Question

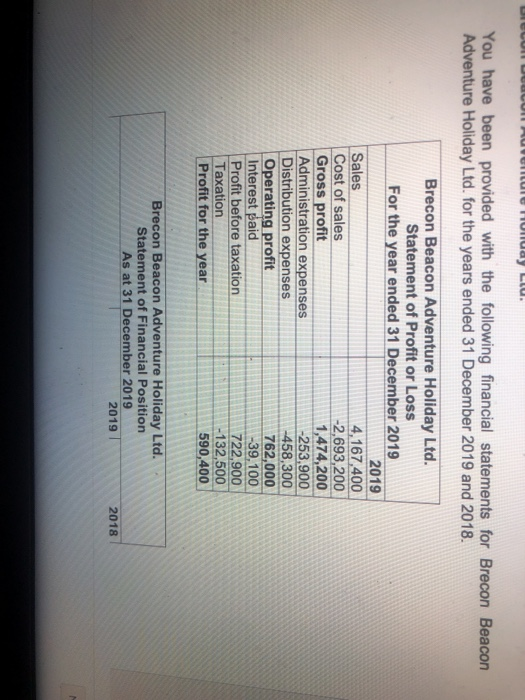

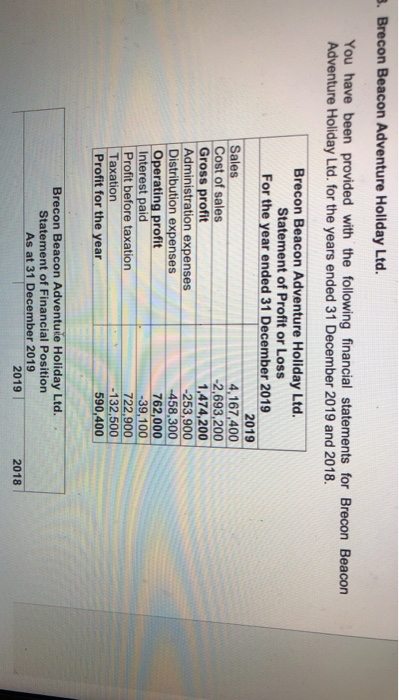

Brecon Beacon Adventure Holiday Ltd.You have been provided with the following financial statements for Brecon Beacon Adventure Holiday Ltd. for the years ended 31 December

