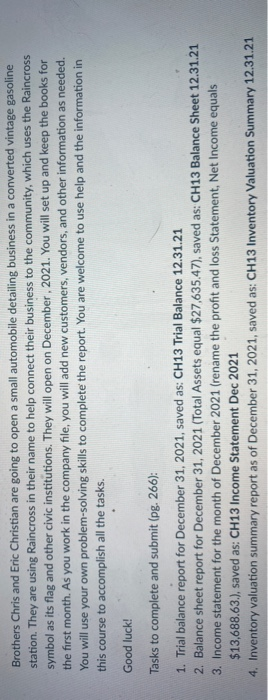

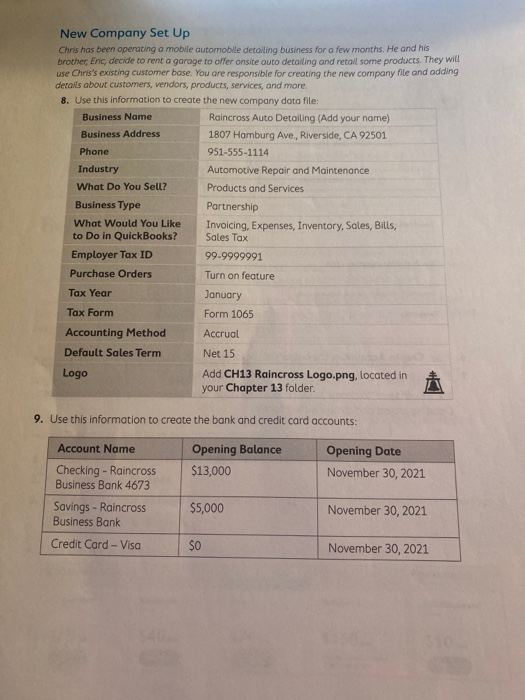

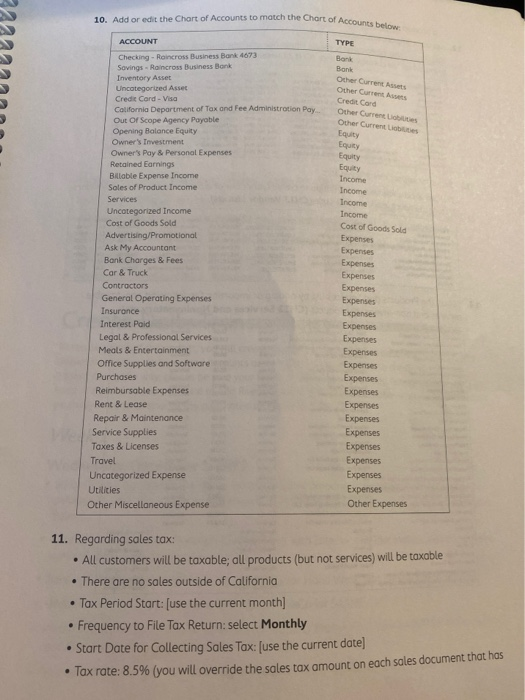

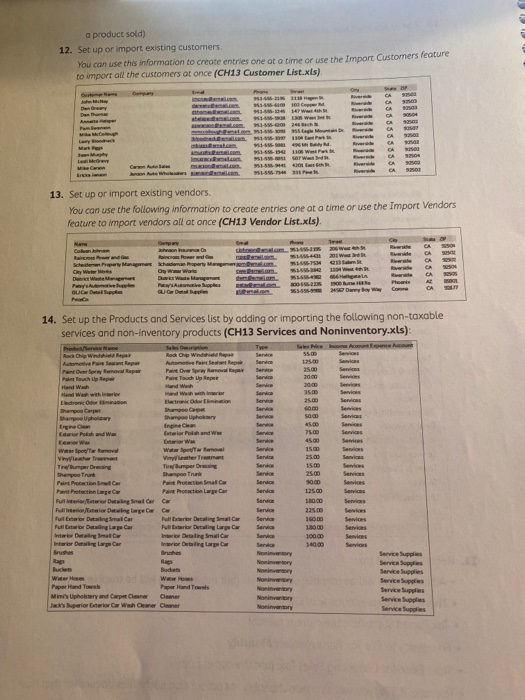

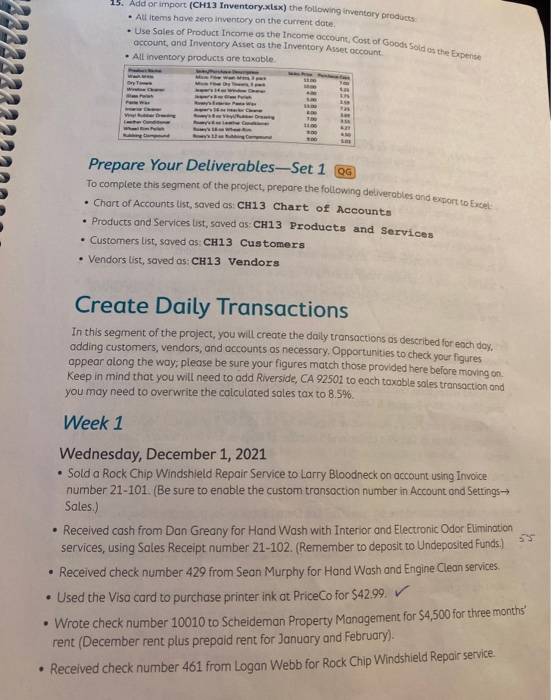

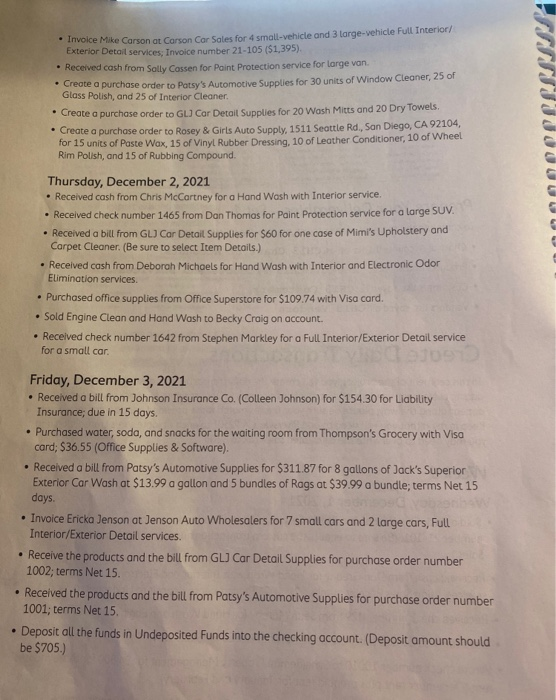

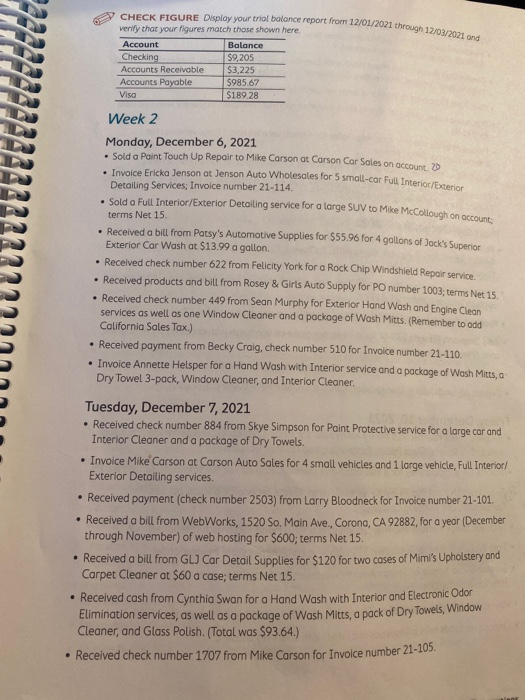

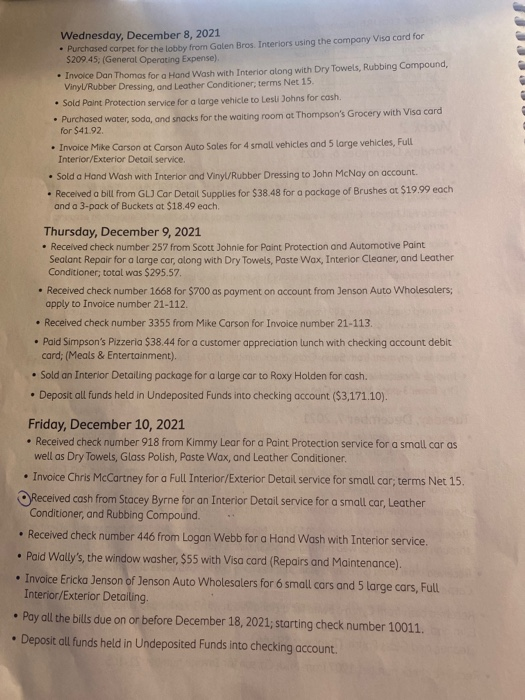

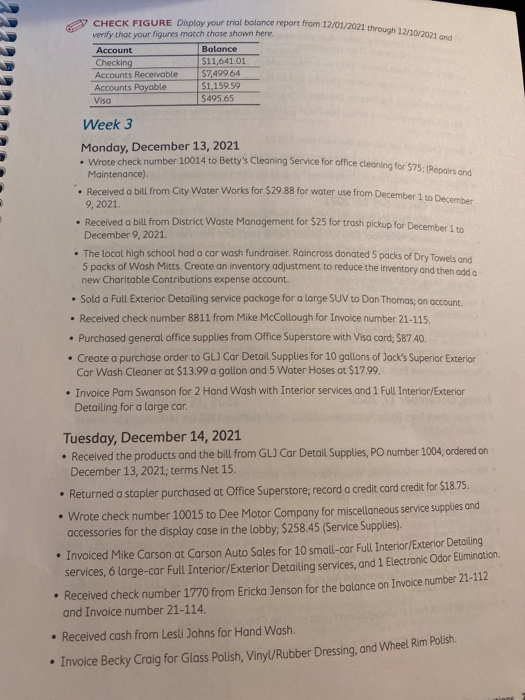

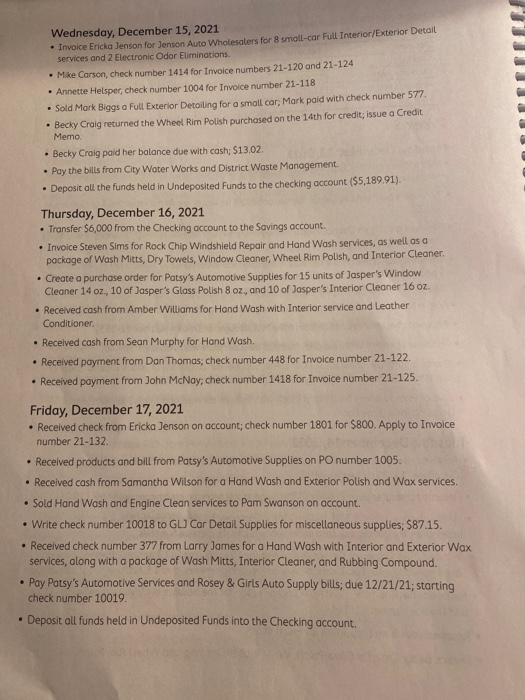

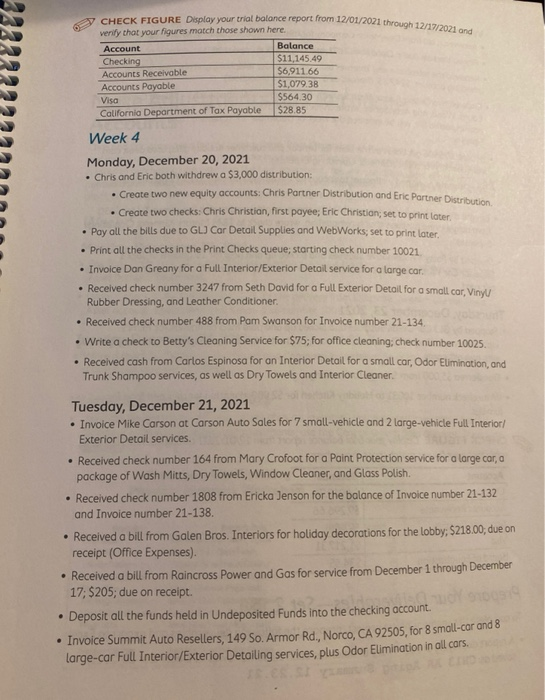

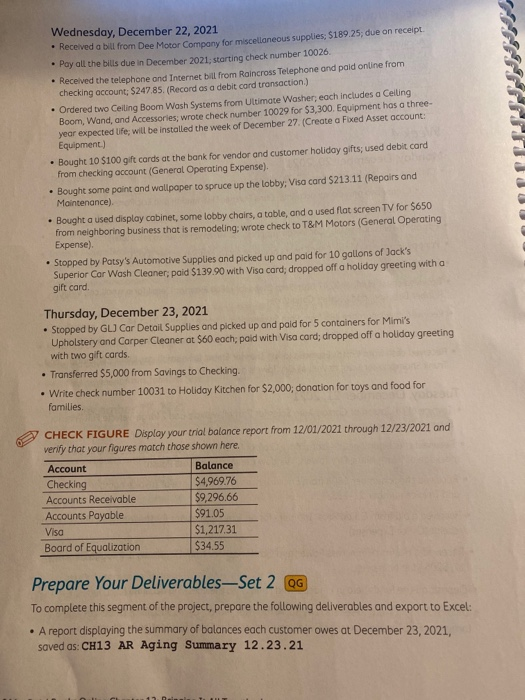

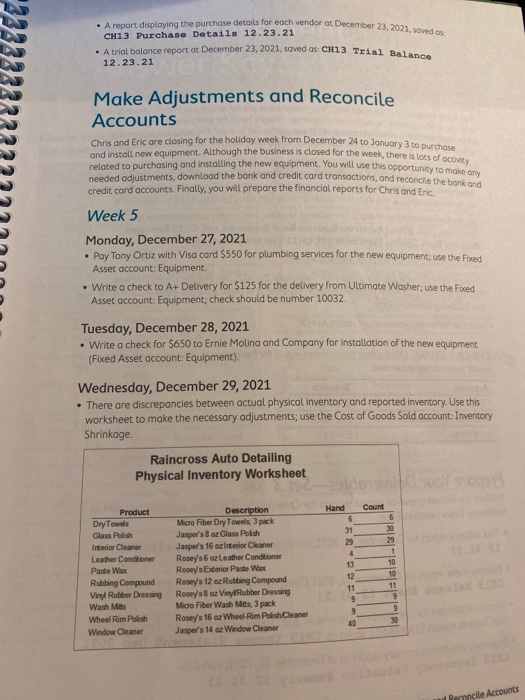

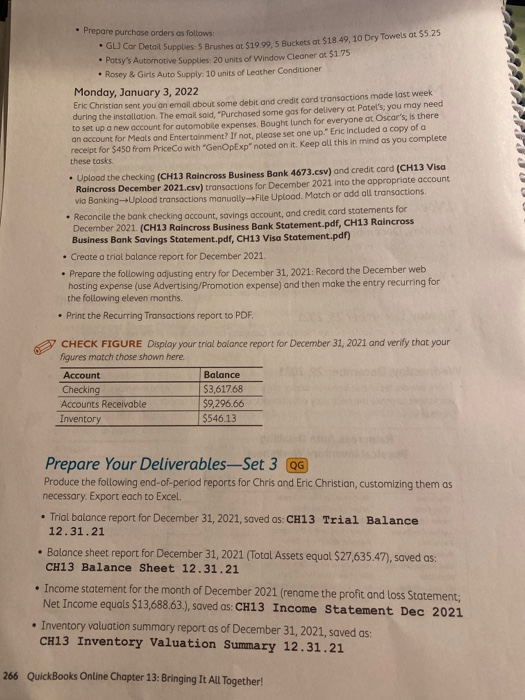

Brothers Chris and Eric Christian are going to open a small automobile detailing business in a converted vintage gasoline station. They are using Raincross in their name to help connect their business to the community, which uses the Raincross symbol as its flag and other civic institutions. They will open on December, 2021. You will set up and keep the books for the first month. As you work in the company file, you will add new customers, vendors, and other information as needed. You will use your own problem-solving skills to complete the report. You are welcome to use help and the information in this course to accomplish all the tasks. Good luck! Tasks to complete and submit (pg. 266): 1. Trial balance report for December 31, 2021, saved as: CH13 Trial Balance 12.31.21 2. Balance sheet report for December 31, 2021 (Total Assets equal $27,635.47), saved as: CH13 Balance Sheet 12.31.21 3. Income statement for the month of December 2021 (rename the profit and loss Statement, Net Income equals $13,688.63.), saved as: CH13 Income Statement Dec 2021 4. Inventory valuation summary report as of December 31, 2021, saved as: CH13 Inventory Valuation Summary 12.31.21 New Company Set Up Chris has been operating a mobile automobile detailing business for a few months. He and his brother, Eric, decide to rent a garage to offer onsite auto detailing and retail some products. They will use Chris's existing customer base. You are responsible for creating the new company file and adding details about customers, vendors, products, services, and more 8. Use this information to create the new company data file: Business Name Raincross Auto Detailing (Add your name) Business Address 1807 Hamburg Ave., Riverside, CA 92501 Phone 951-555-1114 Industry Automotive Repair and Maintenance What Do You Sell? Products and Services Business Type Partnership What Would You Like Invoicing, Expenses, Inventory, Sales, Bills, to Do in QuickBooks? Sales Tax Employer Tax ID 99-9999991 Purchase Orders Turn on feature Tax Year January Tax Form Form 1065 Accounting Method Accrual Default Sales Term Net 15 Logo Add CH13 Raincross Logo.png, located in your Chapter 13 folder. 9. Use this information to create the bank and credit card accounts: Opening Balance $13,000 Opening Date November 30, 2021 Account Name Checking - Raincross Business Bank 4673 Savings - Raincross Business Bank Credit Card - Visa $5,000 November 30, 2021 $0 November 30, 2021 10. Add or edit the Chart of Accounts to match the Chart of Accounts below ACCOUNT TYPE Bank Bank Other Current Assets Other Current Credit Card Other Current Louis Other Current Liabilities Equity Equity Checking - Raincross Business Bank 4673 Savings - Raincross Business Bank Inventory Asset Uncategorized Asset Credit Card - Visa California Department of Tax and Fee Administration Pay Out of Scope Agency Payable Opening Balance Equity Owner's Investment Owner's Pay & Personal Expenses Retained Earnings Billable Expense Income Soles of Product Income Services Uncategorized Income Cost of Goods Sold Advertising/Promotional Ask My Accountant Bank Charges & Fees Car & Truck Contractors General Operating Expenses Insurance Interest Paid Legal & Professional Services Meals & Entertainment Office Supplies and Software Purchases Reimbursable Expenses Rent & Lease Repair & Maintenance Service Supplies Taxes & Licenses Travel Uncategorized Expense Utilities Other Miscellaneous Expense Equity Income Income Income Income Cost of Goods Sold Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Other Expenses 11. Regarding sales tax: All customers will be taxable; all products (but not services) will be taxable . There are no sales outside of California Tax Period Start: [use the current month) Frequency to File Tax Return:select Monthly Start Date for Collecting Sales Tax: (use the current date) Tax rate: 8.5% (you will override the sales tax amount on each sales document that has a product sold) 12. Set up or import existing customers. You can use this information to create entries one at a time or use the Import Customers feature to import all the customers at once (CH13 Customer List.xls) CA CA 1. We CA can - 130 1-6-456 OFW CA 90 Lad More CA CA non ute Wholesalcem 13. Set up or import existing vendors. You can use the following information to create entries one at a time or use the Import Vendors feature to import vendors all at once (CH13 Vendor List.xls) we 201 West side | CA Scheider Man Show More. Gay W DW CA CA GUO Del Supple 14. Set up the Products and Services List by adding or importing the following non-taxable services and non-inventory products (CH13 Services and Noninventory.xls): Rock Chip Windows Rock Chip Wide Automotive Part Set Repair Service Serie Penter for Rent 25. Services 2000 and we were Flere Sen 25.00 75.00 45.00 Services Sens Services 15.00 25.00 Servis Services hape why Shanghai Engine Exterior Polish and W Erior Wax Water Sport Remove Vinyleather Trumpere Thumper Dress Shampoo Trunk Paint Protection Car Paint Protectional Car |Panthaa Panoraction |uriralatra Danisamalare Rullleri/terior Detailing large Car C Fuiletarter Desing Star Pullarior Detailing Small Car Pullingwear Rarior Detailing large Car Interior Dewi Saw Interior Dewi wewe Brushes Raps Senta Service Service Senio Seria Service Service Service 225.00 Services Services Service Service 18000 100.00 140.00 War Hores Www Hos Paper Hand Towel Paper Hand Towels Mimi's Upholstery and Carpet Clean Ja Superior Better Car Wash Cleaner Clemer Service Supplies Service Supplies Service Supplies Service Supplies Service Supplies Service Supplies Use Sales of Product Income as the Income account, Cost of Goods Sold as the Expense 15. Add or import (CH13 Inventory.xlsx) the following inventory products: All items have zero inventory on the current date. account, and Inventory Asset as the Inventory Asset account. All inventory products are taxable. Dy we We My 11.00 10 Prepare Your Deliverables-Set 1 QG To complete this segment of the project, prepare the following deliverables and export to Excel Chart of Accounts list, saved as: CH13 Chart of Accounts Products and Services List, saved as: CH13 Products and Services Customers list, saved as: CH13 Customers Vendors list, saved as: CH13 Vendors Create Daily Transactions In this segment of the project, you will create the daily transactions as described for each day, adding customers, vendors, and accounts as necessary, Opportunities to check your figures appear along the way, please be sure your figures match those provided here before moving on. Keep in mind that you will need to add Riverside, CA 92501 to each taxable sales transaction and you may need to overwrite the calculated sales tax to 8.5%. Week 1 Wednesday, December 1, 2021 Sold a Rock Chip Windshield Repair Service to Larry Bloodneck on account using Invoice number 21-101. (Be sure to enable the custom transaction number in Account and Settings Sales.) Received cash from Dan Greany for Hand Wash with Interior and Electronic Odor Elimination services, using Sales Receipt number 21-102.