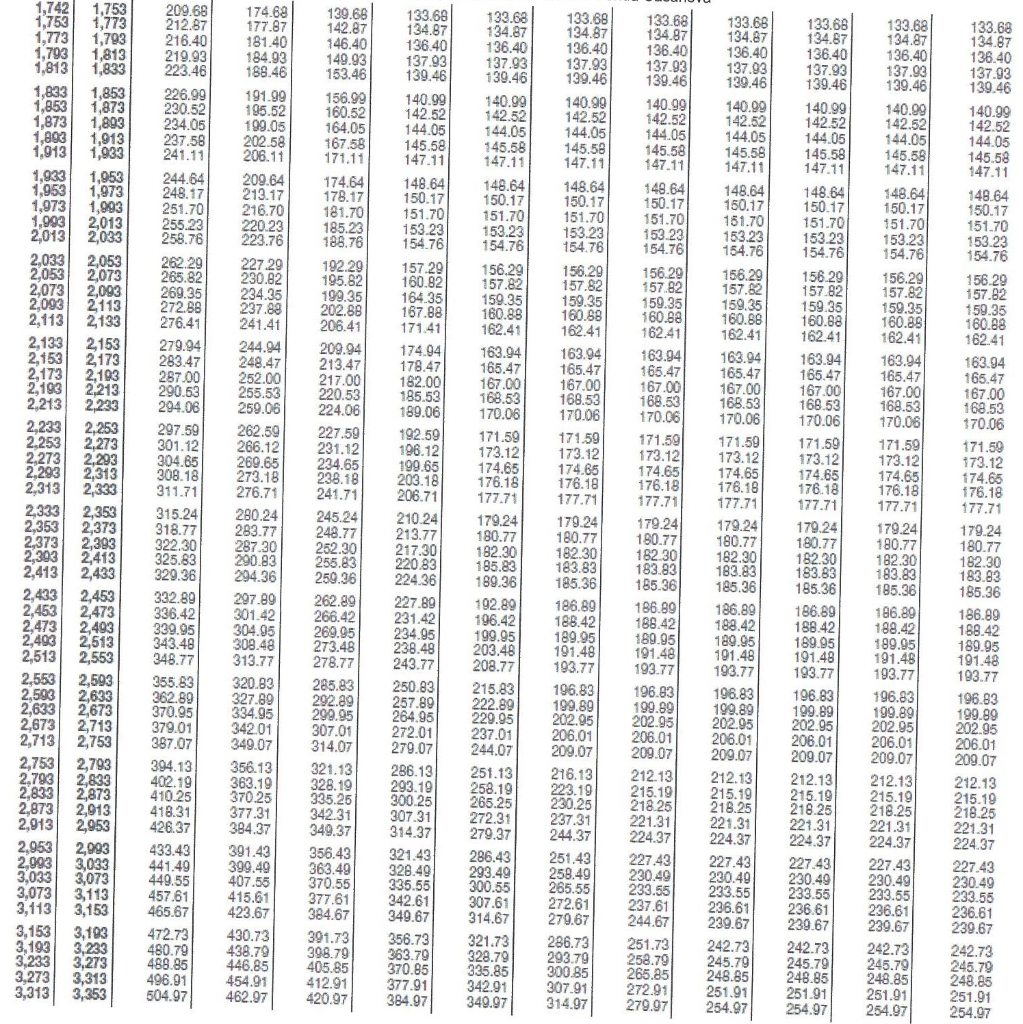

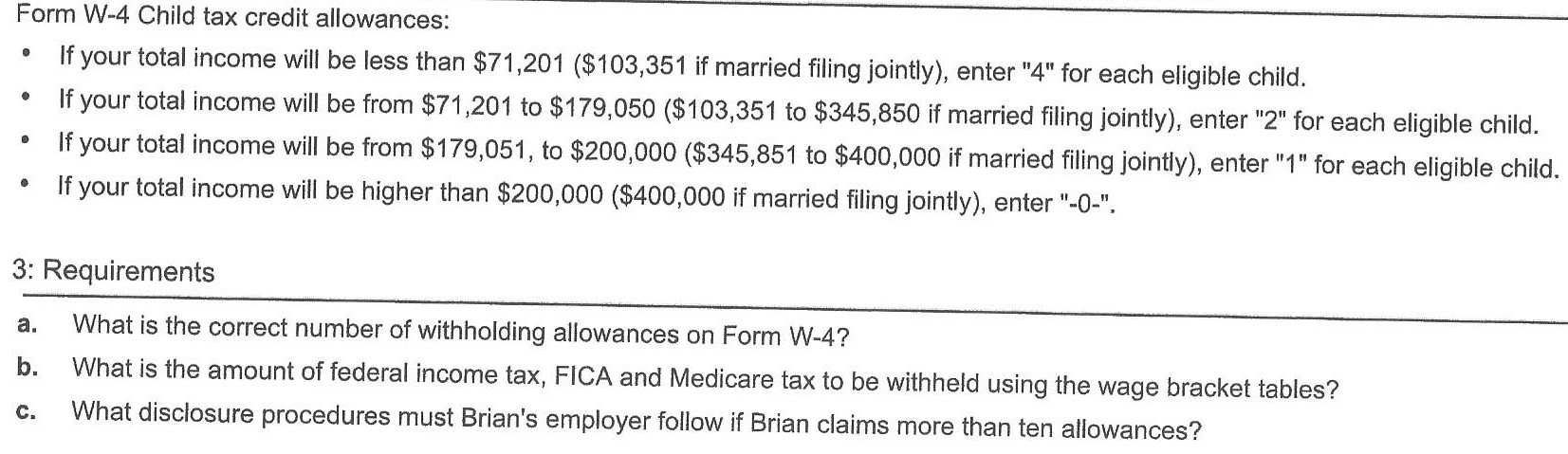

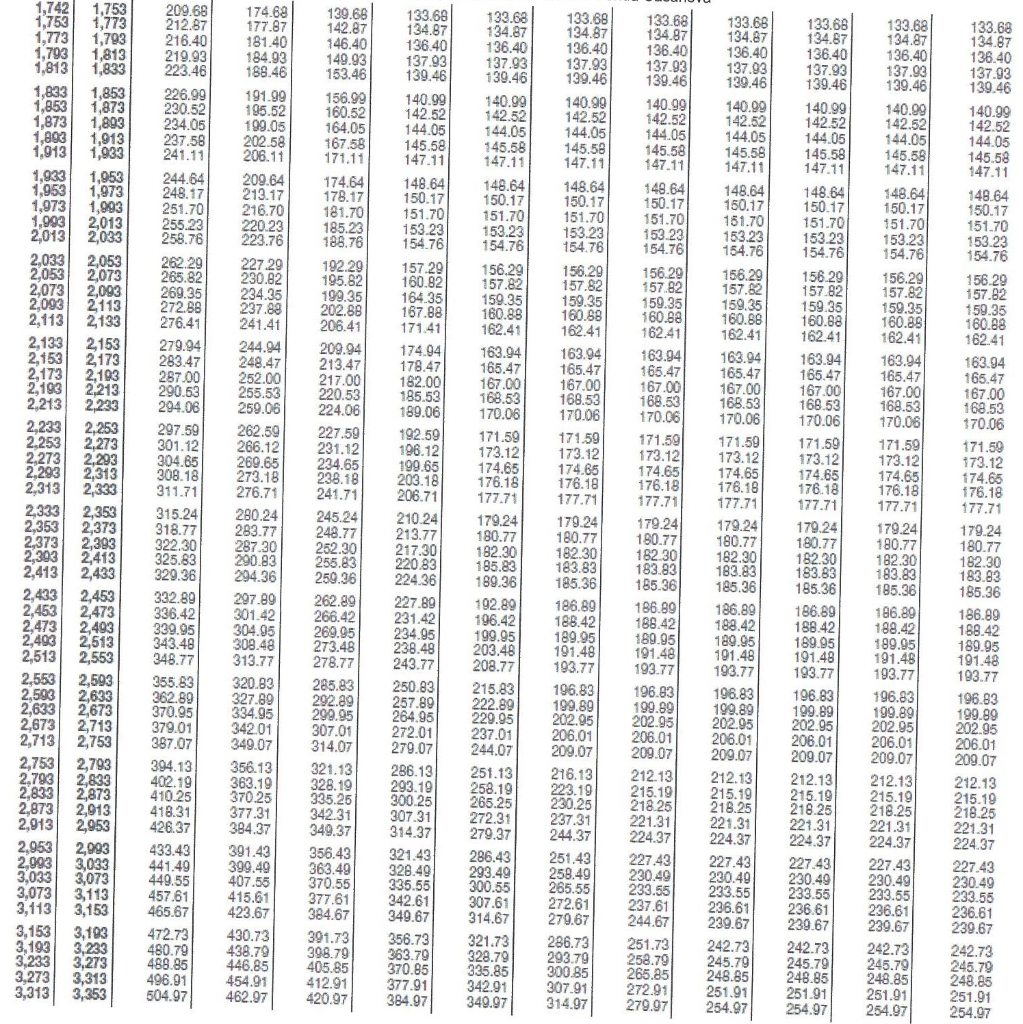

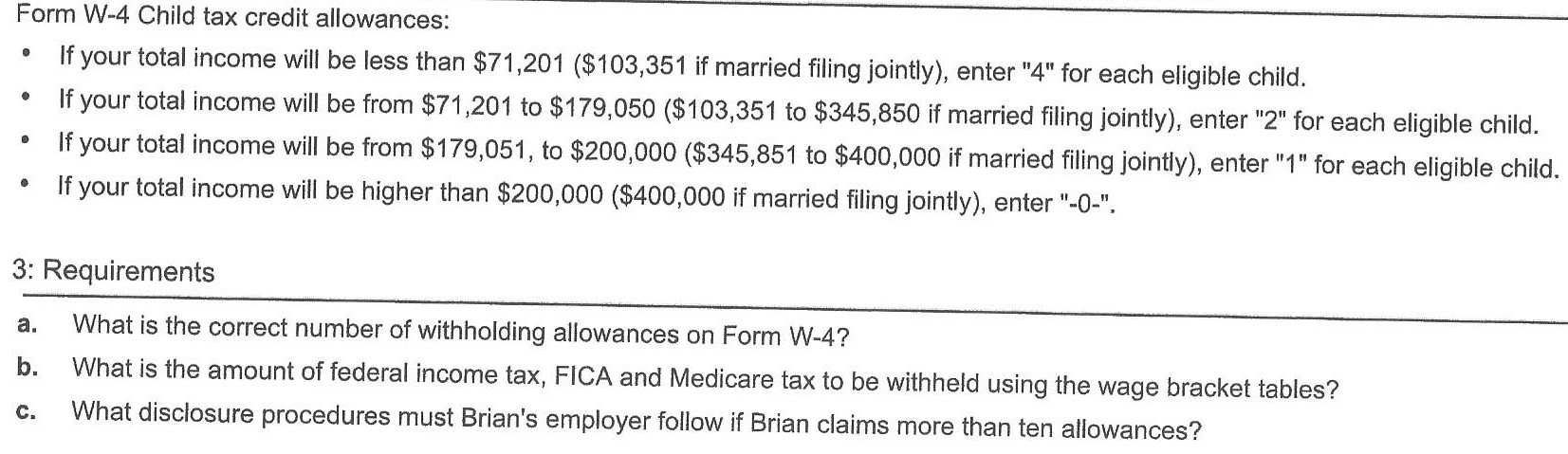

Brian and Julia Leach are married, file a joint return and have two dependent children (twins, age 9). Brian begins a new job and is asked to fill out a Form W-4. His monthly gross earnings will be $2,900. Julia does not work outside their home. Brian can claim two additional withholding allowances because he will have large deductions. (Click the icon to view the withholding table for married persons with monthly payroll.) 2(Click the icon to view the W-4 allowances for the child tax credit.) Read the requirements Requirement a. What is the correct number of withholding allowances on Form W-4? The correct number of withholding allowances on Form W-4 is Requirement b. What is the federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables? (Enter the amount withheld to two decimal places, X.XX. Note: the range of allowances presented in the table may not reach the number of allowances the taxpayer is entitled to take.) The monthly federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables is Requirement c. What disclosure procedures must Brian's employer follow if Brian claims more than ten allowances? O A. Brian's employer has 10 days to file the Form W-4 with the IRS. If the Form W-4 is not filed within 10 days, Brian's employer must pay a $500 fine to the IRS. OB. There are no special disclosure procedures. Previously, employers had to forward the Form W-4 to the IRS if the taxpayer claimed more than 10 allowances, but that requirement has been eliminated. O C. Brian's employer has 30 days to file the Form W-4 with the IRS. If the Form W-4 is not filed within 30 days, Brian's employer must pay a $250 fine to the IRS. OD. Brian's employer must have Brian fill out a new Form W-4 because an employee is not allowed to claim more than 10 allowances, 1: Reference Combined Federal