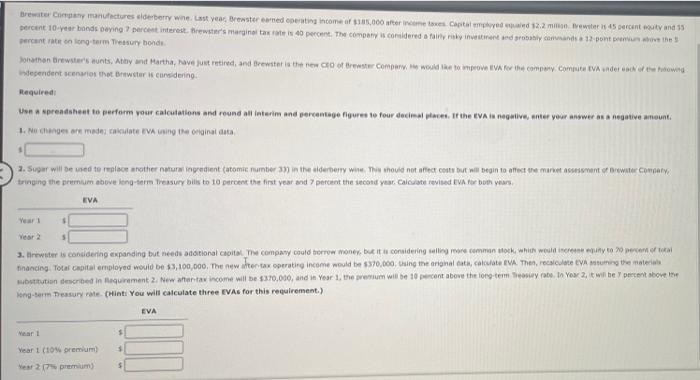

Brew Company manufactures de borry whe Last year Brewster and operating income of $1,000 after cometes Capital med 12.2 meter 45 percent out and 15 percent 10-year bands being percent interest rewster's marginal tax rate 40 percent. The company is considered a fairly ky invented by and a 12 ponte percentrate on long-term Teasury honde Jonathan Brewster's aunts, Athy unit Martha, nave just retired and Brewster is the worst Company, w would be improve it for the company.com EVA under en ordre down stependent on the Brewster i sidering Required Use a spreadsheet to perform your calculations and round all interim md percentage loures to low decimals. If the UVA is negative, enter your answer ana negative mount 1. No changes are made a te IVA using the original data 2. Super will be used to replace another natura ingredient (atomic numer 3 in the elderberry would not affect costs but will begin to affect te mare customer rewiter comary tringing the premium above long-term Treasury bills to 10 percent the first year and 7 percent the second year. Calculate revised EVA for both years EVA Year 2 3. tister is considering expanding but needs aditional Capital The compaw could borrow money, but it is considering selling more common work, which would incremento 20 percent of total tinancing, Total Gapital employed would be $3,100,000. The water tax operating income would be $370.000 ting the original ata, calculate EVA Then, recalce Vung the materia subtitution described in Requirement 2. New fata income will be $370,000, and in Year 1, the num will be 10 percent above the long-term my rate. In Year 2, it will be present above me longtem Treasury rate. (Hint: You will calculate three EVAs for this requirement.) EVA Mart $ Year 1 (1o premium) Year 27 premium Brew Company manufactures de borry whe Last year Brewster and operating income of $1,000 after cometes Capital med 12.2 meter 45 percent out and 15 percent 10-year bands being percent interest rewster's marginal tax rate 40 percent. The company is considered a fairly ky invented by and a 12 ponte percentrate on long-term Teasury honde Jonathan Brewster's aunts, Athy unit Martha, nave just retired and Brewster is the worst Company, w would be improve it for the company.com EVA under en ordre down stependent on the Brewster i sidering Required Use a spreadsheet to perform your calculations and round all interim md percentage loures to low decimals. If the UVA is negative, enter your answer ana negative mount 1. No changes are made a te IVA using the original data 2. Super will be used to replace another natura ingredient (atomic numer 3 in the elderberry would not affect costs but will begin to affect te mare customer rewiter comary tringing the premium above long-term Treasury bills to 10 percent the first year and 7 percent the second year. Calculate revised EVA for both years EVA Year 2 3. tister is considering expanding but needs aditional Capital The compaw could borrow money, but it is considering selling more common work, which would incremento 20 percent of total tinancing, Total Gapital employed would be $3,100,000. The water tax operating income would be $370.000 ting the original ata, calculate EVA Then, recalce Vung the materia subtitution described in Requirement 2. New fata income will be $370,000, and in Year 1, the num will be 10 percent above the long-term my rate. In Year 2, it will be present above me longtem Treasury rate. (Hint: You will calculate three EVAs for this requirement.) EVA Mart $ Year 1 (1o premium) Year 27 premium