Answered step by step

Verified Expert Solution

Question

1 Approved Answer

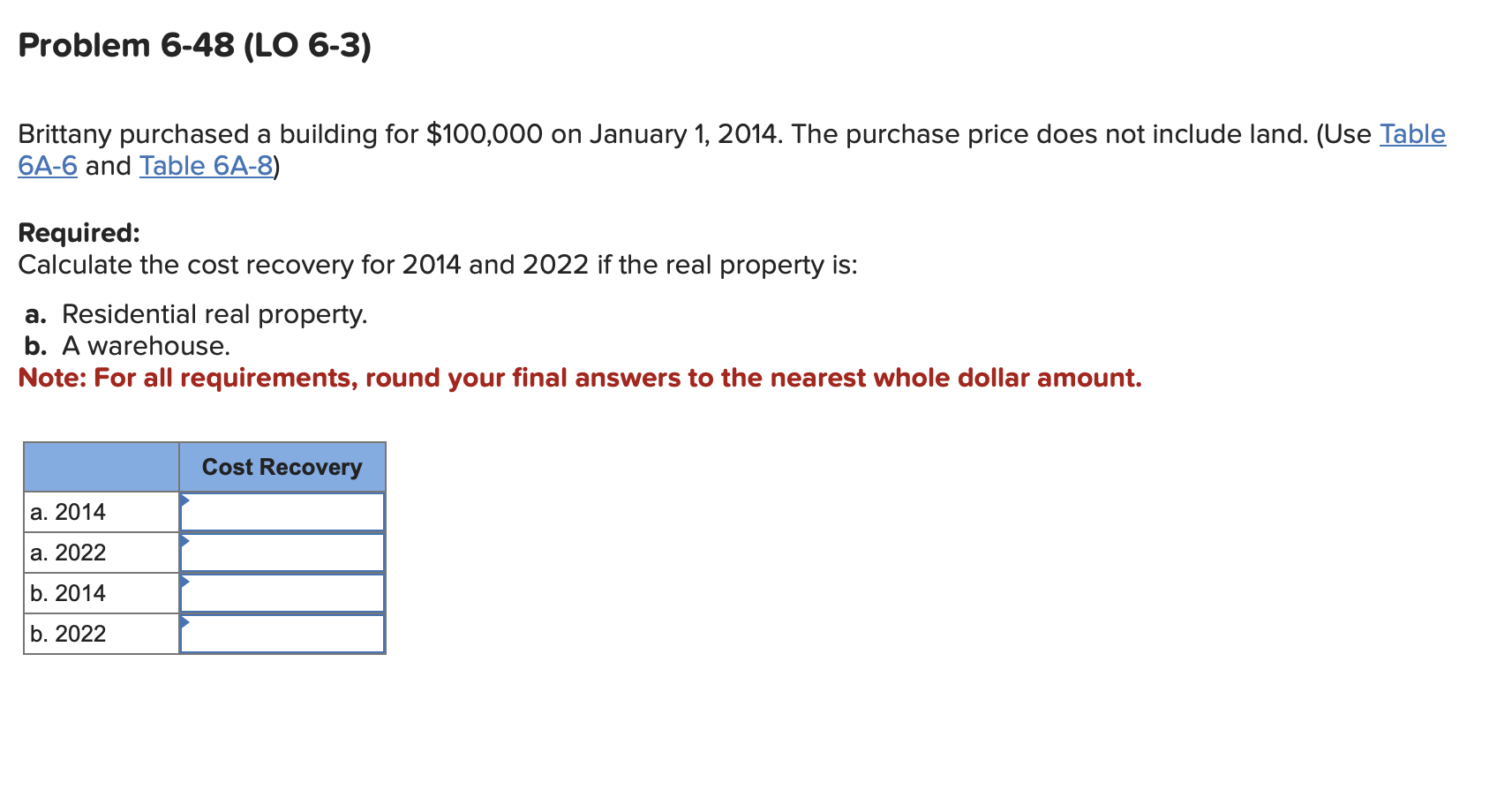

Brittany purchased a building for $100,000 on January 1,2014 . The purchase price does not include land. (Use Table 6A6 and Table 6A-8) Required: Calculate

