Answered step by step

Verified Expert Solution

Question

1 Approved Answer

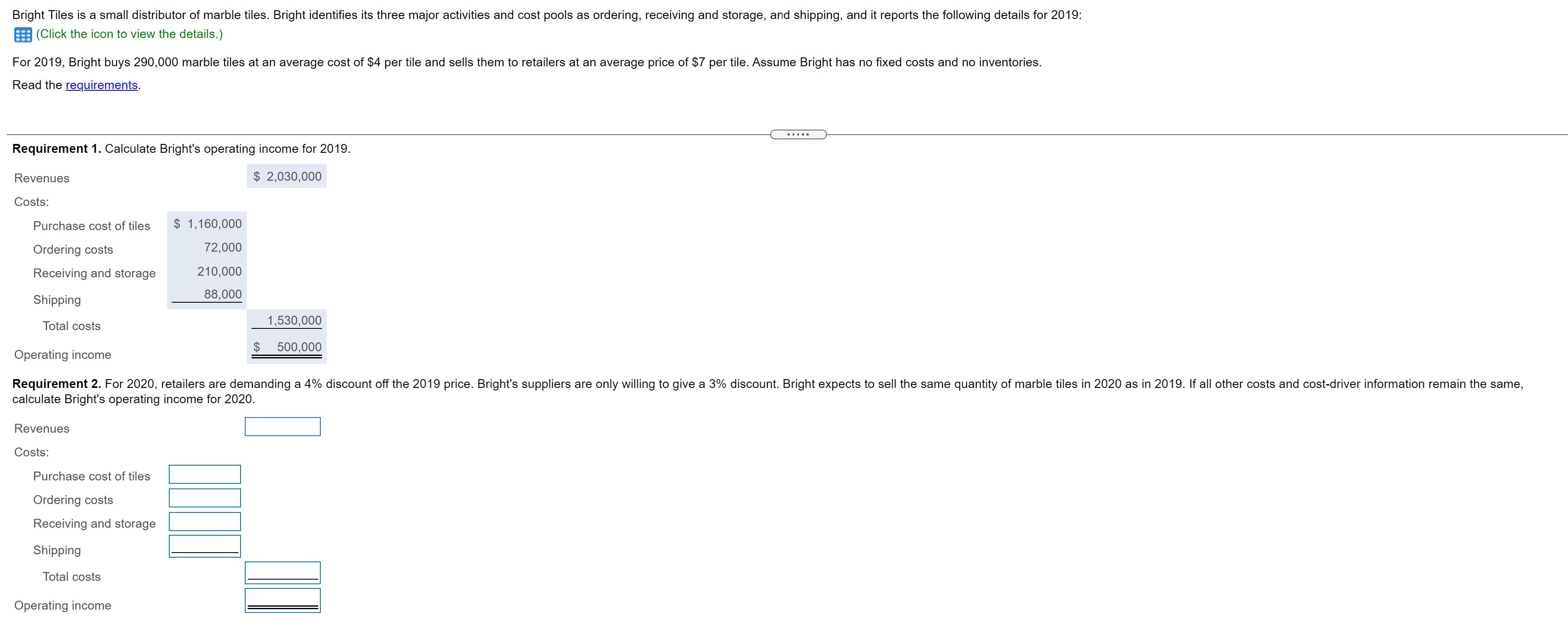

Bright Tiles is a small distributor of marble tiles. Bright identifies its three major activities and cost pools as ordering, receiving and storage, and

