Answered step by step

Verified Expert Solution

Question

1 Approved Answer

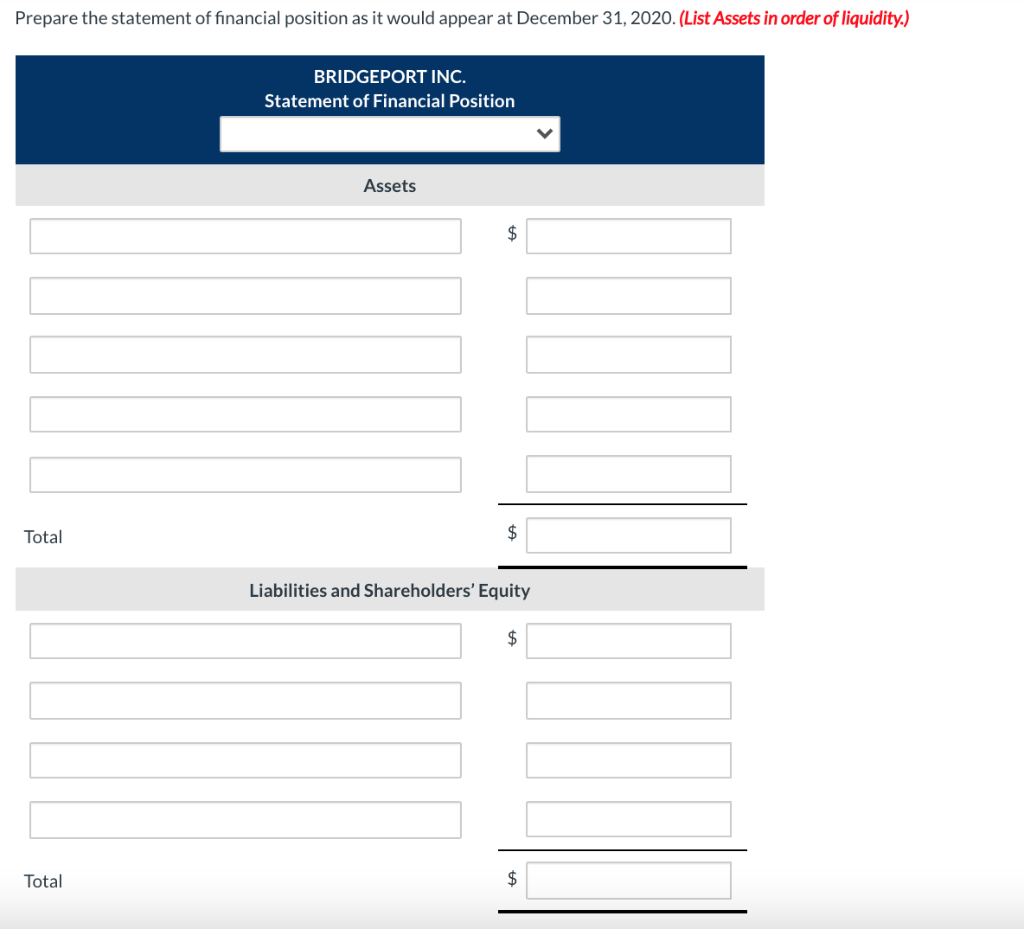

Bridgeport Inc. applies ASPE and had the following statement of financial position at the end of operations for 2019: BRIDGEPORT INC. Statement of Financial Position

Bridgeport Inc. applies ASPE and had the following statement of financial position at the end of operations for 2019:

