Answered step by step

Verified Expert Solution

Question

1 Approved Answer

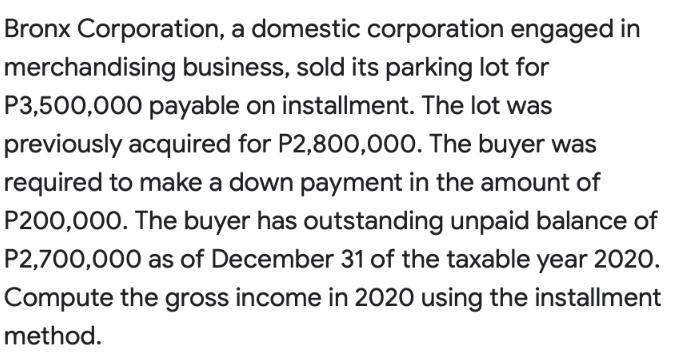

Bronx Corporation, a domestic corporation engaged in merchandising business, sold its parking lot for P3,500,000 payable on installment. The lot was previously acquired for

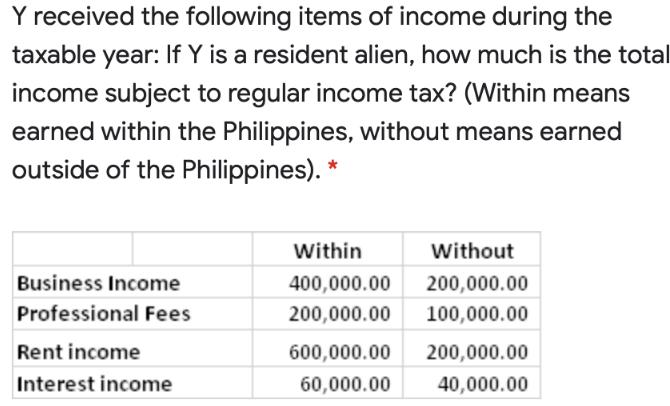

Bronx Corporation, a domestic corporation engaged in merchandising business, sold its parking lot for P3,500,000 payable on installment. The lot was previously acquired for P2,800,000. The buyer was required to make a down payment in the amount of P200,000. The buyer has outstanding unpaid balance of P2,700,000 as of December 31 of the taxable year 2020. Compute the gross income in 2020 using the installment method. Y received the following items of income during the taxable year: If Y is a resident alien, how much is the total income subject to regular income tax? (Within means earned within the Philippines, without means earned outside of the Philippines). * Business Income Professional Fees Rent income Interest income Within 400,000.00 200,000.00 Without 200,000.00 100,000.00 600,000.00 200,000.00 60,000.00 40,000.00

Step by Step Solution

★★★★★

3.53 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Compute the gross income in 2020 using the installment method for the sale of the parking lot Cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started