Income Tax, Employee Social Security Tax, and Employee Medicare Tax Withholding Tables MARRIED Persons - MONTHLY Payroll Period (For Wages Paid through December 2019) And the wages And the number of withholding allowances claimed is are At least But 0 1 2 5 7 9 10 than comlanillrintlon uuni The amount of income, social security, and Medicare taxes to be withheld is- /xlitemprod. 200.68 2012.7 19.66 142.87 146.40 1.93 13.46 156.99 160.52 164.05 133.68 | 24.97 13.40 137 139.46 140.99 142.8 14.05 145.8 7. 44 10.17 70 15023 154.76 16.29 15782 133.8 134.87 136.40 13703 139.6 141.9 142.52 14.05 145.58 147.11 148.64 150.17 151.70 153.23 154.76 157.29 160.82 16.35 167.88 17141 1764 173.47 12.00 165.52 169.06 92.59 196.12 199.65 216.40 219.93 22.46 26.99 200.52 234.05 237.58 41.11 244.66 248.7 251.70 255.23 258.6 2,29 28.82 269 25 2728 276.41 279.94 283.47 25700 290.63 28.8 297.59 201.12 30. 200 18 31.71 315.24 318.77 322.30 325.8 29.36 322.89 176.68 177.87 11.40 184.8 18.46 11.99 5.52 19.05 22.52 06.11 200.64 213.17 216.70 220 22 223,761 227 29 230.82 234.35 237, 241.4t 244.94 242.47 252.00 255.53 259.06 22.5g 26.12 2.5 273.18 276.77 280.24 23.77 7. 90.00 04.36 07.9 201.42 304.95 309.48 313.77 20.33 327. 34.95 34211 349.07 356.12 363.19 370.25 377.31 384.37 21.42 39.49 107.55 415.1 423.67 167. 171.11 174.64 178.17 181.70 125.23 16 12.29 5. 2 9.35 202.88 206.43 20094 213.47 17.00 220.53 24.06 227.50 231.12 234.65 1742 1.753 1753 1.773 1.73 1.73 1,703 1313 1913 1.833 1.853 1.853 1,373 1,873 199 , 1.13 1.913 1923 1,933 1,953 1,953 1973 1.973 1993 4.903 2013 2013 2033 2.033) 2.053 2,053 2073 2073 2.00 2.00 213 2.113 2133] 2.133 2158 2. 153 2173 2.173 2.193 2 2.213 2213 2. 2.233 2.253 2.253 2,273 2.273 2203 2.208 2.43 2313 239 2333 2.353 2.373 2.303 2003 2413 2.43| 2.4 2. 403 2.463 2. 463 2.473 2.473 2.43 2.493 2.513 2.513 2.553 2.58 2,503 2.500 2,633 2.633 2673 2.673 2713 2713 2.753 2753 2.793 2.783 2. 633 2.33 2.373 2.73 2013 23 2.953 2.953 2993 283 3033 3.0 3.073 3.073 3113 3.113 3.163 3, 1958 3. 