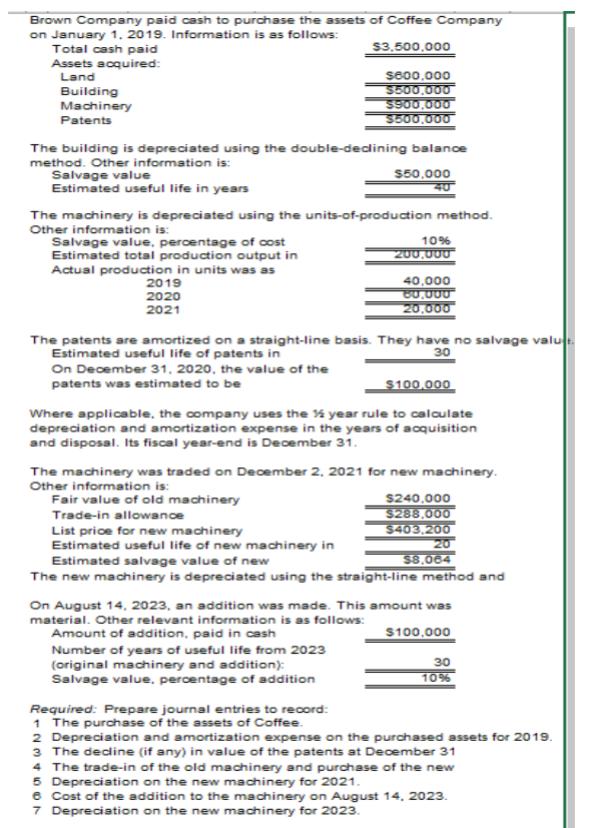

Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid Assets acquired:

Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid Assets acquired: Land Building Machinery $3.500.000 se00,000 5500,000 5500,000 5500,000 Patents The building is depreciated using the double-dedining balance method. Other information is: Salvage value S50,000 Estimated useful life in years The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost Estimated total production output in Actual production in units was as 10% 200,000 40,000 60,000 20,000 2019 2020 2021 The patents are amortized on a straight-line basis. They have no salvage valu 30 Estimated useful life of patents in On December 31, 2020, the value of th patents was estimated to be the $100,000 Where applicable, the company uses the % year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31. The machinery was traded on December 2, 2021 for new machinery. Other information is: S240,000 $288,000 $403,200 20 $8.064 Fair value of old machinery Trade-in allowance List price for new machinery Estimated useful life of new machinery in Estimated salvage value of new The new machinery is depreciated using the straight-line method and On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash Number of years of useful life from 2023 (original machinery and addition): Salvage value, percentage of addition S100,000 30 10% Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019. 3 The decine (if any) in value of the patents at December 31 4 The trade-in of the old machinery and purchase of the new 5 Depreciation on the new machinery for 2021. e Cost of the addition to the machinery on August 14, 2023. 7 Depreciation on the new machinery for 2023.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journal entries has been done below and all the calculations are given in working notes after journal entries Also single account for Depreciat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started