| BRIDGEPORT INC. Statement of Financial Position December 31, 2019 | |||||||

| Cash | $50,500 | Accounts payable | $ 93,000 | ||||

| Accounts receivable | 90,000 | Long-term debt | 85,000 | ||||

| Inventory | 82,000 | Common shares | 100,000 | ||||

| Machinery (net) | 125,000 | Retained earnings | 89,500 | ||||

| Trademarks | 20,000 | ||||||

| $367,500 | $367,500 | ||||||

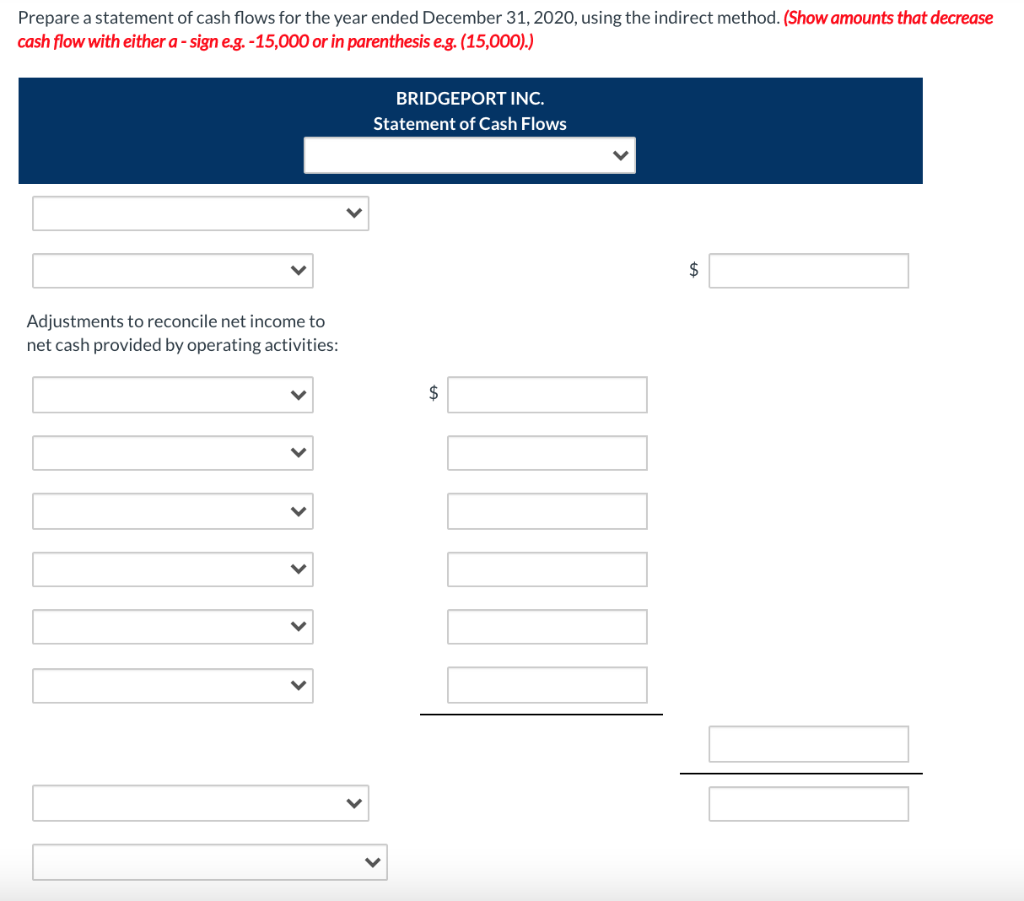

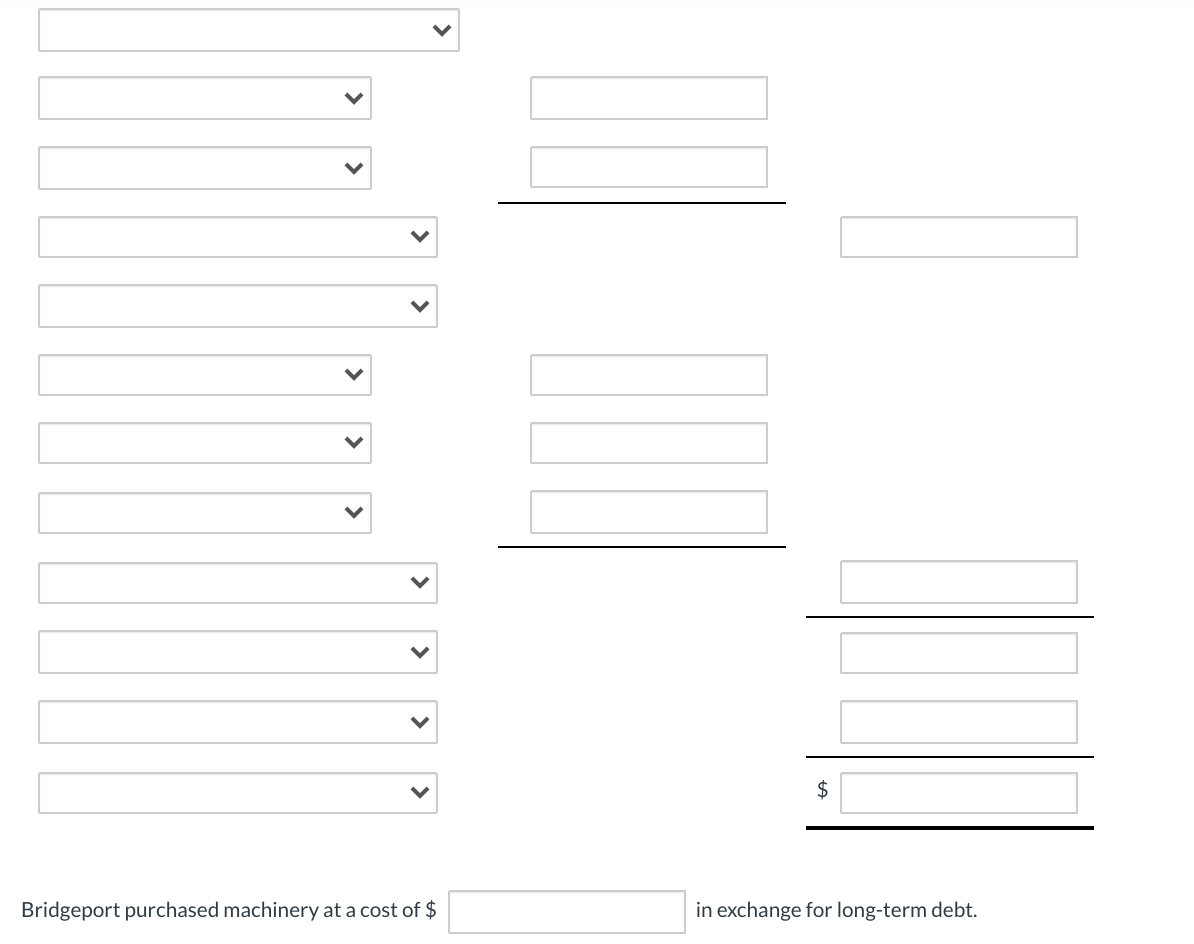

During 2020, the following occurred:

ddddd

| 1. | Jia Inc. sold some of its trademarks. The trademarks had an unlimited useful life and a cost of $10,000. They were sold for proceeds of $21,500. | |

| 2. | Machinery was purchased in exchange for long-term debt of $40,000. | |

