Answered step by step

Verified Expert Solution

Question

1 Approved Answer

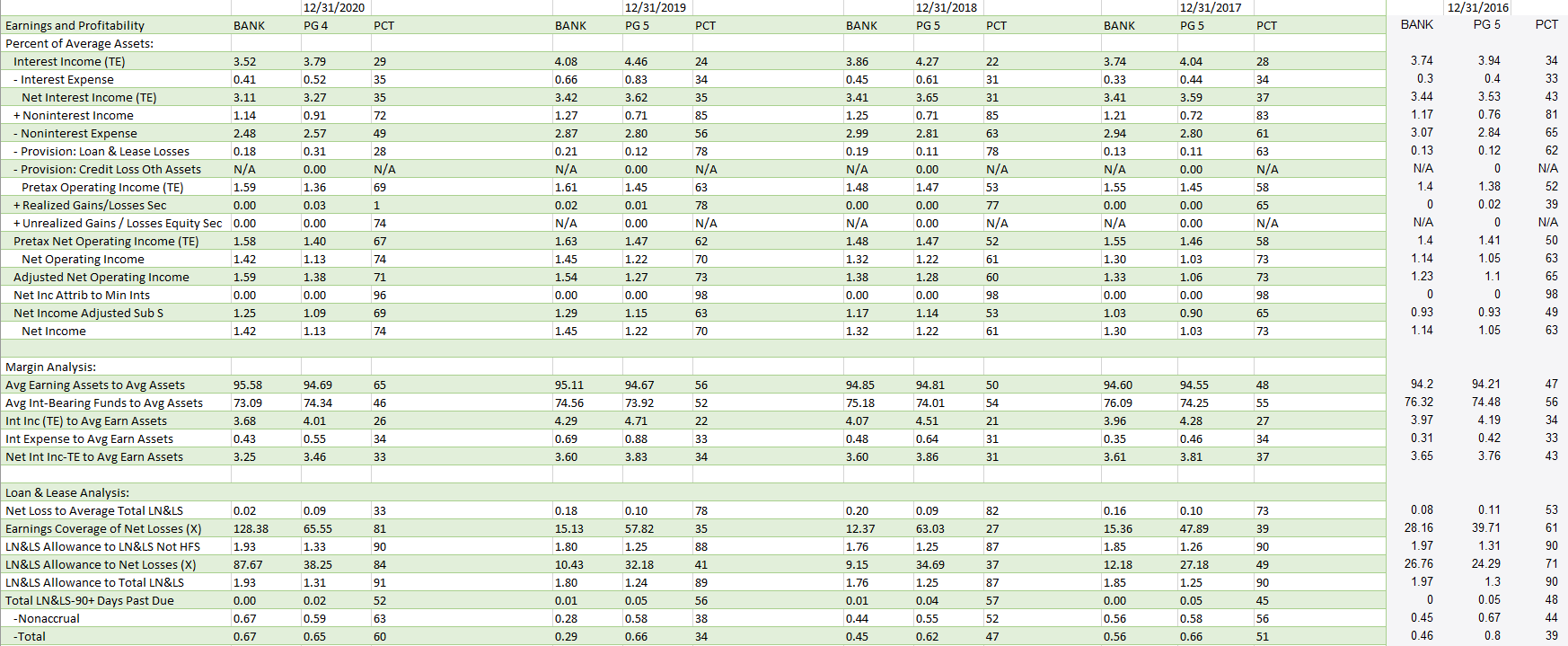

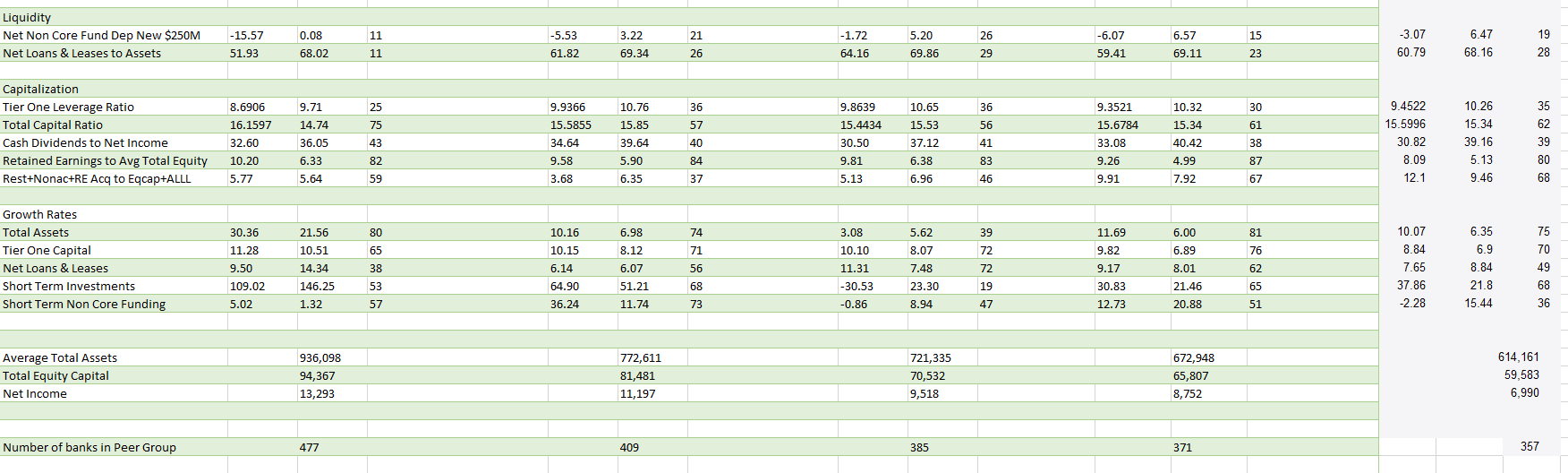

Briefly analyze the following performance measures over the last 5 years: Interest Income, Interest Expense, and NIM Non-interest income, Non-interest expense, and Burden ROA and

Briefly analyze the following performance measures over the last 5 years:

- Interest Income, Interest Expense, and NIM

- Non-interest income, Non-interest expense, and Burden

- ROA and ROE

Based on your analyses, what are the main positive and negative trends in the bank's performance indicators?

Briefly describe the areas of the bank's strengths and weaknesses relative to its peer group.

Please let me know if I am missing any information required to answer the questions!

