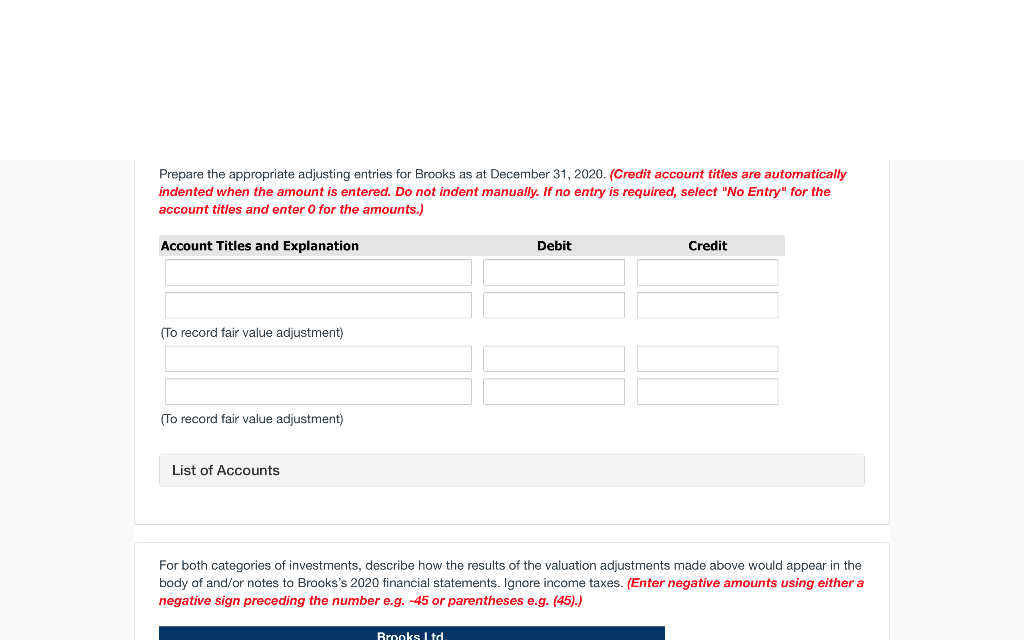

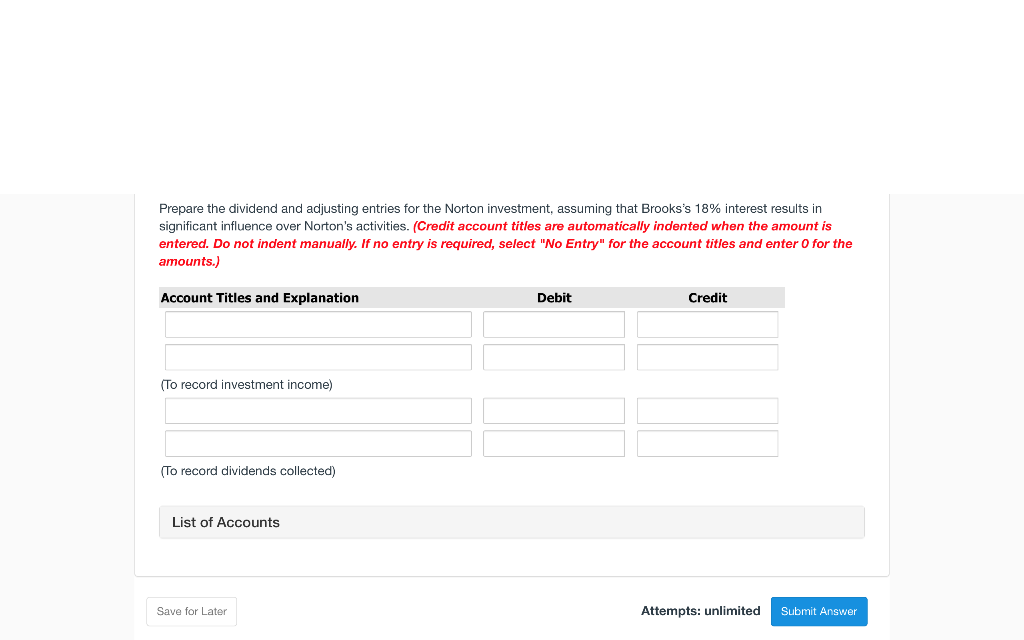

Question

Brooks Corp. is a medium-sized corporation that specializes in quarrying stone for building construction. The company has long dominated the market, and at one time