103 3.193 3.83 3233 3273 3.273 3.313 3.3131 3.353 13.66 194.37 16.40 37.33 199.46 100 1252 144.05 145.50 147.11 142.64 150.7 151.01 153.23 14.76 129 157.2 158 35 10.8 1.41 13.04 165.47 67.00 168.8 1006 11.59 13.2 1748 176.16 17.71 19.24 10.7 12.30 183.3 185.36 126.89 18.42 189.5 191.48] 77 196.83 19.69 2.05 206.01 200.07 16.13 238.8 241.71 200.18 133.68 1984.7 126.40 37.03 129.46 1400 12.2 4.06 145.56 | 147.11 148.64 15.17 1i 15323 14.76 15629 157. 159.35 10.86 1.41 1. 4 165.47 7.00 168.53 170.06 171.50 173.12 174.65 176.18 177.7 179.24 160.77 182.230 162.23 1.36 1. 9 198.42 ,85 11.48 192.77 1.23 1999 202.95 206.0; 200.07 212.13 215.19 2165 22 1.31 224.37 227.43 220.49 233.55 133 134.87 16 37.93 130.46 10.99 2.2 14.05 5.58 147.11 14,64 150.17 151.70] 152.23 14.76 156.23 572 152.35 10.8g 12.4 163.94 165.47 1.00 1.53 17006 171.58 173.12 174.65 176.16 17.74 179.24 10.7 12.30 195.83 180.236 12.29 196.42 199.95 202.46 202.77 215.83 222.89 229.5 237.01 244.0 251.13 25.19 265.25 272.21 279.37 286.43 293.40 300.55 07.61 314. 321.73 322.79 33.85 32.9 349.gr 235 2373 159.35 160.5g 41 62.4 365.47 17.00 168.50 70.8 171.50 13.12 174.65 176.19 377,71 179.24 10.77 12.30 163.93 165.36 16.89 16.42 9 191.8 103.77 196.83 99. 202.95 206.01 20.07 223 215.19 21:25 221.31 224.37 27.43 230.40 233.5 245.24 248.77 252 230 255.3 28.26 28.29 266.42 260.35 273.48 278.77 285.83 2 299.95 307.01 3147 21.13 328.0 5.25 34231 206.71 210 24 213.77 27.30 220 83 224.36 27.9 231.42 22.9% 238.8 243.77 250.83 257.99 264.95 272.01 270.07 266.13 23.19 0025|| 07.31 374.37 21.43 320.49 235.55 242.61 49.67 356.73 3.79] 370.85 77.91 34.97 133.6 134.87 136.40 137.93 139.4 140.9 1422 144.05 1458 147.11 148.64 | 150.17 151.70 18 23 158.76 158 29 17.82 1933 160.88 162.41. 163.94 15.47 , 18.53 170.06 171.59 73.12 74.65 7. 13 137.71 1024 10. 