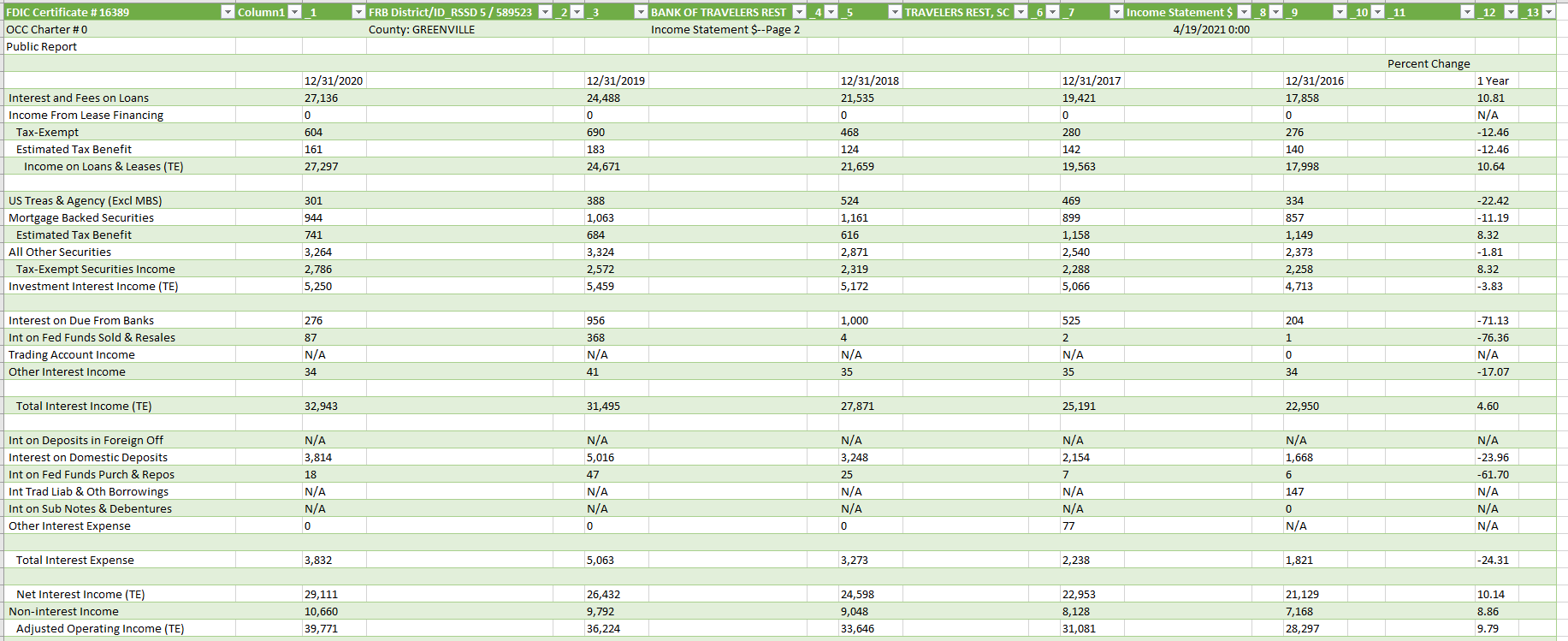

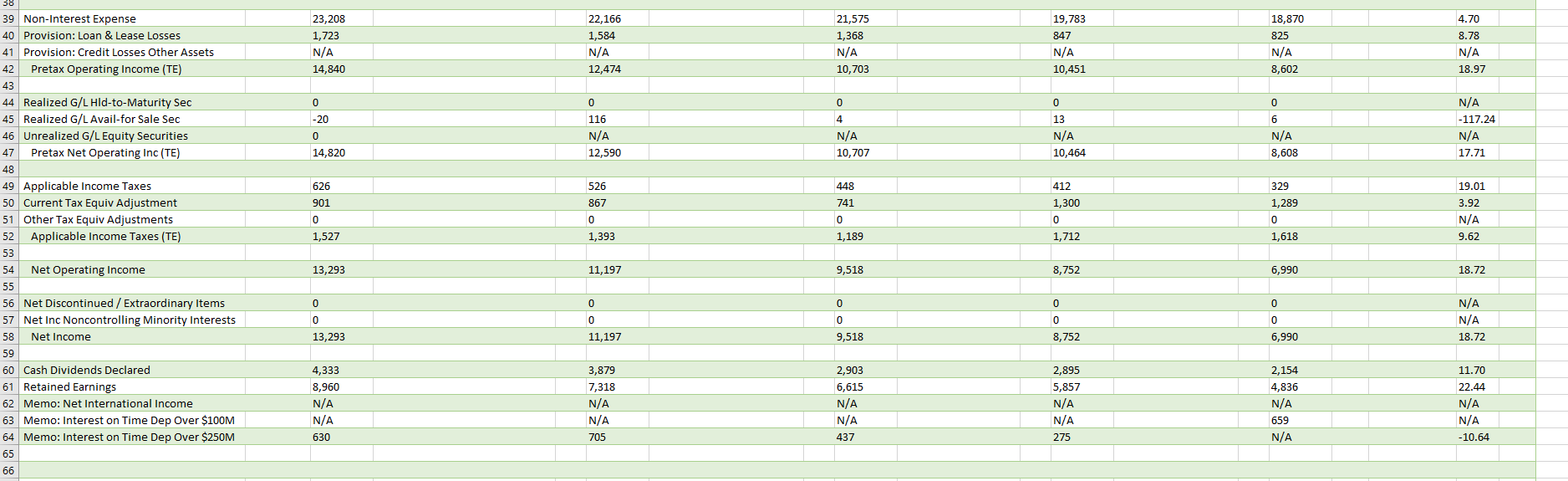

FDIC Certificate # 16389 OCC Charter #0 Public Report Interest and Fees on Loans Income From Lease Financing Tax-Exempt Estimated Tax Benefit Income on Loans & Leases (TE) US Treas & Agency (Excl MBS) Mortgage Backed Securities Estimated Tax Benefit All Other Securities Tax-Exempt Securities Income Investment Interest Income (TE) Interest on Due From Banks Int on Fed Funds Sold & Resales Trading Account Income Other Interest Income Total Interest Income (TE) Int on Deposits in Foreign Off Interest on Domestic Deposits Int on Fed Funds Purch & Repos Int Trad Liab & Oth Borrowings Int on Sub Notes & Debentures Other Interest Expense Total Interest Expense Net Interest Income (TE) Non-interest Income Adjusted Operating Income (TE) Column1 1 12/31/2020 27,136 0 604 161 27,297 301 944 741 3,264 2,786 5,250 276 87 N/A 34 32,943 N/A 3,814 18 N/A N/A 0 3,832 29,111 10,660 39,771 FRB District/ID_RSSD 5/589523 County: GREENVILLE 2 3 12/31/2019 24,488 0 690 183 24,671 388 1,063 684 3,324 2,572 