Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bro please help me.. i dont have much time,please help me as soon as possible if you can. may The Almighty bless you. A. Mr

bro please help me.. i dont have much time,please help me as soon as possible if you can. may The Almighty bless you.

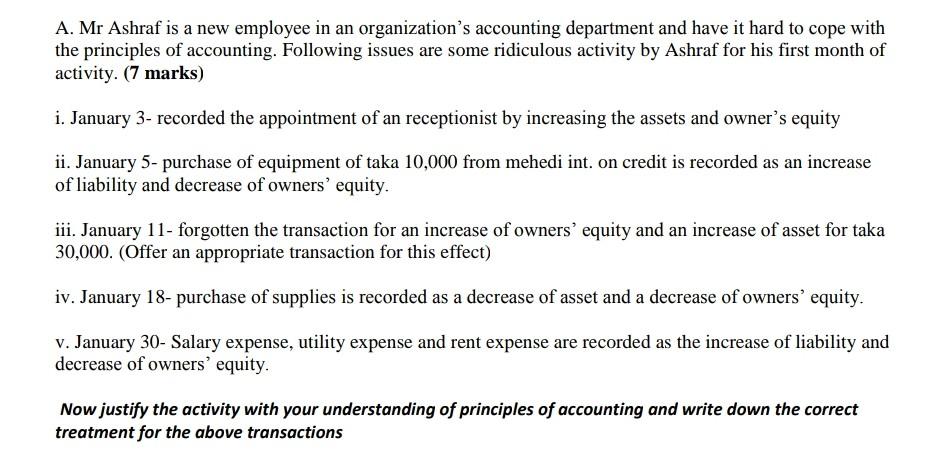

A. Mr Ashraf is a new employee in an organization's accounting department and have it hard to cope with the principles of accounting. Following issues are some ridiculous activity by Ashraf for his first month of activity. (7 marks) i. January 3- recorded the appointment of an receptionist by increasing the assets and owner's equity ii. January 5- purchase of equipment of taka 10,000 from mehedi int. on credit is recorded as an increase of liability and decrease of owners' equity. iii. January 11- forgotten the transaction for an increase of owners' equity and an increase of asset for taka 30,000. (Offer an appropriate transaction for this effect) iv. January 18- purchase of supplies is recorded as a decrease of asset and a decrease of owners' equity. v. January 30- Salary expense, utility expense and rent expense are recorded as the increase of liability and decrease of owners' equity. Now justify the activity with your understanding of principles of accounting and write down the correct treatment for the above transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started