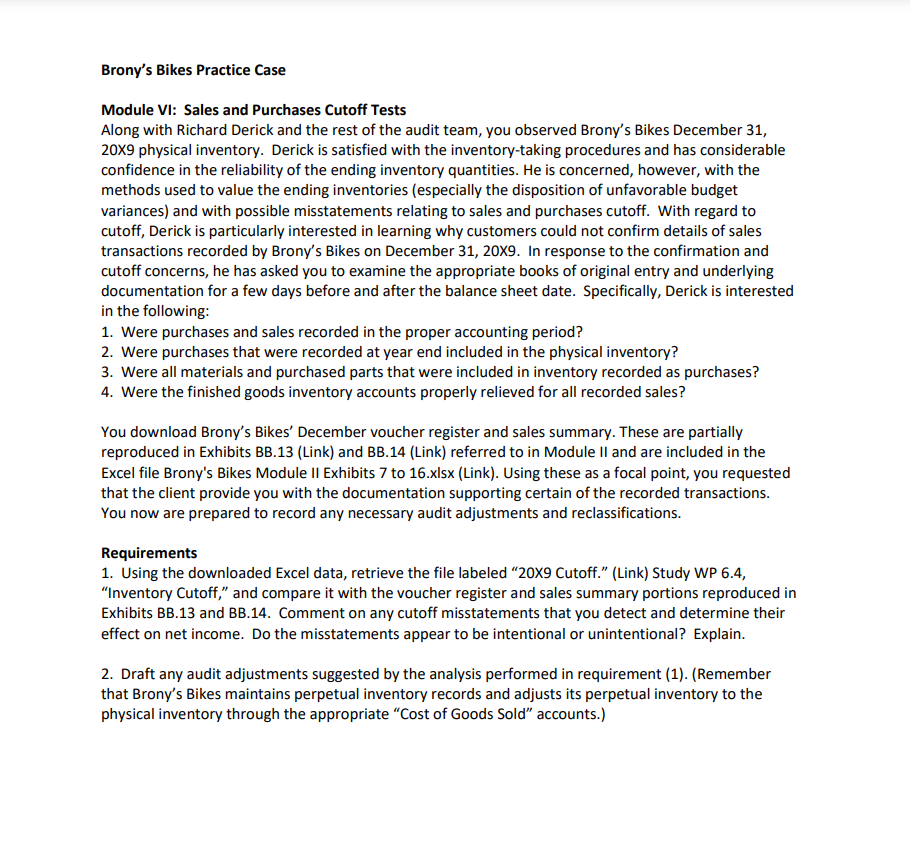

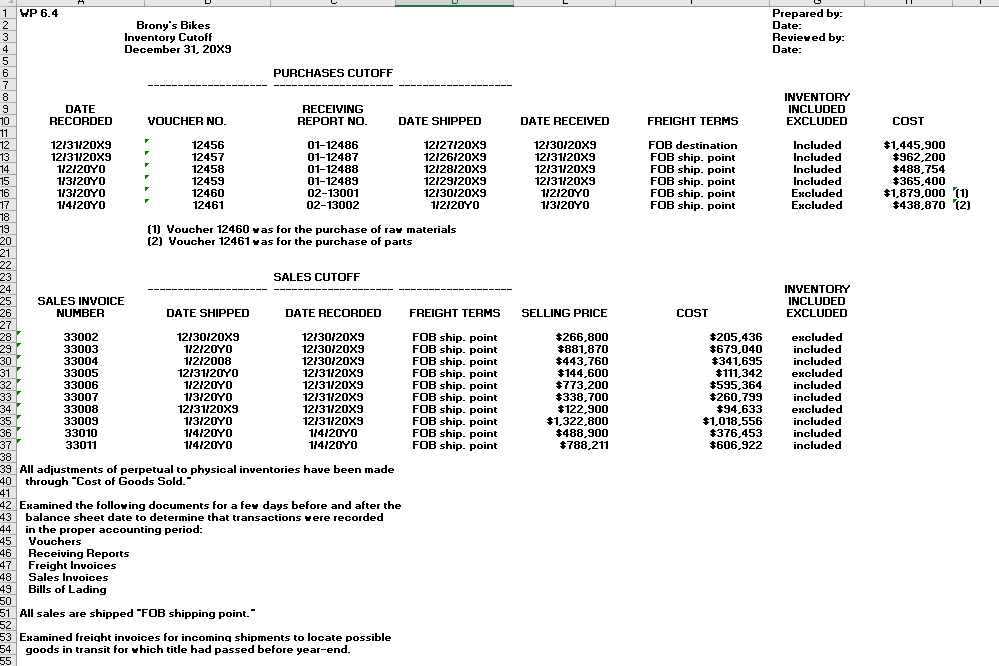

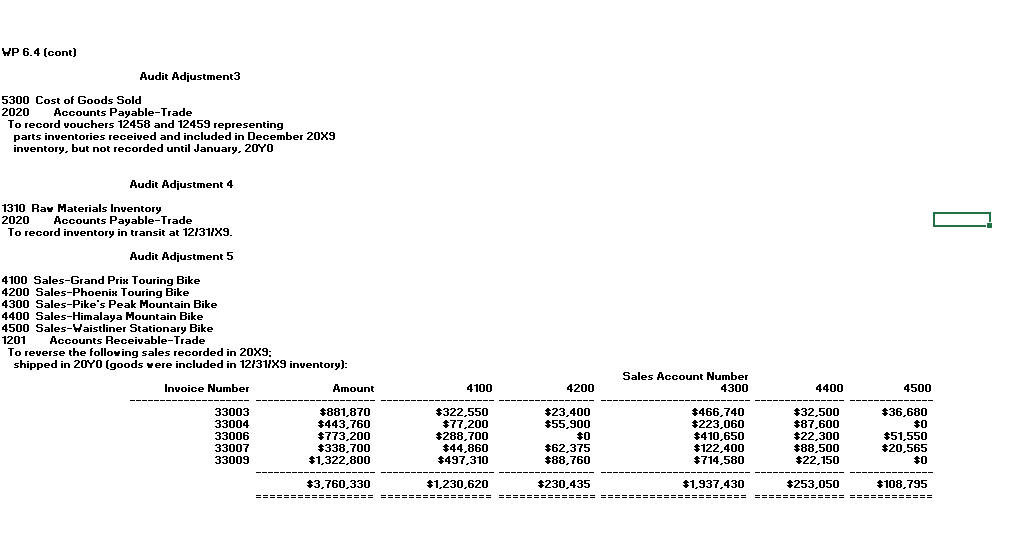

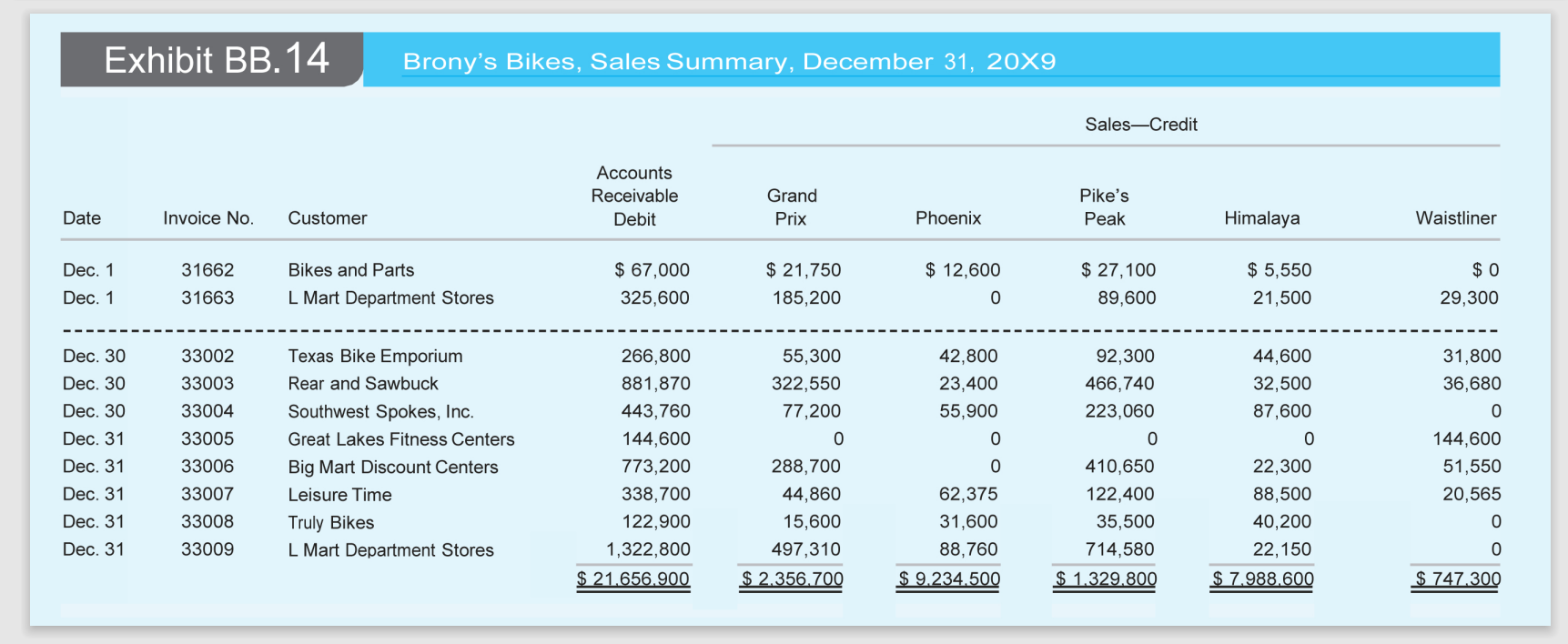

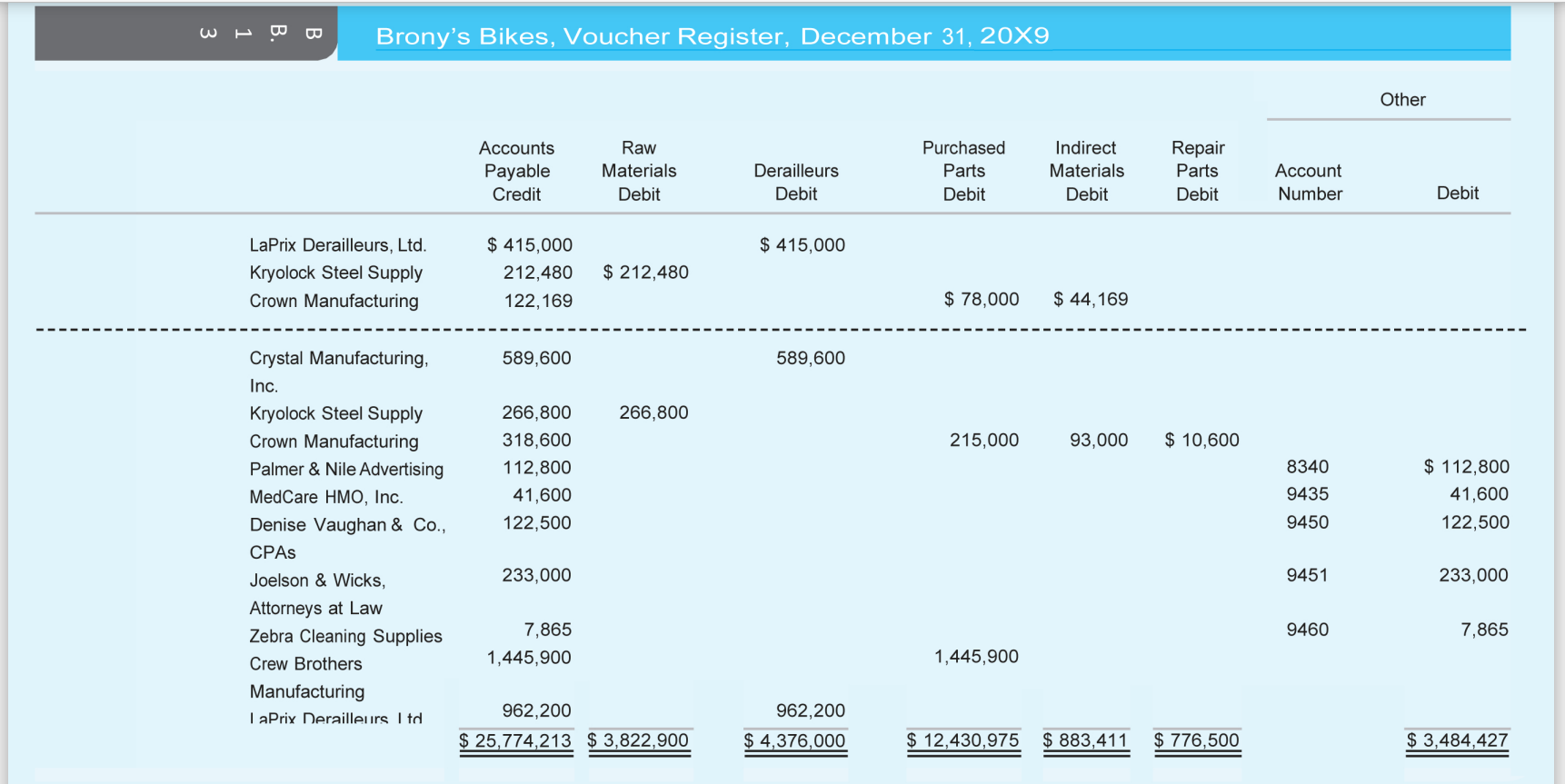

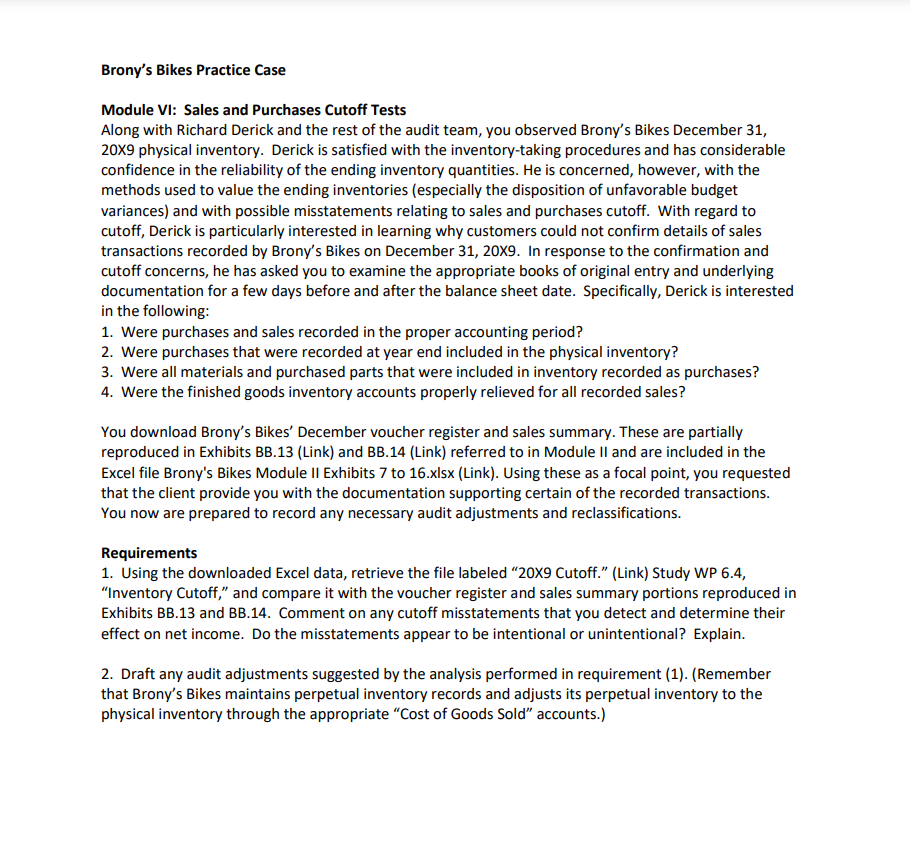

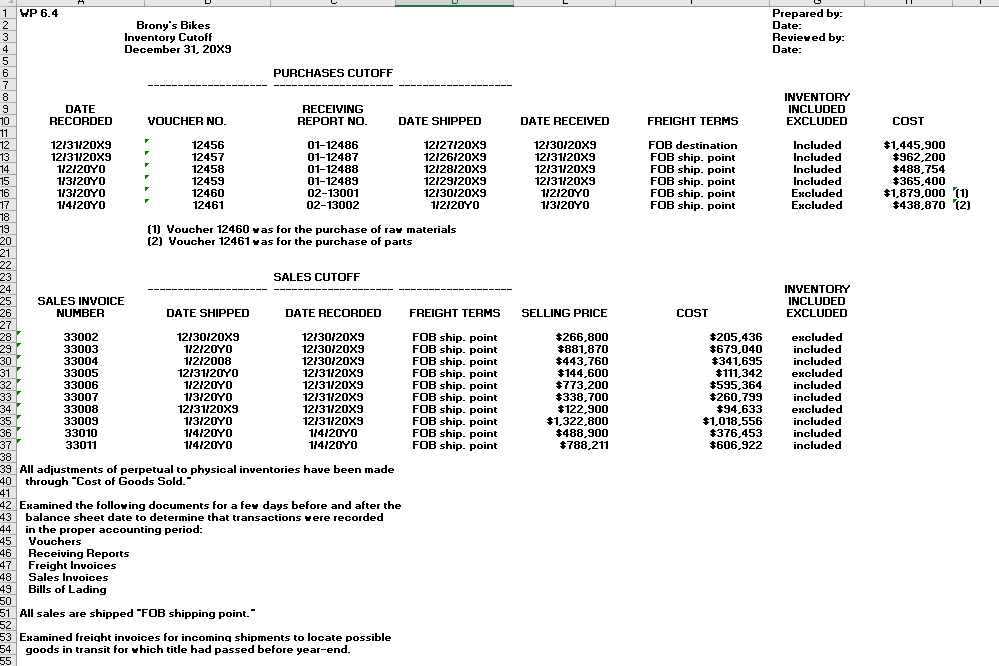

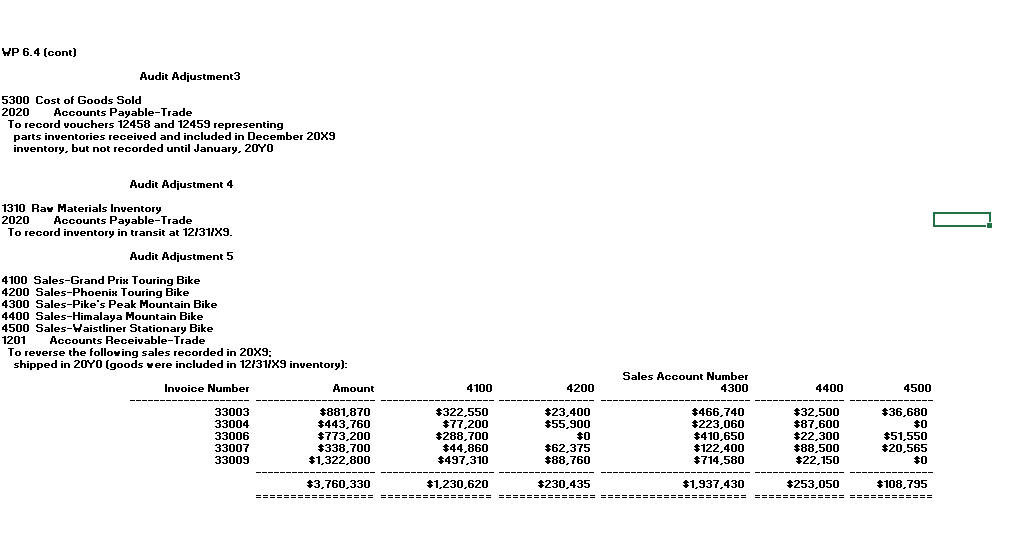

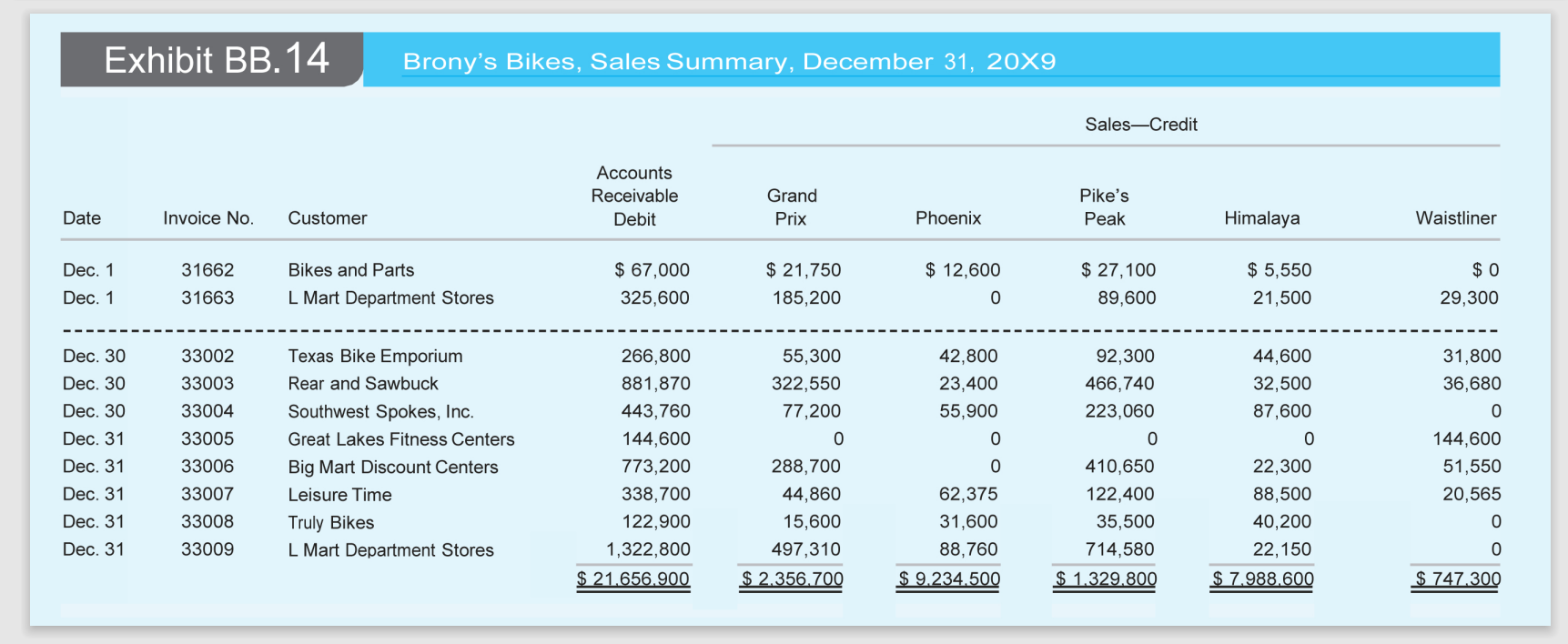

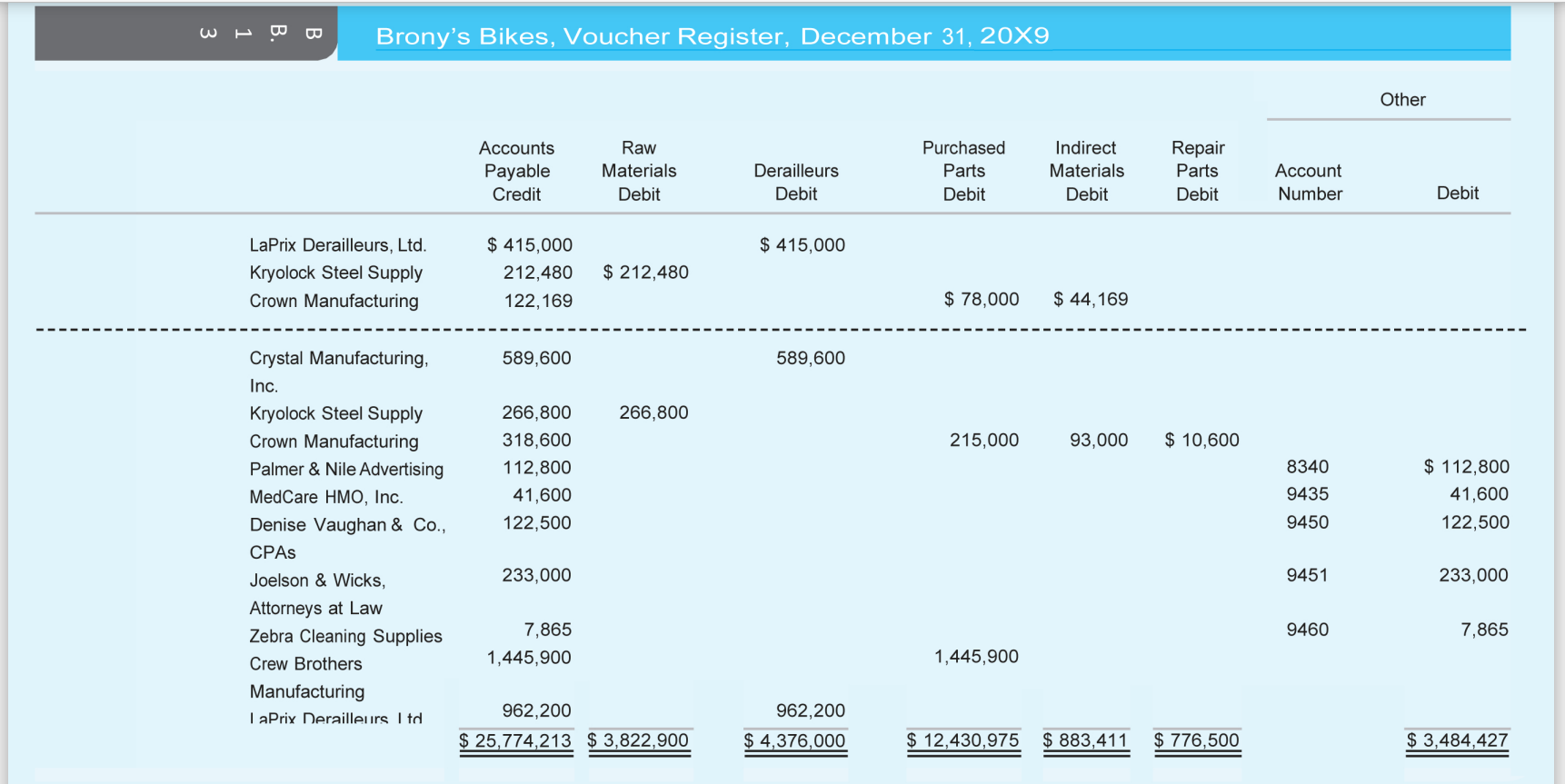

Brony's Bikes Practice Case Module VI: Sales and Purchases Cutoff Tests Along with Richard Derick and the rest of the audit team, you observed Brony's Bikes December 31, 20x9 physical inventory. Derick is satisfied with the inventory-taking procedures and has considerable confidence in the reliability of the ending inventory quantities. He is concerned, however, with the methods used to value the ending inventories (especially the disposition of unfavorable budget variances) and with possible misstatements relating to sales and purchases cutoff. With regard to cutoff, Derick is particularly interested in learning why customers could not confirm details of sales transactions recorded by Brony's Bikes on December 31, 20X9. In response to the confirmation and cutoff concerns, he has asked you to examine the appropriate books of original entry and underlying documentation for a few days before and after the balance sheet date. Specifically, Derick is interested in the following: 1. Were purchases and sales recorded in the proper accounting period? 2. Were purchases that were recorded at year end included in the physical inventory? 3. Were all materials and purchased parts that were included in inventory recorded as purchases? 4. Were the finished goods inventory accounts properly relieved for all recorded sales? You download Brony's Bikes' December voucher register and sales summary. These are partially reproduced in Exhibits BB.13 (Link) and BB.14 (Link) referred to in Module Il and are included in the Excel file Brony's Bikes Module Il Exhibits 7 to 16.xlsx (Link). Using