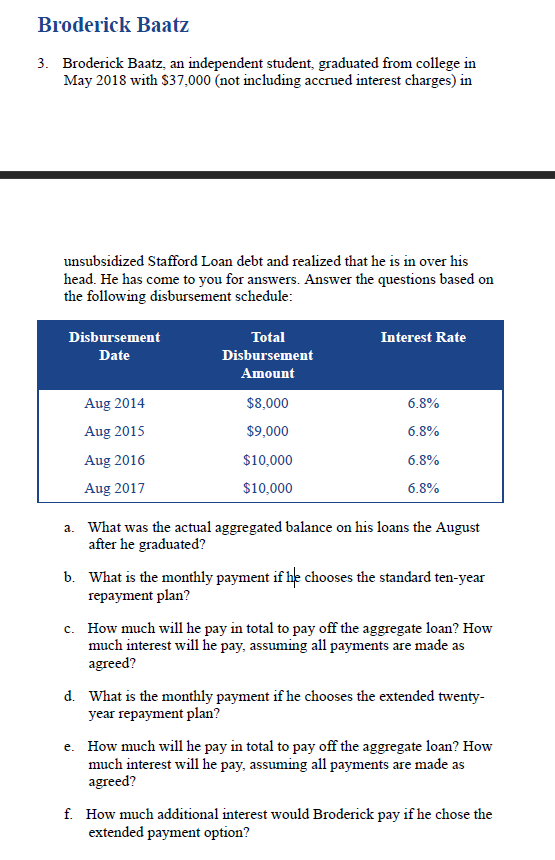

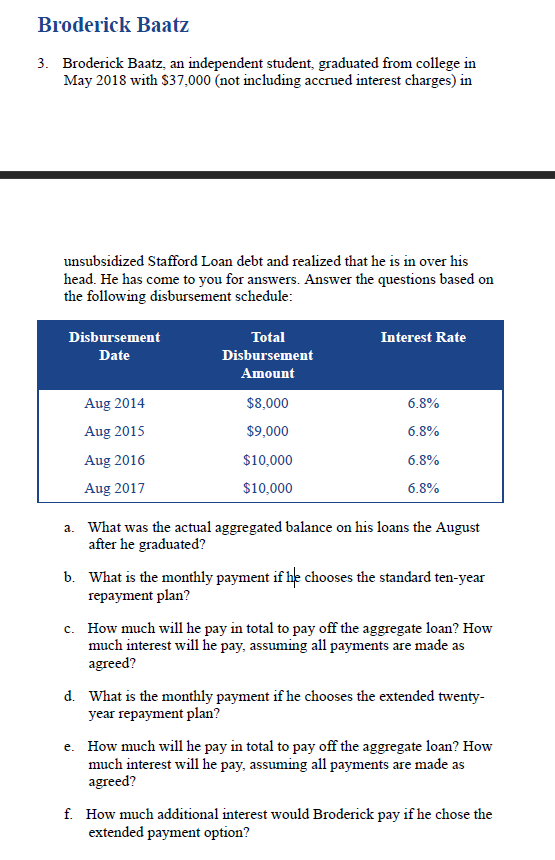

Broderick Baatz 3. Broderick Baatz, an independent student, graduated from college in May 2018 with $37,000 (not including accrued interest charges) in unsubsidized Stafford Loan debt and realized that he is in over his head. He has come to you for answers. Answer the questions based on the following disbursement schedule: Disbursement Date Interest Rate Total Disbursement Amount $8,000 6.8% $9,000 6.8% Aug 2014 Aug 2015 Aug 2016 Aug 2017 6.8% $10,000 $10,000 6.8% a. What was the actual aggregated balance on his loans the August after he graduated? b. What is the monthly payment if he chooses the standard ten-year repayment plan? C. How much will he pay in total to pay off the aggregate loan? How much interest will he pay, assuming all payments are made as agreed? d. What is the monthly payment if he chooses the extended twenty- year repayment plan? e. How much will he pay in total to pay off the aggregate loan? How much interest will he pay, assuming all payments are made as agreed? f. How much additional interest would Broderick pay if he chose the extended payment option? Broderick Baatz 3. Broderick Baatz, an independent student, graduated from college in May 2018 with $37,000 (not including accrued interest charges) in unsubsidized Stafford Loan debt and realized that he is in over his head. He has come to you for answers. Answer the questions based on the following disbursement schedule: Disbursement Date Interest Rate Total Disbursement Amount $8,000 6.8% $9,000 6.8% Aug 2014 Aug 2015 Aug 2016 Aug 2017 6.8% $10,000 $10,000 6.8% a. What was the actual aggregated balance on his loans the August after he graduated? b. What is the monthly payment if he chooses the standard ten-year repayment plan? C. How much will he pay in total to pay off the aggregate loan? How much interest will he pay, assuming all payments are made as agreed? d. What is the monthly payment if he chooses the extended twenty- year repayment plan? e. How much will he pay in total to pay off the aggregate loan? How much interest will he pay, assuming all payments are made as agreed? f. How much additional interest would Broderick pay if he chose the extended payment option