(Remember to deposit to Undeposited Funds) Received check number 429 from Sean Murphy for Hand Wash and Engine Clean services. . Used the Visa card to purchase printer ink at PriceCo for $42.99 Wrote check number 10010 to Scheideman Property Management for $4,500 for three months' rent (December rent plus prepaid rent for January and February) Received check number 461 from Logan Webb for Rock Chip Windshield Repair service. Invoice Mike Carson at Carson Car Sales for 4 small-vehicle and 3 large-vehicle Full Interior/ Exterior Detail services: Invoice number 21-105 (51,395). Received cash from Solly Cassen for Paint Protection service for large van. Create a purchase order to Patsy's Automotive Supplies for 30 units of Window Cleaner, 25 of Glass Polish, and 25 of Interior Cleaner Create a purchase order to GLI Car Detail Supplies for 20 Wash Mitts and 20 Dry Towels. Create a purchase order to Rosey & Girls Auto Supply, 1511 Seattle Rd, San Diego, CA 92104, for 15 units of Paste Wax, 15 of Vinyl Rubber Dressing, 10 of Leather Conditioner, 10 of Wheel Rim Polish, and 15 of Rubbing Compound. Thursday, December 2, 2021 Received cash from Chris McCartney for a Hand Wash with Interior service, Received check number 1465 from Dan Thomas for Paint Protection service for a large SUV. Received a bill from GLJ Car Detail Supplies for $60 for one case of Mimi's Upholstery and Carpet Cleaner (Be sure to select Item Details.) Received cash from Deborah Michaels for Hand Wash with Interior and Electronic Odor Elimination services. Purchased office supplies from Office Superstore for $109.74 with Visa card. Sold Engine Clean and Hand Wash to Becky Craig on account. Received check number 1642 from Stephen Markley for a Full Interior/exterior Detail service for a small car Friday, December 3, 2021 Received a bill from Johnson Insurance Co. (Colleen Johnson) for $154.30 for Liability Insurance; due in 15 days. . Purchased water, soda, and snacks for the waiting room from Thompson's Grocery with Visa card; $36.55 (Office Supplies & Software). Received a bill from Patsy's Automotive Supplies for $311.87 for 8 gallons of Jack's Superior Exterior Car Wash at $13.99 a gallon and 5 bundles of Rags at $39.99 a bundle; terms Net 15 days Invoice Ericka Jenson at Jenson Auto Wholesalers for 7 small cars and 2 large cars, Full Interior/Exterior Detail services. Receive the products and the bill from GLJ Car Detail Supplies for purchase order number 1002; terms Net 15. Received the products and the bill from Patsy's Automotive Supplies for purchase order number 1001; terms Net 15. Deposit all the funds in Undeposited Funds into the checking account. (Deposit amount should be $705.) CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/03/2021 and verify that your figures match those shown here. Account Balance Checking $9,205 Accounts Receivable $3,225 Accounts Payable $985.67 Visa $189.28 Week 2 Monday, December 6, 2021 Sold a Paint Touch Up Repair to Mike Carson at Carson Car Sales on account 20 Invoice Ericka Jenson at Jenson Auto Wholesales for 5 small-car Full Interior/Exterior Detailing Services: Invoice number 21-114. Sold a Full Interior/Exterior Detailing service for a large SUV to Mike McCollough on account: terms Net 15. Received a bill from Patsy's Automotive Supplies for $55.96 for 4 gallons of Jock's Superior Exterior Car Wash at $13.99 a gallon. Received check number 622 from Felicity York for a Rock Chip Windshield Repair service. Received products and bill from Rosey & Girts Auto Supply for PO number 1003; terms Net 15. Received check number 449 from Sean Murphy for Exterior Hand Wash and Engine Clean services as well as one Window Cleaner and a package of Wash Mitts. (Remember to add California Sales Tax.) Received payment from Becky Craig, check number 510 for Invoice number 21-110 Invoice Annette Helsper for a Hand Wash with Interior service and a package of Wash Mitts, a Dry Towel 3-pack, Window Cleaner, and Interior Cleaner. Tuesday, December 7, 2021 Received check number 884 from Skye Simpson for Paint Protective service for a large car and Interior Cleaner and a package of Dry Towels. Invoice Mike Carson at Carson Auto Sales for 4 small vehicles and 1 large vehicle, Full Interior/ Exterior Detailing services Received payment (check number 2503) from Larry Bloodneck for Invoice number 21-101. Received a bill from WebWorks, 1520 So. Main Ave., Corona, CA 92882, for a year (December through November) of web hosting for $600; terms Net 15. Received a bill from GLJ Car Detail Supplies for $120 for two cases of Mimi's Upholstery and Carpet Cleaner at $60 a case; terms Net 15. Received cash from Cynthia Swan for a Hand Wash with Interior and Electronic Odor Elimination services, as well as a package of Wash Mitts, a pack of Dry Towels, Window Cleaner, and Glass Polish. (Total was $93.64.) Received check number 1707 from Mike Carson for Invoice number 21-105. Wednesday, December 8, 2021 Purchased carpet for the lobby from Galen Bros. Interiors using the company Visa card for $209.45; (General Operating Expense). Invoice Dan Thomas for a Hand Wash with Interior along with Dry Towels, Rubbing Compound, Vinyl/Rubber Dressing, and Leather Conditioner, terms Net 15 Sold Paint Protection service for a large vehicle to Lesli Johns for cash. Purchased water, soda, and snacks for the waiting room at Thompson's Grocery with Visa card for $41.92 Invoice Mike Corson at Carson Auto Sales for 4 small vehicles and 5 large vehicles, Full Interior/Exterior Detail service. Sold a Hand Wash with Interior and Vinyl/Rubber Dressing to John McNay on account. Received a bill from GL Car Detail Supplies for $38.48 for a package of Brushes at $19.99 each and a 3-pack of Buckets at $18.49 each. Thursday, December 9, 2021 Received check number 257 from Scott Johnie for Paint Protection and Automotive Paint Sealant Repair for a large car, along with Dry Towels, Paste Wax, Interior Cleaner, and Leather Conditioner; total was $295.57 Received check number 1668 for $700 as payment on account from Jenson Auto Wholesalers; apply to Invoice number 21-112 Received check number 3355 from Mike Carson for Invoice number 21-113. Paid Simpson's Pizzeria $38.44 for a customer appreciation lunch with checking account debit card; (Meals & Entertainment). Sold an Interior Detailing package for a large car to Roxy Holden for cash. Deposit all funds held in Undeposited Funds into checking account ($3,171.10). Friday, December 10, 2021 Received check number 918 from Kimmy Lear for a Paint Protection service for a small car as well as Dry Towels, Glass