| 3. | Long-term debt in the amount of $14,600 was retired before maturity by paying $14,600 cash. | |

| 4. | An additional $11,500 in common shares was issued. | |

| 5. | Dividends totalling $13,100 were declared and paid to shareholders. Dividends paid are treated as financing activities. | |

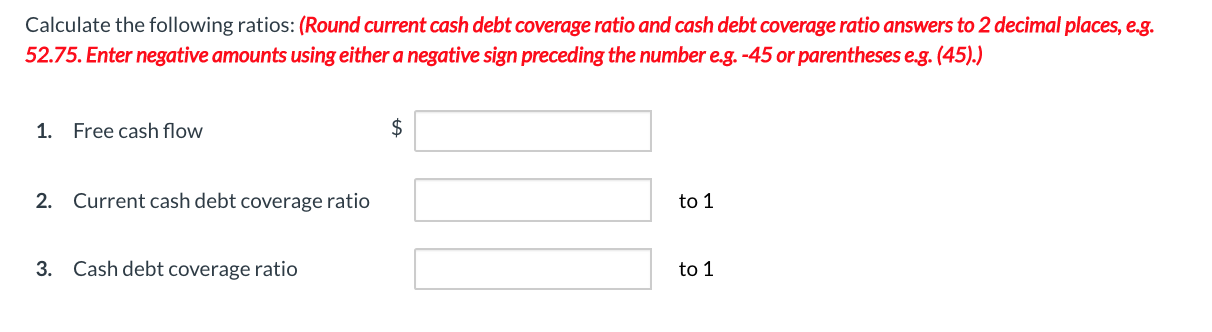

| 6. | Net income for 2020 was $44,000 after allowing for depreciation of $19,000. | |

| 7. | Machinery with a carrying value of $18,000 was sold at a gain of $7,000. | |

| 8. | At December 31, 2020, Cash was $69,300; Accounts Receivable was $111,000; Accounts Payable was $83,000 and Inventory increased to $107,000.    plz show steps as well plz show steps as well |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started