these as a focal point, you requested that the client provide you with the documentation supporting certain of the recorded transactions. You now are prepared to record any necessary audit adjustments and reclassifications. Requirements 1. Using the downloaded Excel data, retrieve the file labeled 20x9 Cutoff." (Link) Study WP 6.4, "Inventory Cutoff," and compare it with the voucher register and sales summary portions reproduced in Exhibits BB.13 and BB.14. Comment on any cutoff misstatements that you detect and determine their effect on net income. Do the misstatements appear to be intentional or unintentional? Explain. 2. Draft any audit adjustments suggested by the analysis performed in requirement (1). (Remember that Brony's Bikes maintains perpetual inventory records and adjusts its perpetual inventory to the physical inventory through the appropriate "Cost of Goods Sold" accounts.) Prepared by: Date: Revieved by: Date: INVENTORY INCLUDED EXCLUDED DATE RECEIVED FREIGHT TERMS COST 12/30/20X9 12/31/20x9 12/31/20X9 12/31/20x9 1/2/2010 1/3/20YO FOB destination FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point Included Included Included Included Excluded Excluded $1,445,900 $962,200 $488,754 $365,400 $1,879,000 (0) $438,870 (2) INVENTORY INCLUDED EXCLUDED SELLING PRICE COST 1 WP 6.4 2 Brony's Bikes 3 Inventory Cutoff 4 December 31, 20X9 5 6 PURCHASES CUTOFF 7 8 9 DATE RECEIVING 10 RECORDED VOUCHER NO. REPORT NO. DATE SHIPPED 11 12 12/31/20X9 12456 01-12486 12127120X9 13 12/31/20X9 12457 01-12487 12/26/20x9 14 1/2/2010 12458 01-12488 12/28/20X9 15 1/3/20YO 12459 01-12489 12/29/20X9 16 1/3/20YO 12460 02-13001 12/30/20x9 17 1/4/2010 12461 02-13002 1/2/2010 18 19 (1) Voucher 12460 was for the purchase of raw materials 20 (2) Voucher 12461 was for the purchase of parts 21 22 23 SALES CUTOFF 24 25 SALES INVOICE 26 NUMBER DATE SHIPPED DATE RECORDED FREIGHT TERMS 27 28 33002 12/30/20X9 12/30/20X9 FOB ship. point 29 33003 1/2/20YO 12/30/20X9 FOB ship. point 30 33004 