Polish, Paste Wax, and Leather Conditioner Invoice Chris McCartney for a Full Interior/Exterior Detail service for small car; terms Net 15. Received cash from Stacey Byrne for an Interior Detail service for a small car, Leather Conditioner, and Rubbing Compound. Received check number 446 from Logan Webb for a Hand Wash with Interior service. Paid Wally's, the window washer, $55 with Visa card (Repairs and Maintenance). Invoice Ericka Jenson of Jenson Auto Wholesalers for 6 small cars and 5 large cars, Full Interior/Exterior Detailing. Pay all the bills due on or before December 18, 2021; starting check number 10011. Deposit all funds held in Undeposited Funds into checking account. . . CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/10/2021 and verify that your figures match those shown here. Account Balance Checking $11,641.01 Accounts Receivable $7,499.64 Accounts Payable $1,159.59 Visa $495.65 Week 3 Monday, December 13, 2021 Wrote check number 10014 to Betty's Cleaning Service for office cleaning for $75: (Repairs and Maintenance) Received a bill from City Water Works for $29.88 for water use from December 1 to December 9, 2021 Received a bill from District Waste Management for $25 for trash pickup for December 1 to December 9, 2021 . The local high school had a car wash fundraiser. Raincross donated 5 packs of Dry Towels and 5 packs of Wash Mitts. Create an inventory adjustment to reduce the inventory and then add a new Charitable Contributions expense account. Sold a Full Exterior Detailing service package for a large SUV to Dan Thomas, on account. Received check number 8811 from Mike McCollough for Invoice number 21-115. Purchased general office supplies from Office Superstore with Visa card; $87.40. Create a purchase order to GLJ Car Detail Supplies for 10 gallons of Jack's Superior Exterior Car Wash Cleaner at $13.99 a gallon and 5 Water Hoses at $17.99. Invoice Pam Swanson for 2 Hand Wash with Interior services and 1 Full Interior/Exterior Detailing for a large car. Tuesday, December 14, 2021 Received the products and the bill from GL Car Detail Supplies, PO number 1004, ordered on December 13, 2021; terms Net 15. Returned a stapler purchased at Office Superstore; record a credit card credit for $18.75. Wrote check number 10015 to Dee Motor Company for miscellaneous service supplies and accessories for the display case in the lobby: $258.45 (Service Supplies). Invoiced Mike Carson at Carson Auto Sales for 10 small-car Full Interior/Exterior Detailing services, 6 large-car Full Interior/Exterior Detailing services, and 1 Electronic Odor Elimination. Received check number 1770 from Ericka Jenson for the balance on Invoice number 21-112 and Invoice number 21-114. Received cash from Lesli Johns for Hand Wash. Invoice Becky Craig for Glass Polish, Vinyl/Rubber Dressing, and Wheel Rim Polish. Wednesday, December 15, 2021 Invoice Ericka Jenson for Jenson Auto Wholesalers for 8 small-car Full Interior/Exterior Detail services and 2 Electronic Odor Eliminations Mike Carson, check number 1414 for Invoice numbers 21-120 and 21-124 Annette Helsper, check number 1004 for Invoice number 21-118 Sold Mark Biggs a Full Exterior Detailing for a small car, Mark paid with check number 577. Becky Craig returned the Wheel Rim Polish purchased on the 14th for credit; issue a Credit Memo . Becky Craig paid her balance due with cash: $13.02. Pay the bills from City Water Works and District Waste Management. Deposit all the funds held in Undeposited Funds to the checking account ($5,189.91). Thursday, December 16, 2021 . Transfer $6,000 from the Checking account to the Savings account. Invoice Steven Sims for Rock Chip Windshield Repair and Hand Wash services, as well as a package of Wash Mitts, Dry Towels, Window Cleaner, Wheel Rim Polish, and Interior Cleaner. Create a purchase order for Patsy's Automotive Supplies for 15 units of Jasper's Window Cleaner 14 oz., 10 of Jasper's Glass Polish 8 oz., and 10 of Jasper's Interior Cleaner 16 oz. Received cash from Amber Williams for Hand Wash with Interior service and Leather Conditioner Received cash from Sean Murphy for Hand Wash. Received payment from Dan Thomas, check number 448 for Invoice number 21-122 Received payment from John McNay, check number 1418 for Invoice number 21-125. Friday, December 17, 2021 Received check from Ericka Jenson on account; check number 1801 for $800. Apply to Invoice number 21-132 Received products and bill from Patsy's Automotive Supplies on PO number 1005. Received cash from Samantha Wilson for a Hand Wash and Exterior Polish and Wax services. Sold Hand Wash and Engine Clean services to Pam Swanson on account. Write check number 10018 to GLJ Car Detail Supplies for miscellaneous supplies; $87.15. Received check number 377 from Larry James for a Hand Wash with Interior and Exterior Wax services, along with a package of Wash Mitts, Interior Cleaner, and Rubbing Compound. Pay Patsy's Automotive Services and Rosey & Girls Auto Supply bills; due 12/21/21; starting check number 10019. Deposit all funds held in Undeposited Funds into the Checking account. CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/17/2021 and verify that your figures match those shown here. Account Balance Checking $11,145.49 Accounts Receivable $6,911.66 Accounts Payable $1,079.38 Visa $564.30 California Department of Tax Payable $28.85 Week 4 Monday, December 20, 2021 . Chris and Eric both withdrew a $3,000 distribution: Create two new equity accounts: Chris Partner Distribution and Eric Partner Distribution Create two checks: Chris Christian, first payee; Eric Christian, set to print later. Pay all the bills due to GL) Car Detail Supplies and WebWorks, set to print later, Print all the checks in the Print Checks queue; starting check number 10021 Invoice Dan Greany for a Full Interior/Exterior Detail service for a large car. Received check number 3247 from Seth David for a Full Exterior Detail for a small car, Vinyu Rubber Dressing and Leather Conditioner. Received check number 488 from Pam Swanson for Invoice number 21-134. Write a check to Betty's Cleaning Service for $75; for office cleaning, check number 10025 Received cash from Carlos Espinosa for an Interior Detail for a small car, Odor Elimination, and Trunk Shampoo services, as well as Dry Towels and Interior Cleaner Tuesday, December 21, 2021 Invoice Mike Carson at Carson Auto Sales for small-vehicle and 2 large-vehicle Full Interior/ Exterior Detail services. Received check number 164 from Mary Crofoot for a Paint Protection service for a large car, a package of Wash Mitts, Dry Towels, Window Cleaner, and Glass Polish. Received check number 1808 from Ericka Jenson for the balance of Invoice number 21-132 and Invoice number 21-138. Received a bill from Galen Bros. Interiors for holiday decorations for the lobby; $218.00, due on receipt (Office Expenses). Received a bill from Raincross Power and Gas for service from December 1 through December 17; $205; due on receipt. Deposit all the funds held in Undeposited Funds into the checking account Invoice Summit Auto Resellers, 149 So. Armor Rd., Norco, CA 92505, for 8 