Answered step by step

Verified Expert Solution

Question

1 Approved Answer

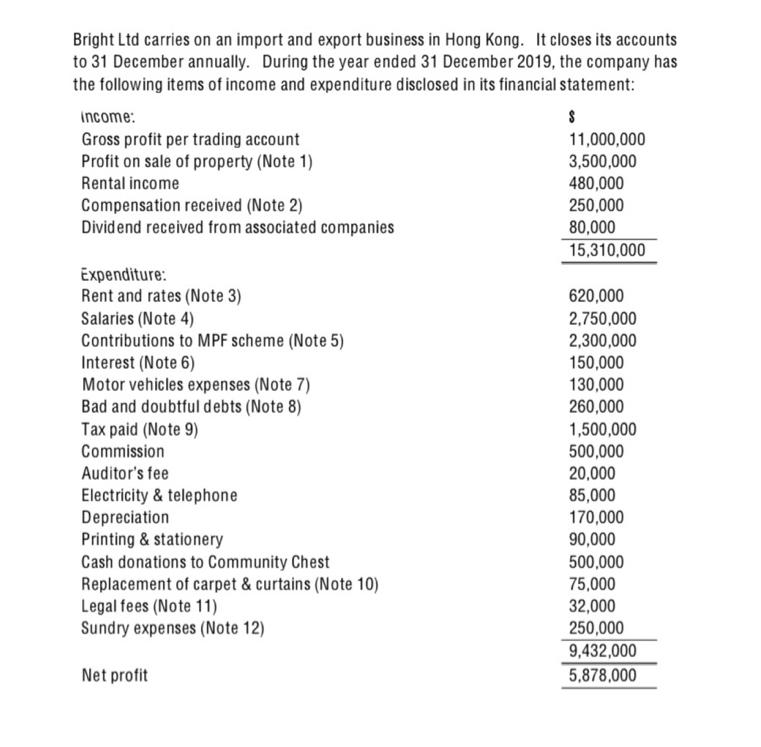

Bright Ltd carries on an import and export business in Hong Kong. It closes its accounts to 31 December annually. During the year ended

