Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brief Exercise 6-36 (Algo) Long-term contract; revenue recognition; loss on entire project [LO6-9] Franklin Construction entered into a fixed-price contract to build a freeway-connecting

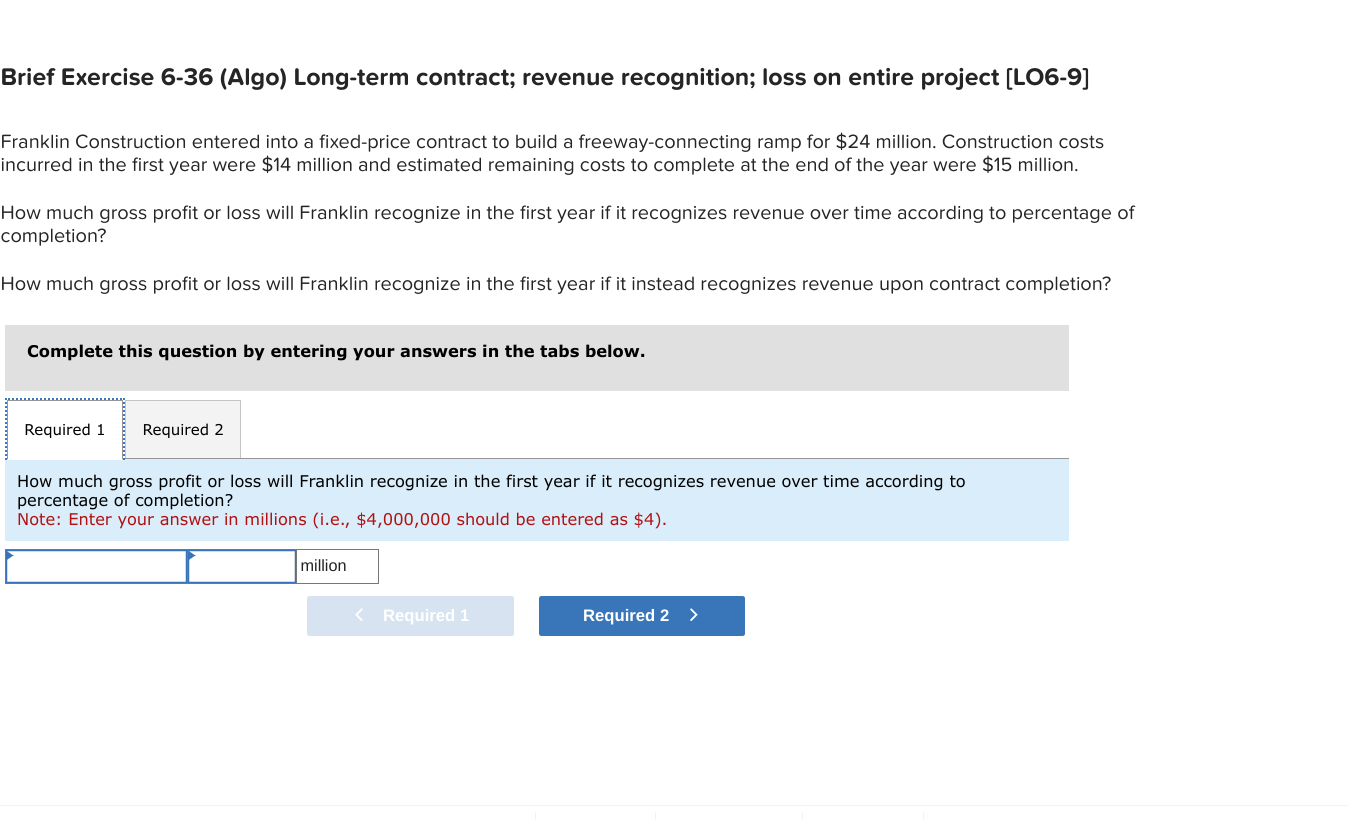

Brief Exercise 6-36 (Algo) Long-term contract; revenue recognition; loss on entire project [LO6-9] Franklin Construction entered into a fixed-price contract to build a freeway-connecting ramp for $24 million. Construction costs incurred in the first year were $14 million and estimated remaining costs to complete at the end of the year were $15 million. How much gross profit or loss will Franklin recognize in the first year if it recognizes revenue over time according to percentage of completion? How much gross profit or loss will Franklin recognize in the first year if it instead recognizes revenue upon contract completion? Complete this question by entering your answers in the tabs below. Required 1 Required 2 How much gross profit or loss will Franklin recognize in the first year if it recognizes revenue over time according to percentage of completion? Note: Enter your answer in millions (i.e., $4,000,000 should be entered as $4). million < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the gross profit or loss that Franklin Construction will recognize in the first ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642737e01ded_980175.pdf

180 KBs PDF File

6642737e01ded_980175.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started