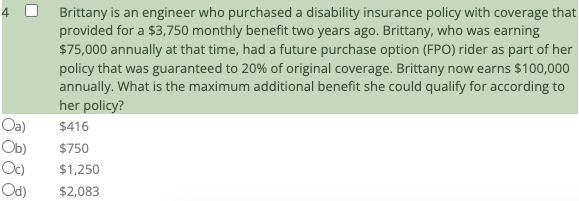

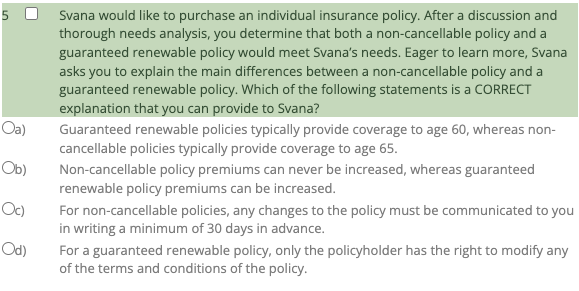

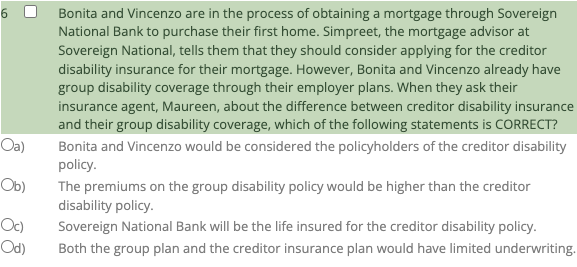

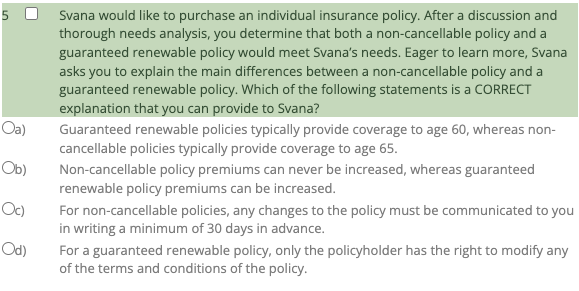

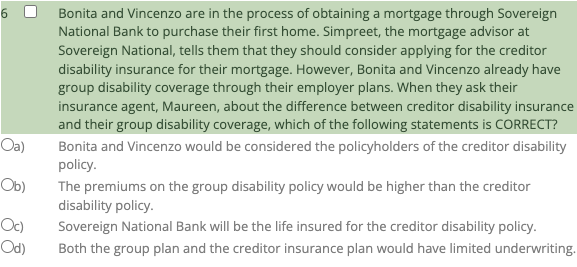

Brittany is an engineer who purchased a disability insurance policy with coverage that provided for a $3,750 monthly benefit two years ago. Brittany, who was earning $75,000 annually at that time, had a future purchase option (FPO) rider as part of her policy that was guaranteed to 20% of original coverage. Brittany now earns $100,000 annually. What is the maximum additional benefit she could qualify for according to her policy? $416 $750 $1,250 $2,083 Oa) Ob) Oc) Od) 5 Oa) Svana would like to purchase an individual insurance policy. After a discussion and thorough needs analysis, you determine that both a non-cancellable policy and a guaranteed renewable policy would meet Svana's needs. Eager to learn more, Svana asks you to explain the main differences between a non-cancellable policy and a guaranteed renewable policy. Which of the following statements is a CORRECT explanation that you can provide to Svana? Guaranteed renewable policies typically provide coverage to age 60, whereas non- cancellable policies typically provide coverage to age 65. Non-cancellable policy premiums can never be increased, whereas guaranteed renewable policy premiums can be increased. For non-cancellable policies, any changes to the policy must be communicated to you in writing a minimum of 30 days in advance. For a guaranteed renewable policy, only the policyholder has the right to modify any of the terms and conditions of the policy. Ob) Oc) Od) Bonita and Vincenzo are in the process of obtaining a mortgage through Sovereign National Bank to purchase their first home. Simpreet, the mortgage advisor at Sovereign National, tells them that they should consider applying for the creditor disability insurance for their mortgage. However, Bonita and Vincenzo already have group disability coverage through their employer plans. When they ask their insurance agent, Maureen, about the difference between creditor disability insurance and their group disability coverage, which of the following statements is CORRECT? Bonita and Vincenzo would be considered the policyholders of the creditor disability policy The premiums on the group disability policy would be higher than the creditor disability policy Sovereign National Bank will be the life insured for the creditor disability policy. Both the group plan and the creditor insurance plan would have limited underwriting. Oa) Ob) Oc) Od)