Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brittany purchased a building for ( $ 180,000 ) on January 1,2013 . The purchase price does not include land. (Use Table ( 6 mathrm{~A}-6

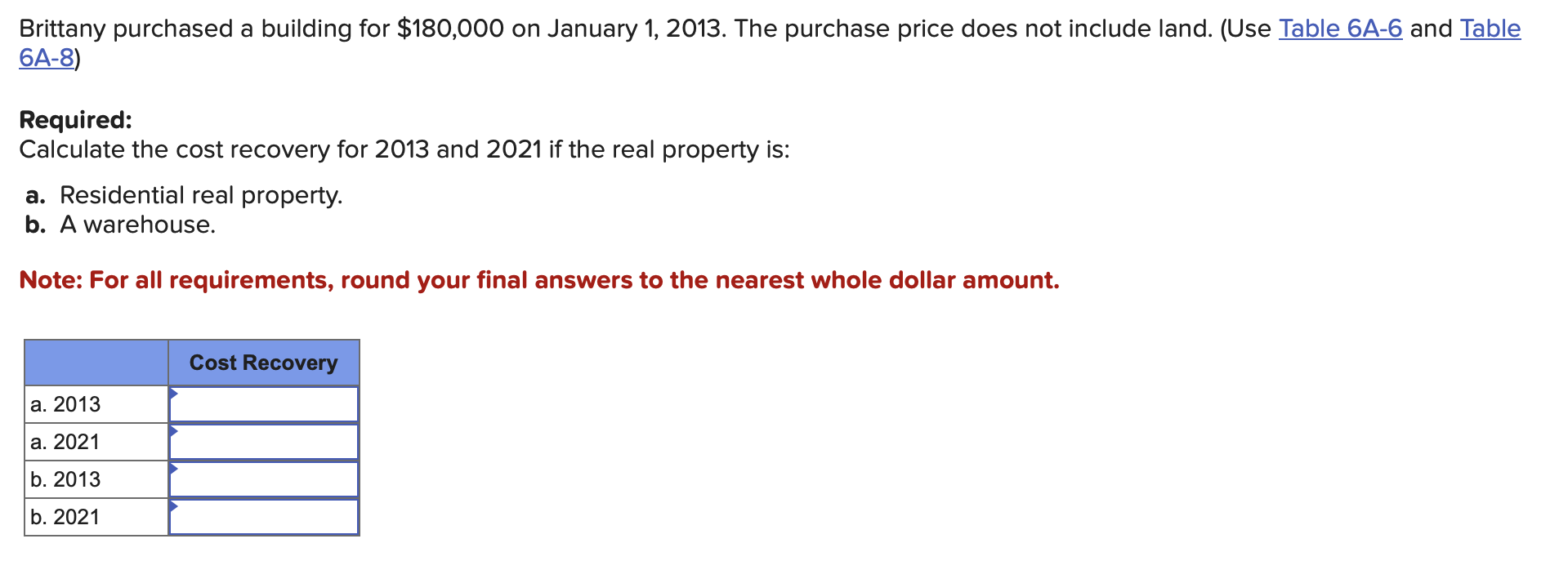

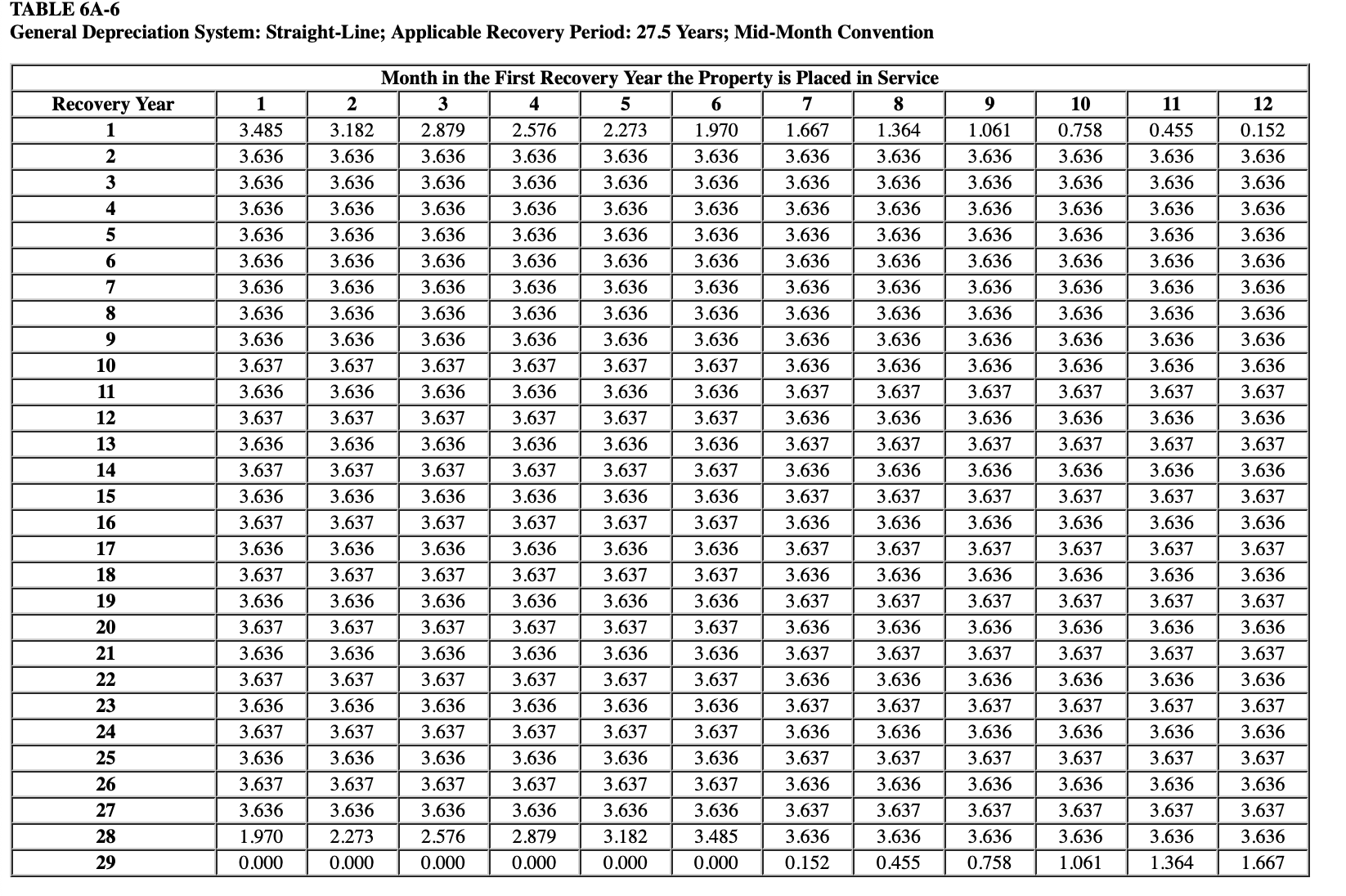

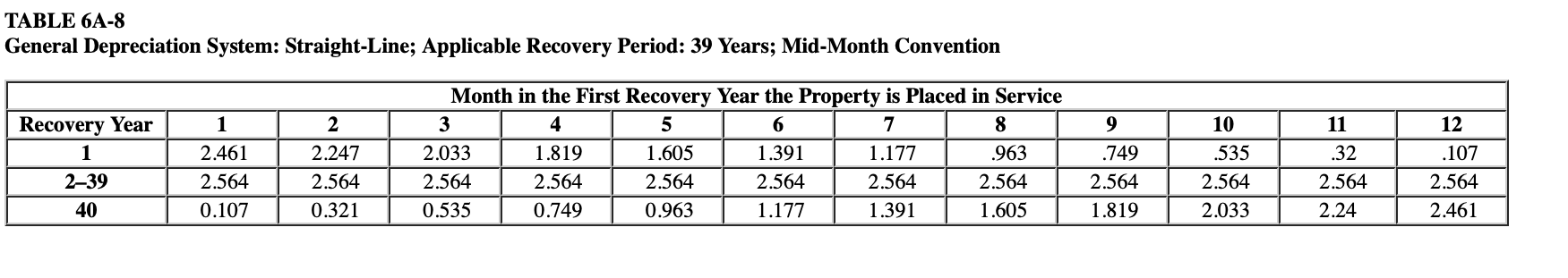

Brittany purchased a building for \\( \\$ 180,000 \\) on January 1,2013 . The purchase price does not include land. (Use Table \\( 6 \\mathrm{~A}-6 \\) and Table \\( \\underline{6 A-8)} \\) Required: Calculate the cost recovery for 2013 and 2021 if the real property is: a. Residential real property. b. A warehouse. Note: For all requirements, round your final answers to the nearest whole dollar amount. General Depreciation System: Straight-Line; Applicable Recovery Period: 27.5 Years; Mid-Month Convention TABLE 6A-8 General Depreciation System: Straight-Line; Applicable Recovery Period: 39 Years; Mid-Month Convention

Brittany purchased a building for \\( \\$ 180,000 \\) on January 1,2013 . The purchase price does not include land. (Use Table \\( 6 \\mathrm{~A}-6 \\) and Table \\( \\underline{6 A-8)} \\) Required: Calculate the cost recovery for 2013 and 2021 if the real property is: a. Residential real property. b. A warehouse. Note: For all requirements, round your final answers to the nearest whole dollar amount. General Depreciation System: Straight-Line; Applicable Recovery Period: 27.5 Years; Mid-Month Convention TABLE 6A-8 General Depreciation System: Straight-Line; Applicable Recovery Period: 39 Years; Mid-Month Convention Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started