182.30 163.83 185.36 166.69 1.42 169.05 191.49 16.77 196.83 199.99 202.95 208.01 209.07 212.13 215.19 218.25 221.31 2.37 227.43 230.48 238.55 236 61 067 242.73 245.79 248.85 251.91 254.97] 133.6 134.87 136.40 137,93 139.6 140.99 142.52 44.05 145.5 17.11 2.64 150.17 15.70 158.23 1.76 156.29 157.82 159.35 160.38 12.4$ 163.94] 65.47 17.00 168.53 | 170.cs| 171.50 | 1.12 174.65 176.18 1.71 179.24 80,77 12.0 183.80 185.36 196.80 12.42 199.95 11.48 12.77 16.63 199.99 202.95 206.04 29.07 212.13 215.19 216.25 221.3 224.37] 227.43 230.49 233.55 236.61 2399.67 242.73 245.79 242.85 251.91 254.97 36.42 133.68 134.87 138.40 137.03 10.46 140.99 12.52 144.05 145.58 147.11 14.4 50.17 51.70 153 23 54.76 16 29 17.2 59.35 160.86 12.41 8.4 165.47 7.00 8.53 70.06 171.58 173.2 174.6 176.18 17.71 17924 10.7 12.30 183. 15.38 16.99 18.42 10.95 191.48 193.77 16.83 199.99 202.95 206.01 09.07 212.13 215.19 21625 221.31 224.37 2273 230.49 233.55 236.61 230.67 242.73 245.79 248.86 251.91 254.97 300.95 343.48 46.77 255. 3289 370.05) 379.01 257.7 34.13 402.19 4025 418.31 42637 433.43 441.49 449.55 457.61 46.67 472.73 480.79 489.85 496.01 504.97 23.19 340.37 230.25 237.31 24.37 251.49 258.9 265.55 272.51 27967 286.3 203.79 2005 07.91 31.97 37.61 236.61 356.43 363.49 370.55 77.61 24.67 30.73 39.79 45.85 412.91 420.97 430.73 432,79 46.5 454.91 42.97 244.67 251.3 28 26.5 9 279.97 202. 242.73 245.79 246.85] 251.99 254.7 Form W-4 Child tax credit allowances: If your total income will be less than $71,201 ($103,351 if married filing jointly), enter "4" for each eligible child. If your total income will be from $71,201 to $179,050 ($103,351 to $345,850 if married filing jointly), enter "2" for each eligible child. If your total income will be from $179,051, to $200,000 ($345,851 to $400,000 if married filing jointly), enter "1" for each eligible child. