Answered step by step

Verified Expert Solution

Question

1 Approved Answer

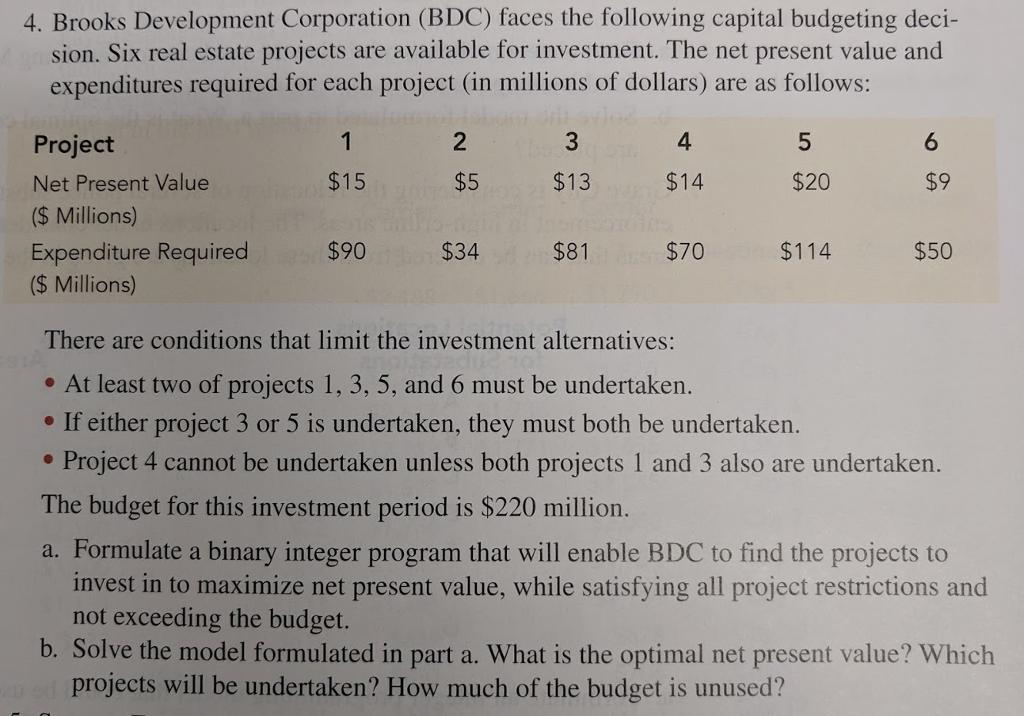

4. Brooks Development Corporation (BDC) faces the following capital budgeting deci- sion. Six real estate projects are available for investment. The net present value

4. Brooks Development Corporation (BDC) faces the following capital budgeting deci- sion. Six real estate projects are available for investment. The net present value and expenditures required for each project (in millions of dollars) are as follows: Project Net Present Value Millions) Expenditure Required ($ Millions) 1 $15 $90 2 $5 $34 3 $13 $81 4 $14 $70 5 $20 $114 6 $9 $50 There are conditions that limit the investment alternatives: At least two of projects 1, 3, 5, and 6 must be undertaken. If either project 3 or 5 is undertaken, they must both be undertaken. Project 4 cannot be undertaken unless both projects 1 and 3 also are undertaken. The budget for this investment period is $220 million. a. Formulate a binary integer program that will enable BDC to find the projects to invest in to maximize net present value, while satisfying all project restrictions and not exceeding the budget. b. Solve the model formulated in part a. What is the optimal net present value? Which red projects will be undertaken? How much of the budget is unused?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Taking the facts into account it can be seen that the project has some problems that should be solve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started