Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kashmiri's Cost of Capital. Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not yet entered the

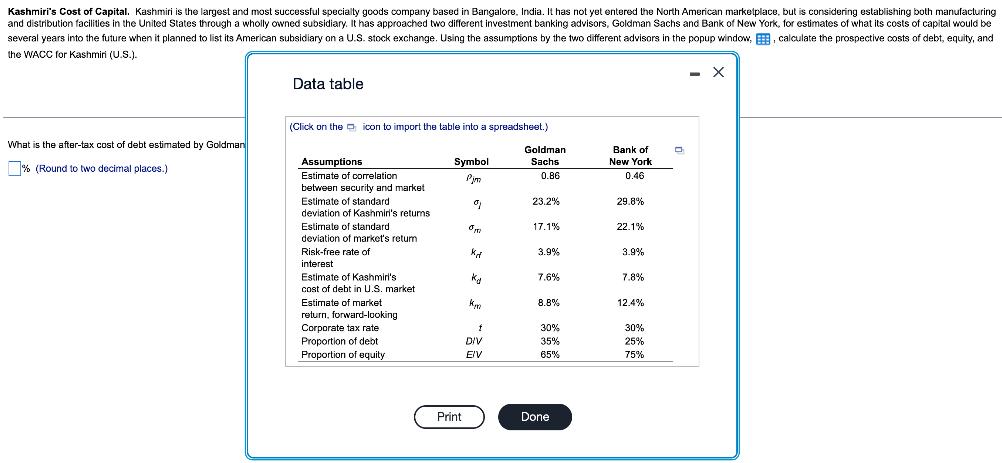

Kashmiri's Cost of Capital. Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not yet entered the North American marketplace, but is considering establishing both manufacturing and distribution facilities in the United States through a wholly owned subsidiary. It has approached two different investment banking advisors, Goldman Sachs and Bank of New York, for estimates of what its costs of capital would be several years into the future when it planned to list its American subsidiary on a U.S. stock exchange. Using the assumptions by the two different advisors in the popup window,, calculate the prospective costs of debt, equity, and the WACC for Kashmiri (U.S.). What is the after-tax cost of debt estimated by Goldman % (Round to two decimal places.) Data table (Click on the icon to import the table into a spreadsheet.) Assumptions Estimate of correlation between security and market Estimate of standard deviation of Kashmir's retums Estimate of standard deviation of market's retum Risk-free rate of interest Estimate of Kashmiri's cost of debt in U.S. market Estimate of market return, forward-looking Corporate tax rate Proportion of debt Proportion of equity Symbol Pjm Print 9 010 Kef K K f DIV EIV Goldman Sachs 0.86 23.2% 17.1% 3.9% 7.6% 8.8% 30% 35% 65% Done Bank of New York 0.46 29.8% 22.1% 3.9% 7.8% 12.4% 30% 25% 75% O - X

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started