Answered step by step

Verified Expert Solution

Question

1 Approved Answer

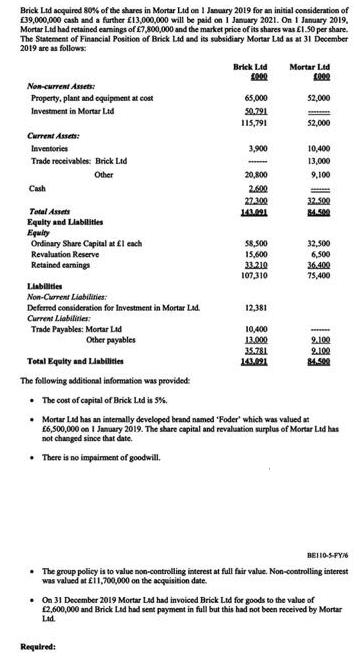

Brick Ltd acquired 80% of the shares in Mortar Ltd on 1 January 2019 for an initial consideration of 39,000,000 cash and a further

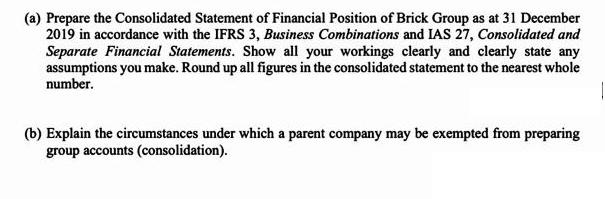

Brick Ltd acquired 80% of the shares in Mortar Ltd on 1 January 2019 for an initial consideration of 39,000,000 cash and a further 13,000,000 will be paid on 1 January 2021. On 1 January 2019, Mortar Ltd had retained earnings of 7,800,000 and the market price of its shares was 1.50 per share. The Statement of Financial Position of Brick Ltd and its subsidiary Mortar Lad as at 31 December 2019 are as follows: Non-current Assets: Property, plant and equipment at cost Investment in Mortar Ltd Current Assets: Inventories Trade receivables: Brick Lad Other Cash Total Assets Equity and Liabilities Equity Ordinary Share Capital at 1 each Revaluation Reserve Retained earnings Liabilities Non-Current Liabilities: Deferred consideration for Investment in Mortar Ltd. Current Liabilities: Trade Payables: Mortar Ltd Other payables Brick Ltd 1000 65,000 50.791 Required: 115,791 3,900 www. 20,800 2.600 27.300 143.091 58,500 15,600 33.210 107,310 12,381 10,400 13.000 35.781 143.091 Mortar Ltd 1000 52,000 52,000 10,400 13,000 9,100 32.500 84.500 32,500 6,500 36.400 75,400 9.100 2.102 84.500 Total Equity and Liabilities The following additional information was provided: The cost of capital of Brick Ltd is 5% . Mortar Ltd has an internally developed brand named 'Foder' which was valued at 6,500,000 on 1 January 2019. The share capital and revaluation surplus of Mortar Ltd has not changed since that date. There is no impairment of goodwill. BE110-5-FY The group policy is to value non-controlling interest at full fair value. Non-controlling interest was valued at 11,700,000 on the acquisition date. . On 31 December 2019 Mortar Lad had invoiced Brick Ltd for goods to the value of 2,600,000 and Brick Ltd had sent payment in full but this had not been received by Mortar Lid. (a) Prepare the Consolidated Statement of Financial Position of Brick Group as at 31 December 2019 in accordance with the IFRS 3, Business Combinations and IAS 27, Consolidated and Separate Financial Statements. Show all your workings clearly and clearly state any assumptions you make. Round up all figures in the consolidated statement to the nearest whole number. (b) Explain the circumstances under which a parent company may be exempted from preparing group accounts (consolidation).

Step by Step Solution

★★★★★

3.65 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

a Consolidated Statement of Financial Position of Brick Group As at 31 December 2019 000 Noncurrent Assets Property plant and equipment 6500052000 117...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started