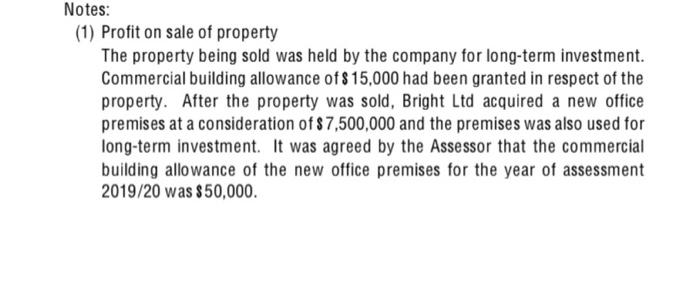

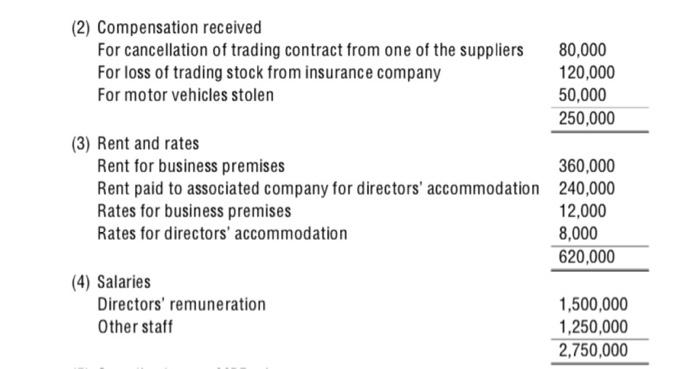

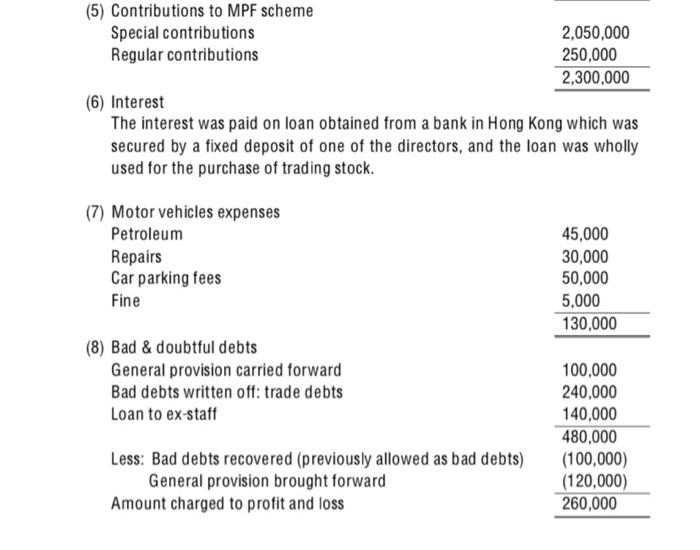

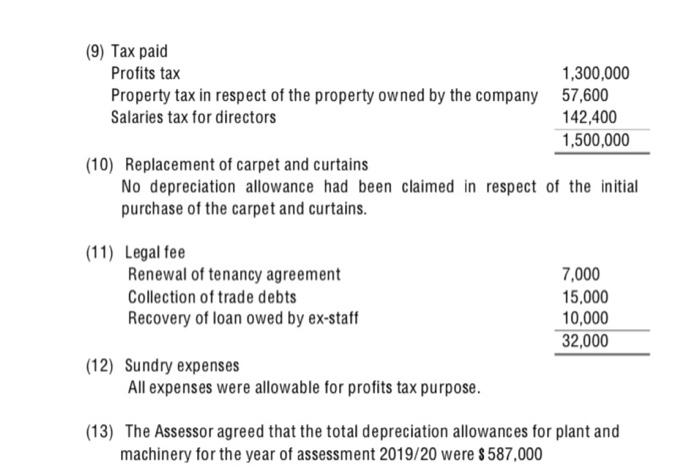

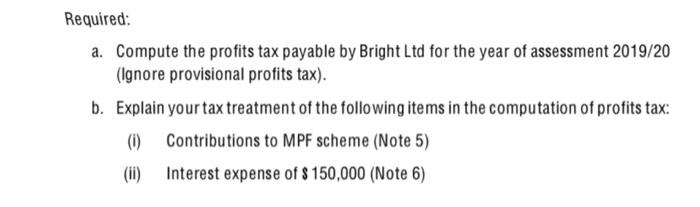

Bright Ltd carries on an import and export business in Hong Kong. It closes its accounts to 31 December annually. During the year ended 31 December 2019, the company has the following items of income and expenditure disclosed in its financial statement: income: Gross profit per trading account Profit on sale of property (Note 1) Rental income Compensation received (Note 2) Dividend received from associated companies Expenditure: Rent and rates (Note 3) Salaries (Note 4) Contributions to MPF scheme (Note 5) Interest (Note 6) Motor vehicles expenses (Note 7) Bad and doubtful debts (Note 8) Tax paid (Note 9) Commission Auditor's fee Electricity & telephone Depreciation Printing & stationery Cash donations to Community Chest Replacement of carpet & curtains (Note 10) Legal fees (Note 11) Sundry expenses (Note 12) Net profit S 11,000,000 3,500,000 480,000 250,000 80,000 15,310,000 620,000 2,750,000 2,300,000 150,000 130,000 260,000 1,500,000 500,000 20,000 85,000 170,000 90,000 500,000 75,000 32,000 250,000 9,432,000 5,878,000 Notes: (1) Profit on sale of property The property being sold was held by the company for long-term investment. Commercial building allowance of $15,000 had been granted in respect of the property. After the property was sold, Bright Ltd acquired a new office premises at a consideration of $7,500,000 and the premises was also used for long-term investment. It was agreed by the Assessor that the commercial building allowance of the new office premises for the year of assessment 2019/20 was $50,000. (2) Compensation received For cancellation of trading contract from one of the suppliers For loss of trading stock from insurance company For motor vehicles stolen (3) Rent and rates Rent for business premises 360,000 Rent paid to associated company for directors' accommodation 240,000 Rates for business premises 12,000 Rates for directors' accommodation 8,000 620,000 (4) Salaries 80,000 120,000 50,000 250,000 Directors' remuneration Other staff 1,500,000 1,250,000 2,750,000 (5) Contributions to MPF scheme Special contributions Regular contributions (6) Interest The interest was paid on loan obtained from a bank in Hong Kong which was secured by a fixed deposit of one of the directors, and the loan was wholly used for the purchase of trading stock. (7) Motor vehicles expenses Petroleum Repairs Car parking fees Fine (8) Bad & doubtful debts General provision carried forward Bad debts written off: trade debts Loan to ex-staff Less: Bad debts recovered (previously allowed as bad debts) General provision brought forward 2,050,000 250,000 2,300,000 Amount charged to profit and loss 45,000 30,000 50,000 5,000 130,000 100,000 240,000 140,000 480,000 (100,000) (120,000) 260,000 (9) Tax paid Profits tax 1,300,000 Property tax in respect of the property owned by the company 57,600 Salaries tax for directors 142,400 1,500,000 (10) Replacement of carpet and curtains No depreciation allowance had been claimed in respect of the initial purchase of the carpet and curtains. (11) Legal fee Renewal of tenancy agreement Collection of trade debts Recovery of loan owed by ex-staff (12) Sundry expenses All expenses were allowable for profits tax purpose. 