Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brougham Packaging is considering expanding its production capacity by purchasing a new machine, the XDC - 4 5 0 . The firm has just spent

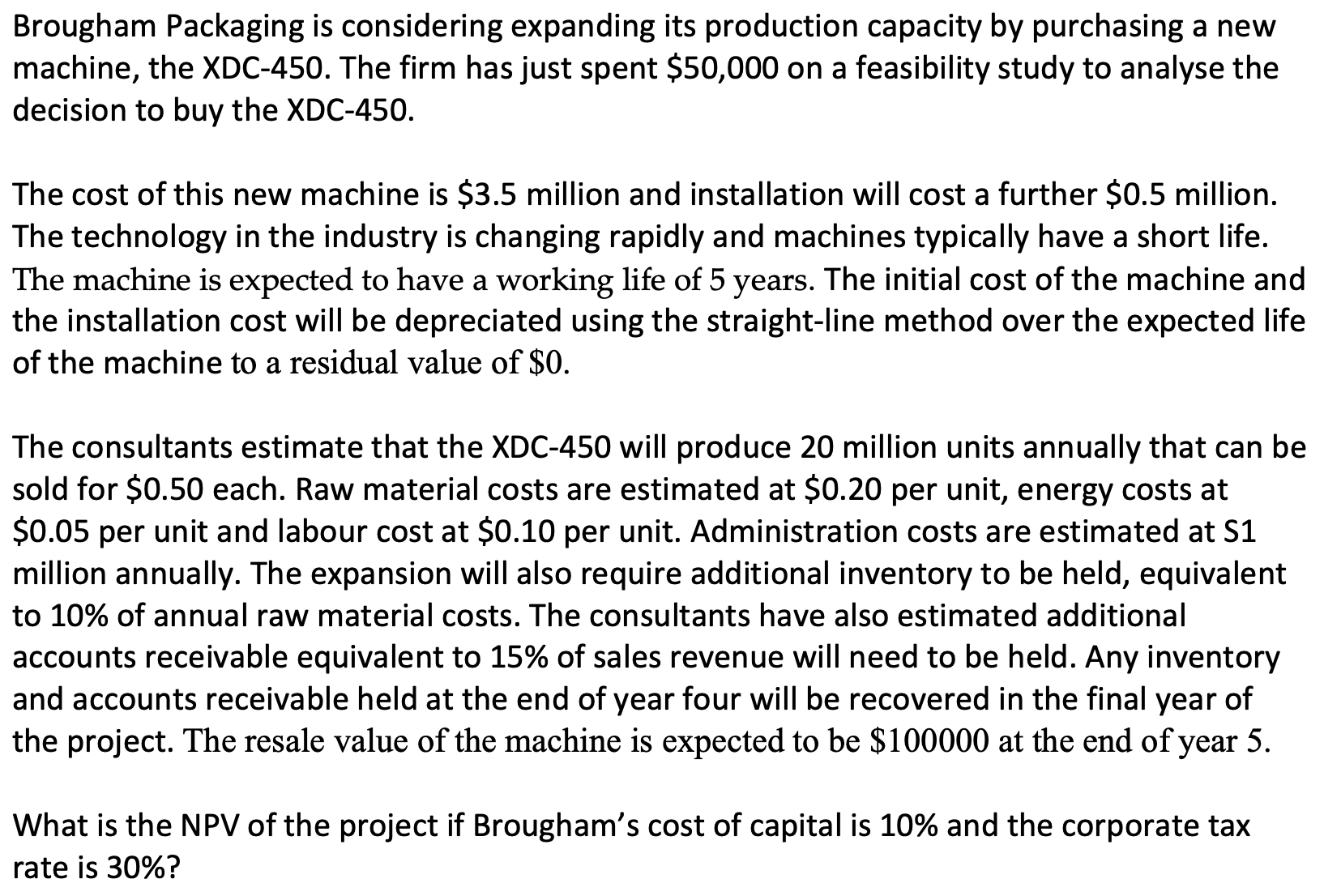

Brougham Packaging is considering expanding its production capacity by purchasing a new

machine, the XDC The firm has just spent $ on a feasibility study to analyse the

decision to buy the XDC

The cost of this new machine is $ million and installation will cost a further $ million.

The technology in the industry is changing rapidly and machines typically have a short life.

The machine is expected to have a working life of years. The initial cost of the machine and

the installation cost will be depreciated using the straightline method over the expected life

of the machine to a residual value of $

The consultants estimate that the XDC will produce million units annually that can be

sold for $ each. Raw material costs are estimated at $ per unit, energy costs at

$ per unit and labour cost at $ per unit. Administration costs are estimated at $

million annually. The expansion will also require additional inventory to be held, equivalent

to of annual raw material costs. The consultants have also estimated additional

accounts receivable equivalent to of sales revenue will need to be held. Any inventory

and accounts receivable held at the end of year four will be recovered in the final year of

the project. The resale value of the machine is expected to be $ at the end of year

What is the NPV of the project if Brougham's cost of capital is and the corporate tax

rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started