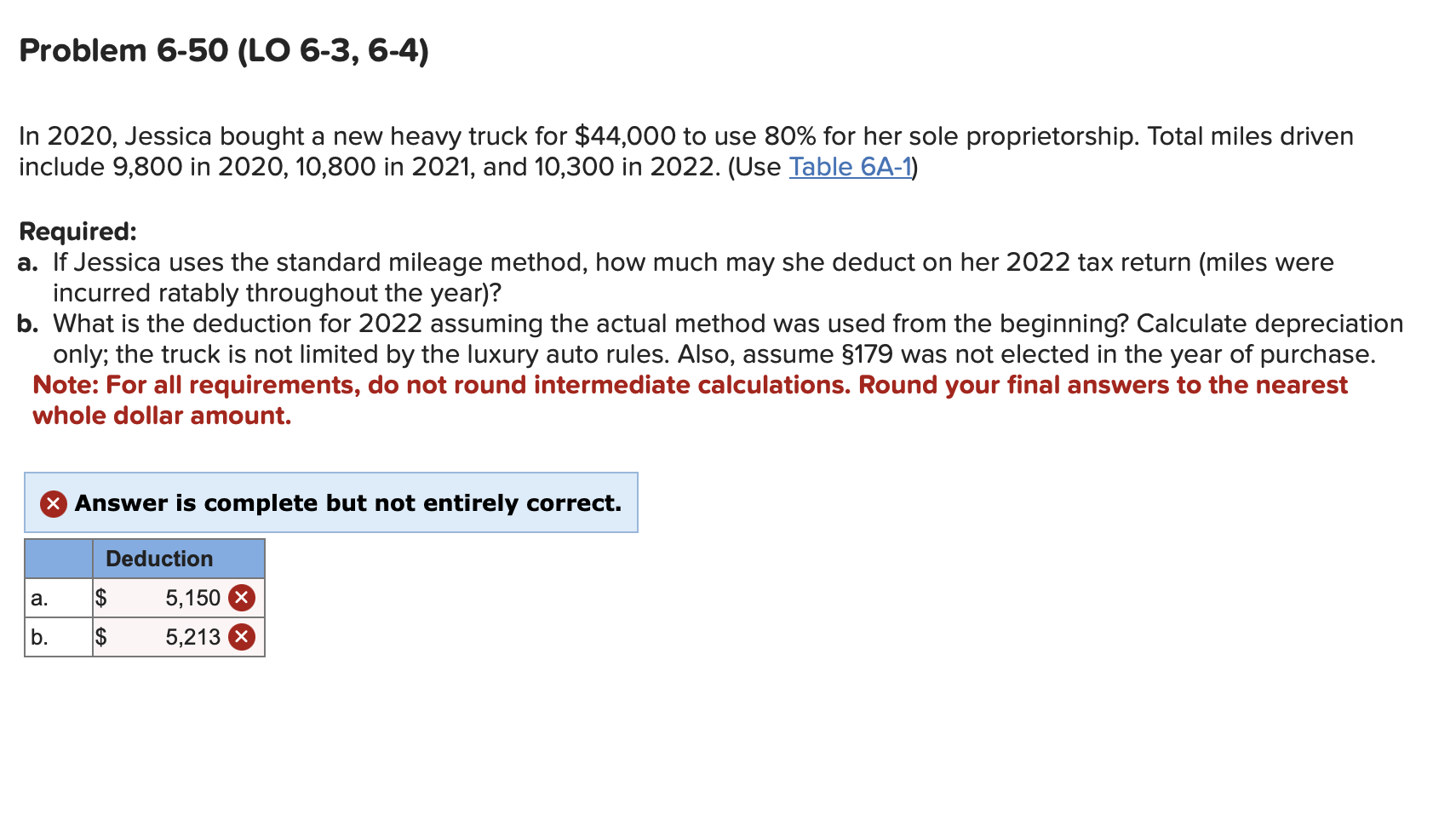

Brittany purchased a building for $100,000 on January 1,2014 . The purchase price does not include land. (Use Table 6A6 and Table 6A-8) Required: Calculate the cost recovery for 2014 and 2022 if the real property is: a. Residential real property. b. A warehouse. Note: For all requirements, round your final answers to the nearest whole dollar amount. In 2020 , Jessica bought a new heavy truck for $44,000 to use 80% for her sole proprietorship. Total miles driven include 9,800 in 2020,10,800 in 2021 , and 10,300 in 2022. (Use Table 6A-1) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2022 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2022 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume $179 was not elected in the year of purchase. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct

Brittany purchased a building for $100,000 on January 1,2014 . The purchase price does not include land. (Use Table 6A6 and Table 6A-8) Required: Calculate the cost recovery for 2014 and 2022 if the real property is: a. Residential real property. b. A warehouse. Note: For all requirements, round your final answers to the nearest whole dollar amount. In 2020 , Jessica bought a new heavy truck for $44,000 to use 80% for her sole proprietorship. Total miles driven include 9,800 in 2020,10,800 in 2021 , and 10,300 in 2022. (Use Table 6A-1) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2022 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2022 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume $179 was not elected in the year of purchase. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started