Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brief Exercise 9-23 Martinez Corp. is facing a decision as to whether to purchase 40% of Kyla Corp.'s shares for $2.00 million cash, giving Martinez

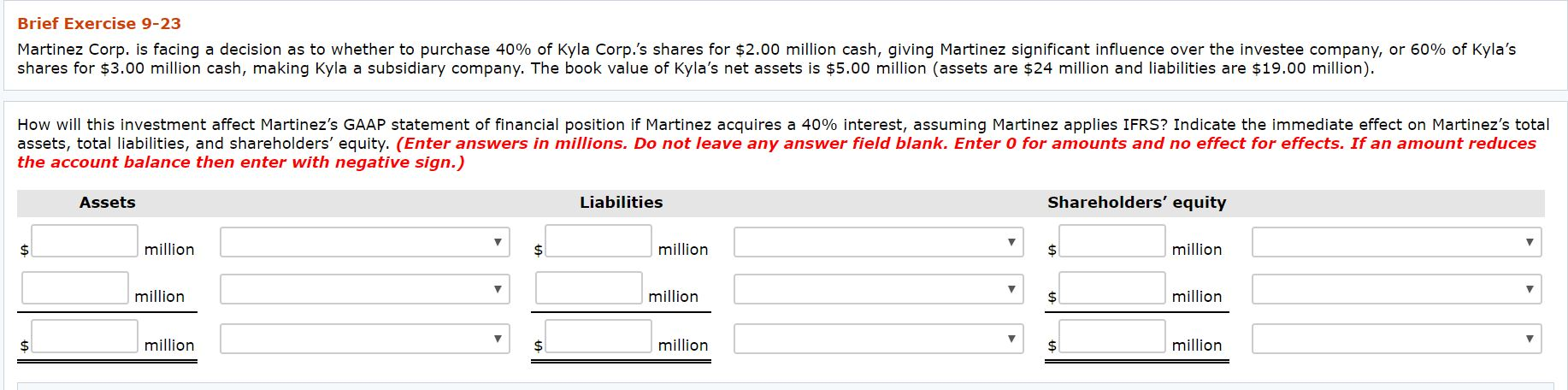

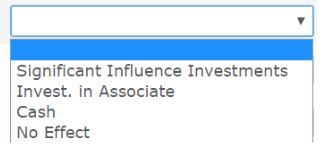

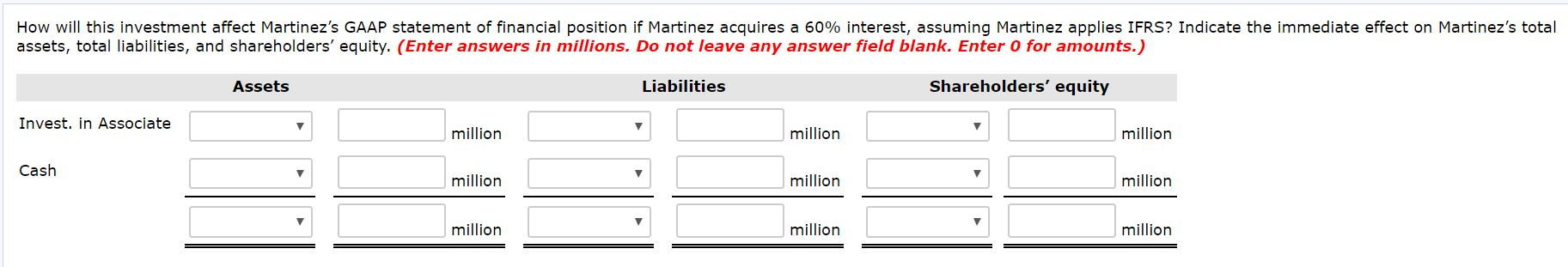

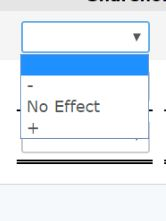

Brief Exercise 9-23 Martinez Corp. is facing a decision as to whether to purchase 40% of Kyla Corp.'s shares for $2.00 million cash, giving Martinez significant influence over the investee company, or 60% of Kyla's shares for $3.00 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $5.00 million (assets are $24 million and liabilities are $19.00 million). How will this investment affect Martinez's GAAP statement of financial position if Martinez acquires a 40% interest, assuming Martinez applies IFRS? Indicate the immediate effect on Martinez's total assets, total liabilities, and shareholders' equity. (Enter answers in millions. Do not leave any answer field blank. Enter o for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) Assets Liabilities Shareholders' equity million million million million million million million million million Significant Influence Investments Invest. in Associate Cash No Effect How will this investment affect Martinez's GAAP statement of financial position if Martinez acquires a 60% interest, assuming Martinez applies IFRS? Indicate the immediate effect on Martinez's total assets, total liabilities, and shareholders' equity. (Enter answers in millions. Do not leave any answer field blank. Enter o for amounts.) Assets Liabilities Shareholders' equity Invest. in Associate million million million Cash million million million million million million No Effect Brief Exercise 9-23 Martinez Corp. is facing a decision as to whether to purchase 40% of Kyla Corp.'s shares for $2.00 million cash, giving Martinez significant influence over the investee company, or 60% of Kyla's shares for $3.00 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $5.00 million (assets are $24 million and liabilities are $19.00 million). How will this investment affect Martinez's GAAP statement of financial position if Martinez acquires a 40% interest, assuming Martinez applies IFRS? Indicate the immediate effect on Martinez's total assets, total liabilities, and shareholders' equity. (Enter answers in millions. Do not leave any answer field blank. Enter o for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) Assets Liabilities Shareholders' equity million million million million million million million million million Significant Influence Investments Invest. in Associate Cash No Effect How will this investment affect Martinez's GAAP statement of financial position if Martinez acquires a 60% interest, assuming Martinez applies IFRS? Indicate the immediate effect on Martinez's total assets, total liabilities, and shareholders' equity. (Enter answers in millions. Do not leave any answer field blank. Enter o for amounts.) Assets Liabilities Shareholders' equity Invest. in Associate million million million Cash million million million million million million No Effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started