5,459 956 368 N/A 41 31,495 N/A 5,016 47 N/A N/A 0 5,063 26,432 9,792 36,224 BANK OF TRAVELERS REST 4 5 Income Statement $--Page 2 12/31/2018 21,535 0 468 124 21,659 524 1,161 616 2,871 2,319 5,172 1,000 4 N/A 35 27,871 N/A 3,248 25 N/A N/A 0 3,273 24,598 9,048 33,646 TRAVELERS REST, SC 6 7 12/31/2017 19,421 0 280 142 19,563 469 899 1,158 2,540 2,288 5,066 525 2 N/A 35 25,191 N/A 2,154 7 N/A N/A 77 2,238 22,953 8,128 31,081 Income Statement $ 4/19/2021 0:00 8 9 12/31/2016 17,858 0 276 140 17,998 334 857 1,149 2,373 2,258 4,713 204 1 0 34 22,950 N/A 1,668 6 147 0 N/A 1,821 21,129 7,168 28,297 10 11 Percent Change 12 13 1 Year 10.81 N/A -12.46 -12.46 10.64 -22.42 -11.19 8.32 -1.81 8.32 -3.83 -71.13 -76.36 N/A -17.07 4.60 N/A -23.96 -61.70 N/A N/A N/A -24.31 10.14 8.86 9.79

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the performance measures over the last 5 years lets break down each category and identify trends 1 Interest Income Interest Expense and Net Interest Margin NIM Interest Income has shown a s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started