1/2/2008 12/30/20x9 FOB ship- point 31 33005 12/31/20YC 12/31/20X9 FOB ship. point 32 33006 1/2/20YO 12/31/20X9 FOB ship. point 33 33007 1/3/2010 12/31/20X9 FOB ship. point 34 33008 12/31/20X9 12/31/20X9 FOB ship. point 35 33009 1/3/2010 12/31/20X9 FOB ship- point 36 33010 1/4/2070 1/4/20YO FOB ship. point 37 33011 1/4/20YO 1/4/2010 FOB ship. point 38 39 All adjustments of perpetual to physical inventories have been made 40 through "Cost of Goods Sold." 41 42 Examined the following documents for a few days before and after the 43 balance sheet date to determine that transactions were recorded 44 in the proper accounting period: 45 Vouchers 46 Receiving Reports 47 Freight Invoices 48 Sales Invoices 49 Bills of Lading 50 51 All sales are shipped "FOB shipping point." 52 53 Examined freight invoices for incoming shipments to locate possible 54 goods in transit for which title had passed before year-end. 55 $266,800 $881,870 $443,760 $144,600 $773,200 $338,700 $122,900 $1,322,800 $488,900 $788,211 $205,436 $679,040 $341,695 $111,342 $595,364 $260,799 $94,633 $1,018,556 $376,453 $606,922 excluded included included excluded included included excluded included included included WP 6.4 (cont) Audit Adjustment3 5300 Cost of Goods Sold 2020 Accounts Payable-Trade To record vouchers 12458 and 12459 representing parts inventories received and included in December 20X9 inventory, but not recorded until January, 2010 Audit Adjustment 4 1310 Raw Materials Inventory 2020 Accounts Payable-Trade To record inventory in transit at 12/31/X9. I Audit Adjustment 5 4100 Sales-Grand Prix Touring Bike 4200 Sales-Phoenix Touring Bike 4300 Sales-Pike's Peak Mountain Bike 4400 Sales-Himalaya Mountain Bike 4500 Sales-Waistliner Stationary Bike 1201 Accounts Receivable-Trade To reverse the following sales recorded in 20X9: shipped in 2010 (goods were included in 12/31/X9 inventory): Sales Account Number 4300 Invoice Number Amount 4100 4200 4400 4500 33003 33004 33006 33007 33009 $881,870 $443,760 $773,200 $338,700 $1,322,800 $322,550 $77,200 $288,700 $44,860 $497,310 $23,400 $55,900 $0 $62,375 $88,760 $466,740 $223,060 $410,650 $122,400 $714,580 $32,500 $36,680 $87,600 0 $0 $22,300 $51,550 $88,500 $20,565 $22,150 $0 ------ $253,050 $108,795 === ============ $3,760,330 $1,230,620 $230,435 ========== ================ ===== EEEEEE ===== $1,937,430 ===== EEEEE Exhibit BB.14 Brony's Bikes, Sales Summary, December 31, 20X9 SalesCredit Accounts Receivable Debit Grand Prix Pike's Peak Date Invoice No. Customer Phoenix Himalaya Waistliner Dec. 1 Dec. 1 31662 31663 Bikes and Parts L Mart Department Stores $ 67,000 325,600 $ 21,750 185,200 $ 12,600 0 $ 27,100 89,600 $ 5,550 21,500 $ 0 29,300 33002 Dec. 30 Dec. 30 Dec. 30 Dec. 31 Dec. 31 42,800 23,400 55,900 0 92,300 466,740 223,060 33003 33004 33005 33006 33007 33008 0 Texas Bike Emporium Rear and Sawbuck Southwest Spokes, Inc. Great Lakes Fitness Centers Big Mart Discount Centers Leisure Time Truly Bikes L Mart Department Stores 266,800 881,870 443,760 144,600 773,200 338,700 122,900 1,322,800 $ 21.656.900 55,300 322,550 77,200 0 288,700 44,860 15,600 497,310 $ 2.356.700 31,800 36,680 0 144,600 51,550 20,565 0 44,600 32,500 87,600 0 22,300 88,500 40,200 22,150 $ 7,988,600 Dec. 31 Dec. 31 410,650 122,400 35,500 714,580 $ 1.329.800 62,375 31,600 88,760 $ 9,234.500 Dec. 31 33009 0 $ 747.300 w Brony's Bikes, Voucher Register, December 31, 20X9 Other Accounts Payable Credit Raw Materials Debit Derailleurs Debit Purchased Parts Debit Indirect Materials Debit Repair Parts Debit Account Number Debit $ 415,000 LaPrix Derailleurs, Ltd. Kryolock Steel Supply Crown Manufacturing $ 415,000 212,480 122, 169 $ 212,480 $ 78,000 $ 44,169 589,600 589,600 266,800 215,000 93,000 $ 10,600 266,800 318,600 112,800 41,600 122,500 8340 9435 $ 112,800 41,600 122,500 9450 Crystal Manufacturing, Inc. Kryolock Steel Supply Crown Manufacturing Palmer & Nile Advertising MedCare HMO, Inc. Denise Vaughan & Co., CPAs Joelson & Wicks, Attorneys at Law Zebra Cleaning Supplies