Question

Brooks Plumbing Products Incorporated (BPP) manufactures plumbing fixtures and other home improvement products that are sold in Home Depot and Walmart as well as hardware

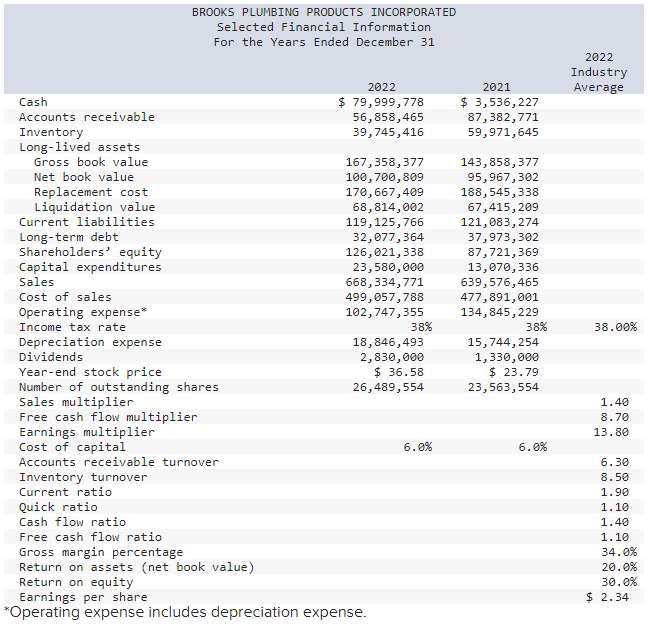

Brooks Plumbing Products Incorporated (BPP) manufactures plumbing fixtures and other home improvement products that are sold in Home Depot and Walmart as well as hardware stores. BPP has a solid reputation for providing value products, good quality, and a good price. The company has been approached by an investment banking firm representing a third company, Garden Specialties Incorporated (GSI), that is interested in acquiring BPP. The acquiring firm (GSI) is a retailer of garden supplies; it sees the potential synergies of the combined firm and is willing to pay BPP shareholders $40 cash per share for their stock, which is greater than the current stock price; the stock has traded at about $34 in recent months. Summary financial information about BPP follows

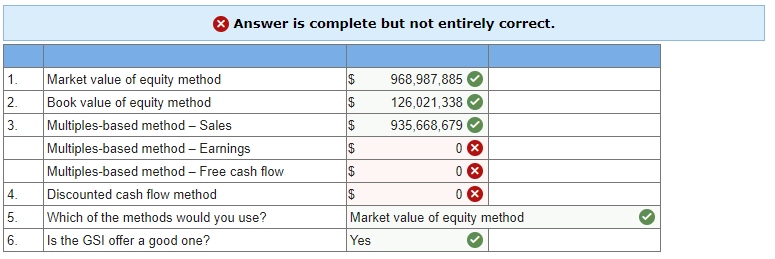

3. What are the valuations of BPP (for 2022) using the multiples-based methods for sales, earnings, and free cash flow?

4. What is the estimated value for BPP using the discounted free cash flow method, assuming that the 2022 amount of free cash flow continues indefinitely?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started