small-car and 8 large-car Full Interior/Exterior Detailing services, plus Odor Elimination in all cars. moccount Wednesday, December 22, 2021 Received a bill from Dee Motor Company for miscellaneous supplies: $189.25, due on receipt. Pay all the bills due in December 2021; starting check number 10026. Received the telephone and Internet bill from Raincross Telephone and paid online from checking account: $247.85. (Record as a debit card transaction.) Ordered two Ceiling Boom Wash Systems from Ultimate Washer, each includes a Ceiling Boom, Wand, and Accessories; wrote check number 10029 for $3,300. Equipment has a three- year expected life; will be installed the week of December 27. (Create a Fixed Asset account: Equipment.) Bought 10 $100 gift cards at the bank for vendor and customer holiday gifts; used debit card from checking account (General Operating Expense) Bought some point and wallpaper to spruce up the lobby: Visa card $213.11 (Repairs and Maintenance) Bought a used display cabinet, some lobby chairs, a table, and a used flat screen TV for $650 from neighboring business that is remodeling; wrote check to T&M Motors (General Operating Expense) Stopped by Patsy's Automotive Supplies and picked up and paid for 10 gallons of Jack's Superior Car Wash Cleaner; paid $139.90 with Visa card; dropped off a holiday greeting with a gift card. Thursday, December 23, 2021 Stopped by GLJ Car Detail Supplies and picked up and paid for 5 containers for Mimi's Upholstery and Carper Cleaner at $60 each; paid with Visa card; dropped off a holiday greeting with two gift cards Transferred $5,000 from Savings to Checking. Write check number 10031 to Holiday Kitchen for $2,000; donation for toys and food for families CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/23/2021 and verify that your figures match those shown here. Account Balance Checking $4,969.76 Accounts Receivable $9,296.66 Accounts Payable $91.05 Visa $1,217.31 Board of Equalization $34.55 Prepare Your Deliverables-Set 2 QG To complete this segment of the project, prepare the following deliverables and export to Excel: A report displaying the summary of balances each customer owes at December 23, 2021, saved as: CH13 AR Aging Summary 12.23.21 To A report displaying the purchase details for each vendor ot December 23, 2021. saved os CH13 Purchase Details 12.23.21 A trial balance report at December 23, 2021, saved as: CH13 Trial Balance 12.23.21 Make Adjustments and Reconcile Accounts Chris and Eric are closing for the holiday week from December 24 to January 3 to purchase and install new equipment. Although the business is closed for the week, there is lors of activity needed adjustments, download the bank and credit card transactions, and reconcile the bank and related to purchasing and installing the new equipment. You will use this opportunity to make any credit card accounts. Finally, you will prepare the financial reports for Chris and Eric. Week 5 Monday, December 27, 2021 Pay Tony Ortiz with Visa card $550 for plumbing services for the new equipment; use the Fixed Asset account: Equipment. Write a check to A+ Delivery for $125 for the delivery from Ultimate Washer; use the Fixed Asset account: Equipment; check should be number 10032 Tuesday, December 28, 2021 Write a check for $650 to Ernie Molina and Company for installation of the new equipment (Fixed Asset account: Equipment). Wednesday, December 29, 2021 . There are discrepancies between actual physical inventory and reported inventory. Use this worksheet to make the necessary adjustments; use the cost of Goods Sold account: Inventory Shrinkage Raincross Auto Detailing Physical Inventory Worksheet Hand 6 Count 6 29 Product Dry Towels Glass Polish Interior Cleaner Leather Conditioner Paste Wax Rubbing Compound Vinyl Rubber Dressing Wash Mitts Wheel Rim Polish Window Cleaner Description Micro Fiber Dry Towels 3 pack Jasper's 8 oz Glass Polish Jasper's 16 oz interior Cleaner Rosey's 6 oz Leather Conditioner Roseys Exterior Paste Wax Roseys 12 oz Rubbing Compound Roseys 8 oz VinyRubber Dressing Micro Fiber Wash Mitts, 3 pack Rosey's 16 oz Wheel Rim Polish Cleaner Jasper's 14 oz Window Cleaner 13 12 11 9 29 1 10 10 11 9 9 30 Remoncile Accounts Prepare purchase orders as follows: GLI Car Detail Supplies: 5 Brushes at $19.99 5 Buckets at $18.49, 10 Dry Towels at $5 25 . Patsy's Automotive Supplies: 20 units of Window Cleaner at $1.75 Rosey & Girts Auto Supply: 10 units of Leather Conditioner Monday, January 3, 2022 Eric Christian sent you an email about some debit and credit card transactions mode last week during the installation. The emal said, "Purchased some gos for delivery at Patel's, you may need to set up a new account for automobile expenses. Bought lunch for everyone at Oscar's, is there an account for Meals and Entertainment? If not, please set one up." Eric included a copy of a receipt for $450 from PriceCo with "GenOpExp" noted on it. Keep all this in mind as you complete these tasks Upload the checking (CH13 Raincross Business Bank 4673.csv) and credit card (CH13 Visa Raincross December 2021.csv) transactions for December 2021 into the appropriate account via Banking Uplood transactions manually-File Uplood. Match or add all transactions Reconcile the bank checking account, savings account, and credit card statements for December 2021. (CH13 Raincross Business Bank Statement.pdf, CH13 Raincross Business Bank Savings Statement.pdf, CH13 Visa Statement.pdf) Create a trial balance report for December 2021 Prepare the following adjusting entry for December 31, 2021: Record the December web hosting expense (use Advertising/Promotion expense) and then make the entry recurring for the following eleven months. Print the Recurring Transactions report to PDF, CHECK FIGURE Display your trial balance report for December 31, 2021 and verify that your figures match those shown here. Account Balance Checking $3,61768 Accounts Receivable $9,296.66 Inventory $546.13 Prepare Your Deliverables-Set 3 QG Produce the following end-of-period reports for Chris and Eric Christian, customizing them as necessary. Export each to Excel. . Trial balance report for December 31, 2021, saved as: CH13 Trial Balance 12.31.21 Balance sheet report for December 31, 2021 (Total Assets equal $27,635.47), saved as: CH13 Balance Sheet 12.31.21 Income statement for the month of December 2021 (rename the profit and loss Statement; Net Income equals $13,688.63.), saved as: CH13 Income Statement Dec 2021 Inventory valuation summary report as of December 31, 2021, saved as: CH13 Inventory Valuation Summary 12.31.21 266 QuickBooks Online Chapter 13: Bringing It All Together! B Project: Raincross Auto Detailing Case Study Brothers Chris and Eric Christian are going to open a small automobile detailing business in a converted vintage gasoline station. They are using Raincross in their name to help connect their business to the community, which uses the Raincross symbol in its flag and other civic institutions. They will open on December 1, 2021. You will set up and keep the books for this first month. As you work in the company file, you will add