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter "-0-", . a. 3: Requirements What is the correct number of withholding allowances on Form W-4? b. What is the amount of federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables? C. What disclosure procedures must Brian's employer follow if Brian claims more than ten allowances? Brian and Julia Leach are married, file a joint return and have two dependent children (twins, age 9). Brian begins a new job and is asked to fill out a Form W-4. His monthly gross earnings will be $2,900. Julia does not work outside their home. Brian can claim two additional withholding allowances because he will have large deductions. (Click the icon to view the withholding table for married persons with monthly payroll.) 2(Click the icon to view the W-4 allowances for the child tax credit.) Read the requirements Requirement a. What is the correct number of withholding allowances on Form W-4? The correct number of withholding allowances on Form W-4 is Requirement b. What is the federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables? (Enter the amount withheld to two decimal places, X.XX. Note: the range of allowances presented in the table may not reach the number of allowances the taxpayer is entitled to take.) The monthly federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables is Requirement c. What disclosure procedures must Brian's employer follow if Brian claims more than ten allowances? O A. Brian's employer has 10 days to file the Form W-4 with the IRS. If the Form W-4 is not filed within 10 days, Brian's employer must pay a $500 fine to the IRS. OB. There are no special disclosure procedures. Previously, employers had to forward the Form W-4 to the IRS if the taxpayer claimed more than 10 allowances, but that requirement has been eliminated. O C. Brian's employer has 30 days to file the Form W-4 with the IRS. If the Form W-4 is not filed within 30 days, Brian's employer must pay a $250 fine to the IRS. OD. Brian's employer must have Brian fill out a new Form W-4 because an employee is not allowed to claim more than 10 allowances, 1: Reference Combined Federal Income Tax, Employee Social Security Tax, and Employee Medicare Tax Withholding Tables MARRIED Persons - MONTHLY Payroll Period (For Wages Paid through December 2019) And the wages And the number of withholding allowances claimed is are At least But 0 1 2 5 7 9 10 than comlanillrintlon uuni The amount of income, social security, and Medicare taxes to be withheld is- /xlitemprod. 