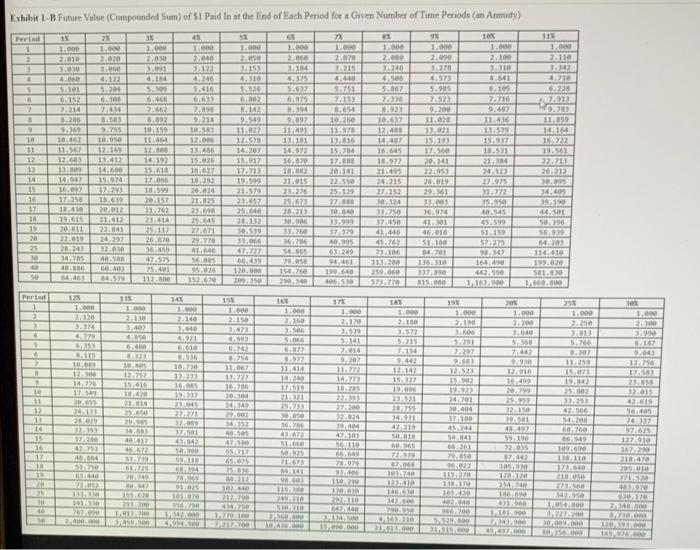

Brenda plans to reduce her spending by $90 a month. What would be the future value of this reduced spending over the next 8 years? (Assume an annual deposit to her savings account and an annual interest rate of 3 percent) Use Exhibit 1.8. (Round discount factor to 3 decimal places and final answer to 2 decimal places.) Future value Exhibit 1 B Future Value(Compounded Sum) of 51 Paid In at the kind of Each Period for a Given Number of Time Periods (an Annuity) 21 61 E 1 1 1.00 2.010 1.000 2.00 7 1.00 2:07 2.020 3.004 2.00 2,154 1. 2.000 3123 4.746 5.414 DONE Pried 1 2 1 + 5 . 2 3 51 1.000 2.050 2.15 4.310 5.526 6.002 RE 1.000 2.000 3.240 4.50 5.857 TONE 9% 1.000 2.000 3:22 6.923 5.985 SIZE 101 1.000 2.100 2.110 6:54 5.105 7.710 1.000 2.110 143 4,718 6.228 7.913 4. 4.14 SZET TOIS GO'S 5.200 30 9.200 9. 0.152 7.214 3.286 369 10.463 11.567 6. 7.662 3822 10/199 11.16 12.00 14.192 15.018 1 5.637 6,975 1.394 9.397 11.491 1111 14.922 16.820 7.90 9.214 10.381 12.006 13:46 15.026 16.677 4.40 5.751 7.15 8.654 10.250 11.970 13.10 15.71 17. 20161 222550 9.549 11.927 12.578 14.202 15.91 172.713 19.99 9.755 10.050 12.10 13.011 14.60 15.924 17.293 11.415 12.579 158917 18.531 14.154 16.222 19.561 10 11 12 13 14 15 10 17 13.50 26.212 16 24.523 22.925 13021 35.193 17.30 20.141 22.953 26.019 29. 361 3340 36.224 41.1 16.01 GELEGE 40.545 10.092 17258 11:40 19,615 20:11 22.01 20141 34.705 ut 1.921 10.537 12.40 14:47 16.64 18.972 21-695 26.215 27152 0.124 32.750 37.50 41.00 45.762 73.100 11:20 259.00 520 20.012 21,413 21.141 24.291 10.999 20.157 21.707 23.414 29117 26 67 36.450 47257 20.024 21.125 23 25.6 22.071 29770 41.646 56.005 6657 12 20 25 21.015 23.225 25.671 23:21 905 3. MADE 40365 29.05 1546 20.se 51.159 35.640 28.132 10.53 39.000 8777 66.439 120.00 209.150 27 30 140 33.999 17979 0.095 01.249 14.451 109.610 106 BLOG 39.100 14.501 50.196 SEA919 14.203 114.410 192.020 51.0 BALLO ZEZE LE 4058 60.403 14.01 136310 337.00 315.00 164.00 62100 1.16). 112. 15670 Perid 1 2 123 1.000 2.120 11 1.000 14% 1.000 VOE 10% 1.000 2. 160 175 1. 2170 3.539 5.141 12 1.000 2100 3.572 15% 1.000 2:15 3.45 4993 747 1.000 2220 1.600 1.000 2100 1.640 255 1.000 2.25 3.813 1.000 2300 3.990 VEG 3.40 OSE 4 5 3.4 06221 10 20 GB 3.113 10. 5.066 8.827 E 7441 ELEVE 2 ZOO 8297 11.25 15.02 10 9.202 11:22 1473 18.20 1.04 12256 17503 14.6 17.149 11.067 123 1600 20.00 1.14 222002 14 9647 132.147 15122 19.000 23.331 15 10.01 1329 10.410 1024 21.016 25.00 29. 14. 14.240 122510 211 25733 16.MS 10 23.045 2.1 9.83 12.523 1992 19.92 34701 1064 32.015 12.10 1014 20.99 25.99 3231 BIOTER 50.00 10 11 12 1 1 15 1 17 24.11 2007 OVE LISSE GO 3670 ME 0505 2014 10.000 47. 103 56110 45.744 54.141 970 17 42219 10.18 00. 4742 SANO BOYLE E 542 6.7 16.9 19 118.110 17.40 SIL 0.921 TOC 99 48.49 595196 22.035 12.042 109.90 622 1719 44 WOW 78.979 17:20 218.470 2001 4 1120 . TE 1102 STO LE 22 DOT 12.10 TO 14 110 160 110 10 212 BE 20. BIBELS OVE 1. 140 DEO 2.100 410 6. 2. W . 100 165 TIME GERE RTVG IR 2. 10.A. IND 45