new customers, vendors, and other information as needed. You will use your own problem-solving skills to complete the project. Throughout the project, you will produce deliverables for evaluation. are welcome to use help and the information in this course to accomplish all the tasks. Brothers Chris and Eric Christian are going to open a small automobile detailing business in a converted vintage gasoline station. They are using Raincross in their name to help connect their business to the community, which uses the Raincross symbol as its flag and other civic institutions. They will open on December, 2021. You will set up and keep the books for the first month. As you work in the company file, you will add new customers, vendors, and other information as needed. You will use your own problem-solving skills to complete the report. You are welcome to use help and the information in this course to accomplish all the tasks. Good luck! Tasks to complete and submit (pg. 266): 1. Trial balance report for December 31, 2021, saved as: CH13 Trial Balance 12.31.21 2. Balance sheet report for December 31, 2021 (Total Assets equal $27,635.47), saved as: CH13 Balance Sheet 12.31.21 3. Income statement for the month of December 2021 (rename the profit and loss Statement, Net Income equals $13,688.63.), saved as: CH13 Income Statement Dec 2021 4. Inventory valuation summary report as of December 31, 2021, saved as: CH13 Inventory Valuation Summary 12.31.21 New Company Set Up Chris has been operating a mobile automobile detailing business for a few months. He and his brother, Eric, decide to rent a garage to offer onsite auto detailing and retail some products. They will use Chris's existing customer base. You are responsible for creating the new company file and adding details about customers, vendors, products, services, and more 8. Use this information to create the new company data file: Business Name Raincross Auto Detailing (Add your name) Business Address 1807 Hamburg Ave., Riverside, CA 92501 Phone 951-555-1114 Industry Automotive Repair and Maintenance What Do You Sell? Products and Services Business Type Partnership What Would You Like Invoicing, Expenses, Inventory, Sales, Bills, to Do in QuickBooks? Sales Tax Employer Tax ID 99-9999991 Purchase Orders Turn on feature Tax Year January Tax Form Form 1065 Accounting Method Accrual Default Sales Term Net 15 Logo Add CH13 Raincross Logo.png, located in your Chapter 13 folder. 9. Use this information to create the bank and credit card accounts: Opening Balance $13,000 Opening Date November 30, 2021 Account Name Checking - Raincross Business Bank 4673 Savings - Raincross Business Bank Credit Card - Visa $5,000 November 30, 2021 $0 November 30, 2021 10. Add or edit the Chart of Accounts to match the Chart of Accounts below ACCOUNT TYPE Bank Bank Other Current Assets Other Current Credit Card Other Current Louis Other Current Liabilities Equity Equity Checking - Raincross Business Bank 4673 Savings - Raincross Business Bank Inventory Asset Uncategorized Asset Credit Card - Visa California Department of Tax and Fee Administration Pay Out of Scope Agency Payable Opening Balance Equity Owner's Investment Owner's Pay & Personal Expenses Retained Earnings Billable Expense Income Soles of Product Income Services Uncategorized Income Cost of Goods Sold Advertising/Promotional Ask My Accountant Bank Charges & Fees Car & Truck Contractors General Operating Expenses Insurance Interest Paid Legal & Professional Services Meals & Entertainment Office Supplies and Software Purchases Reimbursable Expenses Rent & Lease Repair & Maintenance Service Supplies Taxes & Licenses Travel Uncategorized Expense Utilities Other Miscellaneous Expense Equity Income Income Income Income Cost of Goods Sold Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Other Expenses 11. Regarding sales tax: All customers will be taxable; all products (but not services) will be taxable . There are no sales outside of California Tax Period Start: [use the current month) Frequency to File Tax Return:select Monthly Start Date for Collecting Sales Tax: (use the current date) Tax rate: 8.5% (you will override the sales tax amount on each sales document that has a product sold) 12. Set up or import existing customers. You can use this information to create entries one at a time or use the Import Customers feature to import all the customers at once (CH13 Customer List.xls) CA CA 1. We CA can - 130 1-6-456 OFW CA 90 Lad More CA CA non ute Wholesalcem 13. Set up or import existing vendors. You can use the following information to create entries one at a time or use the Import Vendors feature to import vendors all at once (CH13 Vendor List.xls) we 201 West side | CA Scheider Man Show More. Gay W DW CA CA GUO Del Supple 14. Set up the Products and Services List by adding or importing the following non-taxable services and non-inventory products (CH13 Services and Noninventory.xls): Rock Chip Windows Rock Chip Wide Automotive Part Set Repair Service Serie Penter for Rent 25. Services 2000 and we were Flere Sen 25.00 75.00 45.00 Services Sens Services 15.00 25.00 Servis Services hape why Shanghai Engine Exterior Polish and W Erior Wax Water Sport Remove Vinyleather Trumpere Thumper Dress Shampoo Trunk Paint Protection Car Paint Protectional Car |Panthaa Panoraction |uriralatra Danisamalare Rullleri/terior Detailing large Car C Fuiletarter Desing Star Pullarior Detailing Small Car Pullingwear Rarior Detailing large Car Interior Dewi Saw Interior Dewi wewe Brushes Raps Senta Service Service Senio Seria Service Service Service 225.00 Services Services Service Service 18000 100.00 140.00 War Hores Www Hos Paper Hand Towel Paper Hand Towels Mimi's Upholstery and Carpet Clean Ja Superior Better Car Wash Cleaner Clemer Service Supplies Service Supplies Service Supplies Service Supplies Service Supplies Service Supplies Use Sales of Product Income as the Income account, Cost of Goods Sold as the Expense 15. Add or import (CH13 Inventory.xlsx) the following inventory products: All items have zero inventory on the current date. account, and Inventory Asset as the Inventory Asset account. All inventory products are taxable. Dy we We My 11.00 10 Prepare Your Deliverables-Set 1 QG To complete this segment of the project, prepare the following deliverables and export to Excel Chart of Accounts list, saved as: CH13 Chart of Accounts Products and Services List, saved as: CH13 Products and Services Customers list, saved as: CH13 Customers Vendors list, saved as: CH13 Vendors Create Daily Transactions In this segment of the project, you will create the daily transactions as described for each day, adding customers, vendors, and accounts as necessary, Opportunities to check your figures appear along the way, please be sure your figures match those provided here before moving on. Keep in mind that you will need to add Riverside, CA 92501 to each taxable sales transaction and you may need to overwrite the calculated sales tax to 8.5%. Week 1 Wednesday, December 1, 2021 Sold a Rock Chip Windshield Repair Service to Larry Bloodneck on account using Invoice number 21-101. (Be sure to enable the custom transaction number in Account and Settings Sales.) Received cash from Dan Greany for Hand Wash with Interior and Electronic Odor Elimination services, using Sales Receipt number 21-102.