Answered step by step

Verified Expert Solution

Question

1 Approved Answer

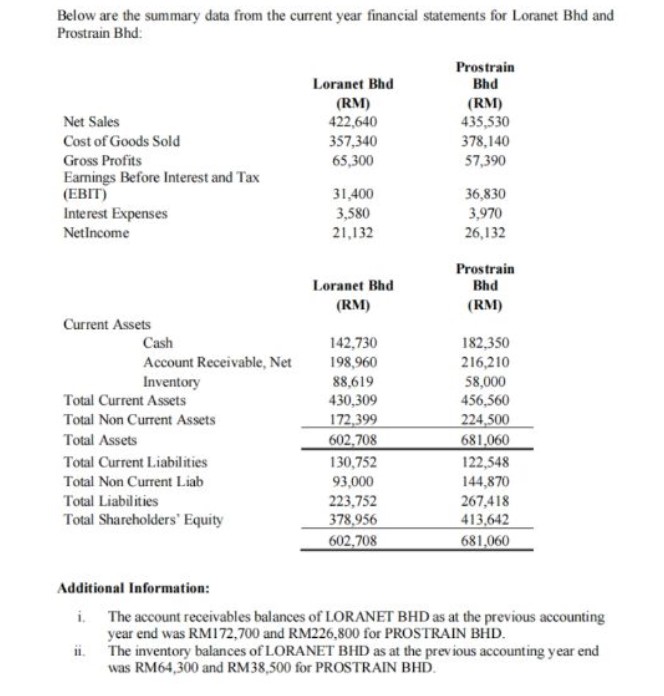

Briefly analyze the financial performance and position of both companies Below are the summary data from the current year financial statements for Loranet Bhd and

Briefly analyze the financial performance and position of both companies

Below are the summary data from the current year financial statements for Loranet Bhd and Prostrain Bhd: Net Sales Cost of Goods Sold Gross Profits Earnings Before Interest and Tax (EBIT) Interest Expenses NetIncome Current Assets Cash Account Receivable, Net Inventory Total Current Assets Total Non Current Assets Total Assets Total Current Liabilities Total Non Current Liab Total Liabilities Total Shareholders' Equity Additional Information: i. ii. Loranet Bhd (RM) 422,640 357,340 65,300 31,400 3,580 21,132 Loranet Bhd (RM) 142,730 198,960 88,619 430,309 172,399 602,708 130,752 93,000 223,752 378,956 602,708 Prostrain Bhd (RM) 435,530 378,140 57,390 36,830 3,970 26,132 Prostrain Bhd (RM) 182,350 216,210 58,000 456,560 224,500 681,060 122,548 144,870 267,418 413,642 681,060 The account receivables balances of LORANET BHD as at the previous accounting year end was RM172,700 and RM226,800 for PROSTRAIN BHD. The inventory balances of LORANET BHD as at the previous accounting year end was RM64,300 and RM38,500 for PROSTRAIN BHD.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Overall Both companies have similar net sales and gross profits Loranet Bhd has a higher EBIT margin than Prostrain Bhd 74 vs 85 Loranet Bhd has a lower net income margin than Prostrain Bhd 50 vs 60 L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started