200.68 2012.7 19.66 142.87 146.40 1.93 13.46 156.99 160.52 164.05 133.68 | 24.97 13.40 137 139.46 140.99 142.8 14.05 145.8 7. 44 10.17 70 15023 154.76 16.29 15782 133.8 134.87 136.40 13703 139.6 141.9 142.52 14.05 145.58 147.11 148.64 150.17 151.70 153.23 154.76 157.29 160.82 16.35 167.88 17141 1764 173.47 12.00 165.52 169.06 92.59 196.12 199.65 216.40 219.93 22.46 26.99 200.52 234.05 237.58 41.11 244.66 248.7 251.70 255.23 258.6 2,29 28.82 269 25 2728 276.41 279.94 283.47 25700 290.63 28.8 297.59 201.12 30. 200 18 31.71 315.24 318.77 322.30 325.8 29.36 322.89 176.68 177.87 11.40 184.8 18.46 11.99 5.52 19.05 22.52 06.11 200.64 213.17 216.70 220 22 223,761 227 29 230.82 234.35 237, 241.4t 244.94 242.47 252.00 255.53 259.06 22.5g 26.12 2.5 273.18 276.77 280.24 23.77 7. 90.00 04.36 07.9 201.42 304.95 309.48 313.77 20.33 327. 34.95 34211 349.07 356.12 363.19 370.25 377.31 384.37 21.42 39.49 107.55 415.1 423.67 167. 171.11 174.64 178.17 181.70 125.23 16 12.29 5. 2 9.35 202.88 206.43 20094 213.47 17.00 220.53 24.06 227.50 231.12 234.65 1742 1.753 1753 1.773 1.73 1.73 1,703 1313 1913 1.833 1.853 1.853 1,373 1,873 199 , 1.13 1.913 1923 1,933 1,953 1,953 1973 1.973 1993 4.903 2013 2013 2033 2.033) 2.053 2,053 2073 2073 2.00 2.00 213 2.113 2133] 2.133 2158 2. 153 2173 2.173 2.193 2 2.213 2213 2. 2.233 2.253 2.253 2,273 2.273 2203 2.208 2.43 2313 239 2333 2.353 2.373 2.303 2003 2413 2.43| 2.4 2. 403 2.463 2. 463 2.473 2.473 2.43 2.493 2.513 2.513 2.553 2.58 2,503 2.500 2,633 2.633 2673 2.673 2713 2713 2.753 2753 2.793 2.783 2. 633 2.33 2.373 2.73 2013 23 2.953 2.953 2993 283 3033 3.0 3.073 3.073 3113 3.113 3.163 3, 1958 3. 