(Remember to deposit to Undeposited Funds) Received check number 429 from Sean Murphy for Hand Wash and Engine Clean services. . Used the Visa card to purchase printer ink at PriceCo for $42.99 Wrote check number 10010 to Scheideman Property Management for $4,500 for three months' rent (December rent plus prepaid rent for January and February) Received check number 461 from Logan Webb for Rock Chip Windshield Repair service. Invoice Mike Carson at Carson Car Sales for 4 small-vehicle and 3 large-vehicle Full Interior/ Exterior Detail services: Invoice number 21-105 (51,395). Received cash from Solly Cassen for Paint Protection service for large van. Create a purchase order to Patsy's Automotive Supplies for 30 units of Window Cleaner, 25 of Glass Polish, and 25 of Interior Cleaner Create a purchase order to GLI Car Detail Supplies for 20 Wash Mitts and 20 Dry Towels. Create a purchase order to Rosey & Girls Auto Supply, 1511 Seattle Rd, San Diego, CA 92104, for 15 units of Paste Wax, 15 of Vinyl Rubber Dressing, 10 of Leather Conditioner, 10 of Wheel Rim Polish, and 15 of Rubbing Compound. Thursday, December 2, 2021 Received cash from Chris McCartney for a Hand Wash with Interior service, Received check number 1465 from Dan Thomas for Paint Protection service for a large SUV. Received a bill from GLJ Car Detail Supplies for $60 for one case of Mimi's Upholstery and Carpet Cleaner (Be sure to select Item Details.) Received cash from Deborah Michaels for Hand Wash with Interior and Electronic Odor Elimination services. Purchased office supplies from Office Superstore for $109.74 with Visa card. Sold Engine Clean and Hand Wash to Becky Craig on account. Received check number 1642 from Stephen Markley for a Full Interior/exterior Detail service for a small car Friday, December 3, 2021 Received a bill from Johnson Insurance Co. (Colleen Johnson) for $154.30 for Liability Insurance; due in 15 days. . Purchased water, soda, and snacks for the waiting room from Thompson's Grocery with Visa card; $36.55 (Office Supplies & Software). Received a bill from Patsy's Automotive Supplies for $311.87 for 8 gallons of Jack's Superior Exterior Car Wash at $13.99 a gallon and 5 bundles of Rags at $39.99 a bundle; terms Net 15 days Invoice Ericka Jenson at Jenson Auto Wholesalers for 7 small cars and 2 large cars, Full Interior/Exterior Detail services. Receive the products and the bill from GLJ Car Detail Supplies for purchase order number 1002; terms Net 15. Received the products and the bill from Patsy's Automotive Supplies for purchase order number 1001; terms Net 15. Deposit all the funds in Undeposited Funds into the checking account. (Deposit amount should be $705.) CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/03/2021 and verify that your figures match those shown here. Account Balance Checking $9,205 Accounts Receivable $3,225 Accounts Payable $985.67 Visa $189.28 Week 2 Monday, December 6, 2021 Sold a Paint Touch Up Repair to Mike Carson at Carson Car Sales on account 20 Invoice Ericka Jenson at Jenson Auto Wholesales for 5 small-car Full Interior/Exterior Detailing Services: Invoice number 21-114. Sold a Full Interior/Exterior Detailing service for a large SUV to Mike McCollough on account: terms Net 15. Received a bill from Patsy's Automotive Supplies for $55.96 for 4 gallons of Jock's Superior Exterior Car Wash at $13.99 a gallon. Received check number 622 from Felicity York for a Rock Chip Windshield Repair service. Received products and bill from Rosey & Girts Auto Supply for PO number 1003; terms Net 15. Received check number 449 from Sean Murphy for Exterior Hand Wash and Engine Clean services as well as one Window Cleaner and a package of Wash Mitts. (Remember to add California Sales Tax.) Received payment from Becky Craig, check number 510 for Invoice number 21-110 Invoice Annette Helsper for a Hand Wash with Interior service and a package of Wash Mitts, a Dry Towel 3-pack, Window Cleaner, and Interior Cleaner. Tuesday, December 7, 2021 Received check number 884 from Skye Simpson for Paint Protective service for a large car and Interior Cleaner and a package of Dry Towels. Invoice Mike Carson at Carson Auto Sales for 4 small vehicles and 1 large vehicle, Full Interior/ Exterior Detailing services Received payment (check number 2503) from Larry Bloodneck for Invoice number 21-101. Received a bill from WebWorks, 1520 So. Main Ave., Corona, CA 92882, for a year (December through November) of web hosting for $600; terms Net 15. Received a bill from GLJ Car Detail Supplies for $120 for two cases of Mimi's Upholstery and Carpet Cleaner at $60 a case; terms Net 15. Received cash from Cynthia Swan for a Hand Wash with Interior and Electronic Odor Elimination services, as well as a package of Wash Mitts, a pack of Dry Towels, Window Cleaner, and Glass Polish. (Total was $93.64.) Received check number 1707 from Mike Carson for Invoice number 21-105. Wednesday, December 8, 2021 Purchased carpet for the lobby from Galen Bros. Interiors using the company Visa card for $209.45; (General Operating Expense). Invoice Dan Thomas for a Hand Wash with Interior along with Dry Towels, Rubbing Compound, Vinyl/Rubber Dressing, and Leather Conditioner, terms Net 15 Sold Paint Protection service for a large vehicle to Lesli Johns for cash. Purchased water, soda, and snacks for the waiting room at Thompson's Grocery with Visa card for $41.92 Invoice Mike Corson at Carson Auto Sales for 4 small vehicles and 5 large vehicles, Full Interior/Exterior Detail service. Sold a Hand Wash with Interior and Vinyl/Rubber Dressing to John McNay on account. Received a bill from GL Car Detail Supplies for $38.48 for a package of Brushes at $19.99 each and a 3-pack of Buckets at $18.49 each. Thursday, December 9, 2021 Received check number 257 from Scott Johnie for Paint Protection and Automotive Paint Sealant Repair for a large car, along with Dry Towels, Paste Wax, Interior Cleaner, and Leather Conditioner; total was $295.57 Received check number 1668 for $700 as payment on account from Jenson Auto Wholesalers; apply to Invoice number 21-112 Received check number 3355 from Mike Carson for Invoice number 21-113. Paid Simpson's Pizzeria $38.44 for a customer appreciation lunch with checking account debit card; (Meals & Entertainment). Sold an Interior Detailing package for a large car to Roxy Holden for cash. Deposit all funds held in Undeposited Funds into checking account ($3,171.10). Friday, December 10, 2021 Received check number 918 from Kimmy Lear for a Paint Protection service for a small car as well as Dry Towels, Glass Polish, Paste Wax, and Leather Conditioner Invoice Chris McCartney for a Full Interior/Exterior Detail service for small car; terms Net 15. Received cash from Stacey Byrne for an Interior Detail service for a small car, Leather Conditioner, and Rubbing Compound. Received check number 446 from Logan Webb for