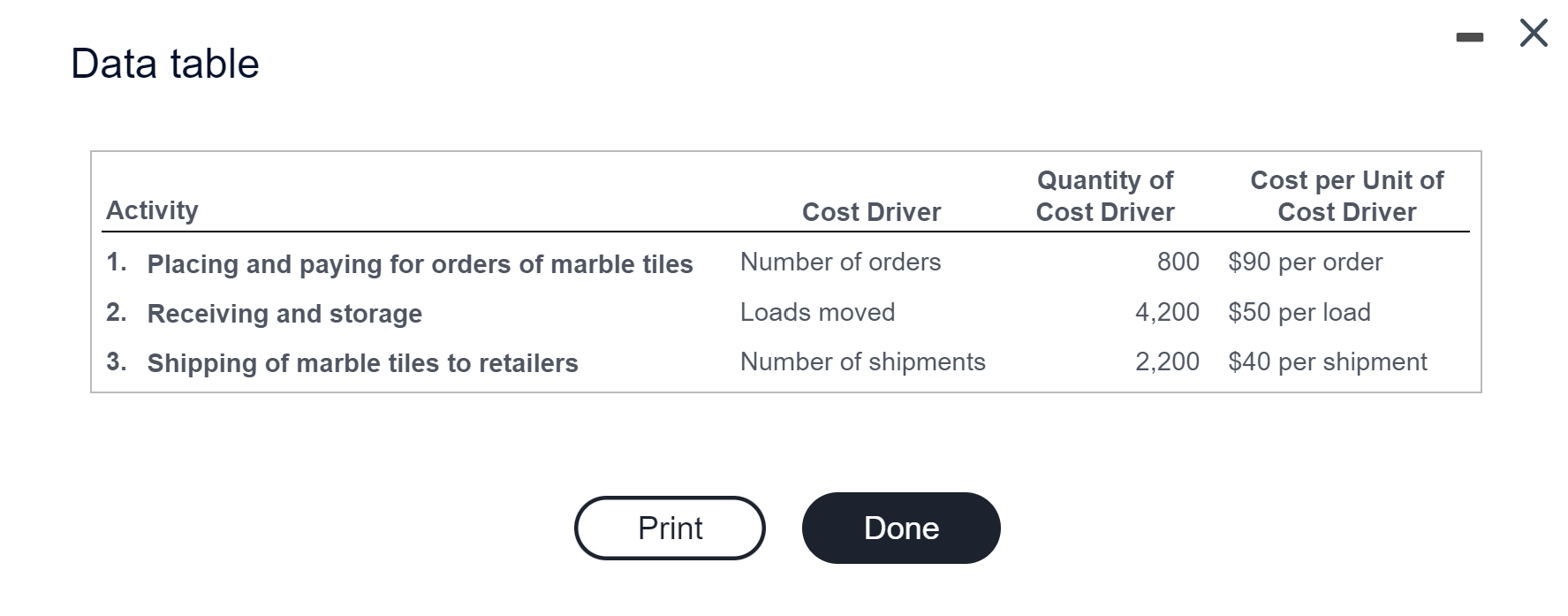

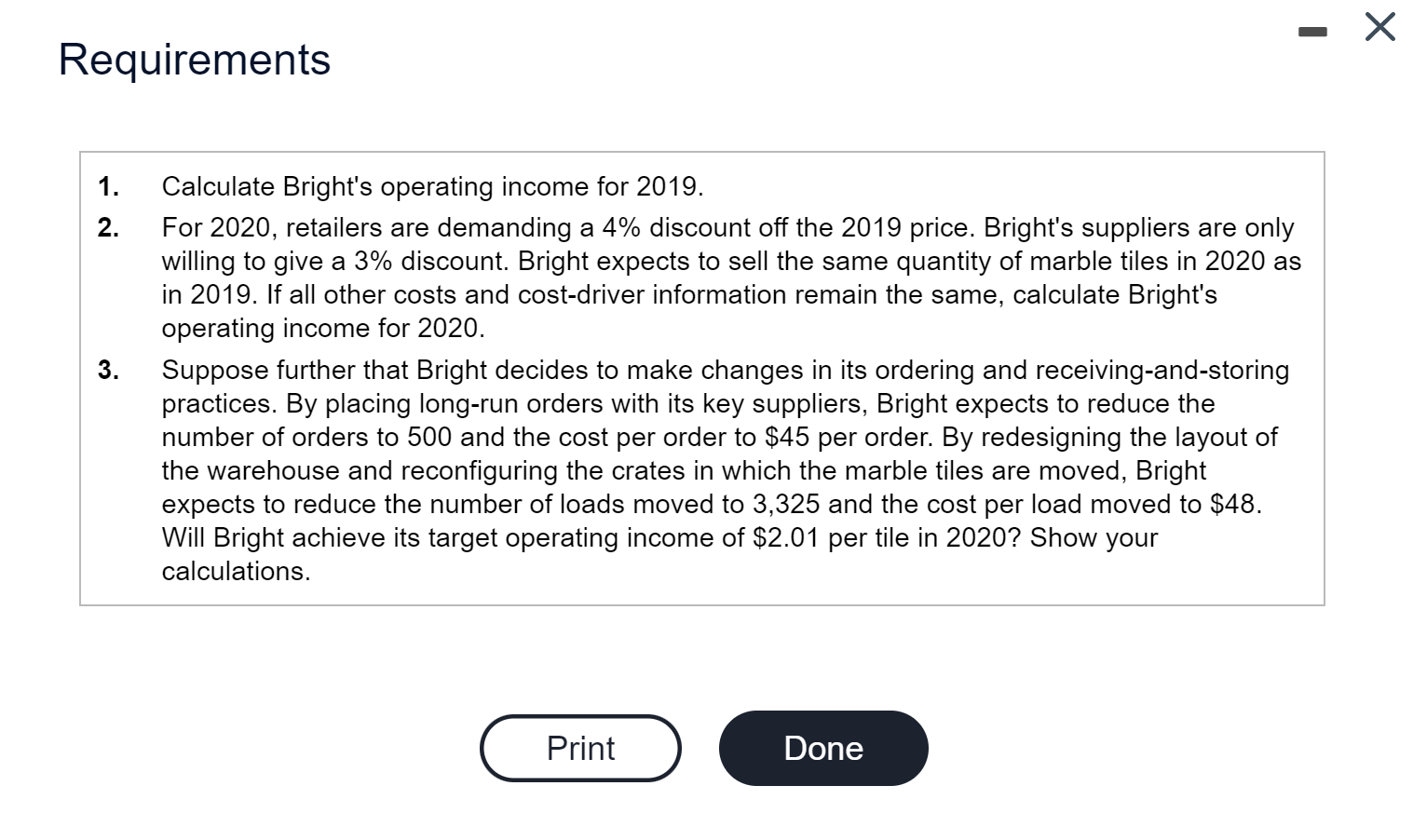

Bright Tiles is a small distributor of marble tiles. Bright identifies its three major activities and cost pools as ordering, receiving and storage, and shipping, and it reports the following details for 2019: (Click the icon to view the details.) For 2019, Bright buys 290,000 marble tiles at an average cost of $4 per tile and sells them to retailers at an average price of $7 per tile. Assume Bright has no fixed costs and no inventories. Read the requirements. Requirement 1. Calculate Bright's operating income for 2019. Revenues Costs: Purchase cost of tiles Ordering costs $ 1,160,000 Receiving and storage 72,000 210,000 88,000 Shipping Total costs $ 2,030,000 Operating income 1,530,000 500,000 Requirement 2. For 2020, retailers are demanding a 4% discount off the 2019 price. Bright's suppliers are only willing to give a 3% discount. Bright expects to sell the same quantity of marble tiles in 2020 as in 2019. If all other costs and cost-driver information remain the same, calculate Bright's operating income for 2020. Revenues Costs: Purchase cost of tiles Ordering costs Receiving and storage Shipping Total costs Operating income Data table Activity 1. Placing and paying for orders of marble tiles 2. Receiving and storage 3. Shipping of marble tiles to retailers Cost Driver Quantity of Cost Driver Cost per Unit of Cost Driver Number of orders 800 $90 per order Loads moved 4,200 $50 per load Number of shipments 2,200 $40 per shipment Print Done Requirements 1. Calculate Bright's operating income for 2019. 2. 3. For 2020, retailers are demanding a 4% discount off the 2019 price. Bright's suppliers are only willing to give a 3% discount. Bright expects to sell the same quantity of marble tiles in 2020 as in 2019. If all other costs and cost-driver information remain the same, calculate Bright's operating income for 2020. Suppose further that Bright decides to make changes in its ordering and receiving-and-storing practices. By placing long-run orders with its key suppliers, Bright expects to reduce the number of orders to 500 and the cost per order to $45 per order. By redesigning the layout of the warehouse and reconfiguring the crates in which the marble tiles are moved, Bright expects to reduce the number of loads moved to 3,325 and the cost per load moved to $48. Will Bright achieve its target operating income of $2.01 per tile in 2020? Show your calculations. Print Done - X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 Revenues Quantity sold x Price per unit 290000 tiles x 7 per tile 2030000 Costs Purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started