Answered step by step

Verified Expert Solution

Question

1 Approved Answer

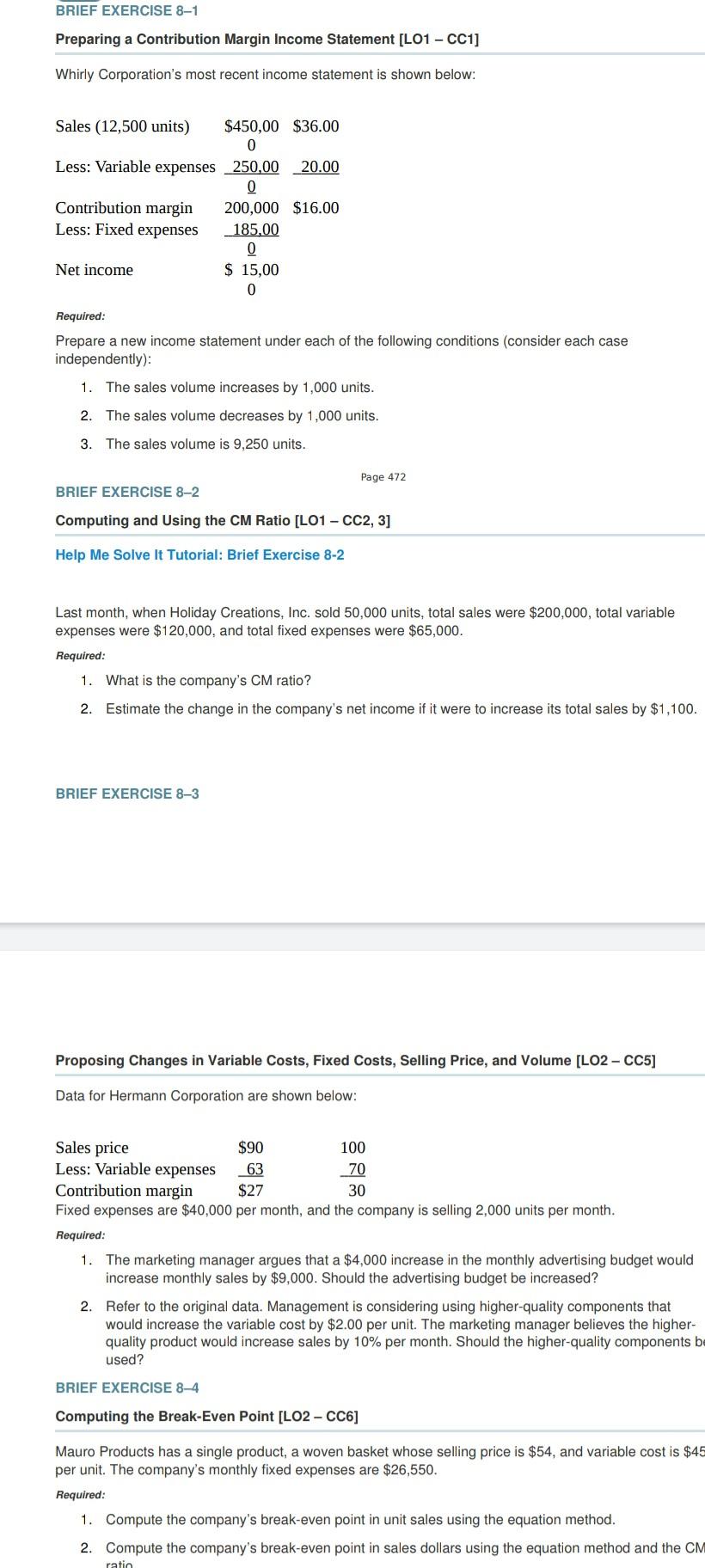

BRIEF EXERCISE 8-1 Preparing a Contribution Margin Income Statement [LO1 - CC1] Whirly Corporation's most recent income statement is shown below: Sales (12,500 units) $450,00

BRIEF EXERCISE 8-1 Preparing a Contribution Margin Income Statement [LO1 - CC1] Whirly Corporation's most recent income statement is shown below: Sales (12,500 units) $450,00 $36.00 0 Less: Variable expenses 250,00 20.00 0 Contribution margin 200,000 $16.00 Less: Fixed expenses 185.00 0 Net income $ 15,00 0 Required: Prepare a new income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by 1,000 units. 2. The sales volume decreases by 1,000 units. 3. The sales volume is 9,250 units. Page 472 BRIEF EXERCISE 8-2 Computing and using the CM Ratio [L01 - CC2, 3] Help Me Solve It Tutorial: Brief Exercise 8-2 Last month, when Holiday Creations, Inc. sold 50,000 units, total sales were $200,000, total variable expenses were $120,000, and total fixed expenses were $65,000. Required: 1. What is the company's CM ratio? 2. Estimate the change in the company's net income if it were to increase its total sales by $1,100. BRIEF EXERCISE 8-3 Proposing Changes in Variable Costs, Fixed Costs, Selling Price, and Volume [LO2- CC5] Data for Hermann Corporation are shown below: Sales price $90 100 Less: Variable expenses 63 70 Contribution margin $27 30 Fixed expenses are $40,000 per month, and the company is selling 2,000 units per month. Required: 1. The marketing manager argues that a $4,000 increase in the monthly advertising budget would increase monthly sales by $9,000. Should the advertising budget be increased? 2. Refer to the original data. Management is considering using higher-quality components that would increase the variable cost by $2.00 per unit. The marketing manager believes the higher- quality product would increase sales by 10% per month. Should the higher-quality components b used? BRIEF EXERCISE 8-4 Computing the Break-Even Point [LO2 - CC6] Mauro Products has a single product, a woven basket whose selling price is $54, and variable cost is $45 per unit. The company's monthly fixed expenses are $26,550. Required: 1. Compute the company's break-even point in unit sales using the equation method. 2. Compute the company's break-even point in sales dollars using the equation method and the CM ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started