Briefly describe any trends or issues that stand out based on your trend and common size balance sheets.

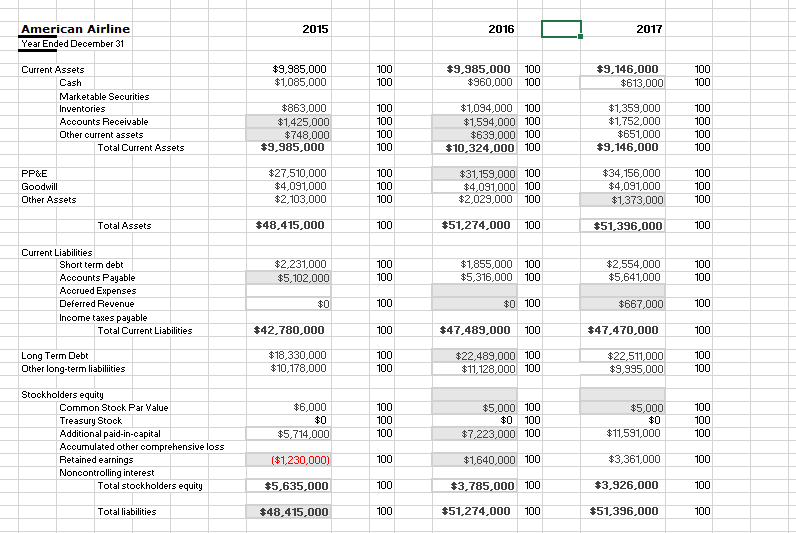

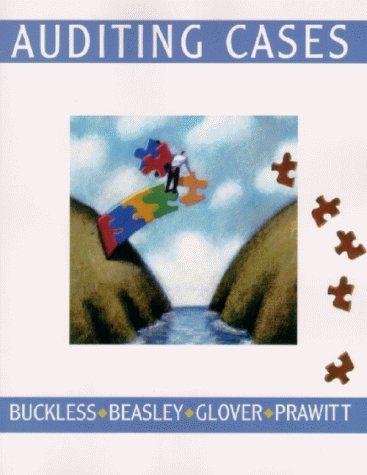

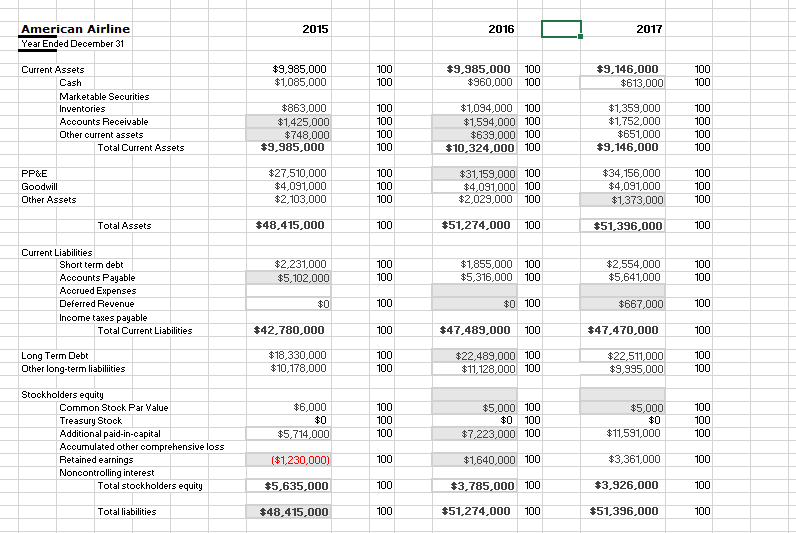

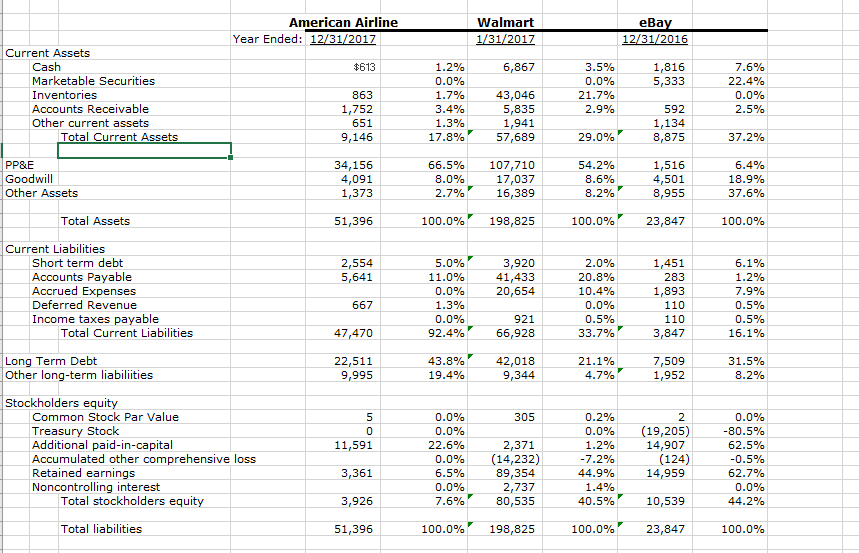

American Airline Year Ended December 31 2015 2016 2017 100 $9,985,000 $1,085,000 Current Assets $9,985,000 100 $9.146,000 Cash Marketable Securities Inventories Accounts Receivable Other current assets $960,000 100 $1,094,000 100 $639,000 100 $613,000 $863,000 $1,425,000 $748,000 $1,359,000 $1,752,000 $651,000 $9.146,000 $1594.0 Total Current Assets $9.985,000 100 $10,324,000 100 $27,510,000 $4,091,000 $2,103,000 100 $34,156,000 $4,091,000 PP&E $31,159,0 $4,091,000 100 $2,029,000 100 Other Assets 100 Total Assets $48.415,000 100 $51.274,000 100 $51.396.000 100 Current Liabilities $2,231,000 $5,102,000 $1,855,000 100 $2,554,000 $5,641,000 Short term debt Accounts Payable Accrued Expenses Deferred Revenue Income takes payable $5,316,000 100 $0 100 $47.489 000 100 100 100 $667,0 Total Current Liabilities $42.780,000 $47.470,000 $18,330,000 $10,178,000 $22,489,0 Long Term Debt Other long-term liabiliities $22,511,000 $9,995,000 100 $11,128,000 100 100 Stockholders equity $6,000 $5,714,000 ($1,230,000) $5,635,000 $48.415,000 $5,000 100 Common Stock Par Value Treasury Stock Additional paid-in-capital Accumulated