103 3.193 3.83 3233 3273 3.273 3.313 3.3131 3.353 13.66 194.37 16.40 37.33 199.46 100 1252 144.05 145.50 147.11 142.64 150.7 151.01 153.23 14.76 129 157.2 158 35 10.8 1.41 13.04 165.47 67.00 168.8 1006 11.59 13.2 1748 176.16 17.71 19.24 10.7 12.30 183.3 185.36 126.89 18.42 189.5 191.48] 77 196.83 19.69 2.05 206.01 200.07 16.13 238.8 241.71 200.18 133.68 1984.7 126.40 37.03 129.46 1400 12.2 4.06 145.56 | 147.11 148.64 15.17 1i 15323 14.76 15629 157. 159.35 10.86 1.41 1. 4 165.47 7.00 168.53 170.06 171.50 173.12 174.65 176.18 177.7 179.24 160.77 182.230 162.23 1.36 1. 9 198.42 ,85 11.48 192.77 1.23 1999 202.95 206.0; 200.07 212.13 215.19 2165 22 1.31 224.37 227.43 220.49 233.55 133 134.87 16 37.93 130.46 10.99 2.2 14.05 5.58 147.11 14,64 150.17 151.70] 152.23 14.76 156.23 572 152.35 10.8g 12.4 163.94 165.47 1.00 1.53 17006 171.58 173.12 174.65 176.16 17.74 179.24 10.7 12.30 195.83 180.236 12.29 196.42 199.95 202.46 202.77 215.83 222.89 229.5 237.01 244.0 251.13 25.19 265.25 272.21 279.37 286.43 293.40 300.55 07.61 314. 321.73 322.79 33.85 32.9 349.gr 235 2373 159.35 160.5g 41 62.4 365.47 17.00 168.50 70.8 171.50 13.12 174.65 176.19 377,71 179.24 10.77 12.30 163.93 165.36 16.89 16.42 9 191.8 103.77 196.83 99. 202.95 206.01 20.07 223 215.19 21:25 221.31 224.37 27.43 230.40 233.5 245.24 248.77 252 230 255.3 28.26 28.29 266.42 260.35 273.48 278.77 285.83 2 299.95 307.01 3147 21.13 328.0 5.25 34231 206.71 210 24 213.77 27.30 220 83 224.36 27.9 231.42 22.9% 238.8 243.77 250.83 257.99 264.95 272.01 270.07 266.13 23.19 0025|| 07.31 374.37 21.43 320.49 235.55 242.61 49.67 356.73 3.79] 370.85 77.91 34.97 133.6 134.87 136.40 137.93 139.4 140.9 1422 144.05 1458 147.11 148.64 | 150.17 151.70 18 23 158.76 158 29 17.82 1933 160.88 162.41. 163.94 15.47 , 18.53 170.06 171.59 73.12 74.65 7. 13 137.71 1024 10. 