Answered step by step

Verified Expert Solution

Question

1 Approved Answer

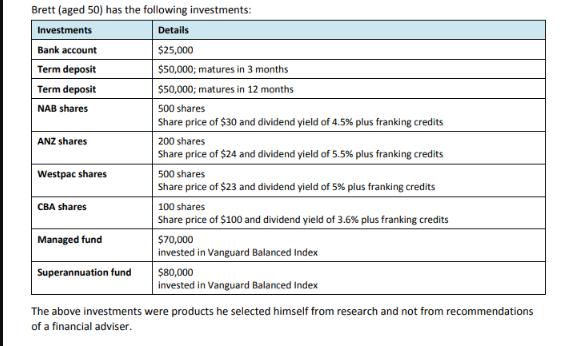

Brett (aged 50) has the following investments: Investments Details $25,000 $50,000; matures in 3 months $50,000; matures in 12 months Bank account Term deposit

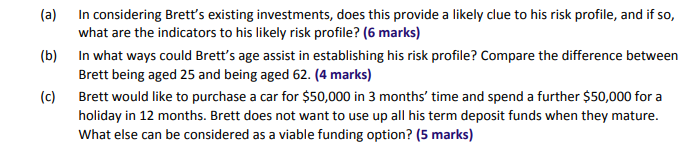

Brett (aged 50) has the following investments: Investments Details $25,000 $50,000; matures in 3 months $50,000; matures in 12 months Bank account Term deposit Term deposit NAB shares ANZ shares Westpac shares CBA shares Managed fund Superannuation fund 500 shares Share price of $30 and dividend yield of 4.5 % plus franking credits 200 shares Share price of $24 and dividend yield of 5.5% plus franking credits 500 shares Share price of $23 and dividend yield of 5% plus franking credits 100 shares Share price of $100 and dividend yield of 3.6 % plus franking credits $70,000 invested in Vanguard Balanced Index $80,000 invested in Vanguard Balanced Index The above investments were products he selected himself from research and not from recommendations of a financial adviser. (a) In considering Brett's existing investments, does this provide a likely clue to his risk profile, and if so, what are the indicators to his likely risk profile? (6 marks) (b) In what ways could Brett's age assist in establishing his risk profile? Compare the difference between Brett being aged 25 and being aged 62. (4 marks) (c) Brett would like to purchase a car for $50,000 in 3 months' time and spend a further $50,000 for a holiday in 12 months. Brett does not want to use up all his term deposit funds when they mature. What else can be considered as a viable funding option? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In considering Bretts existing investments several indicators can provide insights into his likely risk profile Allocation to different asset classes Bretts investment portfolio includes a mix of as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started