Crew Brothers Manufacturing I aPrix Derailleurs ltd 233,000 9451 233,000 9460 7,865 7,865 1,445,900 1,445,900 962,200 962,200 $ 25,774,213 $ 3,822,900 $ 4,376,000 $ 12,430,975 $ 883,411 $ 776,500 $ 3,484,427 Brony's Bikes Practice Case Module VI: Sales and Purchases Cutoff Tests Along with Richard Derick and the rest of the audit team, you observed Brony's Bikes December 31, 20x9 physical inventory. Derick is satisfied with the inventory-taking procedures and has considerable confidence in the reliability of the ending inventory quantities. He is concerned, however, with the methods used to value the ending inventories (especially the disposition of unfavorable budget variances) and with possible misstatements relating to sales and purchases cutoff. With regard to cutoff, Derick is particularly interested in learning why customers could not confirm details of sales transactions recorded by Brony's Bikes on December 31, 20X9. In response to the confirmation and cutoff concerns, he has asked you to examine the appropriate books of original entry and underlying documentation for a few days before and after the balance sheet date. Specifically, Derick is interested in the following: 1. Were purchases and sales recorded in the proper accounting period? 2. Were purchases that were recorded at year end included in the physical inventory? 3. Were all materials and purchased parts that were included in inventory recorded as purchases? 4. Were the finished goods inventory accounts properly relieved for all recorded sales? You download Brony's Bikes' December voucher register and sales summary. These are partially reproduced in Exhibits BB.13 (Link) and BB.14 (Link) referred to in Module Il and are included in the Excel file Brony's Bikes Module Il Exhibits 7 to 16.xlsx (Link). Using these as a focal point, you requested that the client provide you with the documentation supporting certain of the recorded transactions. You now are prepared to record any necessary audit adjustments and