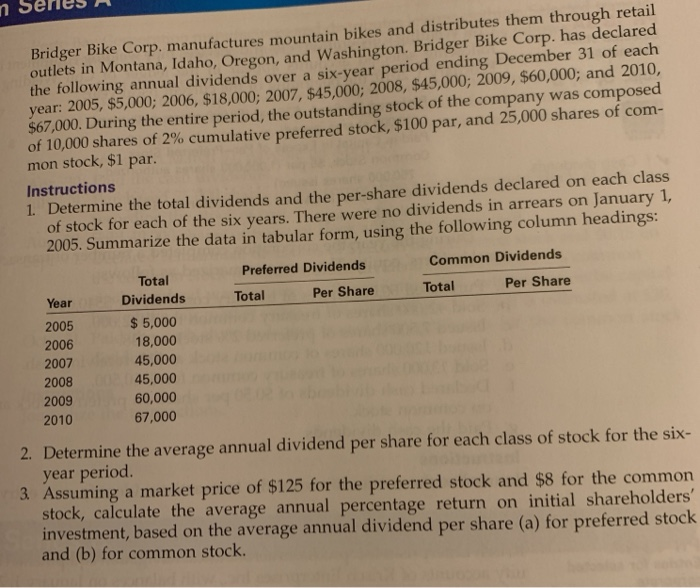

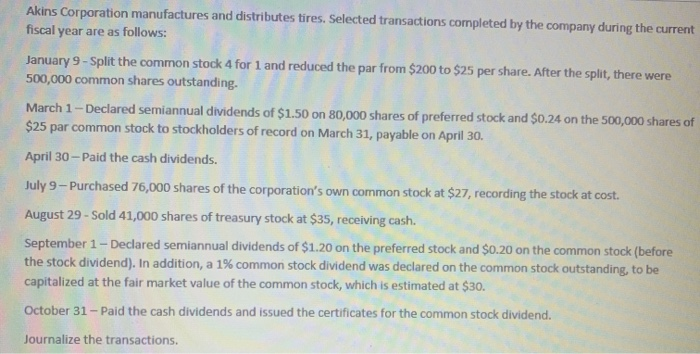

Bridger Bike Corp. manufactures mountain bikes and distributes them through retail outlets in Montana, Idaho, Oregon, and Washington. Bridger Bike Corp. has declared the following annual dividends over a six-year period ending December 31 of each year: 2005, $5,000; 2006, $18,000; 2007, $45,000; 2008, $45,000; 2009, $60,000; and 2010, $67,000. During the entire period, the outstanding stock of the company was composed of 10,000 shares of 2% cumulative preferred stock, $100 par, and 25,000 shares of com- mon stock, $1 par. Instructions 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, 2005. Summarize the data in tabular form, using the following column headings: Total Preferred Dividends Common Dividends Year Dividends Total Per Share Total Per Share 2005 $ 5,000 2006 18,000 2007 45,000 2008 45,000 2009 60,000 2010 67,000 2. Determine the average annual dividend per share for each class of stock for the six- year period. 3 Assuming a market price of $125 for the preferred stock and $8 for the common stock, calculate the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock. Akins Corporation manufactures and distributes tires. Selected transactions completed by the company during the current fiscal year are as follows: January 9 - Split the common stock 4 for 1 and reduced the par from $200 to $25 per share. After the split, there were 500,000 common shares outstanding. March 1 - Declared semiannual dividends of $1.50 on 80,000 shares of preferred stock and $0.24 on the 500,000 shares of $25 par common stock to stockholders of record on March 31, payable on April 30. April 30 - Paid the cash dividends. July 9 - Purchased 76,000 shares of the corporation's own common stock at $27, recording the stock at cost. August 29 - Sold 41,000 shares of treasury stock at $35, receiving cash. September 1 - Declared semiannual dividends of $1.20 on the preferred stock and $0.20 on the common stock (before the stock dividend). In addition, a 1% common stock dividend was declared on the common stock outstanding, to be capitalized at the fair market value of the common stock, which is estimated at $30. October 31 - Paid the cash dividends and issued the certificates for the common stock dividend. Journalize the transactions