Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bricks Ltd recently had a board meeting where it was resolved that the company has to obtain more capital due to a range of

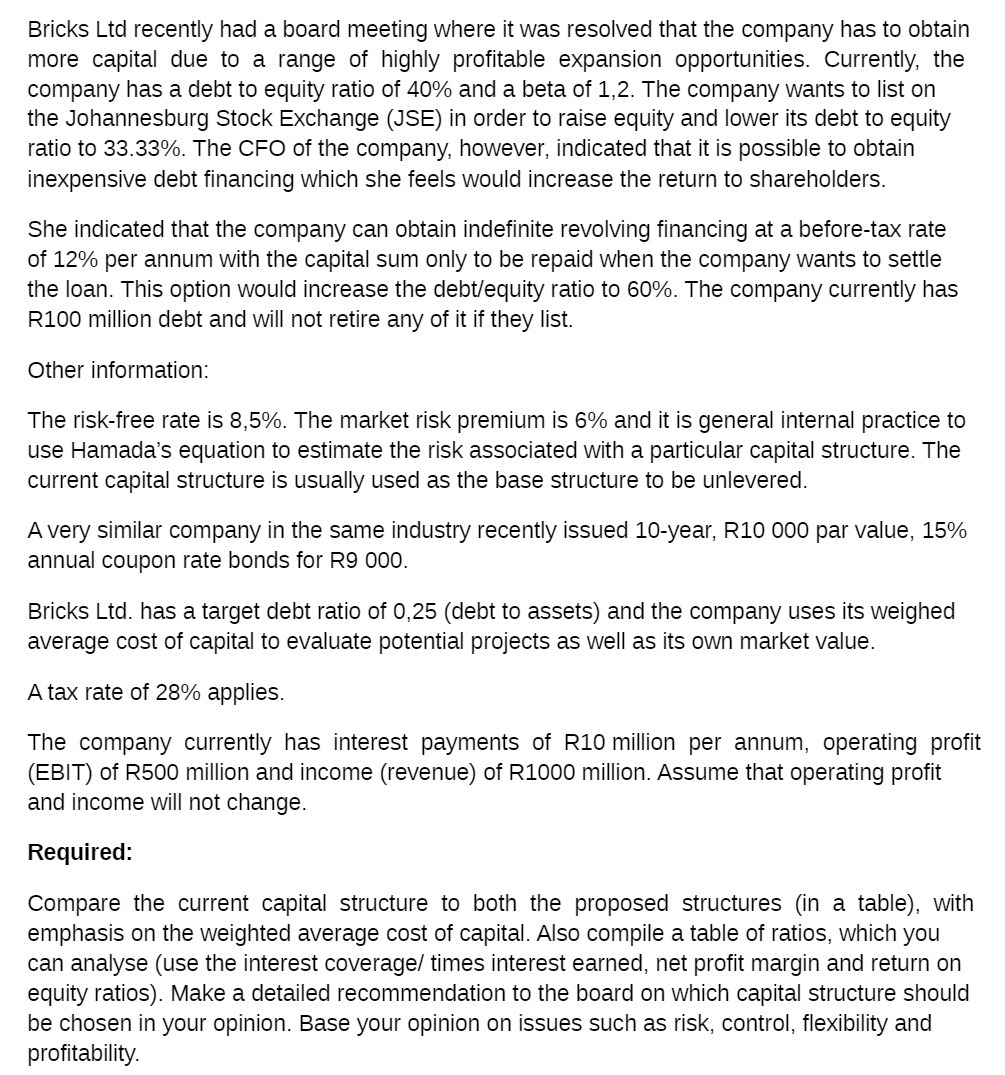

Bricks Ltd recently had a board meeting where it was resolved that the company has to obtain more capital due to a range of highly profitable expansion opportunities. Currently, the company has a debt to equity ratio of 40% and a beta of 1,2. The company wants to list on the Johannesburg Stock Exchange (JSE) in order to raise equity and lower its debt to equity ratio to 33.33%. The CFO of the company, however, indicated that it is possible to obtain inexpensive debt financing which she feels would increase the return to shareholders. She indicated that the company can obtain indefinite revolving financing at a before-tax rate of 12% per annum with the capital sum only to be repaid when the company wants to settle the loan. This option would increase the debt/equity ratio to 60%. The company currently has R100 million debt and will not retire any of it if they list. Other information: The risk-free rate is 8,5%. The market risk premium is 6% and it is general internal practice to use Hamada's equation to estimate the risk associated with a particular capital structure. The current capital structure is usually used as the base structure to be unlevered. A very similar company in the same industry recently issued 10-year, R10 000 par value, 15% annual coupon rate bonds for R9 000. Bricks Ltd. has a target debt ratio of 0,25 (debt to assets) and the company uses its weighed average cost of capital to evaluate potential projects as well as its own market value. A tax rate of 28% applies. The company currently has interest payments of R10 million per annum, operating profit (EBIT) of R500 million and income (revenue) of R1000 million. Assume that operating profit and income will not change. Required: Compare the current capital structure to both the proposed structures (in a table), with emphasis on the weighted average cost of capital. Also compile a table of ratios, which you can analyse (use the interest coverage/ times interest earned, net profit margin and return on equity ratios). Make a detailed recommendation to the board on which capital structure should be chosen in your opinion. Base your opinion on issues such as risk, control, flexibility and profitability.

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Certainly The proposed listing capital structure aligns with the companys goal of obtaining more capital for expansion opportunities in the following ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started