a Hand Wash with Interior service. Paid Wally's, the window washer, $55 with Visa card (Repairs and Maintenance). Invoice Ericka Jenson of Jenson Auto Wholesalers for 6 small cars and 5 large cars, Full Interior/Exterior Detailing. Pay all the bills due on or before December 18, 2021; starting check number 10011. Deposit all funds held in Undeposited Funds into checking account. . . CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/10/2021 and verify that your figures match those shown here. Account Balance Checking $11,641.01 Accounts Receivable $7,499.64 Accounts Payable $1,159.59 Visa $495.65 Week 3 Monday, December 13, 2021 Wrote check number 10014 to Betty's Cleaning Service for office cleaning for $75: (Repairs and Maintenance) Received a bill from City Water Works for $29.88 for water use from December 1 to December 9, 2021 Received a bill from District Waste Management for $25 for trash pickup for December 1 to December 9, 2021 . The local high school had a car wash fundraiser. Raincross donated 5 packs of Dry Towels and 5 packs of Wash Mitts. Create an inventory adjustment to reduce the inventory and then add a new Charitable Contributions expense account. Sold a Full Exterior Detailing service package for a large SUV to Dan Thomas, on account. Received check number 8811 from Mike McCollough for Invoice number 21-115. Purchased general office supplies from Office Superstore with Visa card; $87.40. Create a purchase order to GLJ Car Detail Supplies for 10 gallons of Jack's Superior Exterior Car Wash Cleaner at $13.99 a gallon and 5 Water Hoses at $17.99. Invoice Pam Swanson for 2 Hand Wash with Interior services and 1 Full Interior/Exterior Detailing for a large car. Tuesday, December 14, 2021 Received the products and the bill from GL Car Detail Supplies, PO number 1004, ordered on December 13, 2021; terms Net 15. Returned a stapler purchased at Office Superstore; record a credit card credit for $18.75. Wrote check number 10015 to Dee Motor Company for miscellaneous service supplies and accessories for the display case in the lobby: $258.45 (Service Supplies). Invoiced Mike Carson at Carson Auto Sales for 10 small-car Full Interior/Exterior Detailing services, 6 large-car Full Interior/Exterior Detailing services, and 1 Electronic Odor Elimination. Received check number 1770 from Ericka Jenson for the balance on Invoice number 21-112 and Invoice number 21-114. Received cash from Lesli Johns for Hand Wash. Invoice Becky Craig for Glass Polish, Vinyl/Rubber Dressing, and Wheel Rim Polish. Wednesday, December 15, 2021 Invoice Ericka Jenson for Jenson Auto Wholesalers for 8 small-car Full Interior/Exterior Detail services and 2 Electronic Odor Eliminations Mike Carson, check number 1414 for Invoice numbers 21-120 and 21-124 Annette Helsper, check number 1004 for Invoice number 21-118 Sold Mark Biggs a Full Exterior Detailing for a small car, Mark paid with check number 577. Becky Craig returned the Wheel Rim Polish purchased on the 14th for credit; issue a Credit Memo . Becky Craig paid her balance due with cash: $13.02. Pay the bills from City Water Works and District Waste Management. Deposit all the funds held in Undeposited Funds to the checking account ($5,189.91). Thursday, December 16, 2021 . Transfer $6,000 from the Checking account to the Savings account. Invoice Steven Sims for Rock Chip Windshield Repair and Hand Wash services, as well as a package of Wash Mitts, Dry Towels, Window Cleaner, Wheel Rim Polish, and Interior Cleaner. Create a purchase order for Patsy's Automotive Supplies for 15 units of Jasper's Window Cleaner 14 oz., 10 of Jasper's Glass Polish 8 oz., and 10 of Jasper's Interior Cleaner 16 oz. Received cash from Amber Williams for Hand Wash with Interior service and Leather Conditioner Received cash from Sean Murphy for Hand Wash. Received payment from Dan Thomas, check number 448 for Invoice number 21-122 Received payment from John McNay, check number 1418 for Invoice number 21-125. Friday, December 17, 2021 Received check from Ericka Jenson on account; check number 1801 for $800. Apply to Invoice number 21-132 Received products and bill from Patsy's Automotive Supplies on PO number 1005. Received cash from Samantha Wilson for a Hand Wash and Exterior Polish and Wax services. Sold Hand Wash and Engine Clean services to Pam Swanson on account. Write check number 10018 to GLJ Car Detail Supplies for miscellaneous supplies; $87.15. Received check number 377 from Larry James for a Hand Wash with Interior and Exterior Wax services, along with a package of Wash Mitts, Interior Cleaner, and Rubbing Compound. Pay Patsy's Automotive Services and Rosey & Girls Auto Supply bills; due 12/21/21; starting check number 10019. Deposit all funds held in Undeposited Funds into the Checking account. CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/17/2021 and verify that your figures match those shown here. Account Balance Checking $11,145.49 Accounts Receivable $6,911.66 Accounts Payable $1,079.38 Visa $564.30 California Department of Tax Payable $28.85 Week 4 Monday, December 20, 2021 . Chris and Eric both withdrew a $3,000 distribution: Create two new equity accounts: Chris Partner Distribution and Eric Partner Distribution Create two checks: Chris Christian, first payee; Eric Christian, set to print later. Pay all the bills due to GL) Car Detail Supplies and WebWorks, set to print later, Print all the checks in the Print Checks queue; starting check number 10021 Invoice Dan Greany for a Full Interior/Exterior Detail service for a large car. Received check number 3247 from Seth David for a Full Exterior Detail for a small car, Vinyu Rubber Dressing and Leather Conditioner. Received check number 488 from Pam Swanson for Invoice number 21-134. Write a check to Betty's Cleaning Service for $75; for office cleaning, check number 10025 Received cash from Carlos Espinosa for an Interior Detail for a small car, Odor Elimination, and Trunk Shampoo services, as well as Dry Towels and Interior Cleaner Tuesday, December 21, 2021 Invoice Mike Carson at Carson Auto Sales for small-vehicle and 2 large-vehicle Full Interior/ Exterior Detail services. Received check number 164 from Mary Crofoot for a Paint Protection service for a large car, a package of Wash Mitts, Dry Towels, Window Cleaner, and Glass Polish. Received check number 1808 from Ericka Jenson for the balance of Invoice number 21-132 and Invoice number 21-138. Received a bill from Galen Bros. Interiors for holiday decorations for the lobby; $218.00, due on receipt (Office Expenses). Received a bill from Raincross Power and Gas for service from December 1 through December 17; $205; due on receipt. Deposit all the funds held in Undeposited Funds into the checking account Invoice Summit Auto Resellers, 149 So. Armor Rd., Norco, CA 92505, for 8 small-car and 8 large-car Full Interior/Exterior Detailing services, plus Odor Elimination in all cars. moccount Wednesday, December 22, 2021 Received a bill from Dee Motor Company for miscellaneous supplies: $189.25, due on receipt. Pay all the bills due in December 2021; starting check number 10026. Received