182.30 163.83 185.36 166.69 1.42 169.05 191.49 16.77 196.83 199.99 202.95 208.01 209.07 212.13 215.19 218.25 221.31 2.37 227.43 230.48 238.55 236 61 067 242.73 245.79 248.85 251.91 254.97] 133.6 134.87 136.40 137,93 139.6 140.99 142.52 44.05 145.5 17.11 2.64 150.17 15.70 158.23 1.76 156.29 157.82 159.35 160.38 12.4$ 163.94] 65.47 17.00 168.53 | 170.cs| 171.50 | 1.12 174.65 176.18 1.71 179.24 80,77 12.0 183.80 185.36 196.80 12.42 199.95 11.48 12.77 16.63 199.99 202.95 206.04 29.07 212.13 215.19 216.25 221.3 224.37] 227.43 230.49 233.55 236.61 2399.67 242.73 245.79 242.85 251.91 254.97 36.42 133.68 134.87 138.40 137.03 10.46 140.99 12.52 144.05 145.58 147.11 14.4 50.17 51.70 153 23 54.76 16 29 17.2 59.35 160.86 12.41 8.4 165.47 7.00 8.53 70.06 171.58 173.2 174.6 176.18 17.71 17924 10.7 12.30 183. 15.38 16.99 18.42 10.95 191.48 193.77 16.83 199.99 202.95 206.01 09.07 212.13 215.19 21625 221.31 224.37 2273 230.49 233.55 236.61 230.67 242.73 245.79 248.86 251.91 254.97 300.95 343.48 46.77 255. 3289 370.05) 379.01 257.7 34.13 402.19 4025 418.31 42637 433.43 441.49 449.55 457.61 46.67 472.73 480.79 489.85 496.01 504.97 23.19 340.37 230.25 237.31 24.37 251.49 258.9 265.55 272.51 27967 286.3 203.79 2005 07.91 31.97 37.61 236.61 356.43 363.49 370.55 77.61 24.67 30.73 39.79 45.85 412.91 420.97 430.73 432,79 46.5 454.91 42.97 244.67 251.3 28 26.5 9 279.97 202. 242.73 245.79 246.85] 251.99 254.7 Form W-4 Child tax credit allowances: If your total income will be less than $71,201 ($103,351 if married filing jointly), enter "4" for each eligible child. If your total income will be from $71,201 to $179,050 ($103,351 to $345,850 if married filing jointly), enter "2" for each eligible child. If your total income will be from $179,051, to $200,000 ($345,851 to $400,000 if married filing jointly), enter "1" for each eligible child. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter "-0-", . a. 3: Requirements What is the correct number of withholding allowances on Form W-4? b. What is the amount of federal income tax, FICA and Medicare tax to be withheld using the wage bracket tables? C. What disclosure procedures must Brian's employer follow if Brian claims more than ten allowances