Question

At the end of 2021, Windsor, Inc. has accounts receivable of $747,400 and an allowance for doubtful accounts of $27,260. 1. On January 24,

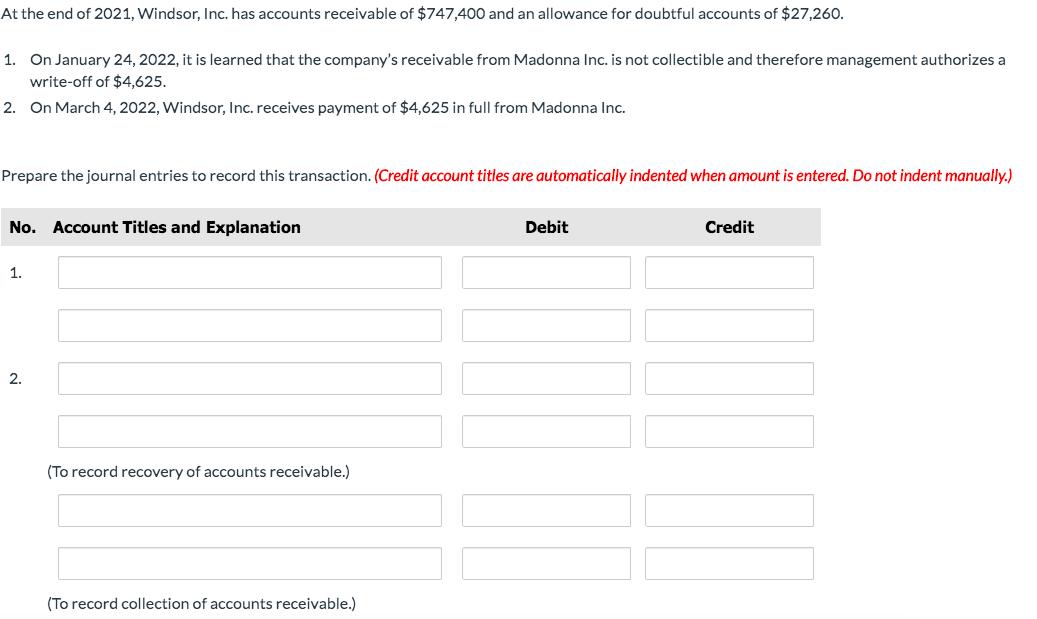

At the end of 2021, Windsor, Inc. has accounts receivable of $747,400 and an allowance for doubtful accounts of $27,260. 1. On January 24, 2022, it is learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,625. 2. On March 4, 2022, Windsor, Inc. receives payment of $4,625 in full from Madonna Inc. Prepare the journal entries to record this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. 2. (To record recovery of accounts receivable.) (To record collection of accounts receivable.)

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Journel Entr ies 1 Allowance for doubtful ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Brian Zwicker

11th Canadian Edition

132564440, 978-0132564441

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App