other compre Retained earnings Noncontrolling interest $0 100 $7.223,000 100 100 $3.785,000 100 $51.274,000 100 $11,591,000 $3.361,000 $3.926,000 $51.396,000 hensive loss 100 100 100 $1,640,0 Total stockholders equity 100 Total liabilities American Airline Walmart Year Ended: 12/31/2017 Current Assets 1,816 5,333 $613 6,867 Marketable Securities Inventories Accounts Receivable Other current assets 0.0% 863 1,752 651 9,146 43,046 5,835 1,941 57,689 592 Total Current Assets 29.0%, 8,875 1,516 4,501 8,955 PP&E 34,156 4,091 1,373 66.5% 107,710 17,037 16,389 54.2% 18.9% 37.6% WI Other Assets Total Assets 51,396 100.096" 198,825 100.0% 23,847 100.0% Current Liabilities Short term debt Accounts Payable Accrued Expenses Deferred Revenue Income taxes payable 1,451 283 1,893 2,554 3,920 41,433 20,654 5,641 667 47,470 22,511 20.8% 10.4% 0.0% 921 66,928 Total Current Liabilities 92.4% r 33.7% 3,847 Long Term Debt Other long-term liabiliities 43.8% 19.4% , 42,018 9,344 7,509 1,952 9,995 8.2% Stockholders equity 305 Common Stock Par Value Treasury Stock Additional paid-in-capital Accumulated other comprehensive loss Retained earnings Noncontrolling interest 0.0% (19,205) -80.5% 62.5% 11,591 3,361 3,926 51,396 2,371 (14,232) 89,354 2,737 80,535 14,907 14,959 590 10,539 23,847 0.0% 7 2% 44.9% (124) 62.7% Total stockholders equity 40.5% Total liabilities 100.0%, 198,825 100.0% 100.0%