Question

BRIEF EXERCISES Compute missing amounts in BE5-1 Presented below are the components in Clearwater Company, Ltd.'s income state- determining net income. ment. Determine the missing

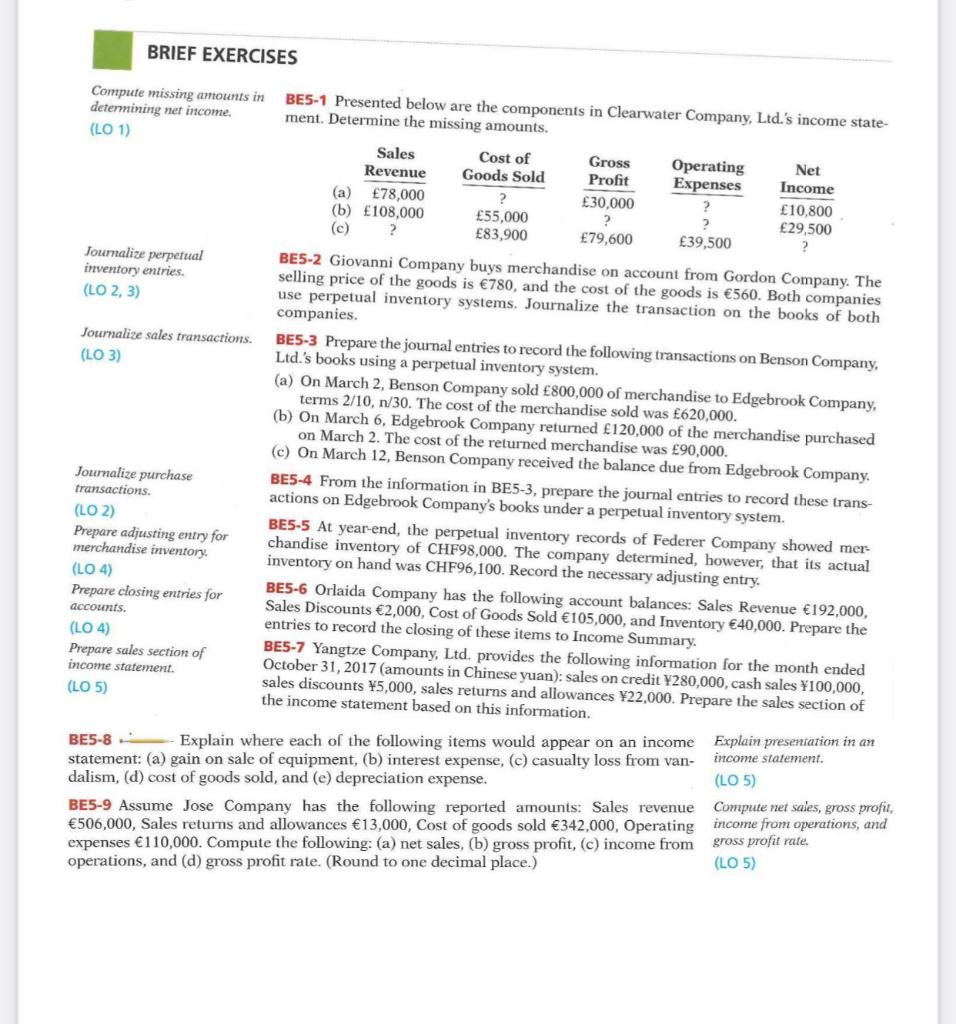

BRIEF EXERCISES Compute missing amounts in BE5-1 Presented below are the components in Clearwater Company, Ltd.'s income state- determining net income. ment. Determine the missing amounts. (LO 1) Sales Revenue Cost of Goods Sold Gross Operating Net Profit Expenses Income (a) 78,000 ? 30,000 ? 10,800 (b) 108,000 (c) ? 55,000 83,900 ? ? 29,500 79,600 39,500 ? Journalize perpetual inventory entries. (LO 2, 3) Journalize sales transactions. (LO 3) Journalize purchase transactions. (LO 2) Prepare adjusting entry for merchandise inventory. (LO 4) Prepare closing entries for accounts. (LO 4) Prepare sales section of income statement. (LO 5) BE5-2 Giovanni Company buys merchandise on account from Gordon Company. The selling price of the goods is 780, and the cost of the goods is 560. Both companies use perpetual inventory systems. Journalize the transaction on the books of both companies. BE5-3 Prepare the journal entries to record the following transactions on Benson Company, Ltd.'s books using a perpetual inventory system. (a) On March 2, Benson Company sold 800,000 of merchandise to Edgebrook Company, terms 2/10, n/30. The cost of the merchandise sold was 620,000. (b) On March 6, Edgebrook Company returned 120,000 of the merchandise purchased on March 2. The cost of the returned merchandise was 90,000. (c) On March 12, Benson Company received the balance due from Edgebrook Company. BE5-4 From the information in BE5-3, prepare the journal entries to record these trans- actions on Edgebrook Company's books under a perpetual inventory system. BE5-5 At year-end, the perpetual inventory records of Federer Company showed mer- chandise inventory of CHF98,000. The company determined, however, that its actual inventory on hand was CHF96,100. Record the necessary adjusting entry. BE5-6 Orlaida Company has the following account balances: Sales Revenue 192,000, Sales Discounts 2,000, Cost of Goods Sold 105,000, and Inventory 40,000. Prepare the entries to record the closing of these items to Income Summary. BE5-7 Yangtze Company, Ltd. provides the following information for the month ended October 31, 2017 (amounts in Chinese yuan): sales on credit 280,000, cash sales 100,000, sales discounts 5,000, sales returns and allowances 22,000. Prepare the sales section of the income statement based on this information. BE5-8 Explain where each of the following items would appear on an income statement: (a) gain on sale of equipment, (b) interest expense, (c) casualty loss from van- dalism, (d) cost of goods sold, and (e) depreciation expense. BE5-9 Assume Jose Company has the following reported amounts: Sales revenue 506,000, Sales returns and allowances 13,000, Cost of goods sold 342,000, Operating expenses 110,000. Compute the following: (a) net sales, (b) gross profit, (c) income from operations, and (d) gross profit rate. (Round to one decimal place.) Explain presentation in an income statement. (LO 5) Compute net sales, gross profit, income from operations, and gross profit rate. (LO 5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started