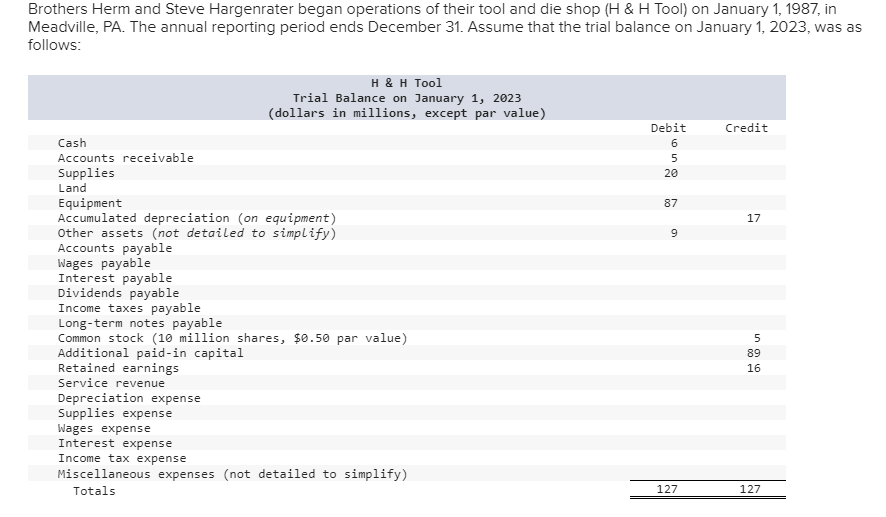

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H & H Tool) on January 1, 1987, in Meadville, PA.

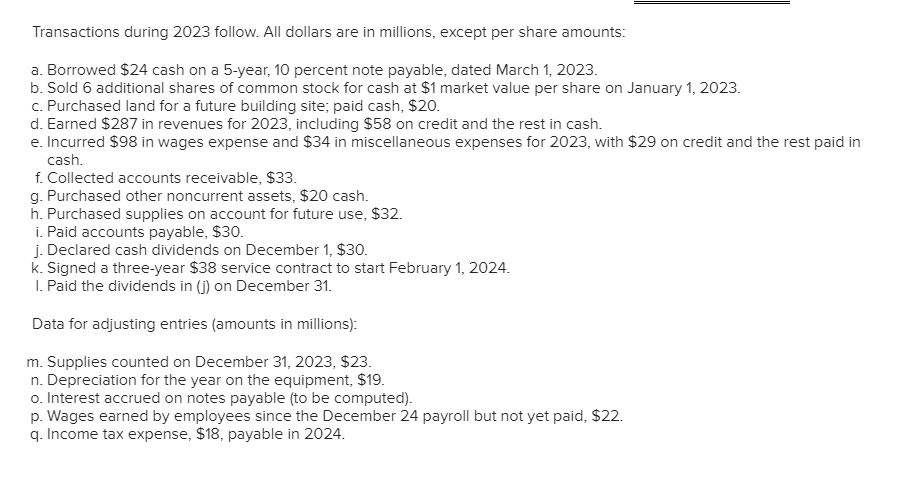

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H & H Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the trial balance on January 1, 2023, was as follows: H & H Tool Trial Balance on January 1, 2023 (dollars in millions, except par value) Cash Debit 6 Credit Accounts receivable 5 Supplies 20 Land Equipment Accumulated depreciation (on equipment) 87 17 9 Other assets (not detailed to simplify) Accounts payable Wages payable Interest payable Dividends payable Income taxes payable Long-term notes payable Common stock (10 million shares, $0.50 par value) Additional paid-in capital Retained earnings Service revenue Depreciation expense Supplies expense Wages expense Interest expense Income tax expense Miscellaneous expenses (not detailed to simplify) Totals 5 89 16 127 127 Transactions during 2023 follow. All dollars are in millions, except per share amounts: a. Borrowed $24 cash on a 5-year, 10 percent note payable, dated March 1, 2023. b. Sold 6 additional shares of common stock for cash at $1 market value per share on January 1, 2023. c. Purchased land for a future building site; paid cash, $20. d. Earned $287 in revenues for 2023, including $58 on credit and the rest in cash. e. Incurred $98 in wages expense and $34 in miscellaneous expenses for 2023, with $29 on credit and the rest paid in cash. f. Collected accounts receivable, $33. g. Purchased other noncurrent assets, $20 cash. h. Purchased supplies on account for future use, $32. i. Paid accounts payable, $30. j. Declared cash dividends on December 1, $30. k. Signed a three-year $38 service contract to start February 1, 2024. I. Paid the dividends in (j) on December 31. Data for adjusting entries (amounts in millions): m. Supplies counted on December 31, 2023, $23. n. Depreciation for the year on the equipment, $19. o. Interest accrued on notes payable (to be computed). p. Wages earned by employees since the December 24 payroll but not yet paid, $22. q. Income tax expense, $18, payable in 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets work through the transactions and prepare the financial statements for H H Tool for the year ended December 31 2023 a Borrowed 24 cash on a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started