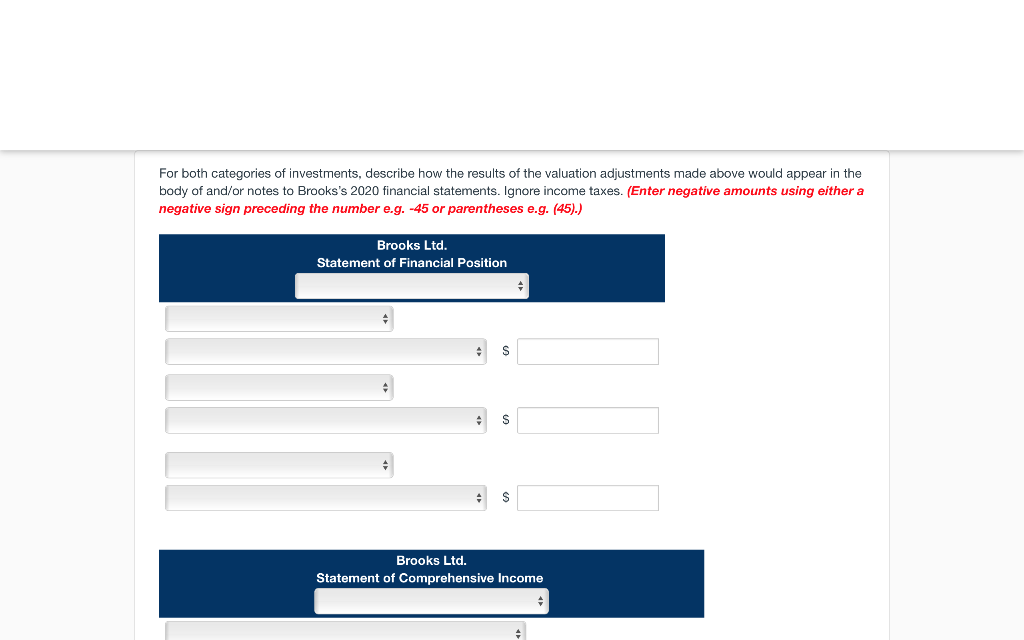

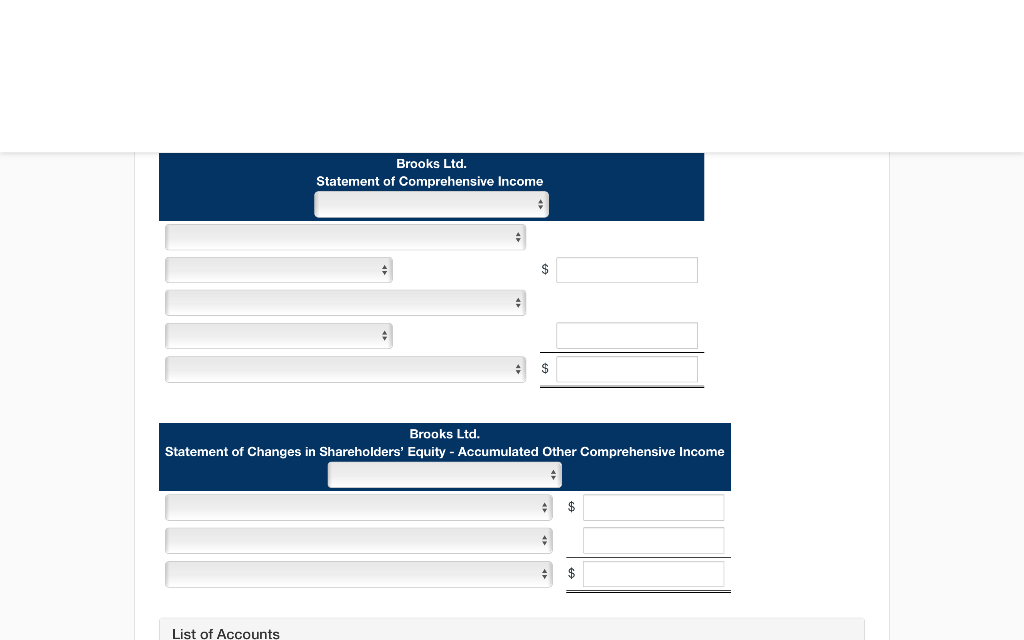

Brooks Corp. is a medium-sized corporation that specializes in quarrying stone for building construction. The company has long dominated the market, and at one time had 70% market penetration. During prosperous years, the companys profits and conservative dividend policy resulted in funds becoming available for outside investment. Over the years, Brooks has had a policy of investing idle cash in equity instruments of other companies. In particular, Brooks has made periodic investments in the companys main supplier, Norton Industries Limited. Although Brooks currently owns 18% of the outstanding common shares of Norton, it does not yet have significant influence over the operations of this investee company. Brooks accounts for its investment in Norton using FV-OCI without recycling through net income. Yasmina Olynyk has recently joined Brooks as assistant controller, and her first assignment is to prepare the 2020 year-end adjusting entries. Olynyk has gathered the following information about Brookss relevant investment accounts:

1.

| In 2020, Brooks acquired shares of Delaney Motors Corp. and Isha Electric Ltd. for short-term trading purposes. Brookspurchased 100,000 shares of Delaney Motors for $1.4 million, and the shares currently have a fair value of $1.6 million. Brookss investment in Isha Electric has not been profitable: the company acquired 50,000 shares of Isha at $20 per share and they currently have a fair value of $720,000. |

2. Before 2020, Brooks had invested $22.50 million in Norton Industries and, at December 31, 2019, the investment had a fair value of $21.50 million. While Brooks did not sell or purchase any Norton shares this year, Norton declared and paid a dividend totalling $2.4 million on all of its common shares, and reported 2020 net income of $13.8 million. Brookss 18% ownership of Norton Industries has a December 31, 2020 fair value of $22,225,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started