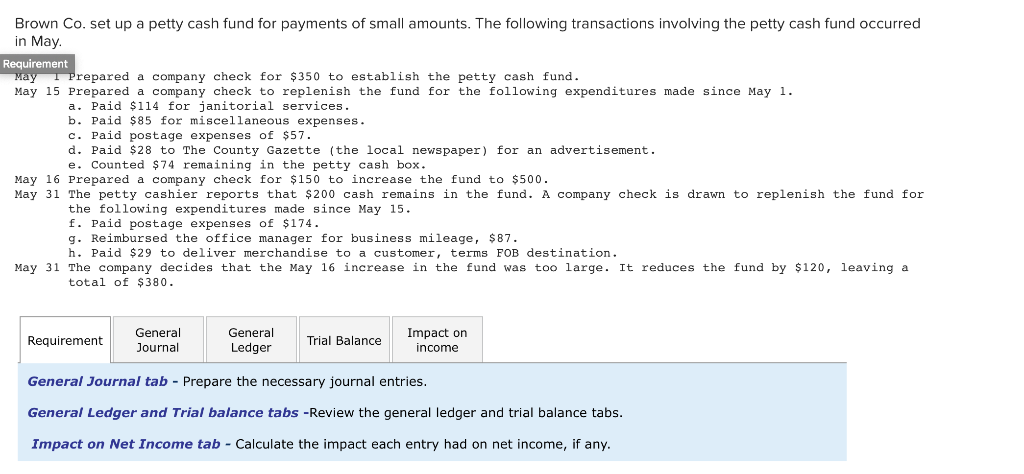

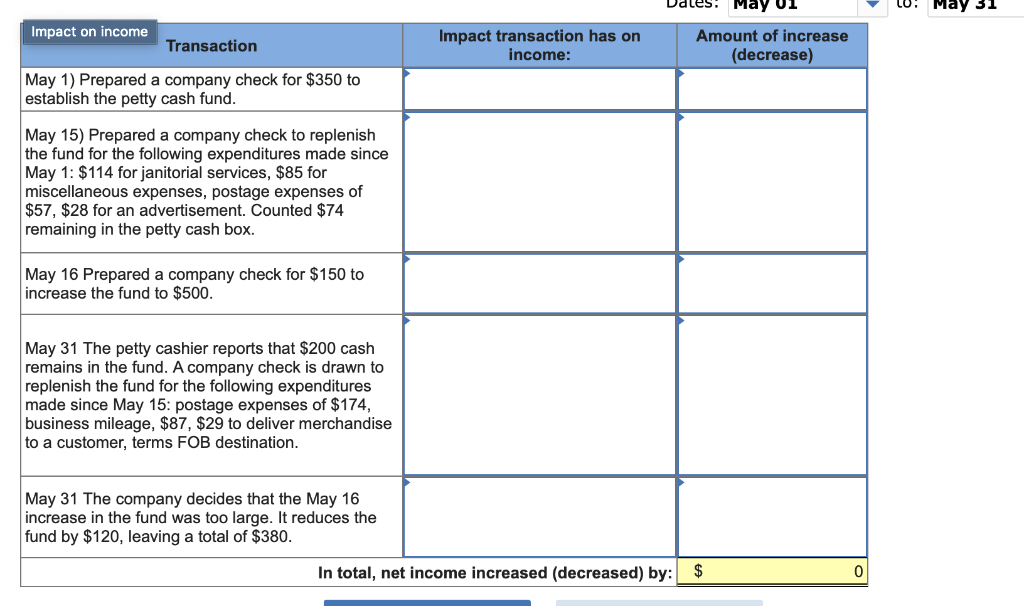

Brown Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May Requirement repared a company check for $350 to establish the petty cash fund May 15 Prepared a company check to replenish the fund for the following expenditures made since May. a. Paid $114 for janitorial services. b. Paid $85 for miscellaneous expenses. c. Paid postage expenses of $57 d. Paid $28 to The County Gazette (the local newspaper) for an advertisement e. Counted $74 remaining in the petty cash box May 16 Prepared a company check for $150 to increase the fund to $500 May 31 The petty cashier reports that $200 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 f. Paid postage expenses of $174. g. Reimbursed the office manager for business mileage, $87. h. Paid $29 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of $380. General ournal General Ledger Impact on income Requirement Trial Balance General Journal tab -Prepare the necessary journal entries General Ledger and Trial balance tabs -Review the general ledger and trial balance tabs Impact on Net Income tab Calculate the impact each entry had on net income, if any Dates. May Impact on income Impact transaction has on income Amount of increase (decrease Transaction May 1) Prepared a company check for $350 to establish the petty cash fund May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $114 for janitorial services, $85 for miscellaneous expenses, postage expenses of $57, $28 for an advertisement. Counted $74 remaining in the petty cash box. May 16 Prepared a company check for $150 to increase the fund to $500 May 31 The petty cashier reports that $200 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15: postage expenses of $174, business mileage, $87, $29 to deliver merchandise to a customer, terms FOB destination May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of $380 In total, net income increased (decreased) by: $ 0 Brown Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May Requirement repared a company check for $350 to establish the petty cash fund May 15 Prepared a company check to replenish the fund for the following expenditures made since May. a. Paid $114 for janitorial services. b. Paid $85 for miscellaneous expenses. c. Paid postage expenses of $57 d. Paid $28 to The County Gazette (the local newspaper) for an advertisement e. Counted $74 remaining in the petty cash box May 16 Prepared a company check for $150 to increase the fund to $500 May 31 The petty cashier reports that $200 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 f. Paid postage expenses of $174. g. Reimbursed the office manager for business mileage, $87. h. Paid $29 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of $380. General ournal General Ledger Impact on income Requirement Trial Balance General Journal tab -Prepare the necessary journal entries General Ledger and Trial balance tabs -Review the general ledger and trial balance tabs Impact on Net Income tab Calculate the impact each entry had on net income, if any Dates. May Impact on income Impact transaction has on income Amount of increase (decrease Transaction May 1) Prepared a company check for $350 to establish the petty cash fund May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $114 for janitorial services, $85 for miscellaneous expenses, postage expenses of $57, $28 for an advertisement. Counted $74 remaining in the petty cash box. May 16 Prepared a company check for $150 to increase the fund to $500 May 31 The petty cashier reports that $200 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15: postage expenses of $174, business mileage, $87, $29 to deliver merchandise to a customer, terms FOB destination May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $120, leaving a total of $380 In total, net income increased (decreased) by: $ 0