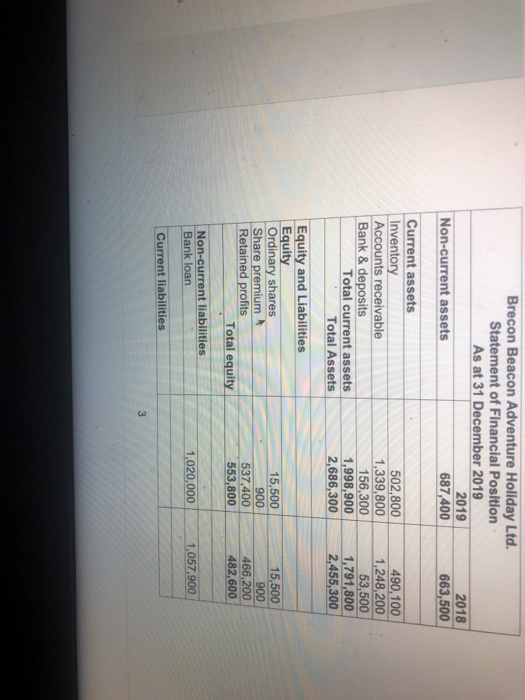

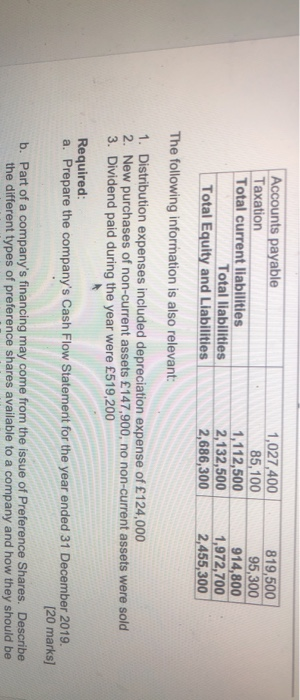

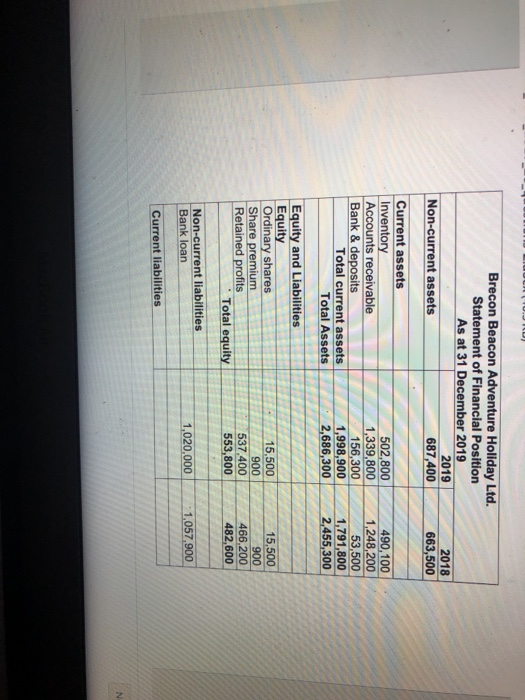

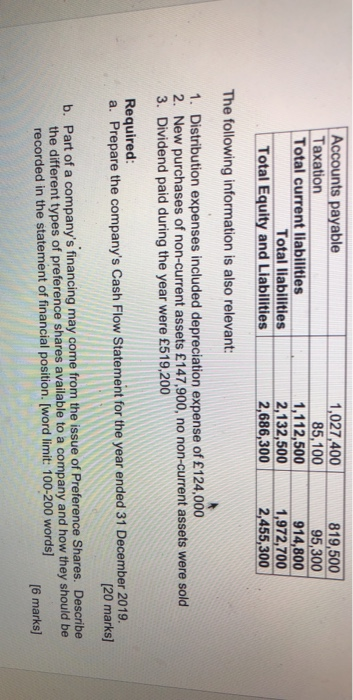

Brecon Beacon Adventure Holiday Ltd.You have been provided with the following financial statements for Brecon Beacon Adventure Holiday Ltd. for the years ended 31 December 2019 and 2018.Brecon Beacon Adventure Holiday Ltd.Statement of Profit or LossFor the year ended 31 December 20192019Sales4,167,400Cost of sales-2,693,200Gross profit1,474,200Administration expenses-253,900Distribution expenses-458,300Operating profit762,000Interest paid-39,100Profit before taxation722,900Taxation-132,500Profit for the year590,400Brecon Beacon Adventure Holiday Ltd.Statement of Financial Position As at 31 December 201920192018Non-current assets687,400663,500Current assetsInventory502,800490,100Accounts receivable1,339,8001,248,200Bank & deposits156,30053,500Total current assets1,998,9001,791,800Total Assets2,686,3002,455,300Equity and LiabilitiesEquityOrdinary shares15,50015,500Share premium900900Retained profits537,400466,200Total equity553,800482,600Non-current liabilitiesBank loan1,020,0001,057,900Current liabilities N1526 Introduction to Financial Accounting4Accounts payable1,027,400819,500Taxation85,10095,300Total current liabilities1,112,500914,800Total liabilities2,132,5001,972,700Total Equity and Liabilities2,686,3002,455,300The following information is also relevant:1. Distribution expenses included depreciation expense of 124,0002. New purchases of non-current assets 147,900, no non-current assets were sold3. Dividend paid during the year were 519,200Required:a. Prepare the companys Cash Flow Statement for the year ended 31 December 2019.[20 marks]b. Part of a companys financing may come from the issue of Preference Shares. Describe the different types of preference shares available to a company and how they should be recorded in the statement of financial position Ordinary shares 1300300Retained profits11987Total Equity419387Non-current liabilitiesBank Loan (due in 10 years)200100Current liabilitiesBank Overdraft100Accounts Payable13485Tax payable718Total current liabilities151103Total Equity & Liabilities770590

Dantes Inferno plcStatement of Profit or Loss For the year ended 31 March20202019000000Sales400440Cost of Goods sold285280Gross Profit115160Operating Expense7047Operating Profit45113Interest Payable44Profit before tax41109Tax718Profit for the year3491Note: the company paid a dividend to ordinary shareholders of 2,000 in 2020 and 4,000 in 2019.Required:a. Analyse the companys financial performance. You should calculate and discuss five (5) different ratios that will be useful to the bank in making its lending decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started