reclassifications. Requirements 1. Using the downloaded Excel data, retrieve the file labeled 20x9 Cutoff." (Link) Study WP 6.4, "Inventory Cutoff," and compare it with the voucher register and sales summary portions reproduced in Exhibits BB.13 and BB.14. Comment on any cutoff misstatements that you detect and determine their effect on net income. Do the misstatements appear to be intentional or unintentional? Explain. 2. Draft any audit adjustments suggested by the analysis performed in requirement (1). (Remember that Brony's Bikes maintains perpetual inventory records and adjusts its perpetual inventory to the physical inventory through the appropriate "Cost of Goods Sold" accounts.) Prepared by: Date: Revieved by: Date: INVENTORY INCLUDED EXCLUDED DATE RECEIVED FREIGHT TERMS COST 12/30/20X9 12/31/20x9 12/31/20X9 12/31/20x9 1/2/2010 1/3/20YO FOB destination FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point Included Included Included Included Excluded Excluded $1,445,900 $962,200 $488,754 $365,400 $1,879,000 (0) $438,870 (2) INVENTORY INCLUDED EXCLUDED SELLING PRICE COST 1 WP 6.4 2 Brony's Bikes 3 Inventory Cutoff 4 December 31, 20X9 5 6 PURCHASES CUTOFF 7 8 9 DATE RECEIVING 10 RECORDED VOUCHER NO. REPORT NO. DATE SHIPPED 11 12 12/31/20X9 12456 01-12486 12127120X9 13 12/31/20X9 12457 01-12487 12/26/20x9 14 1/2/2010 12458 01-12488 12/28/20X9 15 1/3/20YO 12459 01-12489 12/29/20X9 16 1/3/20YO 12460 02-13001 12/30/20x9 17 1/4/2010 12461 02-13002 1/2/2010 18 19 (1) Voucher 12460 was for the purchase of raw materials 20 (2) Voucher 12461 was for the purchase of parts 21 22 23 SALES CUTOFF 24 25 SALES INVOICE 26 NUMBER DATE SHIPPED DATE RECORDED FREIGHT TERMS 27 28 33002 12/30/20X9 12/30/20X9 FOB ship. point 29 33003 1/2/20YO 12/30/20X9 FOB ship. point 30 33004 1/2/2008 12/30/20x9 FOB ship- point 31 33005 12/31/20YC 12/31/20X9 FOB ship. point 32 33006 1/2/20YO 12/31/20X9 FOB ship. point 33 33007 1/3/2010 12/31/20X9 FOB ship. point 34 33008 12/31/20X9 12/31/20X9 FOB