 Net income $27,000 Additional information: 1. Dividends in the amount of $6,000 were declared and paid during 2020. 2. Depreciation expense and amortization expense are included in operating expenses. 3. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of $20,000 and was 70% depreciated was sold during 2020. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease BRECKER INC. Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities TNet Income Adjustments to reconcile net income to S127,000) Cash Flows from Operating TDepreciation Expense 28,000 TGain on Sale of Equipment 72,000) 11,000) Tincrease in Accounts Receivable IX Purchase of Investments (17,000) TDecrease in Inventories Increase in Prepaid Rent Tincrease in Accounts Payable Decrease in Income Taxes Payable Increase in Salaries and Wages Payable 20,000 42,000) 16,000 72.000) 7.000 25,000 Pet Cash Provided by Operating Activities 52,000 TCash Flows from Investing Activities TSale of Equipment 18,000) Purchase of Equipment 744,000) 1,000 x Net Cash Provided by Inve! (35,000) tash TCash Flows from Financing Activities Cash Flows from Financing Activities 72.000) 79.000) 6.000) TDividend Payments TNet Cash Used by Financing Activities 717,000) TNet Decrease in Cash) 72,000) 7,000 TCash at Beginning of Period TCash tash at End of Period $6,000)