7,000 15,000 10,000 32,000 (13) The Assessor agreed that the total depreciation allowances for plant and machinery for the year of assessment 2019/20 were $587,000 Required: a. Compute the profits tax payable by Bright Ltd for the year of assessment 2019/20 (Ignore provisional profits tax). b. Explain your tax treatment of the following items in the computation of profits tax: (i) Contributions to MPF scheme (Note 5) (ii) Interest expense of $ 150,000 (Note 6) Bright Ltd carries on an import and export business in Hong Kong. It closes its accounts to 31 December annually. During the year ended 31 December 2019, the company has the following items of income and expenditure disclosed in its financial statement: income: Gross profit per trading account Profit on sale of property (Note 1) Rental income Compensation received (Note 2) Dividend received from associated companies Expenditure: Rent and rates (Note 3) Salaries (Note 4) Contributions to MPF scheme (Note 5) Interest (Note 6) Motor vehicles expenses (Note 7) Bad and doubtful debts (Note 8) Tax paid (Note 9) Commission Auditor's fee Electricity & telephone Depreciation Printing & stationery Cash donations to Community Chest Replacement of carpet & curtains (Note 10) Legal fees (Note 11) Sundry expenses (Note 12) Net profit S 11,000,000 3,500,000 480,000 250,000 80,000 15,310,000 620,000 2,750,000 2,300,000 150,000 130,000 260,000 1,500,000 500,000 20,000 85,000 170,000 90,000 500,000 75,000 32,000 250,000 9,432,000 5,878,000 Notes: (1) Profit on sale of property The property being sold was held by the company for long-term investment. Commercial building allowance of $15,000 had been granted in respect of the property. After the property was sold, Bright Ltd acquired a new office premises at a consideration of $7,500,000 and the premises was also used for long-term investment. It was agreed by the Assessor that the commercial building allowance of the new office premises for the year of assessment 2019/20 was $50,000. (2) Compensation received For cancellation of trading contract from one of the suppliers For loss of trading stock from insurance company For motor vehicles stolen (3) Rent and rates Rent for business premises 360,000 Rent paid to associated company for directors' accommodation 240,000 Rates for business premises 12,000 Rates for directors' accommodation 8,000 620,000 (4) Salaries 80,000 120,000 50,000 250,000 Directors' remuneration Other staff 1,500,000 1,250,000 2,750,000 (5) Contributions to MPF scheme Special contributions Regular contributions (6) Interest The interest was paid on loan obtained from a bank in Hong Kong which was secured by a fixed deposit of one of the directors, and the loan was wholly used for the purchase of trading stock. (7) Motor vehicles expenses Petroleum Repairs Car parking fees Fine (8) Bad & doubtful debts General provision carried forward Bad debts written off: trade debts Loan to ex-staff Less: Bad debts recovered (previously allowed as bad debts) General provision brought forward 2,050,000 250,000 2,300,000 Amount charged to profit and loss 45,000 30,000 50,000 5,000 130,000 100,000 240,000 140,000 480,000 (100,000) (120,000) 260,000 (9) Tax paid Profits tax 1,300,000 Property tax in respect of the property owned by the company 57,600 Salaries tax for directors 142,400 1,500,000 (10) Replacement of carpet and curtains No depreciation allowance had been claimed in respect of the initial purchase of the carpet and curtains. (11) Legal fee Renewal of tenancy agreement Collection of trade debts Recovery of loan owed by ex-staff (12) Sundry expenses All expenses were allowable for profits tax purpose. 7,000 15,000 10,000 32,000 (13) The Assessor agreed that the total depreciation allowances for plant and machinery for the year of assessment 2019/20 were $587,000 Required: a. Compute the profits tax payable by Bright Ltd for the year of assessment 2019/20 (Ignore provisional profits tax). b. Explain your tax treatment of the following items in the computation of profits tax: (i) Contributions to MPF scheme (Note 5) (ii) Interest expense of $ 150,000 (Note 6)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Required Compute the profits tax payable by Bright Ltd for the year of assessment 201920 Ignore p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started