ship. point 35 33009 1/3/2010 12/31/20X9 FOB ship- point 36 33010 1/4/2070 1/4/20YO FOB ship. point 37 33011 1/4/20YO 1/4/2010 FOB ship. point 38 39 All adjustments of perpetual to physical inventories have been made 40 through "Cost of Goods Sold." 41 42 Examined the following documents for a few days before and after the 43 balance sheet date to determine that transactions were recorded 44 in the proper accounting period: 45 Vouchers 46 Receiving Reports 47 Freight Invoices 48 Sales Invoices 49 Bills of Lading 50 51 All sales are shipped "FOB shipping point." 52 53 Examined freight invoices for incoming shipments to locate possible 54 goods in transit for which title had passed before year-end. 55 $266,800 $881,870 $443,760 $144,600 $773,200 $338,700 $122,900 $1,322,800 $488,900 $788,211 $205,436 $679,040 $341,695 $111,342 $595,364 $260,799 $94,633 $1,018,556 $376,453 $606,922 excluded included included excluded included included excluded included included included WP 6.4 (cont) Audit Adjustment3 5300 Cost of Goods Sold 2020 Accounts Payable-Trade To record vouchers 12458 and 12459 representing parts inventories received and included in December 20X9 inventory, but not recorded until January, 2010 Audit Adjustment 4 1310 Raw Materials Inventory 2020 Accounts Payable-Trade To record inventory in transit at 12/31/X9. I Audit Adjustment 5 4100 Sales-Grand Prix Touring Bike 4200 Sales-Phoenix Touring Bike 4300 Sales-Pike's Peak Mountain Bike 4400 Sales-Himalaya Mountain Bike 4500 Sales-Waistliner Stationary Bike 1201 Accounts Receivable-Trade To reverse the following sales recorded in 20X9: shipped in 2010 (goods were included in 12/31/X9 inventory): Sales Account Number 4300 Invoice Number Amount 4100 4200 4400 4500 33003 33004 33006 33007 33009 $881,870 $443,760 $773,200 $338,700 $1,322,800 $322,550 $77,200 $288,700 $44,860 $497,310 $23,400 $55,900 $0 $62,375 $88,760 $466,740 $223,060 $410,650 $122,400 $714,580 $32,500 $36,680 $87,600 0 $0 $22,300 $51,550 $88,500 $20,565 $22,150 $0 ------ $253,050 $108,795 === ============ $3,760,330 $1,230,620 $230,435 ========== ================ ===== EEEEEE ===== $1,937,430 ===== EEEEE Exhibit BB.14 Brony's Bikes, Sales Summary, December 31, 20X9 SalesCredit Accounts Receivable Debit Grand Prix Pike's Peak Date Invoice No. Customer Phoenix Himalaya Waistliner Dec. 1 Dec. 1 31662 31663 Bikes and Parts L Mart Department Stores $ 67,000 325,600 $ 21,750 185,200 $ 12,600 0 $ 27,100 89,600 $ 5,550 21,500 $ 0 29,300 33002 Dec. 30 Dec. 30 Dec. 30 Dec. 31 Dec. 31 42,800 23,400 55,900 0 92,300 466,740 223,060 33003 33004 33005 33006 33007 33008 0 Texas Bike Emporium Rear and Sawbuck Southwest Spokes, Inc. Great Lakes Fitness Centers Big Mart Discount Centers Leisure Time Truly Bikes L Mart Department Stores 266,800 881,870 443,760 144,600 773,200 338,700 122,900 1,322,800 $ 21.656.900 55,300 322,550 77,200 0 288,700 44,860 15,600 497,310 $ 2.356.700 31,800 36,680 0 144,600 51,550 20,565 0 44,600 32,500 87,600 0 22,300 88,500 40,200 22,150 $ 7,988,600 Dec. 31 Dec. 31 410,650 122,400 35,500 714,580 $ 1.329.800 62,375 31,600 88,760 $ 9,234.500 Dec. 31 33009 0 $ 747.300 w Brony's Bikes, Voucher Register, December 31, 20X9 Other Accounts Payable Credit Raw Materials Debit Derailleurs Debit Purchased Parts Debit Indirect Materials Debit Repair Parts Debit Account Number Debit $ 415,000 LaPrix Derailleurs, Ltd. Kryolock Steel Supply Crown Manufacturing $ 415,000 212,480 122, 169 $ 212,480 $ 78,000 $ 44,169 589,600 589,600 266,800 215,000 93,000 $ 10,600 266,800 318,600 112,800 41,600 122,500 8340 9435 $ 112,800 41,600 122,500 9450 Crystal Manufacturing, Inc. Kryolock Steel Supply Crown Manufacturing Palmer & Nile Advertising MedCare HMO, Inc. Denise Vaughan & Co., CPAs Joelson & Wicks, Attorneys at Law Zebra Cleaning Supplies Crew Brothers Manufacturing I aPrix Derailleurs ltd 233,000 9451 233,000 9460 7,865 7,865 1,445,900 1,445,900 962,200 962,200 $ 25,774,213 $ 3,822,900 $ 4,376,000 $ 12,430,975 $ 883,411 $ 776,500 $ 3,484,427