Answered step by step

Verified Expert Solution

Question

1 Approved Answer

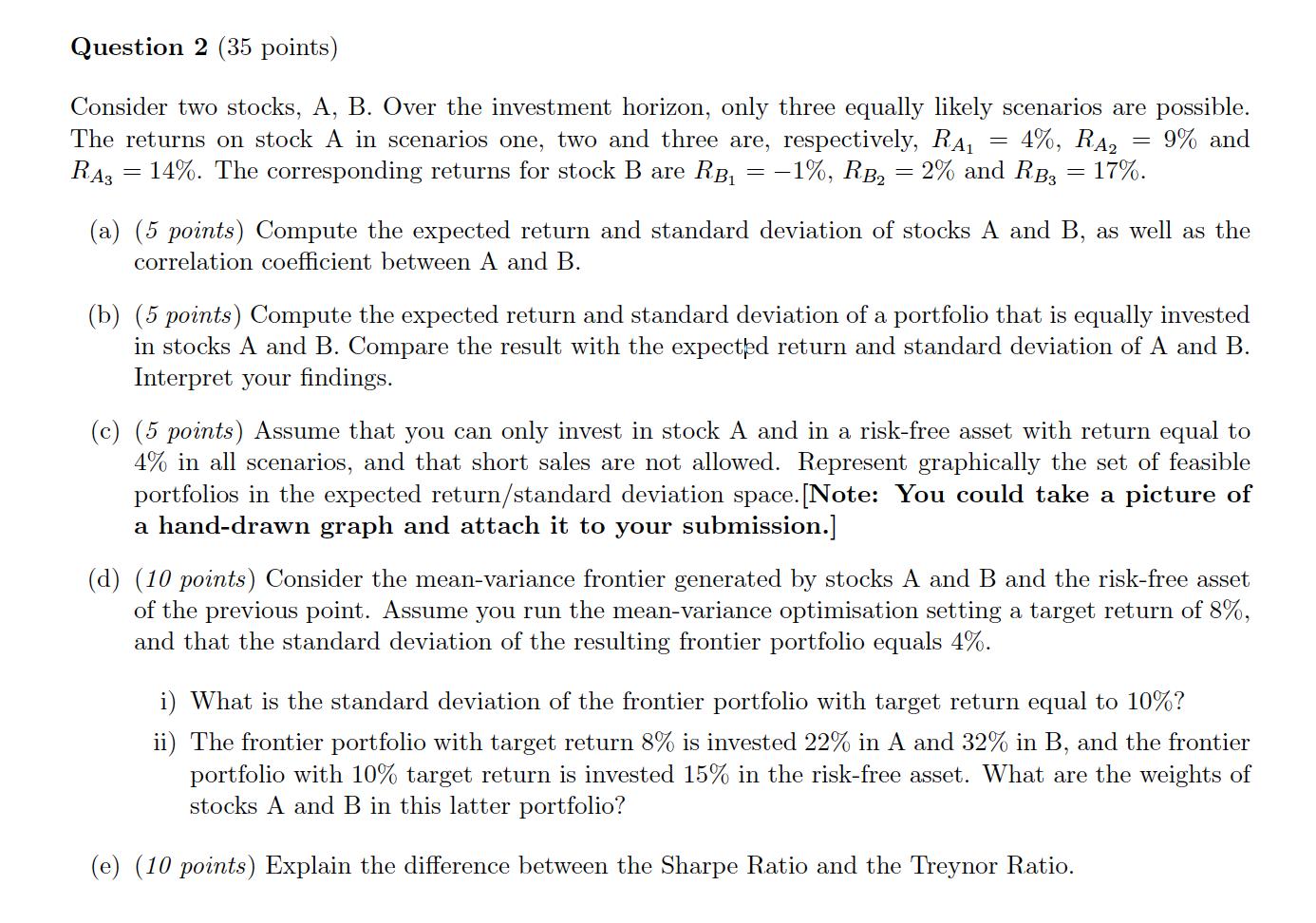

Question 2 (35 points) Consider two stocks, A, B. Over the investment horizon, only three equally likely scenarios are possible. The returns on stock

Question 2 (35 points) Consider two stocks, A, B. Over the investment horizon, only three equally likely scenarios are possible. The returns on stock A in scenarios one, two and three are, respectively, RA 4%, RA 9% and RA3 17%. 14%. The corresponding returns for stock B are RB = -1%, RB = 2% and RB3 - = - (a) (5 points) Compute the expected return and standard deviation of stocks A and B, as well as the correlation coefficient between A and B. (b) (5 points) Compute the expected return and standard deviation of a portfolio that is equally invested in stocks A and B. Compare the result with the expected return and standard deviation of A and B. Interpret your findings. (c) (5 points) Assume that you can only invest in stock A and in a risk-free asset with return equal to 4% in all scenarios, and that short sales are not allowed. Represent graphically the set of feasible portfolios in the expected return/standard deviation space. [Note: You could take a picture of a hand-drawn graph and attach it to your submission.] (d) (10 points) Consider the mean-variance frontier generated by stocks A and B and the risk-free asset of the previous point. Assume you run the mean-variance optimisation setting a target return of 8%, and that the standard deviation of the resulting frontier portfolio equals 4%. i) What is the standard deviation of the frontier portfolio with target return equal to 10%? ii) The frontier portfolio with target return 8% is invested 22% in A and 32% in B, and the frontier portfolio with 10% target return is invested 15% in the risk-free asset. What are the weights of stocks A and B in this latter portfolio? (e) (10 points) Explain the difference between the Sharpe Ratio and the Treynor Ratio.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a b c d e Scenarios Probability P Return on A Ra One Two Three Two Three Scenarios Probability P Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started