the telephone and Internet bill from Raincross Telephone and paid online from checking account: $247.85. (Record as a debit card transaction.) Ordered two Ceiling Boom Wash Systems from Ultimate Washer, each includes a Ceiling Boom, Wand, and Accessories; wrote check number 10029 for $3,300. Equipment has a three- year expected life; will be installed the week of December 27. (Create a Fixed Asset account: Equipment.) Bought 10 $100 gift cards at the bank for vendor and customer holiday gifts; used debit card from checking account (General Operating Expense) Bought some point and wallpaper to spruce up the lobby: Visa card $213.11 (Repairs and Maintenance) Bought a used display cabinet, some lobby chairs, a table, and a used flat screen TV for $650 from neighboring business that is remodeling; wrote check to T&M Motors (General Operating Expense) Stopped by Patsy's Automotive Supplies and picked up and paid for 10 gallons of Jack's Superior Car Wash Cleaner; paid $139.90 with Visa card; dropped off a holiday greeting with a gift card. Thursday, December 23, 2021 Stopped by GLJ Car Detail Supplies and picked up and paid for 5 containers for Mimi's Upholstery and Carper Cleaner at $60 each; paid with Visa card; dropped off a holiday greeting with two gift cards Transferred $5,000 from Savings to Checking. Write check number 10031 to Holiday Kitchen for $2,000; donation for toys and food for families CHECK FIGURE Display your trial balance report from 12/01/2021 through 12/23/2021 and verify that your figures match those shown here. Account Balance Checking $4,969.76 Accounts Receivable $9,296.66 Accounts Payable $91.05 Visa $1,217.31 Board of Equalization $34.55 Prepare Your Deliverables-Set 2 QG To complete this segment of the project, prepare the following deliverables and export to Excel: A report displaying the summary of balances each customer owes at December 23, 2021, saved as: CH13 AR Aging Summary 12.23.21 To A report displaying the purchase details for each vendor ot December 23, 2021. saved os CH13 Purchase Details 12.23.21 A trial balance report at December 23, 2021, saved as: CH13 Trial Balance 12.23.21 Make Adjustments and Reconcile Accounts Chris and Eric are closing for the holiday week from December 24 to January 3 to purchase and install new equipment. Although the business is closed for the week, there is lors of activity needed adjustments, download the bank and credit card transactions, and reconcile the bank and related to purchasing and installing the new equipment. You will use this opportunity to make any credit card accounts. Finally, you will prepare the financial reports for Chris and Eric. Week 5 Monday, December 27, 2021 Pay Tony Ortiz with Visa card $550 for plumbing services for the new equipment; use the Fixed Asset account: Equipment. Write a check to A+ Delivery for $125 for the delivery from Ultimate Washer; use the Fixed Asset account: Equipment; check should be number 10032 Tuesday, December 28, 2021 Write a check for $650 to Ernie Molina and Company for installation of the new equipment (Fixed Asset account: Equipment). Wednesday, December 29, 2021 . There are discrepancies between actual physical inventory and reported inventory. Use this worksheet to make the necessary adjustments; use the cost of Goods Sold account: Inventory Shrinkage Raincross Auto Detailing Physical Inventory Worksheet Hand 6 Count 6 29 Product Dry Towels Glass Polish Interior Cleaner Leather Conditioner Paste Wax Rubbing Compound Vinyl Rubber Dressing Wash Mitts Wheel Rim Polish Window Cleaner Description Micro Fiber Dry Towels 3 pack Jasper's 8 oz Glass Polish Jasper's 16 oz interior Cleaner Rosey's 6 oz Leather Conditioner Roseys Exterior Paste Wax Roseys 12 oz Rubbing Compound Roseys 8 oz VinyRubber Dressing Micro Fiber Wash Mitts, 3 pack Rosey's 16 oz Wheel Rim Polish Cleaner Jasper's 14 oz Window Cleaner 13 12 11 9 29 1 10 10 11 9 9 30 Remoncile Accounts Prepare purchase orders as follows: GLI Car Detail Supplies: 5 Brushes at $19.99 5 Buckets at $18.49, 10 Dry Towels at $5 25 . Patsy's Automotive Supplies: 20 units of Window Cleaner at $1.75 Rosey & Girts Auto Supply: 10 units of Leather Conditioner Monday, January 3, 2022 Eric Christian sent you an email about some debit and credit card transactions mode last week during the installation. The emal said, "Purchased some gos for delivery at Patel's, you may need to set up a new account for automobile expenses. Bought lunch for everyone at Oscar's, is there an account for Meals and Entertainment? If not, please set one up." Eric included a copy of a receipt for $450 from PriceCo with "GenOpExp" noted on it. Keep all this in mind as you complete these tasks Upload the checking (CH13 Raincross Business Bank 4673.csv) and credit card (CH13 Visa Raincross December 2021.csv) transactions for December 2021 into the appropriate account via Banking Uplood transactions manually-File Uplood. Match or add all transactions Reconcile the bank checking account, savings account, and credit card statements for December 2021. (CH13 Raincross Business Bank Statement.pdf, CH13 Raincross Business Bank Savings Statement.pdf, CH13 Visa Statement.pdf) Create a trial balance report for December 2021 Prepare the following adjusting entry for December 31, 2021: Record the December web hosting expense (use Advertising/Promotion expense) and then make the entry recurring for the following eleven months. Print the Recurring Transactions report to PDF, CHECK FIGURE Display your trial balance report for December 31, 2021 and verify that your figures match those shown here. Account Balance Checking $3,61768 Accounts Receivable $9,296.66 Inventory $546.13 Prepare Your Deliverables-Set 3 QG Produce the following end-of-period reports for Chris and Eric Christian, customizing them as necessary. Export each to Excel. . Trial balance report for December 31, 2021, saved as: CH13 Trial Balance 12.31.21 Balance sheet report for December 31, 2021 (Total Assets equal $27,635.47), saved as: CH13 Balance Sheet 12.31.21 Income statement for the month of December 2021 (rename the profit and loss Statement; Net Income equals $13,688.63.), saved as: CH13 Income Statement Dec 2021 Inventory valuation summary report as of December 31, 2021, saved as: CH13 Inventory Valuation Summary 12.31.21 266 QuickBooks Online Chapter 13: Bringing It All Together! B Project: Raincross Auto Detailing Case Study Brothers Chris and Eric Christian are going to open a small automobile detailing business in a converted vintage gasoline station. They are using Raincross in their name to help connect their business to the community, which uses the Raincross symbol in its flag and other civic institutions. They will open on December 1, 2021. You will set up and keep the books for this first month. As you work in the company file, you will add new customers, vendors, and other information as needed. You will use your own problem-solving skills to complete the project. Throughout the project, you will produce deliverables for evaluation. are welcome to use help and the information in this course to accomplish all the tasks